30 June, 2023

Market Overview:

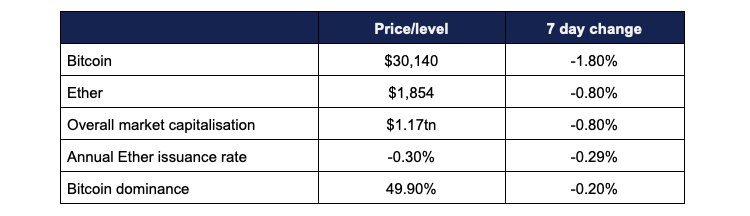

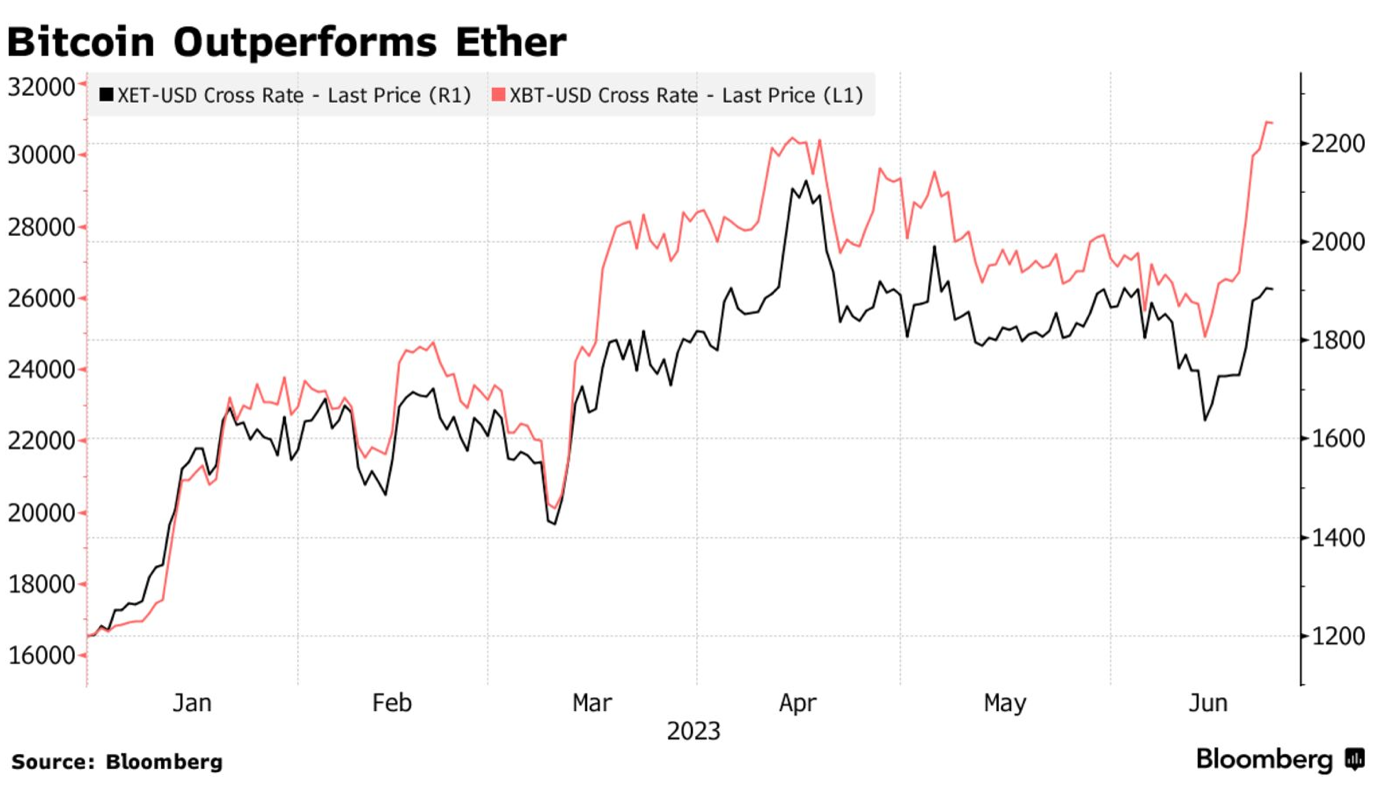

Digital assets experienced steady trading after last week’s explosive growth.

- Bitcoin reached a new one year high on Friday, peaking at $31,390; its highest value since May 2022

- Weekly trading remained above $30,000, ranging predominantly between $30,200 and $30,750

- Ether relatively underperformed Bitcoin this week; some industry analysts posited that the lack of definitive SEC statements regarding its status may have caused greater investor caution with the asset

- Ether peaked at $1,927 on Sunday, before declining to a weekly low of $1,826 on Wednesday

- Conversely, another digital asset, Bitcoin Cash (the most prominent Bitcoin fork) experienced growth after its recent inclusion in institutional exchange EDX Markets’ limited trade offering (alongside Bitcoin, Litecoin, and Ether) led to greater investor confidence that it may not be a security

- At the time of writing, Bitcoin Cash more than doubled in market capitalisation within a week by virtue of said listing

- Digital assets also demonstrated their appeal in the face of government instability; during the apparent Russian coup attempt on Saturday, Ruble-denominated Tether stablecoin trades more than tripled on a daily basis

- Overall digital asset market capitalisation gained $130bn to reach current levels of $1.16tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week across all blockchains and platforms remained steady, around $44.2bn

Digital assets performed strongly once again as Fidelity became the third asset manager in the Trillions club to enter the race for a spot Bitcoin ETF. Coinbase pushed back against the SEC whilst Binance pulled out of markets as regulation and enforcement concerns continue to loom over major exchanges. Digital assets continued to demonstrate their global appeal; the UK formalised crypto assets within regulated financial activity, HSBC opened up ETF trading to Hong Kong clients, Swiss banks reached out to new digital asset clients in UAE and Singapore, Japan’s largest bank announced plans for stablecoin issuance, JP Morgan moved into blockchain-based Euro payments, MicroStrategy spent big on Bitcoin,and BlackRock confirmed intentions for future DeFi involvement.

What happened: Fidelity joins race for spot Bitcoin ETF

How is this significant?

- Following BlackRock’s recent filing for a spot Bitcoin ETF, a race appears to have begun among TradFi institutions, whose hopes were reignited by the belief that “BlackRock may know something” in regards to the likelihood of such applications being granted

- After last week’s entry of Invesco, WisdomTree, and Valkyrie, another major player staked a claim this week; $4.3tn AUM firm Fidelity threw their hat in the ring on Thursday

- Fidelity—who also boast $11tn in assets under administration—thus became the third member of the trillion-plus club to confirm an interest in a spot Bitcoin ETF, following BlackRock and Invesco ($1.5tn)

- Rumours regarding Fidelity’s interest emerged several days before the filing was made official—Reutersreported their plans on Tuesday, noting that BlackRock’s filing “helped reverse negative sentiment in the bitcoin and broader cryptocurrency markets”

- Industry expectations around Fidelity’s pending entry helped to propel Bitcoin to its highest levels in over a year, breaking the $31,000 barrier

- Renewed interest in Bitcoin ETFs also led to major growth in crypto ETP inflows, achieving their best week (nearly $200m) since July last year

- The arrival of yet another major financial institution appeared to buoy industry optimism further; Edward Moya, senior market analyst at Oanda told Reuters “There's a lot of optimism here that you're going to get a bitcoin ETF. If that does get done, it could open the door for much more institutional money and probably some high-net-worth retail traders to get back into crypto”

- Jaime Baeza of hedge fund ANB investments agreed, telling Bloomberg “Fidelity’s filing for a Bitcoin ETF, amid the recent period of regulatory scrutiny, brings a much-needed positive outlook to the crypto industry… moves by top traditional financial institutions such as BlackRock and Fidelity signify that institutional interest and participation remain, injecting credibility and potential stability into the market”

- Like most of last week’s entrants, Fidelity’s filing was actually a re-filing; they applied to list their Wise Origin Bitcoin Trust once more, following a previous rejection from the SEC

- Due to BlackRock’s ETF filing success rate, size, and perceived ability to “read the regulatory tea leaves”, companies previously denied by the SEC now appear galvanised to try again

- The Financial Times quoted one industry analyst’s belief that BlackRock’s filing “pretty much undercut all the SEC’s arguments other than ‘meh, we don’t like Bitcoin’,” but also cautioned that Bloomberg’s ETF expert Eric Balchunas currently rated their odds of approval as “50-50”

- The FT also reported that the recent launch of institutional digital asset exchange EDX Markets—backed by Fidelity, Schwab, and Citadel—“could be the exact solution needed to get the SEC comfortable” due to its institutional backing and accredited investor requirements

- A new report from Bernstein Research declared that the US has plenty of room for a spot ETF, which “would offer the most convenient, compliant and acceptable product for both retail and institutional players to gain bitcoin exposure”

- Analysts led by Gautam Chhugani cited Grayscale’s $19bn GBTC fund, which earns $380m in fees per year “despite the product being inefficient, illiquid, and traded at a significant discount over the last 28 months”

- Grayscale charges a 2% annual fee for GBTC; compared with ETFs generally tending towards the 0.5% fee range

- Whilst some institutions followed BlackRock’s lead by filing for spot ETFs, others took note of their approach

- On Wednesday, Cathie Wood’s ARK Investments amended their existing spot ETF application (filed in April) with a possible “silver bullet”; a surveillance-sharing agreement with CBOE

- Cathie Wood believes this addition could put ARK in the driver’s seat for first approved spot Bitcoin ETF; since theirs was the first filed this year, it’s also first in line for any judgement deadlines

- In other ETF news, the SEC approved its first-ever leveraged (futures) Bitcoin ETF, the Volatility Shares 2x Bitcoin Strategy ETF (BITX US) on CBOE’s BZX exchange

- The leveraged ETF performed strongly on its debut, likely benefitting from Bitcoin’s upswing and renewed interest from spot filings; it accrued $5.5m trading volume on its first day

- Barron’s reported that some industry observers found it peculiar to see a risky leveraged-based product approved before a more straightforward spot ETF, quoting ETF Store’s Nate Geraci; “It’s absolutely ridiculous that a 2x Bitcoin futures ETF is launching before a spot Bitcoin ETF”

- Canadian ETF issuers 3iQ agreed a deal with Coinbase to integrate Ether staking into their Ether Fund and Ether ETF from August onwards

- 3iQ CEO Fred Pye celebrated the move, stating “we believe that commencing ETH staking offers the best of both worlds to our investors—providing additional yield while eliminating the complexities of directly handling digital assets”

- Additionally, on Thursday the CME Group announced plans to launch a new investment vehicle based on digital assets; specifically, a Bitcoin/Ether Ratio futures contract

- CME Group Global Head of Cryptocurrency Products, Giovanni Vicioso, said that with the (cash-settled) futures “investors will be able to capture Ether and Bitcoin exposure in a single trade, without needing to take a directional view. This new contract will help create opportunities for a broad array of clients looking to hedge positions or execute other trading strategies, all in an efficient, cost-effective manner”

- In other Fidelity news, their aforementioned EDX Markets venture confirmed a change in custodian; dropping a previous partnership with Paxos in favour of banking charter holders Anchorage Digital

What happened: Enforcement news

How is this significant?

- On Thursday, Coinbase sought a dismissal of the SEC’s current lawsuit against them, claiming that the commission’s allegations lack merit

- In an interview with Bloomberg, chief legal officer Paul Grewal stated that Coinbase reject more than 90% of assets considered for listing, stating “Coinbase just doesn’t list securities; period”

- He added that the exchange “uses the exact same process” for token listings as the SEC reviewed in 2021, prior to approving Coinbase’s public listing in April that year

- Grewal argues “to now claim, after the fact, that the SEC gave no consideration or no regard whatsoever to the legality of the Coinbase business would be to fly in the face of its statutory obligation”

- Their petition for dismissal says “the only change is in the SEC’s position regarding its powers. That position is untenable as a matter of law, and its assertion through this enforcement action offends due process and the constitutional separation of powers”

- Coinbase shares rose in early trading on news of the dismissal application, and despite suffering in the wake of the SEC’s enforcement action, remain up nearly 100% year-to-date

- Binance faced another challenging week to their international businesses, particularly in Europe

- Banking partner Paysafe Ltd. announced they were withdrawing support for Euro-denominated bank transfers from September 25th onwards

- This follows a previous withdrawal of support for GBP bank transfers by the same company in March, and caps a steady decline in market share for Euro-denominated trade by Binance; rivals Kraken now controls more than half of EUR trading pair volume

- A Binance spokesperson said they would “change provider” and that “all methods of depositing and withdrawing other fiat currencies as well as buying and selling crypto on Binance.com remain unaffected”

- Meanwhile, Binance withdrew from its Belgian and Austrian presence following a lack of approval from authorities

- Traders on Binance.US face currently suffer from unfavourable prices when trying to offload their tokens on the American subsidiary; tokens across the exchange are currently priced at a 2% to 5% discount compared to global market rates

- This follows Binance.US’s decline from 22% local market share in March to just 1.5% following the SEC’s enforcement actions

- The enforcement effect hasn’t just affected its US subsidiary; Bloomberg cited Kaiko data revealing that Binance’s overall market share is at a one-year low; but it still remains by some distance the largest exchange globally

What happened: BlackRock executive foresees eventual institutional DeFi involvement

How is this significant?

- BlackRock dominated recent news cycles following their spot Bitcoin ETF filing; but according to recent statements by a top executive, they could (eventually) find themselves operating in the decentralised landscape of DeFi alongside more traditional investment vehicles like ETFs

- Speaking at the FT/Coinbase Global State of Crypto summit, BlackRock’s head of strategic partnerships Joseph Chalom shared his belief that institutions will become DeFi participants, but that it will likely be “many years” before that’s the industry norm

- Regarding his long-term horizon, he explained his abundance of caution; “Not that I’m pessimistic—I just live in a highly regulated space and so do our clients”

- Acknowledging conference organisers Coinbase, he anticipated that crypto-native firms could become the “bridge” between DeFi and traditional investors, providing services like institutional-grade wallets

- Chalom said BlackRock have already fielded questions from clients regarding DeFi, and that current areas of focus for the company included tokenisation and stablecoins, particularly in the movement of institutional money

What happened: UK government recognises crypto as regulated financial activity

How is this significant?

- A press release on Thursday identified the digital asset industry as a “rocket boost” for the UK economy

- By receiving royal assent, the Financial Services and Markets Bill passed into law, meaning that digital assets are officially recognised within the realms of regulated financial activity

- The UK Treasury’s Andrew Griffith stated “2023 is proving to be a banner year for reforming our financial services. This landmark piece of legislation gives us control of our financial services rulebook, so it supports UK businesses and consumers and drives growth… it will unlock billions in investment—cash that can unlock innovation and grow the economy”

- Additionally, the press release specifically acknowledged the new Act’s capacity to enable “regulation of cryptoassets to support their safe adoption in the UK” and enable the establishment of sandboxes to “facilitate the use of new technologies such as blockchain in financial markets”

- Earlier in the week, the UK’s Law Commission recommended that the UK “develop laws that govern cryptoassets to ensure the country becomes a global hub for crypto assets and non-fungible tokens”

- The commission’s report aligned with Rishi Sunak’s stated goal to make the UK a global crypto hub; it recommended that a third category of personal property be developed to more accurately encapsulate digital assets

- Recommendations seek to “allow these new technologies to flourish, enabling a diverse range of market participants to interact with and benefit from them”, and will now go before the UK government to decide on

What happened: HSBC enables Hong Kong customers to invest in digital asset ETFs

How is this significant?

- Hong Kong’s largest bank, HSBC is following recent government ambitions to turn the city into a global digital asset hub, allowing customers to directly invest via locally-listed crypto ETFs

- Chinese digital asset analyst Wu Blockchain broke the news on Monday that HSBC became the first bank in Hong Kong that “allows its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange”

- Gemini exchange co-founder Tyler Winklevoss tweeted “The East/West Crypto Flippening is accelerating. Hong Kong has just beat the USA to the punch on a Bitcoin ETF...and Ether ETF”

- However, it should be noted that the three ETFs listed in Hong Kong are all futures ETFs, as in the US

- Nonetheless, this increased exposure comes within a month of the city’s new crypto regulatory regime going live, greatly expanding the accessibility of the asset class

- In other Hong Kong news, virtual insurance firm OneDegree—which features coverage for digital assets—completed a $27m funding round to accelerate Asian expansion, following a $28m funding round two years ago

- OneDegree executive Alvin Kwock claims the firm “has received more than 100 digital asset insurance inquiries so far this year, of which half of the potential clients are outside Hong Kong”

- Jeremy Allaire, CEO of USDC stablecoin issuers Circle confirmed they were closely watching developments in the city as part of their Asian expansion plans

- He told Bloomberg “Hong Kong clearly is looking to establish itself as a very significant centre for digital assets markets and for stablecoins and we are paying very close attention to that… What’s happening in Hong Kong may be a proxy for ultimately how do these markets grow in Greater China”

What happened: Julius Baer expands crypto presence in Dubai

How is this significant?

- Swiss private bank Julius Baer confirmed plans this week to apply for a digital asset licence in Dubai, taking advantage of the UAE’s regulatory clarity to set up their first international crypto offering

- Head of digital assets development Jonathan Hayes identified the UAE as a “key geography”, thus deciding to supplement their existing UAE banking licence with a “digital assets licence variation”

- Lucia Desmarquest, the bank’s central and eastern European deputy head, said that despite last year’s market decline, a broad range of clients (aged 25 to 70) still expressed an interest in the asset class

- Their wealth management division currently provides exposure to “the top 15 or so” coins and tokens in the market, and their Swiss headquarters recently introduced Lombard Lending for crypto; allowing clients to borrow against digital assets custodied at the bank as collateral

What happened: MicroStrategy confirms major Bitcoin buys

How is this significant?

- MicroStrategy increased their Bitcoin exposure this week, confirming their largest purchase of the digital asset since 2021

- According to a new SEC filing, the enterprise software firm acquired 12,333 Bitcoins between April 29 and June 27 at an average price of $28,136; a total acquisition cost of around $347m

- This brings their total holdings to approximately 152,333 Bitcoin worth approximately $4.6bn at current prices; eclipsing the company’s own market capitalisation of $4.2bn

- Since the firm began buying Bitcoin in 2020 (to combat “the eroding effects of inflation” on cash reserves) they’ve become the world’s largest corporate holder of the asset

- Due to the scale of their holdings, MicroStrategy shares act almost like a proxy for Bitcoin exposure; whilst Bitcoin is up nearly 85% year to date, MicroStrategy shares have doubled

What happened: Contagion latest

How is this significant?

- The Wall Street Journal reported this week that FTX “has begun the process of soliciting interested parties to the reboot of the FTX.com exchange”, according to CEO John J Ray III

- Such plans would likely face challenges, including the need to rebrand and provision of compensation for customers invested in the failed FTX platform

- The new FTX management revealed further insight into fraudulent practices under Bankman-Fried’s leadership, including the firing of an employee who raised concerns over commingling of funds

- Ray said the new management team has made “substantial progress” in recovering $7bn of liquid assets

- In other FTX bankruptcy news, reports emerged that advisors have halted the $500m sale of the company’s stake in A.I. firm Anthropic, likely hoping to benefit from an increased valuation if artificial intelligence hype continues

- FTX management also seeks to recover $700m paid to K5 Global in exchange for access to celebrities and politicians

- One FTX creditor was able to tokenise their bankruptcy claim on the blockchain as an NFT, selling it to a user who was then able to use it as collateral for stablecoin borrowing; demonstrating the wide variety of applications and marketplaces enabled by decentralisation

- The state of Nevada asked a court to appoint a receiver for failed crypto custodians Prime Trust, based in Las Vegas

- After losing access to some of their wallets storing digital assets, “Prime purchased additional digital currency using customer money from its omnibus customer accounts to satisfy withdrawals”, leaving them eventually unable to cover deposits

- Liquidators of Three Arrows Capital (3AC) are attempting to recover $1.3bn from the founders of the collapsed hedge fund, according to Bloomberg sources

- According to the liquidators, co-founders Su Zhu and Kyle Davies used significant leverage in an attempt to recoup losses from exposure to the collapsed Terra Luna blockchain ecosystem, by which point 3AC was already functionally insolvent

What happened: Sygnum bank identifies institutional digital asset opportunity in Singapore

How is this significant?

- Swiss digital asset bank Sygnum commented this week on the performance of their new crypto brokerage business in Singapore, highlighting continued interest in the asset class amongst high-value clientele

- The bank recently secured in-principle approval for brokerage services, leading Singapore CEO Gerald Goh to reveal further details on their business in an interview

- Said Goh; “A lot of our demand right now is coming from web3 or crypto fund managers who as part of their regulated fund management activities, have a business reason to be buying or selling digital assets, including cryptocurrencies”

- He also believes that the US’ loss could be their gain, following well-publicised travails in the American banking sector earlier this year; “After the US banking crisis, demand for regulated crypto financial institutions have gone up and the Singapore licence will help us to offer the services to such clients”

- Sygnum will offer custody and broker-dealer services in Singapore, with expressions of interest from a wide variety of well-heeled sources; including “fund houses, family offices and institutions”

What happened: BitPanda raises $33m for institutional exchange

How is this significant?

- European Fintech firm BitPanda secured a major funding round this week to spin off its BitPanda Pro digital asset exchange into a separate regulated entity called One Trading

- BitPanda will continue to offer trading through broker services, but will no longer run an exchange

- OneTrading (and current BitPanda Pro) CEO Josh Barraclough said BitPanda and BitPanda Pro are “separating so that they can build out a market leading product for sophisticated retail and institutional customers, with the right focus and investment to be successful. Bitpanda continues to operate, but no longer has an exchange or institutional OTC business”

- OneTrading has already applied for a MiFiD (Markets in Financial Instruments Directive) approval as “a full-scale MiFID licence in the Netherlands would enable it to list regulated financial instruments to both institutions and sophisticated retail investors”

- Barraclough told Bloomberg that events of last year crystalised the need for a more institutional approach to exchanges, hence the new entity; “It’s about how you bridge the gap between traditional finance and crypto. The writing was always on the wall that crypto would become more regulated. I take a TradFi lens and bring the benefits of that to crypto”

What happened: Japan’s biggest bank reveals stablecoin issuance plans

How is this significant?

- Mitsubishi UFJ Financial Group (MUFG)—the largest bank in Japan—confirmed plans for stablecoin issuance via their own blockchain platform

- According to a new stablecoin law that became active this month, only licenced banks, trust companies, and registered money transfer agents are able to issue stablecoins within Japan, in order to increase confidence and security in the tokens

- MUFG already has its own blockchain platform called Progmat, and VP Tatsuya Saito confirmed they’ve held discussions with “entertainment firms, other non-financial businesses… Japanese financial institutions [and] overseas financial groups”

- Saito envisaged that Japan could become a global stablecoin issuance hub, as local regulations allow them to be issued in dollar or other fiat-pegged denominations

- Later in the week, blockchain interoperability protocol DataChain confirmed investment from MUFG, linked to the issuance of tokenised securities on the Progmat platform

What happened: Mastercard extends crypto involvement

How is this significant?

- Global payment giant Mastercard increased their digital asset industry exposure this week, through several initiatives

- Firstly, they extended their Mastercard Engage to include digital asset integration

- Engage is designed to link potential card issuers with partners who can provide relevant technical expertise; “allowing a growing cohort of crypto firms to leverage Mastercard’s global network”, according to a press release

- Mastercard’s Raj Dhamodharan (executive vice president for blockchain and digital assets) commented “The expanded Mastercard Engage network will help empower players across the digital asset ecosystem and beyond to fulfil their ambitions at scale, paired with the safety and security that comes with the Mastercard brand”

- Additionally, Dhamodharan revealed the Multi-Token Network (MTN) testbed, a pilot program in the UK designed to explore tokenised bank deposits

- He told industry publication Coindesk “What powers the global economy today is regulated money in the banks. So we’re starting with making tokenized bank deposits, so the unit of money in a bank account is a digital asset on the blockchain, bringing the same level of programmability to those as you find with digital currency in the crypto ecosystem”

- In particular, he foresees potential benefits in international value transfer “Let’s say a bank in the UK has this tokenized form of bank deposit; and let's say another bank in Singapore also has a tokenized form of deposits. You can see this being exchanged one for the other, also known as cross border transfer of value, which traditionally had a lot of issues in terms of being able to move in a fast and flexible way”

What happened: Stablecoin issuers Tether sign nation-level blockchain development MoU

How is this significant?

- On Wednesday, stablecoin issuers Tether announced a Memorandum of Understanding (MoU) with the government of Georgia (the country, not the state)

- According to Tether, “this strategic collaboration aims to position Georgia as a central hub for peer-to-peer and blockchain technology, igniting a revolution of innovation and economic growth”

- Georgia’s deputy economy minister Irakli Nadareishvili commented “We agreed on cooperation in the educational field regarding blockchain technology, which will contribute to the development of local blockchain technologies in the country, as well as the introduction of companies operating in this sector in Georgia”

- The partnership also appears to form part of a business branding exercise by Georgia, as according to the press release it seeks to “position itself as a leading hub for digital innovation in the region”

What happened: JP Morgan adds tokenised Euro payments to its permissioned blockchain

How is this significant?

- JP Morgan was one of the earliest blockchain adopters amongst big banks, through their 2019 creation of JPM Coin as an international dollar movement solution for clients

- On Wednesday, they diversified the currency integrations possible through JPM Coin, adding Euro-denominated payments for corporate clients

- Basak Toprak, JPMorgan’s MENA region head of Coin Systems, told Bloomberg that Siemens performed the first Euro-based cross-border transaction on their platform

- By using blockchain instead of traditional payment rails, JPM Coin transfers can be executed constantly, introducing benefits not possible in the business-hour-bound environments of legacy systems

- Toprak pointed out that expedited transfers can have a multitude of positive aspects; “There are cost benefits to paying at the right time. This could mean they could earn more interest income on their deposits”