August 23rd, 2024

Market Overview:

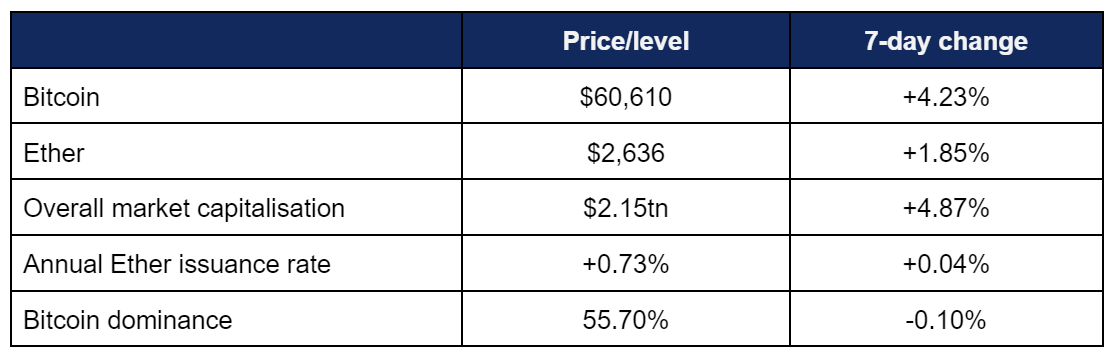

Digital assets saw growth this week, as hopes grew around the possibility of higher rate cuts by the Federal Reserve.

- Bitcoin recovered ground from recent losses, moving back into bullishness as minutes from the Federal Reserve indicated an increased willingness for interest rate cuts

- Bitcoin rose in the wake of such reporting, hitting a weekly high of $61,590 on Thursday, showcasing steady upward trajectory throughout most of the week after a Friday low of $57,900

- Ether’s weekly chart was more measured overall, but with greater volatility in shorter timeframes; a Tuesday high of $2,693 was followed by a Wednesday low of $2,559

- Spot ETF fortunes contrasted strongly this week, as Bitcoin registered an unbroken run of inflows, whilst Ether ETFs continued to bleed overall due to Grayscale outflows

- Overall digital asset market capitalisation increased to $2.15tn, exhibiting a greater rate of growth than either Bitcoin or Ether; indicating strong outperformance by altcoins this week as they bounced back harder from larger losses over the past few weeks

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew to $86.1bn

Digital assets showcased some signs of recovery from the previous fortnight’s tribulations, helped by an unbroken inflow streak within Bitcoin ETFs. Both sides of the US political spectrum communicated positive attitudes towards the asset class this week, whilst Franklin Templeton and State Street enhanced their tokenisation capabilities, Binance announced mass headcount growth, several firms made acquisitions, and Tether revealed the first MENA stablecoin, pegged to the UAE Dirham.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced contrasting fortunes this week, as Bitcoin products notched a run of inflows whilst Ether products lagged and suffered consecutive outflows

- According to CoinShares data, digital asset investment products (dominated by spot ETFs) saw modest overall inflows of $30m in the week ending Friday the 16th, although this week witnessed increased inflows in line with broader market momentum

- Spot Bitcoin ETFs saw consistent net inflows throughout the week to date, as BlackRock’s IBIT and Fidelity’s FBTC more than made up for continued outflows from Grayscale’s converted trust, GBTC

- Bitcoin ETFs hit a six day streak of inflows, including a $92.7m daily haul for IBIT as markets reopened on Monday

- Although Grayscale’s 1.5% GBTC maintained its trend of post-launch outflows, the firm’s newly launched mini-BTC ETF (with a 0.15% fee) registered several days of eight-figure inflows this week

- Spot Ether ETFs however exhibited consistent outflows, albeit at a relatively modest level, and once again dominated almost entirely by outflows from Grayscale’s converted Ethereum trust, the 2.5% fee ETHE

- BlackRock’s ETHA registered the highest daily net inflows at $26.8m, with most other funds featuring flat trading of net zero flows, as volume lagged far behind the established Bitcoin ETFs

- A new insights report from Coinbase examined data from recent 13F filings with the SEC (required from firms managing more than $100m in assets), showcasing an increased institutional involvement in ETFs

- The report stated “continued ETF inflows during Bitcoin’s underperformance [in Q2] may be a promising indicator of sustained interest in crypto from the new pools of capital that the ETFs give access to… A growing portion of these flows appear to be driven by institutions, whose ownership of shares rose from 21.4% to 24.0%”

- Bloomberg senior ETF analyst Eric Balchunas noted the launch of more leveraged ETFs based around corporate Bitcoin leaders MicroStrategy; a popular proxy for Bitcoin exposure

- The Defiance 1.75x long MicroStrategy ETF traded a record $50m on Tuesday, leading to the launch of a 1.5x short MicroStrategy ETF to play both sides of the coin

- Balchunas also noted the status of proposed ETFs for popular smart contract blockchain Solana; but the news wasn’t good for altcoin enthusiasts, as the products were given “A snowball's chance in hell of approval” under current regulatory leadership

- Although the US appears unlikely to approve them anytime soon, Brazil actually approved its second Solana ETF this week, issued in a partnership between Hashdex and investment bank BTG Pactual

What happened: Political news

How is this significant?

- As the US presidential race continues to gather steam, reports regarding digital assets emerged from both sides of the aisle

- After last week’s concerns regarding a possible continuation of Biden administration hostilities, news this week suggested that the Harris campaign may take a more conciliatory stance towards the industry

- According to senior campaign advisor Brian Nelson, “She’s going to support policies that ensure that emerging technologies and that sort of industry can continue to grow”

- Speaking to Bloomberg during the Democratic National Convention, he said Harris supported greater regulatory clarity; “[Harris will] focus on cutting needless bureaucracy and unnecessary regulatory red tape… [encouraging] innovative technologies while protecting consumers and creating a stable business environment with consistent and transparent rules of the road“

- Crypto-friendly senator Tim Scott this week proposed an increased congressional specialisation in digital assets if his Republican party take over control of the Senate and thus the Senate Banking Committee

- Scott spoke at the Wyoming Blockchain Symposium, and stated “Wouldn't it be kind of cool if we had a subcommittee on the banking committee that focuses on the industry so that we bring more light to the conversation, more hearings on the industry, so that we get things done faster”

- Wyoming senator Cynthia Lummis noted that the banking committee lags behind the House Financial Services committee in lacking a specialised subcommittee, blaming the “headwinds” of staunchly anti-crypto Democrats like Sherrod Brown and Elizabeth Warren

- She also acknowledged the lack of movement on passing a crypto bill like the FIT21 Act through both houses of congress, but senior Democrat Chuck Schumer did state in a recent Harris4Crypto town hall meeting that he wished to pass legislation by the end of the year

- Personal financial disclosures of Republican candidate (and former president) Donald Trump revealed that he owns between $1m to $5m in crypto assets, apparently mostly in Ethereum

- Furthermore, Trump used his social media this week to promote a DeFi (decentralised finance) platform founded by two of his sons

- In his post for the “DeFiant Ones” project, he wrote “For too long, the average American has been squeezed by the big banks and financial elites. It’s time we take a stand — together. #BeDefiant”

- In other news from the political and regulatory spectrum, Nigeria’s SEC performed an about-turn on recent hostility towards the industry, moving to licence crypto exchanges “as adoption rates surge” in the country

- SEC director general Emomotimi Agama told Bloomberg TV “Being a crypto enthusiast and fintech enthusiast, I can tell you without doubt that this is going to happen sooner than you think. We must support the youths of this country to be able to achieve the benefit that is accruable in fintech. The market size is huge and it is growing”

What happened: Franklin Templeton tokenised fund expands to new blockchain

How is this significant?

- Following on from last week’s expansion onto Ethereum layer-2 blockchain Arbitrum, Franklin Templeton continued to broaden its tokenisation base, adding its money market fund to the Avalanche blockchain

- This marks a further evolution for the FOBXX fund (token name: BENJI), the USA’s first registered on-chain fund, adding to its presence on the Ethereum blockchain

- Franklin Templeton head of digital assets Roger Bayston stated “Bringing the Benji platform to the Avalanche network further expands access to our first-of-its-kind tokenised money market fund. We look forward to working with Avalanche’s vibrant developer community to bring new blockchain-enabled innovations into the market”

- He added further praise to the chain, saying “I think the Avalanche ecosystem represents a super robust network that allows us to deliver high quality attributes and characteristics to our customers”

- FOBXX currently manages around $420m in assets, placing it second in the tokenised fund market after BlackRock’s breakout success BUIDL at $502m

- In other news around the Avalanche blockchain, crypto asset manager Grayscale recently added an Avalanche token trust to its portfolio of investment products, with head of product and research, Rayhaneh Sharif-Askary commenting “Through its key strategic partnerships and unique, multi-chain structure, Avalanche is playing a pivotal role in the advancement of RWA [real world asset] tokenisation”

What happened: Binance reveals mass hiring push to increase compliance expertise

How is this significant?

- Following in the recent industry trend of increasing headcount, Binance CEO Richard Teng this week revealed major new employment goals for the world’s leading exchange, with recruitment for 1,000 roles

- A large number of new staff are earmarked for customer service and the exchange’s compliance efforts—spending on which currently costs the exchange $200m annually

- Teng said that the company plans to boost its compliance department count from around 500 now to 700 by the end of the year

- Adding 1,000 new employees accounts for a growth of approximately 20% from earlier this year

What happened: State Street increases crypto custody and tokenisation capabilities

How is this significant?

- State Street, the world’s largest custody bank, has recruited the services of Swiss tokenisation and crypto custody specialists Taurus, “in anticipation of a more congenial regulatory climate in the US”

- The initial focus of the partnership will be geared towards RWA [real world asset] tokenisation with an as-yet unnamed client

- Donna Milrod, State Street’s head of Digital Asset Solutions, told industry publication Coindesk that as a custody bank, they were strongly opposed to the SEC’s controversial SAB121 accounting guidelines, which required banks to hold custodied crypto assets on their own balance sheets, unlike other assets

- Milrod said “While we're starting with tokenisation, that's not where we're ending. As soon as the U.S. regulations help us out, we will be providing digital custody services as well. We know how to be a custodian. We don't do that on our balance sheet. We do that off-balance sheet. They're not our asset”

- Taurus co-founder Lamine Brahimi agreed on the need for accounting reform, saying “I'm quite sure this partnership with State Street will be a positive signal for the US financial markets in general, which, because of SAB 121, have been lagging those in Europe”

What happened: Mining firm Bitfarm acquires rival in $175m deal

How is this significant?

- In a press release this week, major mining firm Bitfarm announced the acquisition of rival firm Stronghold, in a deal with an overall $175m value

- This consist of $125m in stock (at a 70% premium over the last 90 days’ average), alongside assumed debt of $50m

- Bitfarms CEO Ben Gagnon said the firm would benefit from not only increased mining hardware, but energy access, particularly across the Mid-Atlantic region

- Additionally, he indicated the Canada-based firm will likely reallocate some of its hashpower towards artificial intelligence applications; “I am committed to diversifying Bitfarms beyond Bitcoin mining to enable us to achieve my main objective of enhancing long-term value for shareholders”

- Analysts identified this move as a strategic bulwark against potential takeovers from larger mining rival Riot Blockchain

- A couple of weeks ago, Riot increased its shareholding in Bitfarms to around 19%, leading to concerns over a potential poison pill takeover after a $950m bid was rejected

- Julio Verissimo, CEO of Borderless Consulting, told industry publication Decrypt “By acquiring Stronghold now, Bitfarms demonstrates that it is not just passively waiting but is taking proactive steps to increase its value and strengthen its negotiating position”

- In other acquisition news, Bitcoin ETF issuer Bitwise bought ETC Group, a London-based digital asset issuer

- Acquiring the $1.1bn AUM ETC Group will bring Bitwise’s assets to around $4.5bn

- Bitwise CEO Hunter Horsley told Bloomberg that the deal was part of an international expansion strategy, and “allows us to serve European investors, to offer clients global insight, and to expand the product suite”

What happened: a16z leads raise for blockchain IP project a $2.25bn valuation

How is this significant?

- Leading Silicon Valley VC Andreessen Horowitz (a16z) led an $80m round this week for Story, a blockchain-based intellectual property project enabling IP creators and owners to “track usage more effectively”

- Story co-founder and CEO SY Lee said that the decentralised and transparent nature of blockchain facilitates IP tracking—and payment for its usage; “Anyone can fork and remix your IP permissionlessly while you capture the upside”

- The Series B round also featured contributions from Polychain Capital and individual investors, and puts the startup’s valuation at $2.25bn, and brings its total raises thus far to $143m

- According to TechCrunch reporting “more than 200 teams—and more than 20 million addressable IPs—are registered on the platform so far”, ranging from fashion design tools to Japanese comic platforms

- A16z’s Chris Dixon explained the investment as an acknowledgement of growing AI creation volume; “These AI systems were likely trained on original, human-created content but often don’t credit or cite their sources. If there’s no attribution or compensation, what incentive will there be to publish original creations on the open internet?”

- Polychain’s Olaf Carlson-Wee stated “What Bitcoin did for money and finance, Story is doing for content and IP. Web3’s first phase was triggered by the 2008 financial crisis, leading to a revolution on money through networks like Bitcoin and Ethereum. Now advancements in AI are triggering a second phase in Web3, which will revolutionise IP”

What happened: Stablecoin issuer Tether announces UAE Dirham token

How is this significant?

- Tether, the largest stablecoin issuer in the world, is addressing the growth of Dubai and Abu Dhabi as crypto hubs, by issuing a new stablecoin pegged in value to the UAE Dirham (AED)

- However, the move may not be quite as revolutionary as it first appears; since 1997, the Dirham has been pegged to the US Dollar at a fixed 3.6725 to 1 rate

- Tether CEO Paolo spoke at an event in Dubai and said “The main purpose is actually creating an optionality towards the US dollar. We see a lot of interest in holding AED outside of the UAE”

- The firm will issue the tokens in collaboration with Abu Dhabi crypto firm Phoenix Group, seeking licencing approval for the Dirham stablecoin under a new Payment Token Services Regulation, introduced in June

- This new localised stablecoin will simplify and streamline trading and investment within the Emirates—and perhaps also help leverage a recent Dubai court decision acknowledging crypto as a valid form of wage payment

- Additionally, a statement from Tether said an AED stablecoin could “streamline international trade and remittances, reduce transaction fees, and provide a hedge against currency fluctuations”