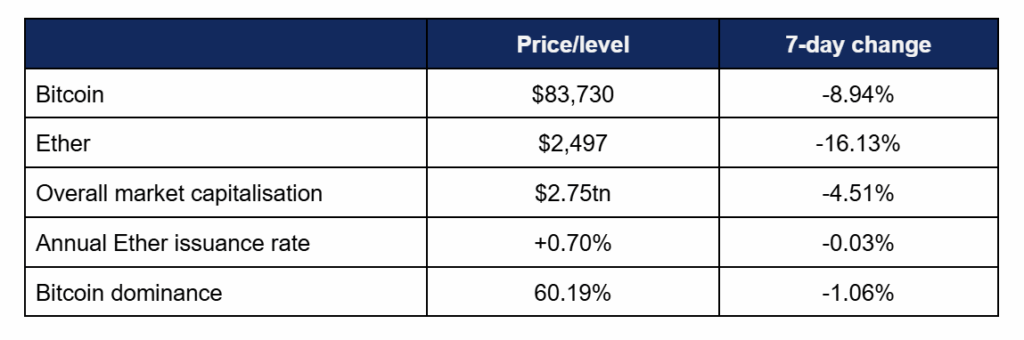

Market Overview:

Digital assets experienced large losses as they closed out one of their worst months ever, before rallying slightly after news of a strategic crypto reserve.

- Bitcoin dropped further as global markets continued to struggle in the uncertainty surrounding tariff wars, hitting its lowest point since early November

- Tariff tensions have heavily impacted stocks and risk-on assets, leading to Bitcoin falling nearly 30% from its all-time high

- Volatile trading saw Bitcoin move across a broad range; falling as low as $78,630 on Friday, before hitting a high of $94,810 early on Monday in the wake of a US Strategic Crypto Reserve confirmation

- However, this early momentum was soon reversed leading Bitcoin to fall back below $85,000, as industry observers questioned the lack of specific detail in the plan, alongside the proposed reserve assets

- Ether showcased similar movements, peaking at $2,530 early on Monday, but retraced further to hit its weekly low of $2,036 early on Tuesday

- Industry sentiment on the Fear & Greed index reached its lowest levels since 2022, briefly dropping into “extreme fear” before recovering to the lower reaches of “fear” at 24/100

- Overall industry market capitalisation dropped as low as $2.63tn and climbed as high as $3.15tn, before settling at current levels

- In contrast to overall trends, the stablecoin sector reached a record market capitalisation this week; possibly indicating that many investors may have hedged risk but maintained instant exposure to the sector—i.e. waiting for re-entry rather than exiting entirely

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped below $100bn for the first time since November, currently sitting at $2.75tn

Digital assets had another tough week, as not even confirmation of a strategic digital asset reserve and White House crypto summit were enough to counteract the continued pressures of global tariff tensions. ETFs accordingly logged their worst week since launch, but the regulatory picture in the USA looked decidedly brighter as the SEC continued to cancel litigation brought during the previous administration, and the world’s largest asset manager added Bitcoin exposure to several of its model portfolios.

What happened: USA confirms crypto reserve plan

How is this significant?

- On Sunday, Donald Trump announced on his social media that he had “directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL [Solana], and ADA [Cardano]”

- The statement marked a line in the sand regarding regulatory approaches compared to the previous administration, as Trump wrote “A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration… I will make sure the U.S. is the Crypto Capital of the World”

- This news caught many off guard for several reasons; being announced on a Sunday, identifying specific reserve assets so soon after Crypto Czar David Sacks’ first press conference, and—above all else—the omission of any Bitcoin or Ether mentions in the original statement

- However Trump soon corrected this, with an additional tweet an hour later clarifying “And, obviously, Bitcoin and Ether, as other valuable crypto assets, will be at the heart of the Reserve”

- This led to major rallies for all the assets named; particularly the altcoins which saw strong double digit growth—albeit substantially retraced at the time of writing

- Confirmation of plans for a national reserve were swifter than most observers expected, even within Washington—congressional crypto advocate Cynthia Lummis suggested on Friday that states would likely embrace Bitcoin reserves before the federal government

- Support at the state level has been mixed; last week a Bitcoin Reserve Act passed Oklahoma’s Government Oversight Committee as part of the legislative process, but a similar bill failed in South Dakota on Tuesday (citing concerns over volatility)

- Reaction and support of Trump’s statement has also been mixed; several industry heavyweights such as Coinbase CEO Brian Armstrong opined that the proposed reserve probably featured too many different assets

- Armstrong tweeted “Just Bitcoin would probably be the best option—simplest, and clear story as successor to gold… If folks wanted more variety, you could do a market cap-weighted index of crypto assets to keep it unbiased. But probably option #1 is easiest”

- Gemini exchange co-founder Cameron Winklevoss questioned the suitability of the selected altcoins, stating “Bitcoin is the only asset that meets the bar for a store of value reserve asset. Maybe Ethereum. Digital gold and digital oil. Which mirrors America’s physical reserves of gold (Fort Knox, NY Fed, etc.) and oil (Strategic Petroleum Reserve)”

- Others questioned the exact mechanics of the Reserve plan; Bitmex founder Arthur Hayes questioned available capital during times of record debt; “Nothing new here. Just words. [Let me know] when they get congressional approval to borrow money and or revalue the gold [reserve] prices higher. Without that, they have no money to buy Bitcoin”

- TD Cowen analysts agreed, cautioning that the Sunday announcement was “uncoordinated” and lacked substance; “We caution against overreacting to the social media post… There was no discussion of how the government would get the funds to buy tokens”

- Nonetheless, some analysts displayed great bullishness at the news, with Standard Chartered head of digital asset research Geoff Kendrick reiterating a $500,000 Bitcoin price target for 2029, claiming “The combination of the worst month in 2.5 years followed by the best weekend in 4 years looks to me like the first solid data point of a ‘Trump put’ for crypto, similar to the ‘Fed put’ for stocks”

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced their worst week since launch, as investors continued to sell off alongside broader global market risk-off behaviour

- According to CoinShares data published on Monday, digital asset investment products outflows hit $2.9bn in the week ending Friday the 28th—by far the highest losses in 14 months

- CoinShares chief researcher James Butterfill highlighted several key factors behind the outsized outflows, stating “We believe several factors contributed to this trend, including the recent Bybit hack, a more hawkish Federal Reserve and the preceding 19-week inflow streak totalling $29bn. These elements likely led to a mix of profit-taking and weakened sentiment toward the asset class”

- This marked a third consecutive week of outflows for the funds, a trend last seen in mid-2024

- Spot Bitcoin ETFs bore the brunt of this unwanted record performance, including record daily outflows above $1bn on Tuesday

- This included $345m of outflows for Fidelity’s FBTC, although the largest daily outflows came from BlackRock’s IBIT on Wednesday, as it lost $418m

- Indeed, the market-leading IBIT had the most reserves for investors to cash out, as it logged (at the time of writing) five consecutive days of nine-digit outflows

- Up until Thursday, the funds experienced an eight day outflow streak, before $194m inflows for ARK Invest’s ARKB helped to turn the day green with $94m net positive flows

- Spot Ether ETFs also suffered record outflows, shedding around $300m from Monday to Friday

- At the time of writing, Ether ETFs notched seven consecutive trading days of outflows, suffering their largest losses on Wednesday with $94m

- Unlike Bitcoin funds, there were zero positive flow days during the last week of trading—and in fact, there were zero inflows towards any funds at all (until Bitwise’s ETHW added $4m in early published results on Monday the 3rd)

- Speaking at the Consensus Hong Kong conference, analyst Yifan He speculated that mainland China investors could eventually gain Bitcoin exposure via ETFs, despite direct trading of crypto assets remaining banned there

- He stated “I see some signal from financial regulators. They’re beginning to talk about bitcoin, saying we need to pay more attention and do more research on digital assets… Now, I’d say there’s more than a 50% chance in three years”

- CME Group confirmed the launch of Solana futures on March 17th, pending regulatory approval; echoing the process of approvals before Bitcoin and Ether gained spot ETFs

What happened: SEC continues cancelling crypto cases

How is this significant?

- The SEC dropped yet more cases against firms in the digital asset industry this week, after recently scrapping cases against Coinbase, Robinhood, development firm Consensys, and NFT marketplace Opensea

- This week, the agency ceased litigation against Gemini exchange, Uniswap Labs, and Kraken

- The latter exchange issued a statement that “The SEC’s decision to dismiss its lawsuit against us (and many others) is more than just a legal victory—it’s a turning point for the future of crypto in the US. It ends a wasteful, politically motivated campaign, lifts uncertainty that stifled innovation and investment, and clears the path toward a stable, forward-thinking regulatory regime”

- Long-running lawsuits are being withdrawn, as the SEC also moved its lead litigator after restructuring its crypto team to a cyber unit with a broader mandate

- The new unit features around 20 fewer staff than the previous dedicated digital asset team, as part of wider government redundancies under Trump

- In other SEC news, the agency confirmed that memecoins do not fall within its purview, classifying them as collectibles rather than securities—guidance which is in line with the previous administration’s behaviour, but crucially is formally delineated, rather than left up for debate without clarity

- Acting SEC chair Mark Uyeda stated “For the last several years, the Commission’s views on crypto have been largely expressed through enforcement actions without engaging the general public. It’s time to rectify this approach and develop crypto policy in a more transparent manner”

- On Monday, the SEC announced a “Spring Sprint Towards Crypto Clarity”, a series of publicly-streamed roundtables to inform future digital asset policy

- Commissioner (and crypto task force head) Hester Peirce stated “I am looking forward to drawing on the expertise of the public in developing a workable regulatory framework for crypto. The roundtables are an important part of our engagement with the public”

What happened: BlackRock adds Bitcoin exposure to model portfolio

How is this significant?

- BlackRock—the world’s largest asset manager—added Bitcoin exposure to its model portfolios for the first time, via its market-leading IBIT spot Bitcoin ETF

- Specifically, the firm is “adding a 1% to 2% IBIT share to its target allotment for Target Allocation with Alternatives and the Target Allocation with Alternatives Tax-Aware portfolios”

- This allocation matches the “reasonable range” exposure outlined by BlackRock in a December paper, but falls short of the 5% allocation that CEO Larry Fink said some client are inquiring about

- These portfolios are designed for investors with higher risk tolerance, as per a BlackRock spokesperson speaking to industry publication DeCrypt

- Michael Gates, the lead portfolio manager of these products, told ETFtrends that “The attraction of adding a liquid, diversifying return stream to portfolios aside from traditional stocks and bonds will provide a strong portfolio case to multi-asset investors and other innovative portfolio builders”

- He added “We believe Bitcoin has long-term investment merit and can potentially provide unique and additive sources of diversification to portfolios”

- com analyst Sumit Roy stated “It’s another step towards bringing Bitcoin into the investment mainstream. IBIT was already a resounding success—this move could boost demand for the fund further”

What happened: White House to host first-ever digital asset summit

How is this significant?

- The White House will host its first-ever “crypto summit” on Friday, with Donald Trump presiding over an event that “will include prominent founders, CEOs, and investors from the crypto industry, as well as members of the president’s Working Group on Digital Assets”

- “Crypto Czar” David Sacks stated that more details around the proposed strategic digital asset reserve would be shared at the summit,

- The White House statement added that “The administration is committed to providing a clear regulatory framework, enabling innovation, and protecting economic liberty”

- It also said “After the previous administration unfairly prosecuted the digital asset space, President Trump’s policy vision represents a new era for digital financial technology. The administration is committed to providing a clear regulatory framework, enabling innovation and protecting economic liberty”

- TD Cowen analysts commented “We believe this summit is important as it will expose how Team Trump intends to advance stablecoin and crypto market structure legislation,” TD Cowen said. “Our view remains that only a bipartisan solution can provide the crypto sector the legal stability it needs”

- In other White House-adjacent news, DTTM Operations—the firm which manages Trump’s intellectual property endeavours—filed a trademark for a potential NFT and metaverse platform

- Additionally, Republican Tom Emmer and Democrat Ritchie Torres announced a collaborative effort to launch the “Congressional Crypto Caucus”

- The “unified bipartisan coalition” will be “ideologically unified and mobilise to support or prevent critical digital asset legislative proposals”, according to a spokesperson for Emmer

What happened: Bank of America reveals digital asset issuance plans

How is this significant?

- Speaking to David Rubenstein at Bloomberg Talks, Bank of America CEO Brian Moynihan confirmed that the bank plans to issue a (dollar-backed) stablecoin as soon as regulations allow

- Moynihan described dollar-backed stablecoins as “no different to a money market fund… or a bank account, really”, adding “It’s pretty clear that there’s going to be a stablecoin, which is going to be fully dollar-backed”

- He said “if they make that legal, we’ll go into that business. So you’ll have a Bank of America coin and a Bank of America US dollar deposit and we’ll be able to move them back and forth. Because (until) now it hasn’t been legal for us to do it, but it’s just then like another foreign currency. The question of what it’s useful for is going to be interesting”

- This backs up statements Moynihan made earlier this year at Davos, were he stated that “If the rules come in and make it a real thing that you can actually do business with, you’ll find that the banking system will come in hard on the transactional side of it”

What happened: Bybit hack latest

How is this significant?

- Last week’s hack of Bybit exchange went down in history as the largest crypto heist ever—compounding caution across traders and leading to cascading liquidations in a perfect storm alongside macro challenges and retail exhaustion

- The FBI confirmed North Korean hacking group Lazarus as responsible, issuing a public advisory identifying particular individuals believed to have been involved

- Thanks to the transparency of blockchain, several forensic investigators were able to trace the movement of the funds, and the methods attempted by criminals to obfuscate them

- The preliminary results of an internal investigation by the exchange found that vulnerable code in a wallet platform was to blame, moreso than Bybit’s own infrastructure

- Bybit issued a $140m bounty for return of the funds, with half reserved for individuals who correctly track the funds, and half for the exchanges, entities, or platforms that freeze the funds

- As of writing, just over $4.2m in bounties were paid out for successful recovery of funds, equating to around $42m returned

What happened: Stablecoin news

How is this significant?

- Stablecoins featured in reporting this week via numerous projects and institutions

- Industry observers and analysts expressed a hope that the forthcoming White House crypto summit would help catalyse and crystalise stablecoin policy and regulation

- Tether appointed Simon McWilliams as its new CFO, identifying the move as a step towards instituting a (long-awaited) full audit for the firm which has thus far only published financial attestations from BDO rather than complete audits

- Speaking of Tether, its market-leading USDT stablecoin was one of several delisted by Binance in the EEA as part of the exchange’s efforts towards compliance with EU-wide MiCA regulations

- Circle CEO Jeremy Allaire argued this week that all issuers of dollar-pegged stablecoins—such as Circle’s USDC—should be registered in the United States (unlike Tether, which recently shifted headquarters to El Salvador)

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.