April 8th, 2025

Market Overview:

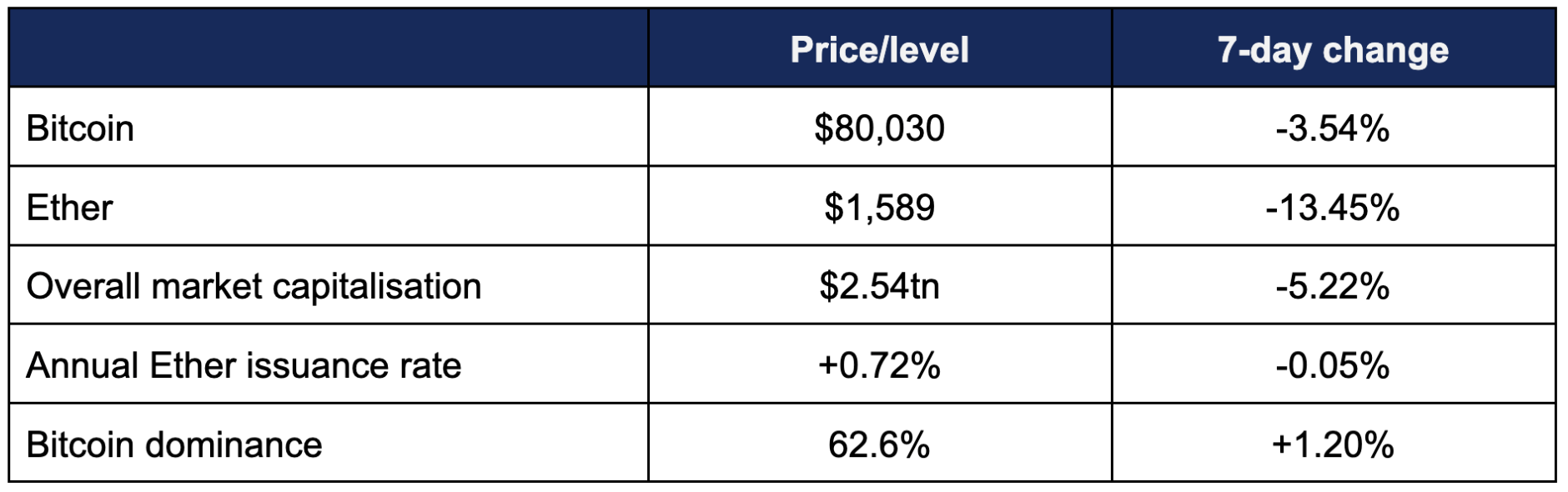

Digital assets declined due to investor panic around the United States’ new reciprocal tariffs, but managed to outperform larger, more traditional markets despite the uncertainty.

- Bitcoin finished the week down after strong early trading, as the economic fallout of new US tariff policy affected markets worldwide

- Bitcoin performed steadily throughout most of the week, before a sharp fall on the weekend, as the 24/7/365 trading schedule of digital assets rendered it vulnerable to new tariff reports whilst securities and commodities markets slept

- Bitcoin dropped from a Thursday high of $87,890 to a Monday low of $74,720, before recovering some losses

- The dip below $75,000 represented its lowest levels since November 2024

- However, despite these losses, Bitcoin outperformed traditional markets, as it actually traded up on the first day after tariff announcements, whilst other markets suffered their worst trading days in at least five years

- At the time of writing, the S&P 500 and Nasdaq are both down more than 9% over the last week; more than twice the losses of Bitcoin

- On Friday alone, the US stock market lost over $3.1tn—more than the market capitalisation of all digital assets

- Ether fell below $1,500, hitting $1,430 on Monday, down from $1,933 on Wednesday

- Overall industry market capitalisation fell as far as $2.35tn, before rallying to current levels of $2.54tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell to $89.2bn

Digital assets were affected by wider global investor panic over new tariff policies and possible trade wars—but crypto managed to significantly outperform traditional markets in the aftermath of the new economic paradigm. Stablecoins continued to advance in both legislation and adoption, Fidelity launched new Crypto IRAs for retirement investing, the DTCC launched a tokenisation platform, South Korea’s National Pension Service explored blockchain integration, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs moved back into outflows, as traders exercised caution in light of president Trump’s new reciprocal tariff regime

- According to CoinShares data published on Monday, digital asset investment products experienced $240m outflows in the week ending 4th April, “likely in response to recent US trade tariff news that poses a threat to economic growth”

- The bulk of this originated from Bitcoin funds, where $207m exited

- Despite the underwhelming performance of Q1, year-to-date inflows for Bitcoin investment products remain at $1.3bn

- Spot Bitcoin ETFs only saw one day of inflows last week (Wednesday)—but they were significant, as investors added $218m

- This was despite $116m outflows from BlackRock’s IBIT, offset by nine-figure inflows for Fidelity’s FBTC ($119m), and ARK Invest’s ARKB ($130m)

- IBIT did follow up as the only fund to register $65m inflows the next day, which was the first trading day after details of America’s new tariff policy were revealed

- Although funds experienced overall outflows throughout the week, they were relatively consistent, as only one day (Tuesday) registered nine-figure outflows, at $158m

- Losses were shared almost equally by FBTC and ARKB, which shed $84m and $87m respectively

- However, in the wake of post-tariff global market meltdowns, most analysts expect a further run of outflows for spot ETFs, although Bloomberg chief ETF analyst Eric Balchunas was keen to stress that “IBIT is STILL up 78% from launch barely a year ago”

- Spot Ether ETFs experienced one day of increased outflows ($52m), but spent the rest of the trading week in flux, with no outflows or inflows above seven figures

- Elsewhere in the ETF complex, Defiance applied for a Double Short Strategy (the company formerly known as MicroStrategy) ETF, profiting from the decay on existing long and short ETFs for the Bitcoin proxy

- The SEC received new submissions for Solana and XRP ETFs, strengthening the case for potential altcoin products to join Bitcoin and Ether

- In the case of XRP, issuers Teucrium launched a leveraged fund for the coin before any spot ETFs were approved, which Balchunas noted is “Very odd (maybe a first)” for an asset’s first ETF

- Hong Kong moved to allow staking for both licenced crypto exchanges and ETFs, potentially unlocking extra value for Ether ETF holders

- The city’s regulator stated “We have noted investors’ demand for staking services, and the potential for staking activities to contribute to the security of the blockchain network”

What happened: Political news

How is this significant?

- Although headlines from the realm of politics were dominated by tariff policy this week, several crypto-related events within US regulation and legislation also made the news

- On Wednesday, the House Financial Services Committee passed potential stablecoin legislation with a vote of 32-17, which included several Democrats voting alongside Republicans

- Committee chairman French Hill cheered the progress, which could bring about actual stablecoin rules after years of trying; “Innovation needs guardrails, not roadblocks”

- The bill will now be sent to the House floor for consideration by Congress, bringing the US one step closer to allowing private issuers to create coins fully backed by US dollars and treasuries

- On Friday, the SEC declared stablecoins aren’t securities requiring registration, as long as they are backed by US dollars, certain commodities, or pools of multiple assets

- Heath Tarbert, president of stablecoin issuer Circle, told Bloomberg “The SEC just drew a clear line: stablecoins backed 1-for-1 with high quality liquid assets—like USDC—are NOT securities”

- In other SEC news, the regulator told a federal judge it wants to “explore a potential resolution” in its enforcement against the Winklevoss brothers’ Gemini exchange

- This indicates that the long-running suit could soon be the latest in a slew of dismissals following the new administration’s shift in crypto policy

- President Trump officially pardoned the co-founders of digital asset derivatives exchange Bitmex, five years after they were charged with violating the Bank Secrecy Act

- American Bitcoin Corp, a joint-venture between Bitcoin miners Hut8 and two of Trump’s sons, announced plans for additional venture funding and eventual public float this week

- Company CSO Eric Trump claimed “We are going to become the greatest Bitcoin mining company on earth and we are doing it here in America”

- He added “there is nothing that DeFi, there is nothing that crypto assets on blockchain can’t do better, cheaper, in every way faster, more transparently, than the financial system we have right now”

What happened: Fidelity allows retirement investments in digital assets

How is this significant?

- Asset management giant Fidelity increased its involvement in digital assets yet further this week, launching a new crypto IRA allowing no-fee investments in Bitcoin, Ether, and Litecoin

- The IRA launched on Wednesday, as a Fidelity spokesperson told industry publication Coindesk “Fidelity is committed to offering investment products and solutions to meet the changing needs and interests of our customers, accompanied by education and support”

- Crypto exposure is now available across three separate plans; a tax-free Roth IRA, a traditional tax preferential IRA, and a rollover IRA for transferring funds from previous plans

- Assets will be custodied in-house by Fidelity Digital Assets, the company’s crypto arm

- Fidelity is currently America’s largest provider of 401(k) funds; the most widespread retirement savings vehicles

- The $5tn asset manager made several other strides within the digital asset landscape recently, developing its own stablecoin and filing to tokenise treasuries for on-chain trading

What happened: Stablecoin news

How is this significant?

- Alongside aforementioned advances in American legislation, stablecoins featured in numerous significant stories this week

- Leading stablecoin issuer Tether, headquartered in crypto-friendly El Salvador, may develop a new US-based stablecoin aimed at institutional clients

- CEO Paolo Ardoino revealed that positive regulatory developments in the US encouraged the firm to consider the new asset, but he stressed that they “need to wait for the final language and to see which bill will pass”

- XRP issuer Ripple integrated its new RLUSD stablecoin into the company’s existing cross-border payments system on Wednesday, and said that several clients are already using it to improve treasury operations

- According to data from tokenisation monitor rwa.xyz, RLUSD has achieved a market capitalisation above $240m, and grown by 87% in the past month; a pace which Ripple’s stablecoin SVP Jack McDonald said “is outpacing our internal projections”

- Japanese banking leader Sumito Mitsui (SMBC) partnered with numerous industry firms this week to “explore the commercialisation of stablecoins”

- Among others, SMBC is working alongside Avalanche blockchain developer Ava Labs, and digital asset security firm Fireblocks

- SMBC expressed interest in numerous aspects of the category, including “using stablecoins for settling tokenised financial and real-world assets (RWA) such as government bonds, corporate debt and real estate”

- Sony’s Singaporean subsidiary now allows customers to pay for purchases using Circle’s USDC stablecoin in its online store, via a partnership with Crypto.com

What happened: IPO news

How is this significant?

- USDC stablecoin issuer Circle advanced its IPO plans this week, officially filing the paperwork to go public and trade under the stock ticker CRCL

- The filing revealed nearly $1.7bn revenues for the firm last year, based on managing its backing reserves

- Circle has big backing for its float; a press release revealed “JPMorgan Chase will act as the lead left active bookrunner in collaboration with Citigroup”

- Additionally, Barclays, Deutsche Bank, and SG Americas are present within the bookrunning syndicate, whilst “BNY Capital Markets, Canaccord Genuity, Needham & Company, Oppenheimer & Co, and Santander are acting as co-managers”

- In the prospectus, CEO Jeremy Allaire stated “Going public now is representative of the fact that we are at a significant crossroads for Circle and the development of the internet financial system… our future (like our past) is rife with uncertainties and risks that we must navigate successfully”

- After a 2022 funding round, the firm was valued at $7.7bn, whilst a scrapped SPAC merger in 2024 upped that figure to $9bn

- Crypto firm Galaxy Digital, founded by tech billionaire Mike Novogratz, received SEC approval for a May launch on the Nasdaq, shifting its headquarters from the Cayman Islands to Delaware

- Trillion dollar asset manager Franklin Templeton led an $8m seed round into crypto startup Cap, a firm “looking to launch an interest-bearing stablecoin and accompanying lending market”

What happened: South Korean National Pension Service seeks blockchain integration

How is this significant?

- According to reports in the Seoul Economic Daily, South Korea’s $836bn National Pension Service (NPS) “is reviewing a plan to use blockchain technology to manage fund deposits, withdrawals, investments, and transaction history more transparently and efficiently”

- It is currently commissioning research on accountancy improvements via blockchain, with a particular focus on the immutable aspect of distributed shared ledgers

- An insider told the paper “It appears that they are considering introducing blockchain technology as a means to further strengthen the security and transparency of the fund management system currently in use. In particular, they must have judged that they needed to build a safer and more reliable system as they are managing the nation's valuable pension assets”

- NPS already has some blockchain and crypto-adjacent exposure via investments in Coinbase and [Micro]Strategy shares, and the country’s widespread 7-11 convenience store chain recently joined a CBDC pilot program

- The 7-11 trial will run through to June as the first major retail test for the nation’s CBDC, using a 10% CBDC discount to entice customers

What happened: Pakistan appoints Binance founder as digital asset advisor

How is this significant?

- In one of the week’s more surprising stories, Pakistan’s finance ministry announced that Binance founder Changpeng “CZ” Zhao was joining its newly-created Crypto Council

- Zhao “will guide the newly-formed council on regulation, infrastructure, education and adoption as a strategic advisor”, according to a ministry statement

- Whilst he didn’t comment directly, Zhao confirmed on Twitter that he’s been advising multiple governments, but is “not interested in politics, only crypto”

- Finance Minister Muhammad Aurangzeb told local media “With CZ onboard, we are accelerating our vision to make Pakistan a regional powerhouse for Web3, digital finance, and block chain[sic]-driven growth”

- Crypto Council head Bilal Bin Saqib told Bloomberg TV that the nation wants to become South Asia’s “crypto capital”, commenting “Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit or it will be at the risk of getting left behind”

- Saqib added “Pakistan is done sitting on the sidelines. We want to have regulatory clarity, we need to have legal framework that is pro business, we need institution adoption […] We want Pakistan as the leader of blockchain-powered finance, and we want to attract international investment”

What happened: Bitcoin mining at risk from new tariff policy

How is this significant?

- Although digital assets are fundamentally borderless—and thus less prone to direct consequences from Trump’s new tariff regime—one key aspect of the industry could feel the strain of new rules

- Bitcoin mining is an essential component of the Bitcoin ecosystem, as miners with dedicated hardware compete to update the shared Bitcoin ledger (i.e. the blockchain) and “mine” new blocks into existence

- However, this hardware is primarily built in and imported from Asia; a fact which could hit American-based mining firms hard in the pocket

- Some analysts are predicting a 20% increase in the cost of Bitcoin mining rigs for American businesses

- Gadi Glikberg, CEO of CodeStream, stated “The newly imposed tariffs are unlikely to trigger a mass exodus. However, they may slow down or redirect future expansion plans, as miners reassess the long-term cost-efficiency of scaling operations within the US”

- Bloomberg cited the example of mining firm head Lauren Lin scrambling to ship 5,600 new mining machines from Thailand to the US in a 48 hour window before tariffs kick in

- Lin commented that spending extra on transportation now was better than spending even more on tariffs later; “Ideally we can charter a flight and get machines over”

- Manufacturing hotspots such as Thailand and Malaysia could prove prohibitively costly from April 9th onwards, currently adding 36% and 24% levies respectively

- However, whilst the US is the world’s largest hub of Bitcoin mining, the world’s largest manufacturer of mining hardware is Beijing-based Bitmain

- This presents a conflict; at the time of writing, Trump is threatening an additional 50% tariffs that could bring total surcharges on Chinese goods entering the US above 100%

- Publicly-listed miners already demonstrate the potential effect of the new tariffs; Marathon, RIOT, and Cleanspark all dropped around 10% in early Monday trading

What happened: Tokenisation news

How is this significant?

- ETF issuer WisdomTree increased its digital asset footprint this week, expanding its WisdomTree Connect institutional platform beyond Ethereum and onto Layer-2 platforms Arbitrum, Base, and Optimism, plus Avalanche

- Its platform now provides access to 13 SEC-registered tokenised funds, including money market, equity index, and fixed income

- The Depository Trust and Clearing Corporation (DTCC) securities settlement system also made significant strides in tokenisation this week, as revealed by a Wednesday press release

- The Wall Street mainstay is embracing the speed and efficiency of blockchain by launching a “blockchain-based platform for tokenised collateral management”

- DTCC Digital Assets CTO Dan Doney said “Collateral mobility is the ‘killer app’ for institutional use of blockchain. By using smart contracts to automate the full range of collateral operations, we enable complex trade execution across markets in real-time at any time, even in volatile conditions”