December 6th, 2024

Market Overview:

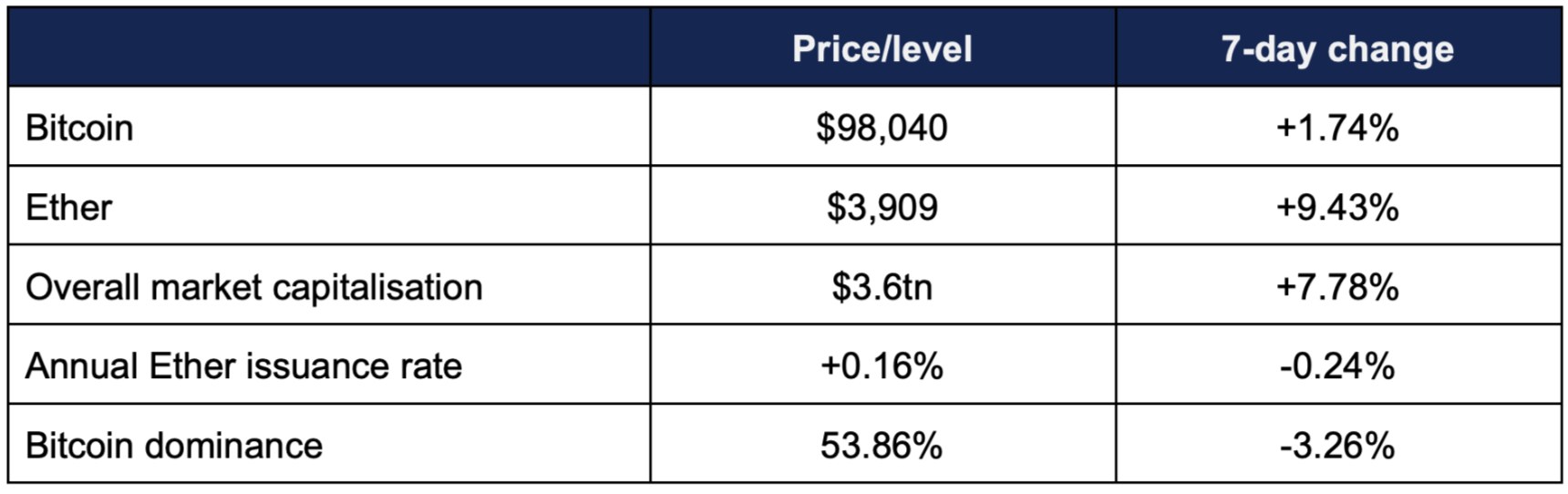

Digital assets experienced another record week (despite short-lived martial law in a major market!), as Bitcoin reached new records and broke through the landmark $100,000 boundary.

- Bitcoin finally surpassed $100,000 this week, setting several new record highs

- Bitcoin traded primarily between $95,000 and $97,500 for the majority of the week, before rapidly rising on Wednesday and Thursday, as a pro-industry nomination for SEC chair led to widespread market optimism

- Bitcoin broke through $100,000 early on Thursday, and hit its latest all-time high of $103,900 by Thursday afternoon (an increase of around 50% in a month)

- The leading digital asset subsequently pulled back after widespread profit-taking and the largest daily liquidations since 2021 dropped it to a weekly low of $93,000, before it returned to bullish momentum

- Ether displayed a more consistent upward trajectory than Bitcoin this week, recovering from a Monday low of $3,504 to reach a Thursday high of $3,944

- Although still short of its $4,891 all-time high set three years ago, this nonetheless represented Ether’s best price since it briefly topped $4,000 in March

- Overall industry market capitalisation reached a new record of $3.71tn, before pulling back to current levels of $3.6tn

- This growth was fuelled not only by Bitcoin and Ether, but several major altcoins such as XRP, which posted weekly growth above 50%

- At the time of writing, 77 of the top 100 digital assets by market capitalisation registered double-digit weekly growth

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased over $10bn to $134bn

The digital asset market displayed continued strength, not only setting new records, but bouncing back swiftly from both (temporary) martial law in a major market and massive profit-taking leading to the largest liquidations in years. Bitcoin reaching a new all-time high above $100,000 dominated reporting, but elsewhere there were numerous positive developments, including record ETF performance, trading volumes, Apple partnerships, tokenisation progress, and much more.

What happened: Bitcoin hits new record, exceeds milestone $100,000 figure

How is this significant?

- Bitcoin reached a long-awaited milestone this week, arriving at the $100,000 mark after years of waiting—and promptly carried on running to just short of $105,000

- This landmark was greeted by headlines across the world

- Initial analyst expectations suggested that when Bitcoin first hit $100,000, it could be difficult to break through as such a round figure clearly suggests a “profit-taking stage”; but instead Bitcoin powered through the sell wells and rapidly ascended several thousand dollars further—before eventually pulling back as profit-taking materialised in US trading hours

- Binance CEO Richard Teng commented “Today’s milestone marks a turning point in Bitcoin’s journey from a niche asset to a mainstream financial instrument”

- Coinbase CEO Brian Armstrong outlined both Bitcoin’s great growth, and its function against currency debasement, as he tweeted “If you bought $100 of Bitcoin when Coinbase was founded in June 2012, it would now be worth about $1,500,000. If you kept the $100 you'd only be able to purchase about $73 worth of goods today. Every government, especially those looking to hedge against inflation, should create a Bitcoin strategic reserve. Happy Bitcoin $100k day”

- Even the traditionally snarky Financial Times Alphaville column, a longtime opponent of all things digital assets, felt obliged to publish a (very begrudging) congratulation towards the digital asset

- Among others to comment on the asset (and its performance) this week were CEOs, central bank chairs, and world leaders; including the incoming president of the USA

- Galaxy Digital CEO Mike Novogratz declared that “We are witnessing a paradigm shift. After four years of political purgatory, Bitcoin and the entire digital-asset ecosystem are on the brink of entering the financial mainstream”

- Donald Trump appeared eager to take credit for the asset’s surge, tweeting “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!! Together, we will Make America Great Again!”

- Meanwhile, Vladimir Putin identified Bitcoin as an asset that, unlike fiat currencies, couldn’t be politicised due to its decentralised nature; “For example, Bitcoin, who can prohibit it? No one”

- Speaking at the New York Times dealbook summit, Fed chairman Jerome Powell also put in his two cents’ worth; “It’s just like gold, only it’s virtual, it’s digital. People are not using it as a form of payment or as a store of value. It’s highly volatile. It’s not a competitor for the dollar, it’s really a competitor for gold”

What happened: ETF News

How is this significant?

- Digital asset ETFs performed strongly across the board, including a strong uptick in Ether funds’ performance

- According to CoinShares data published on Monday, digital asset investment product inflows experienced a sharp drop in inflow value ($270m) in the week ending November 29th—although it must be noted that said trading week was truncated due to the US Thanksgiving holiday

- This included the first week of Ether ETFs beating Bitcoin ETFs for performance, with $634m inflows versus $457m outflows

- The Ether inflow figures brought year-to-date inflows up to $2.2bn including their best-ever trading day; adding $333m on Friday, with BlackRock’s ETHA fund accounting for the lion’s share ($250m)

- Overall, US spot ETFs logged a record month in November, adding a total of $7.6bn net inflows

- This eclipsed the previous record (February 2024) by over $1.5bn

- In the trading week to date, spot Bitcoin ETFs exhibited bullish momentum, consistently showcasing nine-figure net inflows, adding $354m, $676m, and $557m on Monday, Tuesday, and Wednesday

- Thursday however was by far the best day for funds, boasting $767m inflows

- BlackRock’s IBIT was (once again) the key beneficiary of these inflows, adding nine figures every day this week ($338m, $693m, $572m, and $770m)

- As Bloomberg’s chief ETF analyst Eric Balchunas noted, this brought IBIT above $50bn AUM

- He added that not only did IBIT reach this landmark figure, but it did so in absolute record time; “It took it 228 days to reach this milestone, the next fastest ETF to reach $50bn was $IEFA in 1,329 days. So over 5x faster than any ETF ever launched. Ridiculous”

- Other Bitcoin ETFs were comparatively muted in performance, although Fidelity’s FBTC and Grayscale’s 0.15% fee mini-ETF did both include trading days with more than $50m inflows (including $95m for the latter on Thursday)

- Spot Ether ETFs continued the positive performance from Friday, posting consistent inflows as the underlying asset approached $4,000

- Although Monday’s inflows stood at a relatively modest $24m, the next two days both brought nine-figure net flows of $133m and $168m

- ETHA and Fidelity’s FETH led the way, as the former featured $56m, $65m, and $124m inflows, and the latter added $20m, $74m, and $41m

- Thursday set yet another record for the funds, beating Friday’s inflows by almost $100m, for $429m net flows

- These record flows included nine-figure performances across multiple ETFs; $293m for ETHA, and $114m for FETH

- Elsewhere in digital asset ETFs, REX launched the first crypto stock covered call ETF, issuers Hashdex posted a triumphant video celebrating the evolution of attitudes regarding Bitcoin

- Current filings for crypto ETFs include index ETFs from Hashdex, Franklin Templeton, Grayscale, and Bitwise, Solana ETFs from five issuers, XRP ETFs from four issuers, and singular submissions for HBAR and Litecoin ETFs

- Solana and XRP ETFs are attracting particular attention from analysts, as the next-highest (non-stablecoin) assets in the industry

- According to Bloomberg ETF analyst James Seyffart, “I do think it's a matter of when—not if—under Trump's future SEC admin”

What happened: Digital assets surpass stocks in South Korea

How is this significant?

- South Korea entered international headlines this week after experiencing “the shortest martial law in history”—but the country also featured in industry headlines for its remarkable digital asset trading activity

- Global optimism around digital assets under a Republican administration has filtered through to Korean traders as well, with Bloomberg pointing out “From Nov. 5 through Nov. 28, the daily average trading on Korean crypto exchanges amounted to about $9.4 billion versus $7 billion for the Kospi, according to data from CCData and Korea Exchange. While the Kospi is down about 3.4% since the election, an index tracking the top 100 digital tokens is up 53% over the same period”

- Ahn Hyunsang, CEO of the Korea Investment Research Institute, noted that the economic malaise which contributed to the martial law declaration also fosters digital asset enthusiasm; “Because the Kosdaq market is doing terribly, people are heading to the coin market”

- Over 15% of the Korean population is currently registered on a digital asset exchange, one of the highest participation rates in the world

- A particular quirk of the Korean digital asset market is the prohibition of any trading on overseas exchanges; ensuring that local exchanges Upbit and Bithumb are amongst the largest in the world, and that the insulation leaves traders paying above the global average due to restricted supply; the so-called “kimchi premium”

- The abrupt and unexpected martial law declaration spurred panic locally that sent Korean markets down; including crypto

- Bitcoin flash-crashed to $63,000 on local exchange Upbit, before rebounding almost instantly as the asset topped $100,000 the next day

What happened: Coinbase partner with Apple Pay

How is this significant?

- American digital asset exchange Coinbase significantly increased its accessibility this week, inking a deal with Apple allowing iOS developers to integrate crypto purchase capabilities directly within their apps via Apple Pay

- In a press release, Coinbase announced that “Coinbase Onramp makes fiat-to-crypto conversions easier with a guest checkout process for eligible purchases, free USDC on and offramping, and access to the most popular payment methods. With Apple Pay, getting onchain only takes seconds”

- TechCrunch noted that this is a significant event for Apple, which previously disavowed digital assets within its ecosystem; “Apple seems to be embracing crypto with this integration—at least, more than it used to—perhaps marking a turn for the iPhone maker’s thorny relationship with the crypto industry”

- CEO Tim Cook first floated the idea of crypto purchased via Apple Pay back in 2021, when he noted that he himself holds digital assets

- In other Coinbase news, the leading publicly-listed exchange recently acquired payments startup Utopia Labs, in an effort to expand its capabilities, according to business development VP Shan Aggarwal

- Aggarwal told Bloomberg “I don’t think there’s a good consumer experience among legacy payment companies that operates on a global stage. We are going to be doubling down to create best-in-class user experiences that completely abstract all complexities associated with crypto. What we are really trying to do is update the financial system”

- CEO Brian Armstrong agrees, stating “We really want to get that to be 20% of global GDP running on crypto rails. We think that they’re faster, they’re cheaper, they’re more global, they’re more fair, they’re more free. Payments are going to flow to the path of least resistance, kind of like water”

What happened: Digital asset trading volumes reach record levels

How is this significant?

- Despite some observations that the current crypto rally “has yet to reprise pandemic era mania” due to a lower retail participation, overall trading volumes set new records in November

- Nonetheless, combined monthly spot and derivative exchange volume exceeded $10tn for the first time in November, according to CCData

- Political positivity was a key factor, and Bitcoin alone drove large volumes, increasing around 50% since US election day

- CCData research analyst Jacob Joseph noted that “This sentiment is evident in the increased appetite for assets like Ripple, which has historically faced heightened regulatory scrutiny. Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month”

- Spot trading volumes reached over $2.7tn on centralised exchanges (although some sources claim $3.43tn), their highest levels since May 2021, and more than double October’s $1.14tn, showcasing the sheer scale of post-election enthusiasm

- Binance led the way in spot volumes, followed by Korean exchange Upbit, and crypto.com

- Institutional exchange CME also saw a massive surge in volume, as futures trading increased 83% to a record $245bn

- If theories around sidelined retail interest hold true, there could be more room for volume growth; eToro market analyst Josh Gilbert stated “From a retail perspective, interest is clearly growing as trading in Bitcoin has picked up significantly. However, we are yet to see the levels we’ve seen in previous cycles, which signals that we’ve got a wave of retail investors still watching [and waiting]”

What happened: Regulatory news

How is this significant?

- This week saw several significant appointments within the US regulatory sphere, increasing expectations of a positively-inclined administration from January onwards

- Firstly, Donald Trump officially named former SEC commissioner Paul Atkins as the next SEC chair, replacing the outgoing Gary Gensler

- Atkins’ appointment was warmly received across the industry (with several analysts claiming the news as the final catalyst to push Bitcoin over $100,000)

- Bloomberg identifies Atkins as a “crypto fan” and “strong proponent of digital assets”, “suggesting four years of relaxed policy and enforcement for crypto firms to hedge funds” in the service of competition and market efficiency

- After leaving the SEC, Atkins founded the consultancy Potomak Global Partners, which included attempts to create a taxonomy with the CFTC for digital tokens and token launches—leading to greater expectations of clarity and collaboration

- University of Kansas Law School professor Alex Platt summarised it thus; “I think the nomination of Atkins would signal and would be understood as a return to the status quo before Gensler. Back to business as usual for the SEC”

- Swyftx brokerage CEO Jason Titman commented that “This is a momentum rally… and the nomination of Paul Atkins as SEC chair just added to the carnival atmosphere”

- Then, late on Thursday, Trump confirmed the rumoured post of “Crypto Czar”, appointing former PayPal COO David Sacks to the role

- Sacks’ will also oversee legislative efforts regarding AI, as Trump confirmed that “He will work on a legal framework so the Crypto industry has the clarity it has been asking for, and can thrive in the US”

- In a 2017 CNBC interview, Sacks praised digital assets, stating “It feels like we are witnessing the birth of a new kind of web. Some people have called it the decentralised web or the internet of money”

- ARK Investment CEO Cathie Wood responded enthusiastically to the appointments, opining that they would benefit the United States’ competitiveness in the global market

- She said “The US almost lost our footing in the crypto asset world… A change in the regulatory system, with both crypto and AI as prime focuses, is going to be quite meaningful”

What happened: Bitcoin miner Marathon Digital acquiring wind farm

How is this significant?

- Marathon Digital (aka MARA), one of the largest publicly-listed Bitcoin miners, featured in the news for several different times this week, including an increase in its renewable energy footprint

- The mining giant purchased a wind farm in North Texas, according to an energy commission filing, allowing the company to mine Bitcoin with 114mw of power during clement climatic conditions

- CEO Fred Thiel stated “We can move the market to where the electrons are, as opposed to moving the electrons to where the market is. We eliminate the dependence on the grid”

- This will further increase the miner’s hash power (already up 15% according to its latest reports), and presents them more control over the grid in times of increased competition from AI-intensive data centres

- In other news, the firm purchased $618m worth of Bitcoin as part of its dual-acquisition (mining and buying) strategy, as per new SEC filings

- This allowed it to add 6,484 Bitcoin (at an average of $95,352) to its treasury

- On Wednesday, Marathon also confirmed the completion of a $850m convertible senior note sale, with the majority of proceeds earmarked for additional Bitcoin purchases

What happened: Ripple’s XRP token surges amidst expectations of ETF

How is this significant?

- Ripple Labs emerged as one of the big winners of the recent digital asset rally this week, as its XRP token strongly outperformed the market thanks to expectations of a more relaxed regulatory approach

- Former CFTC commissioner Chris Giancarlo recently told FOX Business that, under the new administration, he expects the SEC to drop any and all ongoing legal challenges against Ripple

- Additionally, the reduced SEC hostility increased hopes for an XRP ETF; issuers WisdomTree became the latest to file for such a product this week

- On Monday alone, XRP rose as much as 32%, as the token moved above $2 for the first time since 2018

- That liquidated more than $60m of short positions on XRP, more than the total amount for Bitcoin and Ether combined

- International appetite for the token was cited as a key driving factor for the rise, particularly from Korean traders

- In other Ripple news, the firm’s new RLUSD stablecoin will soon begin trading, following NYDFS approval

- Ripple urged patience to those awaiting the launch, stressing the need for full regulatory compliance and standards

What happened: Tokenisation news

How is this significant?

- Frankfurt-based 21X received approval from German regulators BaFin this week to develop and launch a new tokenised securities exchange next year

- The firm confirmed its exchange would launch in Q1 2025, and run on the Ethereum scaling solution Polygon

- In a press release, 21X revealed its licence was issued after an 18 month process including such stakeholders as the Bundesbank, BaFin, and the ECB

- 21X CEO Max Heinzle stated “This is more than just a license—it’s a revolutionary moment for capital markets. For the first time ever institutional and retail investors can trade and settle tokenised securities on a fully regulated, blockchain-based exchange with the same level of trust, security and compliance as traditional markets”

- Meanwhile, London-based firm Trilitech launched a tokenised Uranium solution on the Tezos blockchain

- Regulated firm Archax will act as custodian for the underlying assets as (per industry publication Coindesk), Trilitech will “offer tokens backed by physical uranium oxide U3O8”, a key component in the rising nuclear power sector