Market Overview

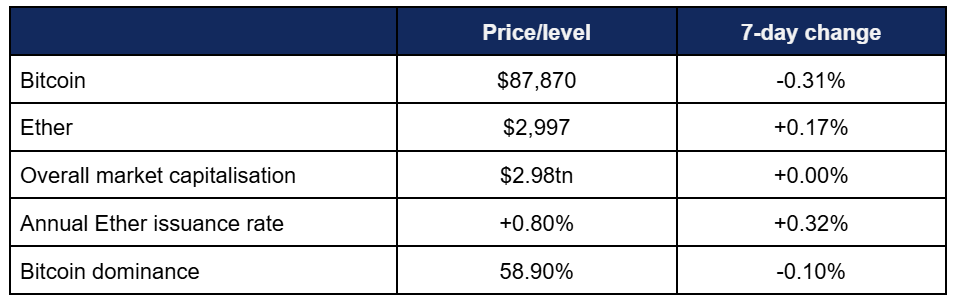

Digital assets closed out 2025 with subdued performance, as trading volumes and activity calmed down during the traditional post-Christmas market lull.

- Bitcoin posted a modest decline this week, as markets went through a traditional lull in trading activity during the Christmas holiday period

- Performance was generally flat with a few brief upward spikes, including a surge to a weekly high of $90,170 early on Monday (up from a weekly low of $86,770 on Christmas Eve)

- At current prices, Bitcoin looks set to end the year slightly down after opening January at $94,600; but remains well above its levels at the start of 2023 ($17,000) and 2024 ($44,000)

- Ether moved in near-lockstep with Bitcoin, albeit spending most of the week trading just below, rather than at, last week’s levels

- Ether peaked at $3,047 on Monday, after a weekly low of $2,894 on Friday, and down from its yearly open at $3,332

- Some analysts believe that year-end tax loss harvesting could feature in performance lately; Bitmine chairman Thomas Lee wrote this week that “Year-end tax-loss related selling is pushing down crypto and crypto equity prices and this effect tends to be the greatest from 12/26 to 12/30, so we are navigating markets with this in mind”

- Overall market capitalisation (very) briefly hit an intraweek high of $3.04tn, before dropping back below the $3tn mark

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped down to $117.9bn

Digital assets had a calm week in the markets compared to recent volatility, as trading activity dwindled during the Christmas break. Due to the holiday season, less news emerged from the US, but other markets including South Korea, China, Russia, and Japan all provided developments in the absence of greater American activity.

ETF News

What Happened?

- Digital asset investment products logged another week of outflows, as sentiment remained subdued during the truncated trading week between Christmas and New Year

- According to Coinshares data published on Monday, the trading week ending Friday the 26th experienced $446m outflows

- Coinshares Head of Research James Butterfill posited “This suggests investor sentiment has yet to fully recover. Year-to-date flows, however, remain broadly in line with last year, with inflows totaling $46.3. billion compared to $48.7 billion in 2024”

- Despite a lackluster end to the year, Coinshares highlighted positive weekly action for some of the new altcoin ETFs, including $70m for XRP spot ETFs

- Spot Bitcoin ETFs closed out the year with a whimper, logging four consecutive days of (low) nine-figure outflows, adding up to six consecutive days of losses

- The only weekly inflows were a negligible $6m for BlackRock’s IBIT on Monday, as most funds delivered net zero performance throughout the majority of the week

- IBIT however also accounted for the majority of weekly outflows, returning three consecutive days of nine-figure capital flight, topping out at $193m on Friday

- Spot Ether ETFs managed a day of $85m inflows, before following Bitcoin’s lead and suffering three days of (eight-figure) outflows

- The big winner of the week was Grayscale’s 0.15% fee mini-ETF, which registered over $34m total inflows, whilst all other funds (except a modest $4m weekly return from Fidelity’s FETH) were in outflow mode

- BlackRock’s ETHA led the way in outflows, shedding around $82m over the four trading days

Crypto Treasury news

What happened?

- Leading Bitcoin treasury firm [Micro]Strategy closed out the year with another nine-figure Bitcoin purchase, spending $109m for 1,229 Bitcoin, funded through sales of Class A common stock

- The firm’s total Bitcoin holdings now stand at 672,497 Bitcoin, acquired at an average price of about $74,997

- Meanwhile, leading Japanese Bitcoin treasury firm Metaplanet returned to the fray after a prolonged absence, marking its first acquisition since the beginning of October

- In total, the company bought 4,279 Bitcoin, bringing total holdings to 35,102 Bitcoin

- Additionally, Norway’s sovereign wealth fund, which owns 0.3% of Metaplanet shares, voted for continuation and expansion of the company’s Bitcoin strategy in its EGM on December 22nd

- Leading Ether treasury firm BitMine increased its Ether holdings to 4.11 million tokens, with over 408,000 staked as validator nodes on the network

- It currently stands as the second-largest corporate crypto treasury (behind Strategy), following its 44,000 Ether buy this week

- Chairman Thomas Lee wrote that “We continue to be the largest ‘fresh money’ buyer of ETH in the world. Year-end tax-loss related selling is pushing down crypto and crypto equity prices and this effect tends to be the greatest from 12/26 to 12/30, so we are navigating markets with this in mind”

What happened: Coinbase increases predictions market push with acquisition

How is this significant?

- Leading American crypto asset exchange Coinbase announced the acquisition of derivatives clearinghouse The Clearing Company (TCC) this week, highlighting its ambition to grow within predictions markets as part of its mission to become an “Everything Exchange”

- The deal marks Coinbase’s tenth acquisition this year, as the exchange has widely expanded products and services

- Clearinghouses provide essential market plumbing infrastructure for predictions markets, and TCC differentiates itself by clearing settlements in stablecoins, using blockchain rather than legacy financial infrastructure

- TCC recently concluded a $15m funding round led by Union Square Ventures, and was founded by veterans from prediction market heavyweights Polymarket and Kalshi

- Just last week, Coinbase launched lawsuits against three state regulators around their attempts to regulate prediction markets, arguing that they fall under the purview of federal regulators (specifically the CFTC) instead

- According to the latest data, weekly notional volume on prediction markets now tops $4bn

- In a press release, Coinbase said it has “an opportunity to enable millions of customers around the world to seamlessly participate in prediction markets right alongside their cash, crypto, equities, and derivatives portfolios”

- Coinbase claims the deal “adds the specialised talent needed to take this [predictions market] category further”, at a time when both Polymarket and Kalshi have secured multi-billion backing

- In other Coinbase news, CEO Brian Armstrong confirmed the arrest of a former customer service agent in India, after hackers bribed them for access to customer data earlier this year

What happened: Sberbank issues first Bitcoin-backed loan

How is this significant?

- Sberbank, the largest bank in Russia, announced this week that it has issued the country’s first Bitcoin-backed loan

- The size of the loan remains undisclosed, but the recipient was Intelion Data, one of Russia’s largest Bitcoin mining concerns

- According to a local crypto news platform, Intelion CEO Timofey Semenov identified the loan as “an important practical example for the industry and an indicator that the market is reaching a new level”

- The bank is using its own Rutoken crypto custody service to safeguard the collateral, as it said in a press release that “We believe this product will be relevant not only for crypto asset miners, but also for companies that own crypto assets”

- This came in the same week as Russia’s central bank published a framework to legalise digital asset trading for individuals and institutions in 2026 (pending risk awareness tests), as the bank confirmed that “digital assets and stablecoins are recognised as monetary assets; they can be bought and sold, but they cannot be used for domestic payments”

- Additionally, Russian news outlet Kommersant reported that the US has “expressed interest in establishing crypto mining operations at the Zaporizhzhia Nuclear Power Plant”

- Under current peace deal negotiations, the plant could be jointly operated by Ukraine, the US, and Russia, with America using its proposed stake for mining operations

What happened: Mirae Asset Group buying Korean crypto exchange for $100m

How is this significant?

- According to reports in South Korea’s Chosun Daily newspaper, local financial services giant Mirae Asset Group ($754bn AUM) is looking to acquire the country’s fourth-largest crypto exchange, Korbit, in a deal worth up to $100m

- The deal would be led by the firm’s non-financial Mirae Asset Consulting subsidiary, due to 2017 Korean regulations separating financial firms from crypto companies

- Korbit ranks as the oldest digital asset exchange in one of the world’s biggest crypto markets, founded all the way back in 2013

- However, despite ranking fourth overall, its trading volumes are orders of magnitude below leading lights Upbit and Bithumb

- One unnamed source told The Korea Times that the move could prove a boon to the exchange, as “Korbit has historically had a limited presence, but Mirae Asset Financial Group’s decades of expertise could allow it to pursue a differentiated strategy”

- The deal follows a period of increased M&A activity within South Korea, after local internet giant Naver confirmed the acquisition of Dunamu (the holding company of leading local exchange Upbit)

What happened: China to allow interest payments on Digital Yuan CBDC

How is this significant?

- China’s Financial Times newspaper this week published reports that the country’s central bank is allowing a dramatic shift in its decade-long Digital Yuan (aka e-CNY) CBDC trial

- People’s Bank deputy governor Lu Lei wrote that it is moving the e-CNY from digital cash to a “digital deposit currency”

- The new framework will go live at the start of 2026, and allows commercial banks to pay interest on verified e-CNY wallets, as well as providing them the same deposit insurance protections as traditional accounts

- Lu stated that as of November 2025, China processed a cumulative $2.38tn worth of e-CNY payments across 3.48 billion separate transactions

- He recognised the recent rise of stablecoins, and wrote “Achieving the advantages of low cost and high efficiency of digital payment methods while ensuring effective macroeconomic control and orderly market development is a realistic requirement that central banks worldwide must face”

- This decision seems to be part of a broader push to increase e-CNY adoption, as the South China Morning Post recently reported that China plans to increase cross-border usage of the CBDC

What happened: Digital asset industry closes record M&A year

How is this significant?

- The Financial Times reported this week that despite challenges in Q4 market performance, the digital asset industry has logged record performance this year -in the field of mergers and acquisitions

- In total, deals this year were worth around $8.6bn; up nearly four-fold from $2.2bn last year

- The paper identified White House support (including successful passage of the GENIUS Stablecoin Act) as a key catalyst for this rise in activity and investment

- The number of deals increased by 18% to 267

- Major deals included Coinbase’s acquisition of derivatives platform Deribit ($2.9bn), Kraken buying NinjaTrader ($1.5bn), and Ripple’s purchase of prime brokerage Hidden Road ($1.25bn)

- The FT noted that despite this quarter’s market slowdown, activity in 2026 is forecast to remain high

- Architect Partners Founder Eric Risley told the paper “We’re in the midst of lots of transactions and… the move from $120,000 to $90,000 has done nothing to derail those conversations”

- Additionally, $14.6bn was raised from 11 IPOs globally, compared to $310m from four IPOs last year

- Clifford Chance partner Diego Ballon Ossio commented “Traditional financial [players] realise this asset class is here to stay, and they need to get their business into that… so they just need to acquire”

- Another area of record performance this year was in blockchain-related SEC filings, as increased regulatory clarity galvanised institutional participation

- According to industry publication TheBlock, over 8,000 filings featured blockchain or crypto-related mentions (dominated by Bitcoin) by the end of August, with levels maintained throughout the remainder of the year

- He added “DTCC’s partnership with Digital Asset and the Canton Network is a strategic step forward as we collaborate across the industry to build a digital infrastructure that seamlessly bridges the traditional and digital financial ecosystems and provides unmatched scalability and safety”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.