May 27th, 2025

Market Overview:

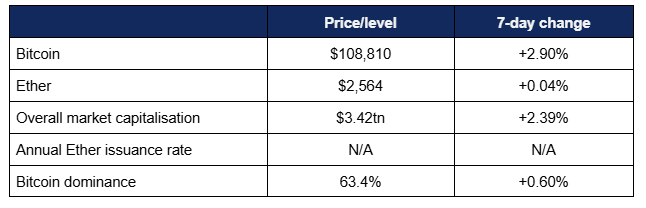

Digital assets had experienced another banner week, as Bitcoin achieved several new record highs.

- Bitcoin reached new records this week, rising above $110,000 and $111,000 for the first time ever

- In the end, Bitcoin hit nearly $112,000, buoyed by broader investor optimism around macroeconomic conditions and potential future US crypto legislation

- Galaxy Digital CEO Mike Novogratz told Bloomberg “It’s the shift of approach from Gary Gensler and the SEC to this Trump administration, which has embraced our industry”

- Bitcoin peaked at $111,970 on Thursday, up from a Tuesday low of $104,440, and spending the majority of the week trading between $106,700 and $109,500

- Ether stalled slightly as Bitcoin dominated investor mindshare, closing the week virtually unchanged

- Ether lagged slightly behind Bitcoin’s peak, rising from a Tuesday low of $2,458 to a weekly high of $2,727 on Friday, before pulling back sharply as Bitcoin sustained a run above its previous record levels

- Altcoins also experienced mixed performances as liquidity flowed back into Bitcoin; several managed strong double-digit growth, but around half of the top 100 projects by market capitalisation declined over the week

- Overall industry market capitalisation increased to $3.42tn, peaking at $3.53tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi was as unchanged as the dominant asset (Ether), remaining at $116.5bn

Digital assets experienced a bullish week, as Bitcoin broke records and reached new highs. Digital asset ETFs accrued considerable inflows, several major US banks made plans for a joint stablecoin, Solana gained mindshare in the tokenisation space, Pakistan adopted a Bitcoin mining policy, several institutions undertook significant raises for crypto asset acquisitions, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products had one of their strongest weeks of the year thus far, adding multiple billions of dollars in value

- Total inflows reached $3.3bn; one of the best weeks since Bitcoin ETFs launched

- According to Coinshares data published on Monday, the US accounted for the vast majority ($3.2bn) of these volumes

- Year-to-date inflows now stand at $10.8bn—counteracting all the March and April outflows as consecutive inflows reached six weeks

- Spot Bitcoin ETFs continued their bullishness, posting nine-figure inflows every single trading day last week, with a minimum of $212m added

- The best trading day witnessed $935m inflows on Thursday, dominated by BlackRock’s IBIT ($877m)

- Indeed, IBIT displayed by far the week’s strongest performance, with daily inflows of $305m, $288m, $531m, $877m, and $431m respectively

- The next-best performance came from Fidelity’s FBTC on Monday ($188m), whilst Friday saw the only significant outflows from any funds, as FBTC, ARK Invest’s ARKB, and Grayscale’s GBTC all dropped between $78m and $89m

- Spot Ether ETFs had one of their best days since launch, reaching six consecutive days of inflows, and rare nine-figure inflows as $111m was added on Thursday

- This meant that Thursday’s combined inflows for spot Bitcoin and Ether ETFs on Thursday logged their best performance since January (during Bitcoin’s run-up to its previous record)

- BlackRock’s ETHA led the way with $53m inflows on Friday, followed by $44m and $42m from Grayscale’s ETHE and Fidelity’s FETH respectively on Thursday

- Due to the Memorial Day bank holiday in thus US, markets were closed on Monday

- Elsewhere in ETFs, the SEC acknowledged a filing for a staked Tron ETF from issuers Canary Capital

- Additionally (and as expected), the SEC delayed decisions on spot XRP and spot Litecoin ETFs, alongside Fidelity’s filing for in-kind Bitcoin redemption

What happened: Major US banks plan joint stablecoin

How is this significant?

- According to a Wall Street Journal report this week, some of America’s biggest banks have planned a joint stablecoin venture, following recent progress on the road to legislation

- The WSJ cited JP Morgan, Bank of America, Wells Fargo, and Citigroup as parties involved in the discussions

- The report’s authors claim that “The bank consortium discussions are in early, conceptual stages and could change. Any final decision would depend on the fate of legislative actions around stablecoins”

- Other participants allegedly include “real-time payments network The Clearing House and Early Warning Services LLC, the fintech company behind peer-to-peer payment system Zelle”

- Regional banks could explore similar paths according to the report

- This move appears to be a reversal of—or a response to—earlier reports that crypto-native firms are applying for banking charters in order to secure their place ahead of expected stablecoin legislation

- Analysts hypothesise that a key motivator for banks could be preserving income from cross-border transactions and retail card payments; areas possibly vulnerable to competition from the rising $245bn stablecoin market

- Another potential area of concern for banks is the rise of yield-bearing stablecoins, which may share some of the yield gained from the stablecoin as underlying backing assets, such as treasuries

- Bitwise CIO Matt Hougan told Bloomberg “The primary argument against yield-bearing stablecoins is fear. Specifically, fear about what their existence would mean to traditional banks”

- Stablecoins received a grand vote of confidence this week when Treasury Secretary Scott Bessent stated in a Bloomberg interview that “we want to apply the highest US regulatory and AML standards to stablecoins… I’ve seen estimates that just over the short term, stablecoins could create two trillion of demand for US treasuries and treasury bills”

- Bessent said “Digital asset companies deserve regulatory clarity—and that’s exactly what we are working toward. Passing the stablecoin bill is just the start”

- This backed up the administration’s “Crypto Czar” David Sacks, who claimed in a CNBC interview “We already have over $200bn in stablecoins—it’s just unregulated. If we provide the legal clarity and legal framework for this, we could create trillions of dollars of demand for our Treasuries practically overnight”

- He added “Stablecoins offer a new, more efficient, cheaper, smoother payment system—new payment rails for the U.S. economy,” he said. “It also extends the dominance of the dollar online”

- However, JP Morgan analysts moved to manage expectations regarding the stablecoin market, pouring cold water on multi-trillion forecasts

- Analysts led by managing director Nikolaos Panigirtzoglou published a report arguing that “The growth of non-interest bearing stablecoins over time would depend mostly on two factors: 1) their use in payments systems and 2) the broader crypto ecosystem's expansion... given [stablecoins’] typical 7%-8% share… We find talk about tripling or quadrupling of the stablecoin universe over the coming year or two to be far too optimistic”

- US banks wouldn’t be the first in the Americas to adopt stablecoins; Guatemala’s largest bank, Banco Industrial, has adopted stablecoin rails for remittances from the US (which account for 20% of the nation's economy)

- Industry publication Coindesk revealed that the bank will charge a flat 99 cent fee, with transfers sent to a customer’s phone number (rather than complex hexadecimal blockchain address) within Banco Industrial’s mobile app

What happened: Digital asset exchange Kraken to debut stock tokenisation

How is this significant?

- On Thursday, the Wall Street Journal reported that Kraken (rumoured to join Coinbase as a publicly-listed company next year) will launch "xStocks"; tokenised equities offering non-US investors exposure to firms such as Nvidia, Apple, and Tesla

- According to the WSJ, Kraken is also tokenising ETFs, including S&P 500 and Gold index trackers

- This opens stocks and shares up to 24/7/365 trading, potentially one of the most fundamental shifts ever in public access, market response, and global equity (bringing us another step closer to Larry Fink's stated ambition of "tokenising every financial instrument")

- Whilst it is technically possible for overseas investors to get exposure to such equities, Kraken co-CEO Arjun Sethi notes “it typically involves very high fees and slow settlement times. There’s a lot of friction”

- Dave Weisberger of CoinRoutes added: “It brings fully transparent access to investing in US stocks to all geographies Kraken operates in. It likely will be available at a much lower cost than GDRs (Global depository receipts) which are offered institutionally today"

- xStocks tokens will be redeemable for their current cash value, and backed by shares of the underlying asset, acquired (as needed) by Kraken’s partner company Backed Finance

- On a technical level, this move is notable for deploying xStocks on the Solana blockchain, one of the first major TradFi applications on the market's third-largest smart contract chain (behind Ethereum and Binance Chain at the time of writing)

- In future, xStocks could be tradeable on other exchanges, or deployed as collateral across DeFi applications

- Indeed, in a press release, Backed Finance stated "The upcoming xStocks launch marks a systemic leap toward mainstream adoption of tokenized securities. Kraken and Solana join us as we lead the charge, powering access, liquidity and enabling DeFi integrations, but our mission doesn’t stop there: xStocks should be available on any chain, and on every exchange"

- This isn't actually the first time an exchange has undertaken share tokenisation efforts; Binance did so in 2021, but had its efforts swiftly shut down by the much more hostile regulatory bodies of the Biden administration

- In 2025, it's a very different story; just last Friday, Treasury Secretary Scott Bessent told Bloomberg "We are going big on digital assets. The Trump administration has made digital assets a priority"

- In other Kraken news, the company rolled out regulated digital asset derivatives in Europe, making perpetual and fixed maturity futures contracts available to EEA customers via the earlier acquisition of a Cypriot investment firm

What happened: FT: Trump Media seeks up to $3bn for crypto purchases

How is this significant?

- The Financial Times reported on Monday week that Trump Media and Technology Group (TMTG) is currently undertaking major fundraising for future crypto asset acquisition—to the tune of $3bn

- According to six sources cited by the FT, $2bn will come from equity, with the remainder raised via a convertible bond

- The FT also claimed the raise could rise, as “the offering had been increased in size in recent weeks due to strong demand”

- However—in characteristically brash fashion—TMTG appeared to deny these claims, stating “Apparently, the Financial Times has dumb writers listening to even dumber sources”

- Despite these denials, TMTG is increasing its presence in the crypto space; including a proposed utility token for the Truth Social ecosystem, and crypto fund Truth.Fi

- Nonetheless, the reports could further increase scrutiny of (and concerns over) president Trump’s involvement with the asset class, displayed this week when protestors picketed a private dinner he held for supporters of his TRUMP memecoin

- In other funding news, investment firm Theta Capital successfully closed a $175m round for its Theta Blockchain Ventures IV fund

- The new fund will target specialist digital asset VCs, building on its current $1.2bn AUM

- CIO Ruud Smets told Bloomberg “We’ve always been looking for areas where specialisation and active management provide a sustainable edge, beyond just getting exposure to the market”

What happened: Texas House of Representatives passes Strategic Bitcoin Reserve bill

How is this significant?

- Texas is now within a governor’s signature of becoming the third state in the US to officially establish a crypto reserve (following New Hampshire and Arizona), after the Texas House bill garnered “overwhelming bipartisan support” and passed by 101 votes to 42

- If governor Greg Abbott signs the bill into law, Texas would however be by far the largest economy within the union to adopt such a policy; Texas’ economy is the eighth-largest in the world, ranking only behind California within the Union

- The prognosis for approval appears positive; Abbott’s press secretary Andrew Mahaleris commented “Already the home of crypto mining, this legislative session Texas should become the crypto capital. Governor Abbott looks forward to reviewing this proposal”

- If approved, Senate Bill 121 will establish a “Texas Strategic Bitcoin Reserve for the purpose of investing in crypto assets and the investment authority of the comptroller of public accounts over the reserve and certain other state funds”

- The Texas Observer reported the bill includes a $21m fund to “kickstart” the reserve, and allows private donations to the reserve (so long as donors are domiciled in Texas)

What happened: Tokenised credit funds set to launch on Solana blockchain

How is this significant?

- Alongside this week’s news of Kraken tokenising stocks on Solana, the blockchain featured in reporting for several other institutional tokenisation efforts, growing its share of the RWA (real-world asset) sector

- Apollo Global’s Apollo Diversified Credit Securitize Fund (ACRED) is being tokenised by Securitize and lending protocol Kamino Finance, extending its presence onto the industry’s third-largest smart contract blockchain

- Securitize head of DeFi Reid Simon told industry publication Coindesk “The value of tokenisation really comes into play when these assets are integrated into DeFi, and new products and strategies are developed around them”

- A few days later, news broke that British blockchain developer R3 is teaming with the Solana Foundation to bring the former’s portfolio of clients ($10bn AUM) and tokenised RWAs

- R3’s blockchain platform Corda currently counts Bank of America, Monetary Authority of Singapore, and HSBC among its participants

- In a statement, R3 said “As the world's most used public blockchain, Solana... [is] the ideal foundation for the next generation of regulated digital finance”

- A recent Boston Consulting Group report forecast that the RWA sector could grow to almost $19tn by 2033

- In other RWA news, the Dubai Land Department debuted its first tokenised real estate, realising plans disclosed last month

- According to a press release, its new Prypco Mint platform “allows investors to purchase fractional ownership in Dubai properties using local currency starting at 2,000 Dirhams [about $540]”

What happened: Pakistan allocates resources towards national Bitcoin mining efforts

How is this significant?

- Pakistan is taking its recent pivot towards pro-crypto policies seriously; this week it was announced that the country is allocating 2000 megawatts of electricity towards an official national Bitcoin mining push

- The newly-established Pakistan Crypto Council (advised by Binance founder Changpeng “CZ” Zhao) is leading the initiative, and the Ministry of Finance said that the Bitcoin mining move could monetise surplus energy production

- The ministry said it would repurpose coal-based power projects like Sahiwal, China Hub, and Port Qasim, currently operating at only 15% capacity

- The Times of Karachi reported that despite the power source, “The Council also intends to ensure compliance with environmental standards, particularly regarding energy efficiency and heat management”

What happened: Bitcoin Treasury news

How is this significant?

- Bitcoin treasury specialists Strategy (formerly MicroStrategy) added further to its holdings this week, acquiring 4,020 Bitcoin for just over $427.1m (an average price of $106,237 per Bitcoin)

- The firm now owns 580,250 Bitcoin acquired at a total cost of $40.61 billion

- Its latest purchases appear to have been funded by a $2.1bn sale of perpetual strife preferred stock

- Nasdaq-listed Semler Scientific made a $50m Bitcoin buy, financed with proceeds from a $500m securities sale

- This brings Semler’s stockpile to 4,264 Bitcoin, acquired for an average price of $91,471

- France-based The Blockchain Group completed convertible bond issuances worth $72m in the pursuit of a “Bitcoin accumulation strategy”

- Additionally, the company outlined ambitions to grow its total holdings to 1,400 Bitcoin

- The largest Bitcoin acquisition move of the week came from Vivek Ramaswamy’s Strive Asset Management

- Earlier this month, Strive announced its Bitcoin strategy, which is now progressing into action

- In a regulatory filing, Strive disclosed a partnership with 117 Castell Advisory Group to purchase distressed Bitcoin claims, “specifically those with confirmed legal judgments and pending distributions”

- These claims often take years to process (as evidenced by the long-running restitution process for the infamous Mt Gox hack), thus potentially allowing Strive to acquire Bitcoin at a discount in exchange for instant funds

- Currently, there are believed to be around $7.9bn of Bitcoin in pending Mt Gox claims; Strive has already outlined plans to raise $1bn for Bitcoin buys through equity and debt offerings

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.