13th October, 2023

Market Overview:

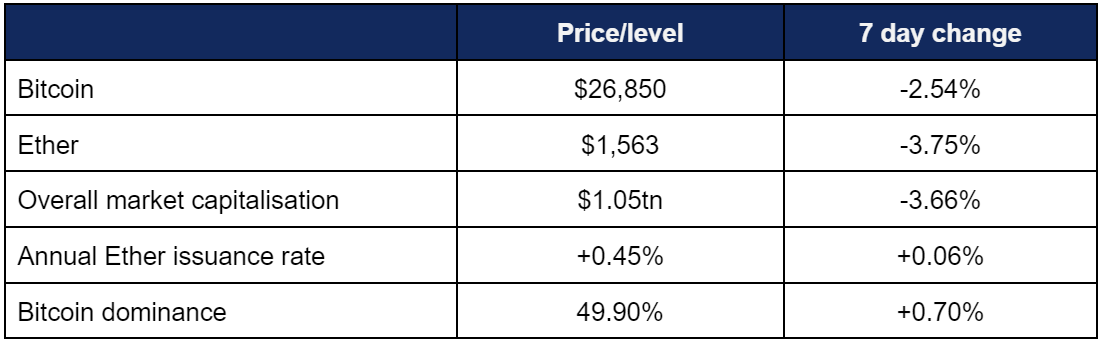

Digital assets reversed their recent positive momentum this week, amidst major market uncertainty following war in the Middle East and poor US economic indicators.

- Bitcoin traded strongly early on, reaching a high of $28,230 on Friday, before geopolitical and macroeconomic uncertainties caused a gradual decline to a weekly low of $26,590 on Thursday evening

- Bitcoin experienced a steep drop on Thursday following new PPI data that came in significantly above expectations, falling below $27,000 for the first time in two weeks

- Ether followed Bitcoin’s chart movements, dropping from a Friday high of $1,660 to a Thursday low of $1,550

- Overall digital asset market capitalisation declined to $1.05tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week dropped to $36.6bn

Digital assets started strongly, but like most markets were affected by news around escalating conflicts in the Middle East. Nonetheless, there were several significant developments in the fields of institutional adoption and recognition. Investment banks and billionaires alike recognised Bitcoin as a potential safe haven and hedge against inflation. JP Morgan, BlackRock, and Barclays were all involved in the transfer of tokenised assets. Amazon partnered with a blockchain gaming project, Fidelity released a report on Bitcoin, and multiple industry startups completed 8-figure raises.

What happened: Jefferies promotes Bitcoin as “critical hedge” against inflation

How is this significant?

- The United States Congress narrowly avoided a shutdown last week with a new debt ceiling deal—but as some analysts states, it merely kicks the national debt problem down the road, rather than solving it

- America's national debt now stands at $33tn, leading to concerns over a "looming debt spiral" (spurred by rising interest rates on said debt) as $1.8bn in daily interest payments on US debt are forecast to hit $4bn daily within ten years

- Outspoken billionaire Elon Musk went so far as to label the US Dollar “a scam” on X (formerly Twitter) this week in the face of the debt ceiling, prior to additional economic challenges created by war in the Middle East

- According to analysts from investment bank Jefferies, Bitcoin could act as a "critical hedge against inflation", and be a key beneficiary of global macroeconomic challenges plaguing central banks

- Christopher Wood, Jefferies' global head of equity strategy wrote in a new client note; "G7 central banks, including most importantly the Federal Reserve, will not be able to exit from unconventional monetary policy in a benign manner and will ultimately remain committed to ongoing central bank balance-sheet expansion in one form or another"

- Should Wood’s prediction ring true, it would mark a dovish pivot from the Fed's ongoing hawkishness—which itself was the result of them failing to address inflationary concerns in a timely manner

- He adds "such failure to exit from unorthodox monetary policy in a benign manner is likely to culminate in the collapse of the USD paper standard to the benefit of both gold bullion owners and also owners of Bitcoin". Whilst gold has traditionally been viewed as a hedge against inflation, Bitcoin—aka "digital gold"—is now increasingly accepted for the same purpose

- As during Covid-driven quantitative easing, Bitcoin could benefit from fiat supply expansion, as such policies keenly illustrate one of its foundational characteristics; a specific, steady, predictable issuance rate, guaranteed in publicly-verifiable code.

- Depending on when exactly any pivot might take place, Bitcoin could be even more attractive as its quadrennial "halving" event is on the horizon. This planned adjustment to the issuance rate (every 210,000 blocks; approximately 4 years in human time) will happen Q2 next year, cutting miners' block rewards in half (from 6.25 per block to 3.125); meaning fewer new Bitcoins than ever before entering supply.

- Bitcoin has strongly outperformed gold thus far this year in the face of relentless interest rate rises; at the time of writing, "digital gold" is up over 60% YTD, whilst "old gold" is up 1.5% YTD according to World Gold Council spot prices

- Wood also believes that institutional demand for Bitcoin is driving this re-evaluation of safe haven assets; "Bitcoin has now become investible for institutions, with custodian arrangements in place for digital assets, and represents an alternative store of value to gold"

- As a result of their analysis, Jefferies currently recommends a 10% allocation to Bitcoin for USD-based long-term investors, including pension funds

- Another established voice to speak out in favour of Bitcoin exposure this week was hedge fund billionaire Paul Tudor Jones

- In a CNBC interview, he forecast the possibility of a US recession, and backed gold and Bitcoin as safe havens; “ I would love gold and bitcoin together. I think they probably take on a larger percentage of your portfolio than they would [historically] because we’re going to go through both a challenging political time here in the United States and we’ve obviously got a geopolitical situation”

What happened: JP Morgan, BlackRock, and Barclays collaborate on tokenised trade

How is this significant?

- Momentum for tokenisation within TradFi environments gathered further this week, as several institutional heavyweights collaborated on a blockchain-based trade

- JP Morgan’s bespoke TCN (tokenised collateral network) was used by BlackRock to tokenise shares in one of its money market funds, subsequently transferring them to banking giant Barclays as collateral for an OTC derivatives trade between both parties

- TCN was first tested in May 2022, but this transaction now marks it as officially live for commercial use

- Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, said that utilisation of the bank’s Onyx blockchain lead to near-instantaneous settlement, rather than taking the best part of a day to execute

- Lobban stated “with the launch of TCN, clients can benefit from additional utility from their MMF investments by posting tokenised MMF shares as collateral–a faster, more cost-effective way of meeting margin requirements”

- He added that if employed at scale, there could be significant benefits in capital efficiency; tokenisation could “increase efficiency by freeing up locked capital so that it could be used as collateral in ongoing transactions”

- JP Morgan head of trading services Ed Bond told Bloomberg that the system would evolve, and in future “Institutions on the network can use a wider scope of assets to meet any collateral requirements they have on the back of trading”

- He also added they already have a pipeline of clients interested in utilising TCN

- Tom McGrath of BlackRock commented on the successful transaction by stating “Money market funds play an important role in providing liquidity to investors in times of high market volatility… tokenisation of money market fund shares as collateral in clearing and margining transactions would dramatically reduce the operational friction in meeting margin calls when segments of the market face acute margin pressures”

What happened: Amazon collaborates with NFT gaming platform Immutable

How is this significant?

- Although NFTs have fallen out of public consciousness over the course of crypto winter, diverse use-cases beyond just digital art have ensured continued development from some major industry players; this week, one teamed up with Amazon to advance blockchain gaming

- Specifically, Australian-based blockchain gaming technology developers Immutable joined “Amazon’s ISV Accelerate Program, a co-sell program for organisations that provide software solutions that run on or integrate with AWS”

- This not only provides Immutable customers with free use of Amazon Web Services hosting technology, but also networking within the wider Amazon ecosystem; including game studios

- John Kearney, head of startups, Amazon Web Services Australia and New Zealand, stated “The example that we’ve put together here with Immutable is super fascinating because of what they’re doing in changing a market [gaming] that’s been around for a long time”

- He added “web3 gaming is one of the fastest growing sub-sectors of the blockchain industry and is already enjoyed by millions of gamers worldwide… AWS is supercharging Immutable’s development by onboarding new game studios, and providing them with resources… which give them the tools to accelerate their global launch”

What happened: UK Financial Conduct Authority pledges enforcement on industry advertising

How is this significant?

- The FCA, the UK’s finance industry watchdog, promised this week to take transgressors to task regarding any breaches of new crypto advertising standards, which went live on the 8th of October

- Lucy Castledine, the FCA’s director of consumer investments, said that the agency will update its list of advertising violators hourly, scraping around 100,000 websites daily for potential breaches of communications guidelines

- New regulations include requirements for clear risk warnings, and 24-hour “cooling off” periods for new customers

- These guidelines were only published in June, leaving some firms scrambling to ensure compliance, and leading others to temporarily withdraw or suspend certain services within the UK

- These rules apply not only to UK-registered firms, but to global firms offering (or not directly excluding) services to UK citizens, leading Castledine to declare that “There are a number of fairly large overseas crypto exchanges that are targeting the UK that have failed to engage with us”

- This statement appears to include Binance, after Reuters reported on Tuesday that the FCA rejected the exchange’s authorised company for approving promotions

- Binance launched a new localised domain for UK users, removed a variety of products and services (such as gift cards or referral bonuses) and (according to a spokesperson) invested “an enormous amount of time and resources” to ensure FCA compliance, but nonetheless appears to have fallen short of the regulator’s expectations

- Just before the new rules came into effect, Nomura-backed crypto custodians Komainu successfully registered with the FCA, ensuring communications compliance

What happened: Bitcoin metrics and perception boom amidst broader market malaise

How is this significant?

- A new report from ARK Invest revealed interesting data about Bitcoin that suggests its performance remains strong even across a stagnant few months for the digital asset market

- In particular, ARK found that the “holding behaviour per supply percentage held by long-term holders is at its highest since 2010”

- This equates to almost 80% of Bitcoin addresses being classified as “long term holders” (those who have held their Bitcoin for 155 days or more), indicating a reluctance to sell tokens at current market prices

- According to data from industry analytics firm Glassnode, these long-term holders are accumulating around $1.35bn worth of Bitcoin on a monthly basis, whilst a new report from exchange Bitfinex suggested that the total supply of Bitcoin owned by long-term holders has increased by one million Bitcoin (out of a current 19.5 million) since April this year

- Bitcoin dominance approached 50%; a 3-month high, signalling a possible flight towards the most established asset as a safe haven within the industry whilst geopolitical and macroeconomic concerns abound

- JP Morgan released a new research report on Bitcoin mining, suggesting the industry is at a “crucible moment”, and that the network may reduce hashrate by around 20% next year after the halving; with fewer Bitcoin available as block rewards, they posit that less-efficient mining hardware will be rapidly decommissioned, lessening competition amongst miners

- The bank also suggested that the next-largest digital asset by market cap, Ethereum, has become more centralised since the network’s “Shanghai” upgrade allowed free movement of validator fund’s in the blockchain’s proof-of-stake infrastructure

- This has led to reduced yields for stakers post-Shanghai, said the analysts led by Nikolaos Panigirtzoglou

- Fidelity’s digital asset arm meanwhile released a new report appraising Bitcoin, and outlining some of the rationale behind its staying power even as newer, faster blockchains routinely launch

- Analysts Chris Kuiper and Jack Neureuter wrote that although “a first-mover technology, will [usually] easily be supplanted by a superior one or have lower returns”, Bitcoin must be viewed more holistically; “Bitcoin’s first technological breakthrough was not as a superior payment technology, but as a superior form of money”

- They claim “Bitcoin should be considered first and separate from all other digital assets that have followed it… [the most] secure, decentralised, sound digital money”

What happened: Standard Chartered analysts release 2026 price prediction

How is this significant?

- Banking giant Standard Chartered—a participant in the digital asset ecosystem through its Zodia institutional exchange—released a new research report on Ethereum this week, outlining a bullish perspective on the multi-year horizon

- Standard Chartered Head of FX Research, Geoff Kendrick, wrote that a variety of factors benefiting from smart contract integration—such as tokenisation and blockchain gaming—could spur an appreciation of the Ethereum blockchain’s native asset Ether

- Additionally, he believes that scaling improvements in the blockchain’s architecture could "help to cement Ethereum’s dominance in the smart contract space, thereby increasing its P/E ratio (if not its earnings) over the next couple of years”

- By the end of 2026, Standard Chartered analysts foresee a $8,000 price for Ether—if proven correct, this would represent more than a five-fold increase over current levels

- He adds that such growth would partially be driven by factors outside of Ethereum’s own remit, including the potential for a rising (Bitcoin) tide lifting all boats; “potential regulation and spot ETFs in the U.S. should benefit ETH as much as BTC; we pencil this in for late 2024, after the U.S. election”

- On an even longer-term (“say, 2040”) horizon, Kendrick believes a similar rate of return could be realised once more; “We see the $8,000 level as a stepping stone to our long-term 'structural' valuation estimate of $26,000-$35,000”

What happened: Crypto prime broker completes $20m funding round from major hedge funds

How is this significant?

- Membrane Labs, a digital asset prime broker, successfully concluded a $20m Series A round this week, involving participation from several TradFi giants

- Amongst the contributors were hedge funds Brevan Howard Digital and Point72 Ventures, alongside market makers Jane Street and Jump Crypto

- Membrane CEO Carson Cook told industry publication Coindesk that FTX crystalised the need for new structures within the industry; “On top of core [settlement network] infrastructure, we built workflow management for collateral management, loans, OTC trades and derivatives. The permeating theme is to increase transparency and risk management, especially in a post-FTX and post-3AC world”

- He added “We can do classic settlement which is just sign and send and a lot of institutions want that functionality because they're used to taking on that settlement risk with other desks or other institutions. We can also offer smart settlement that uses a system of smart contracts as an escrow… clients can choose to take on the smart contract risk and not have the counterparty risk”

What happened: Contagion latest

How is this significant?

- Reporting was once again dominated by details of former FTX leader Sam Bankman-Fried’s ongoing criminal trial for fraud, especially after former executives testified against him

- First was his former best friend and FTX co-founder Gary Wang, who testified that Bankman-Fried enabled the funnelling of funds from FTX to trading firm Alameda Research

- However, it was the testimony of former Alameda CEO (and Bankman-Fried’s on-again-off-again girlfriend) Caroline Ellison which saw the most interest from journalists

- Bankman-Fried’s attorneys allege that Ellison failed to properly manage risk in her role as Alameda CEO, leading to losses compounding; Ellison claims that “SBF” corrupted her, instructed all her criminal endeavours, and that she felt “relief” when the exchange finally collapsed

- She also revealed that the exchange used customer money to buy out Binance’s ownership share in FTX, and claimed that Bankman-Fried wanted “to get regulators to crack down on Binance”

- Outside of Manhattan courtrooms, digital asset exchange Bitfinex proposed a $150m share buyback for customers compensated with shares after a 2016 hack led to Bitcoin losses

- A tip-off from liquidators was revealed as the catalyst for Three Arrows Capital co-founder Su Zhu’s arrest at Singapore’s Changi airport last week

What happened: Stablecoin market cap drops to lowest level since 2021

How is this significant?

- According to industry analytics firm CCdata, the overall market capitalisation of stablecoins has dropped to the lowest levels since August 2021

- Total value dropped to just under $124bn, and the volumes traded on centralised exchanges fell to $331bn; the lowest since July 2020

- Regarding volumes, it should be noted that trading on decentralised exchanges (DEXes) has grown significantly since July 2020, especially as more traders chose to self-custody their funds following FTX’s collapse last year

- Tether has increased its dominance in the stablecoin space, currently accounting for over 67% of the total

- PayPal’s “corporate stablecoin” has seen slow uptake since launch; although it should be noted that it is available on far fewer platforms than most competitors

- Thus far, around $100m of value has been issued through PayPal’s PUSD stablecoin