December 13th, 2024

Market Overview:

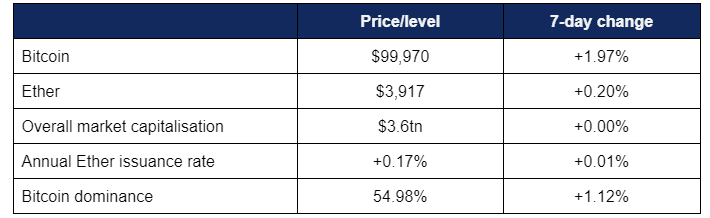

Digital assets saw modest growth this week, as Bitcoin recovered to break through the $100,000 mark once again following some significant profit-taking.

- Bitcoin bounced back strongly from heavy profit-taking in the wake of last week’s record run above the $100,000 mark, recovering to reach the landmark figure again after dropping down to the mid-$90,000s

- Bitcoin spent the majority of the week trading between around $98,000 and $99,900, as traders front-ran the $100,000 level

- Bitcoin experienced a sharp dip on Tuesday en route to a weekly low of $94,590, before mounting a recovery to a Thursday high of $102,350—within touching distance of last week’s new record high

- Some analysts attributed this rally to further political support, amidst reports that the next CFTC chair could be the crypto policy head of a major digital asset VC

- Ether experienced similar movements to Bitcoin, albeit with an earlier peak of $4,090 late on Friday—a new yearly high

- It subsequently dipped alongside Bitcoin to a weekly low of $3,523 on Tuesday, before recovering to current levels

- Overall industry market capitalisation remained steady at $3.6tn, as growth in Bitcoin and Ether was counteracted by pullbacks across several major altcoins, consolidating after explosive growth last week

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased by roughly $2bn to $136.3bn

The digital asset market showcased strong performance across Bitcoin and Ether, whilst most altcoins cooled off after double-digit growth during last week’s record run. Bitcoin once again exceeded $100,000 as there was more good news in the political and regulatory spheres, backed by numerous stablecoin developments, positive endorsements from illustrious names including BlackRock, Goldman Sachs, and Ray Dalio, amongst much much more.

What happened: Political news

How is this significant?

- Bitcoin and other digital assets continued to feature prominently in the political discourse this week, with president-elect Donald Trump now just a few weeks away from taking office

- Speaking at the New York Stock Exchange, Trump said the US is “going to do something great with crypto”

- He backed his previous intentions to make the country “the crypto capital of the planet”, as he told CNBC “We’re gonna do something great with crypto because we don’t want China, or anybody else… but others are embracing it, and we want to be ahead”

- Speaking at the Bitcoin MENA conference in Abu Dhabi, his son Eric Trump declared “The people who don’t see it are the people who are going to get left behind. My father’s going to be an unbelievable ally to the industry”

- He also commented on the recent appointment of David Sacks as “Crypto Czar”, saying “Isn’t it really nice to see somebody who understands it so well, who’s been so successful in it, leading the charge?”, and vowed a shift away from “incompetent SEC directors who waged war on the crypto industry for no reason whatsoever”

- Late on Thursday, the digital asset industry also applauded news that noted congressional digital asset advocate French Hill will be the next Chairman of the House Financial Services Committee, marking another pro-crypto appointment in the legislative and regulatory spheres

- Elsewhere, a new report in the Financial Times indicated that El Salvador may be required to scale back its Bitcoin laws in order to qualify for a $3.5bn IMF loan, although the bank acknowledged earlier this year that feared “risks [regarding Bitcoin adoption] have not yet materialised”

- However, these changes are unlikely to have a material effect on the nation’s Bitcoin policy, only requiring that Bitcoin acceptance by vendors be made voluntary rather than mandatory, rather than removing it altogether

- Meanwhile, Hong Kong regulators pledged a “swift licencing process” to speed up a greater presence of digital asset platforms within the city

What happened: ETF News

How is this significant?

- Digital asset ETFs continued their recent strong performance, logging near-uninterrupted nine-figure daily inflows

- According to CoinShares data published on Monday, digital asset investment product inflows recorded record inflows in the trading week ending the 6th of December

- Total inflows amounted to $3.85bn, handsomely beating the previous largest figure set just a few weeks prior

- This included $2.5bn inflows for Bitcoin, and a record $1.2bn for Ether products

- Additionally, blockchain equities experienced their highest inflows since January, adding $124m

- These figures further increased the record year-to-date inflow and total AUM figures for digital asset investment product, at $41bn and $165bn respectively

- In the trading week to date, spot Bitcoin ETFs continued their strong performance, posting nine-figure inflows for ten consecutive days,

- Inflows were dominated by BlackRock’s IBIT and Fidelity’s FBTC

- IBIT posted inflows of $394m and $296m on Monday and Tuesday (after $257m on Friday), before an uncharacteristic net-zero flow day on Wednesday

- However, Wednesday proved to be the calm before the storm, as IBIT logged $432m net inflows on Thursday

- Meanwhile, FBTC achieved nine-figure inflows Monday through Wednesday, adding $176m, $211m, and $122m

- Other significant inflows included $61m for Bitwise’s BITB, $53m for ARK Invest’s ARKB, and $111m for Grayscale’s 0.15% fee mini-ETF (a new record for the fund)

- Bloomberg’s chief ETF analyst Eric Balchunas summed up the incredible performance of Bitcoin ETFs thus far by revealing “$IBIT already has as much in assets as the 50 European focused ETFs (region + single country) COMBINED and they've been around for 20yrs”

- Additionally, he celebrated coverage of ETF success on vaunted US news programme 60 Minutes, and noted that on Friday US ETFs passed Satoshi-linked wallets as the top holders of Bitcoin

- In just 11 months of trading, ETFs have now absorbed around 2.5% of Bitcoin in circulation

- Post-Trump Bitcoin ETF inflows now exceed $10bn

- Digital asset ETFs featured heavily at Bloomberg’s annual ETFs in Depth conference; BlackRock’s Jay Jacobs stated that “We’re really just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own ($IBIT and $ETHA) so that’s what we’re focused on (vs launching new alt coin ETFs)”

- Mike Venuto of Tidal backed this up at the conference, saying “We have ppl coming to us all the time trying to pitch ‘Bitcoin + something else’ ETFs… Every options strategy you can think of is going to be tied to Bitcoin, Nvidia, Tesla and MicroStrategy in ETFs. It’s coming”

- Spot Ether ETFs built on bullish momentum, with every trading day this week (at the time of writing) featuring nine-figure inflows

- In total, Ether products have now logged nine-figure inflows in seven of the last eight trading days

- Net inflows this week came in at $150m, $306m, and $102m

- BlackRock’s ETHA had the largest cumulative inflows this week (adding $155m, $82m, $74m, and $202m), but Fidelity’s FETH matched the largest single-day inflows, accruing $202m on Tuesday

- Elsewhere in digital asset ETFs, reports this week suggested that the SEC has informed potential issuers of its intention to reject pending Solana ETFs since the commission still accuses it of being a security; a move which Balchunas called a “parting gift” from outgoing chair Gary Gensler

- However, this is unlikely to be the end for altcoin aspirations, as Bloomberg analysts predict issuers will just refile under the new regulatory regime of presumably pro-crypto chair Paul Atkins

- Beyond the US, issuer Valour added 20 new crypto ETPs to Sweden’s Spotlight stock market on Thursday, bringing the total number of digital asset funds there to 45

- The new funds primarily focus on lesser-known altcoins, as Valour co-founder Johan Wattenström claimed “By simultaneously introducing such a diverse range of innovative products, we are not merely expanding our portfolio—we are offering investors access to the forefront of blockchain technology”

What happened: BlackRock outlines “reasonable” Bitcoin exposure theory

How is this significant?

- After championing the leading digital asset for over a year, the world’s largest asset manager finally put a concrete recommendation on Bitcoin portfolio allocation this week

- According to a Thursday paper by the BlackRock Research Institute, a 2% portfolio weighting for Bitcoin is a “reasonable range” for multi-asset investors to gain upside exposure without significantly increasing risk

- In particular, a 1% to 2% exposure “would produce a similar share of profile risk as the Magnificent Seven tech stocks in a standard 60/40 portfolio” according to the analysts

- However, the report cautioned against exposure beyond 2%, opining “share of total portfolio risk becomes outsized compared with the average magnificent 7 stock”

- Bloomberg’s James Seyffart noted that both Bitcoin’s correlation with global equities and volatility have steadily decreased over the last couple of years

- Report authors including BlackRock’s ETF CIO Samantha and senior portfolio strategist Paul Henderson stated “We see a case for investors with suitable governance and risk tolerance to include Bitcoin in a multi-asset portfolio... A Bitcoin allocation would have the advantage of providing a diverse source of risk, while an overweight to the Magnificent 7 would add to existing risk and to portfolio concentration”

- They added that “Looking ahead, should Bitcoin indeed achieve broad adoption, it could potentially also become less risky—but at that point it might no longer have a structural catalyst for further sizable price increases”

What happened: Texas lawmaker proposes Strategic Bitcoin Reserve

How is this significant?

- On Thursday, Texas state representative Giovanni Capriglione filed a bill advocating for the creation of a statewide Strategic Bitcoin Reserve

- During an X (formerly Twitter) Spaces, Capriglione revealed “I just filed the bill... to be entitled ‘an act relating to the establishment of a Bitcoin reserve within the state treasury of Texas and the management of crypto[assets] by governmental entities filed in the state of Texas Strategic Bitcoin Reserve”

- CNBC identified House Bill 1598 as a potential “proving ground for the US Treasury”

- Capriglione stated “Probably the biggest enemy of our investments is inflation. A Strategic Bitcoin Reserve, investing in Bitcoin, would be a win-win for the state”

- The bill allows for taxes, fees, and donations paid to the government via Bitcoin, providing the basis for a reserve to be held for at least five years

- He added that “My goal is to make this bill as big and as broad as possible. This initial step is to allow some optionality and flexibility on it, but if I am able to get support from other legislators, we will make it even stronger”

- If the bill is passed, it would represent a watershed for Bitcoin as a reserve asset; Texas is not only the second-largest economy in the US, but the eighth-largest in the entire world

- In a CNBC interview on Thursday, Donald Trump appeared to reinforce his intentions to create a national reserve

- When Jim Cramer asked if he planned to create a “Strategic petroleum reserve-like for crypto", Trump responded "I think so. We're gonna do something great with crypto, 'cause we don't want China, or anybody else, not just China, others are embracing it, and we want to be the head“

- Meanwhile, in America’s neighbour to the north, Vancouver City Council approved mayor Ken Sim’s proposal to explore “the diversification of financial reserves” by “becoming a Bitcoin-friendly city” that accepts payments for government services in the digital asset

- The motion calls for a feasibility study into Bitcoin integration by the end of Q1 2025, as mayor Sim argued “It would be irresponsible for the City of Vancouver to not look at the merits of adding Bitcoin to the City’s strategic assets to preserve the City’s financial stability”

What happened: Goldman Sachs CEO open to Bitcoin and Ether trading

How is this significant?

- Speaking at the recent Reuters Next event, Goldman Sachs CEO David Solomon struck a cautiously optimistic note on digital assets, revealing that the bank could undertake spot trading and make markets with Bitcoin and Ether “if regulations allow”

- Solomon couldn’t directly commit due to uncertain over exactly how rules will evolve, but commented “I do think that these technologies are addressing [issues], and they're getting a lot of attention at the moment because there's a view that the regulatory framework is going to evolve… differently than it seemed like it was evolving under the last administration”

- He said “The regulatory framework has to evolve … and everyone’s speculating as to how that regulatory framework will evolve, but it’s still unclear… But for the moment … our ability to act in these markets is extremely limited”

- Speaking on digital assets in general, he stated “you know these are speculative assets at the moment. But people are very interested in them. I understand why”

- Solomon also dismissed the notion of reputational risks from association with crypto; “I don’t correlate [ex-FTX CEO] Sam Bankman-Fried with digital assets. There are plenty of people who commit criminal actions with respect to fiat currency and that doesn’t create a reputational risk around fiat currency”

- Although its hands remain tied in terms of direct trading and marketmaking, Goldman is already heavily involved in the broader blockchain space; it holds over $700m in Bitcoin ETFs, and its digital asset head Mathew McDermott recently confirmed multiple tokenisation projects with institutional clients

What happened: Stablecoin news

How is this significant?

- Numerous significant events occurred in the stablecoin space this week, featuring several major issuers

- USDC issuer Circle formalised a partnership with leading crypto exchange Binance this week to support the stablecoin across Binance’s platforms

- Circle chief business officer Kash Razzaghi commented that the move is a win-win; “Binance has undergone a deep transformation of its business, and over time, we mutually agreed that it made sense to pair one of the world’s most trusted and regulated stablecoins, USDC, with the world’s largest crypto exchange to prioritise the safety and security of their customers’ assets as the company focuses on improving its regulatory scorecard”

- Although Tether remains by far the largest player in stablecoins, Razzaghi believes that Circle’s focus on compliance positions it “incredibly well competitively” in “a world where stablecoins are regulated in every major financial center”

- Binance CEO Richard Teng stated “Through our strategic partnership, our users will have even more opportunities to use USDC on our platform, including more USDC trading pairs, special promotions on USDC across trading, and other products on Binance”

- His Circle counterpart Jeremy Allaire added “With Binance rapidly becoming the world's leading financial super app, and stablecoin adoption and utility at the core of this future financial system, this is a tremendous opportunity for USDC as it becomes ubiquitous on the Binance platform”

- PayPal’s SVP of crypto, Jose Fernandez da Ponte, recently revealed that the company foresees greatly increased levels of stablecoin adoption, with regions outside of the US leading the way

- Meanwhile, Citi Wealth analysts released a 2025 Wealth Outlook Report arguing that stablecoins help to alleviate concerns that digital assets such as Bitcoin could undermine and threaten the US dollar

- The strategists wrote “Greater regulatory clarity could also potentially further boost [stablecoins] appeal. If so, demand for U.S. Treasury bills from stablecoin issuers might grow from around 1% of purchases today. Rather than usurping the dollar, therefore, this variety of cryptocurrency could make dollars more accessible to the world and reinforce the USD’s longstanding global dominance”

- They added “Activity has reached record highs, with $5.5 trillion in value across the first quarter of 2024. By comparison, Visa saw about $3.9 trillion in volume. In response to this challenge, Visa, PayPal and other traditional providers are adapting by offering stablecoins of their own or settling transactions in other firms’ coins”

- Tether was approved as an accepted virtual asset (AVA) this week by Abu Dhabi’s Financial Services Authority

- TechCrunch reported that Indian and Chinese investment firms PeakXV and HongShan led a $10m seed round in “in KAST, a dollar-denominated neobank-like platform that lets customers hold and spend stablecoins through traditional payment avenues”

- Identifying stablecoins as a remedy for cross-border issues in traditional banking, KAST co-founder Daniel Bertoli argued “The next generation of digital banks will be inherently global and built on stablecoins from the ground up”

- Ripple CEO Brad Garlinghouse confirmed that the XRP issuers received NYDFS approval this week for issuance of its planned RLUSD stablecoin

- He confirmed that the coin would go “live soon” across a variety of exchanges and partners

- Reports on Thursday revealed that French financial group Oddo BHF SCA is developing a Euro-denominated stablecoin in conjunction with institutional crypto firm Fireblocks

- Forthcoming EU-wide MiCA regulations are expected to spur more banks and Tradfi institutions into the stablecoin space

- According to Bloomberg sources, Oddo “expects to launch the token next year, pending regulatory approval”, echoing plans from fintechs such as Robinhood, Revolut, and Stripe

- Finally, former SoftBank executive Akshay Naheta is reportedly selling a stake in his stablecoin startup “to expand into newer markets, including the US”

- Naheta’s firm Distributed Technologies Research currently offers “payout and pay-in facilities in over 40 countries, which will be scaled to over 100 countries next year with billions of dollars in transactions going through it”, according to a company spokesperson

What happened: Regulatory news

How is this significant?

- US regulatory news and developments continued to roll in this week ahead of the imminently-incoming Trump administration and Republican congress

- Trump’s recent SEC chair pick Paul Atkins had his pro-crypto credentials reconfirmed this week, when eagle-eyed researchers dug up a podcast in which he criticised the US government for FTX’s failure

- Atkins stated that “The collapse of FTX was this international debacle that happened because, I think, the US didn’t make our rules accommodating to this new technology”

- He added that major firms like Binance were reluctant to operate within the US, as decentralised ledgers “cannot comply with the regulations as written by the Securities and Exchange Commission… It just will not work, according to the rules the way they’re written, so that’s a problem”

- Meanwhile, former SEC chair Richard Breeden told Bloomberg “If I was in the crypto industry, I would be thrilled to have such a thoughtful person with lots of knowledge about crypto being in charge of regulation and knowing that you’re likely to get a fair and balanced regulator”

- New crypto (and AI) czar David Sacks appears similarly sceptical of heavy-handed regulation

- Sacks said in a 2021 podcast “The fact of the matter is you’ve got a lot of brilliant young entrepreneurs, computer scientists building this financial infrastructure of the future with crypto. We don’t necessarily want to interfere with that to the point where we break it”

- Coinbase CEO Brian Armstrong celebrated the Sacks pick, tweeting “It's incredible to think what is possible with sharp, pro-tech, pro-business people in government”

- The SEC could potentially become even more crypto-conscious, as commissioner Caroline Crenshaw, a Democrat who objected to Bitcoin ETFs, could lose her place after a renomination vote was postponed, leaving limited time in the remaining congressional calendar to reschedule

- This was identified by some as a deliberate delay to encourage formation of an all-Republican commission, as outgoing (anti-crypto) senator Sherrod Brown stated “This is why people hate Washington”

- Earlier in the week, Bitwise CIO Matt Houghan suggested that regulators must get used to a more conciliatory crypto stance; “Regulators spent four years trying to shut down crypto. Crypto responded by: Winning in court . Winning at the ballot box. The media wants to portray crypto's political efforts in a negative light. It's actually how democracy works. If you face what you think is inappropriate regulation, your only possible responses are the one listed above”

- If FIT21 legislation passes, the majority of digital asset oversight would fall to the CFTC; and the current reported frontrunner for CFTC chair is another digital assets buff; Andreessen Horowitz (a16z) Crypto policy lead Brian Quintenz

- Quintenz previously served as a CFTC commissioner, following work in the hedge fund realm

- In an interview, Binance CEO Richard Teng welcomed a “bright future” for crypto policy and regulation in the US, whilst Kraken CEO David Ripley told Bloomberg he expects a positive resolution to the exchange’s ongoing legal conflicts with the SEC

- However, Ripple’s chief legal officer Stuart Alderoty appeared more focused on current regulatory efforts, bemoaning continued legal enforcements from what amounts to a lame duck administration

- This included an 81 page brief in the SEC’s filing against Binance

What happened: Billionaire investor Ray Dalio recommends Bitcoin amidst rising national debt

How is this significant?

- Ray Dalio, founder of Bridgewater Associates (the world’s largest hedge fund), outlined his current (bullish) position on Bitcoin during a speech at Abu Dhabi Finance Week

- He said “I want to steer away from debt assets like bonds and debt, and have some hard money like gold and Bitcoin”

- This is because he sees all major economies (except Germany) as afflicted by high levels of indebtedness, causing concerns over inflation and fiat currency; “it is impossible for these countries to be able to not have a debt crisis in the years ahead that will lead to a great decline of [money] value”

- Although he previously recommended a 2% portfolio allocation towards Bitcoin, his current logic still represents an evolution from previous views, where he told CNBC last year that he didn’t particularly like the asset, viewing it as neither effective money nor a store of value

- Another billionaire investor, Interactive Brokers founder Thomas Peterffy, also came out in support of Bitcoin this week

- Speaking to Bloomberg at a Goldman Sachs Group conference, he advised Bitcoin exposure, although cautioned against over-exposure

- He said “I think anybody who does not have Bitcoin should have some Bitcoin, but not too much”

- Peterffy’s allocation recommendation actually (slightly) exceeds BlackRock’s guidelines published this week, as he explained “I would recommend that people put maybe 2% to 3% of their net worth into Bitcoin. We for example will not allow anyone to invest more than 10% of their assets into Bitcoin because I think that would be very dangerous”

What happened: Virtu and Standard Chartered joining digital asset derivatives trading platform

How is this significant?

- Virtu Financial and Standard Chartered were among major financial institutions this week to sign up with a new crypto derivatives platform owned by the London Stock Exchange

- The GFO-X exchange will begin operations in Q1 2025, and handle Bitcoin index futures trading and options

- Other participants confirmed for the exchange include ABN Amro Clearing and market makers IMC, whilst other backers include the asset management arm of pensions giant M&G

- CEO Arnab Sen said that shifting political realities led to increased institutional interest; “There are huge tailwinds post the US election. We had multiple firms reach out since then which previously would have had a cautious stand”

What happened: Smart contract blockchain Avalanche raises $250m in funding

How is this significant?

- Avalanche, a smart contract blockchain currently ranked 11th by overall market capitalisation secured a major funding injection this week, raising $250m via token sales to overhaul and improve its technology

- These tokens are locked or vested for an extended period of time in order to ensure aligned objectives between Avalanche and the investors

- Industry publication Coindesk reported at least 40 firms participated in the raise, led by Dragonfly, Galaxy Digital, and ParaFi Capital

- A press release by Avalanche (aka AVAX) suggested that its new Avalanche9000 upgrade could reduce deployment costs by 99%, according to current testnet data

- Co-founder Emin Gun Sirer told Forbes that Avalanche already retained a $3bn treasury, but that “The primary goal was to get alignment and incentivise the right kinds of partners to build with”

- ParaFi founder Ben Forman stated “Avalanche is uniquely positioned to be a driving force in the evolution of onchain institutional finance. Architectural advantages like fast transaction finality and high throughput, combined with customizable virtual machines, make it an ideal platform for securely and compliantly issuing and managing tokenized assets”

What happened: Coinbase investigation indicates deliberate crypto debanking efforts

How is this significant?

- From 2022 onwards, several voices in the digital asset industry raised concerns that the federal government was trying to “kill off” the industry via “Operation Chokepoint 2.0”—a concerted effort to forbid banks from offering services to digital asset firms

- Now, according to confidential banking documents obtained by Coinbase, such theories may hold water

- History Associates, a research firm hired by Coinbase, previously took the FDIC and SEC to court in order to compel them to provide internal communications

- Although heavily-redacted, such materials were eventually provided, and painted a picture of industry victimisation

- One letter from the FDIC to a bank read “We respectfully ask that you pause all crypto asset-related activity. The FDIC will notify all FDIC-supervised banks at a later date when a determination has been made on the supervisory expectations for engaging in crypto asset-related activity”

- Coinbase chief legal officer Paul Grewal questioned the legality of such exclusions, telling industry publication Coindesk “The letters show that this was no conspiracy theory at all, that this was not… a paranoid industry. There was a concerted plan on the part of the FDIC that they carried out to deny banking services to a legal American industry. That should give everyone great pause”

- Grewal later tweeted an update indicating that the FDIC had been overzealous in its redactions, and thus failed to comply with a court mandate; “JUST IN: Judge Reyes ruled that FDIC didn't do what it was ordered to do. ‘The Court is concerned with what appears to be FDICs lack of good-faith effort in making nuanced redactions. Defendant cannot simply blanket redact everything that is not an article or preposition’.”

- Pro-crypto SEC commissioner Hester Peirce appeared to confirm the policy, saying in a FOX Business interview that the SEC must “stop this approach of trying to prevent crypto from getting access to the services that it needs—custody, for example—to move forward”

- JP Morgan told CNBC that even if offices like the OCC might not directly forbid banking crypto, they certainly made it unfeasible; “The complexity of managing such compliance is often simply too high for some businesses where there are challenges in monitoring for risk. We welcome the opportunity to work with the new Administration and Congress on ways to remove regulatory ambiguity”

- Although the New York Times suggested that industry insiders may have exaggerated debanking efforts as a “convenient political cudgel”, the paper nonetheless accepts that at least 30 crypto startups funded by VC Andreessen Horowitz (a16z) were affected by deliberate debanking efforts

What happened: First Abu Dhabi Bank partners with tokenisation platform Libre

How is this significant?

- $335bn First Abu Dhabi Bank (FAB) this week signed a memorandum of understanding to collaborate with Libre on tokenisation efforts

- Libre is one of the leading tokenisation firms in the world, backed by Japanese finance giant Nomura via its Laser Digital crypto arm

- The endeavours will concentrate on “blockchain-based collateralised lending using real world asset (RWAs) tokens”

- According to Coindesk “FAB will be handling liquidity through lending credit lines on Libre’s assets on public chains like Ethereum, Polygon, Solana, NEAR, Aptos and Coinbase’s layer2 network BASE”

- Libre CEO Avtar Sehra explained “We've been working on adding utility to our AUM in the form of collateralised lending. Essentially it's an on-chain infrastructure that allows these RWAs to be used as collateral. The lending is all in stablecoins, not in fiat, and is being provided through existing lenders, like broker dealers, or Laser Digital, and now they are getting credit lines from providers like FAB”