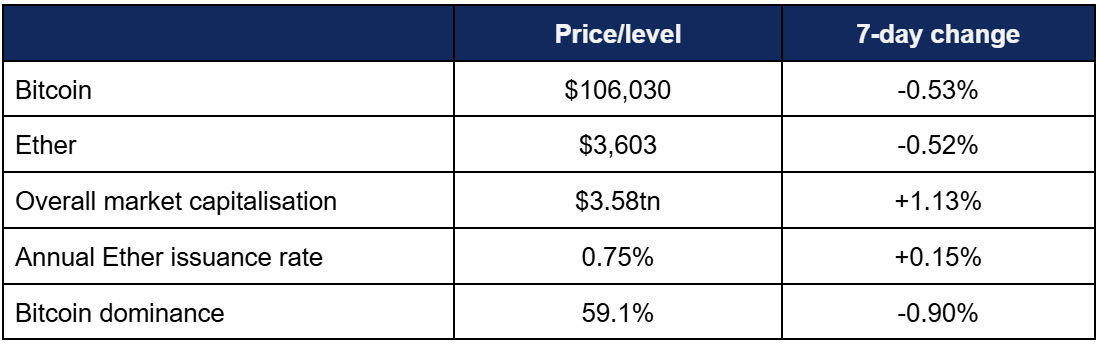

Market Overview

- Bitcoin faced one of its most challenging periods this year, briefly dropping below $100,000 for the first time since May as risk-off investor behaviour gripped broader markets during the prolonged US government shutdown

- This included its worst week since March, fuelled by a significant amount of selling from long-term holders

- Bitcoin fell to lows of $99,100 on Tuesday, before rallying to a weekly high of $106,800 on Monday as hopes increased for an end to the longest government shutdown in US history

- Ether performed similarly, rising from a Tuesday low of $3,098, to a high of $3,648 on the following Monday

- Investor sentiment on the Fear & Greed index remained starkly within “fear” territory at 31/100

- Overall market capitalisation actually closed up slightly on last week thanks to rallies across the wider altcoin complex; though at its lowest intraweek levels, the market had effectively erased all-year-to-date gains

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped by over $6bn to $137b

Digital assets experienced an extremely challenging week as Bitcoin briefly dropped below $100,000 for the first time since May, before the market rallied strongly in anticipation of a potential government shutdown resolution. Around the world hedge funds continue to increase their exposure to the asset class, governments moved forward in crypto regulation, prediction markets captured the spotlight, and several major tokenisation initiatives continued positive momentum within the category.

What happened: ETF News

How is this significant?

- Digital asset investment products experienced a second consecutive week of outflows thanks to continued investor uncertainty over the US government shutdown

- According to Coinshares data published on Monday, net outflows across all funds reached $1.17bn during the trading week ending Friday the 7th; the highest levels in several months

- Coinshares head of research James Butterfill cited “negative sentiment… due to ongoing gyrations in the crypto markets following the 10th of October liquidity cascade and uncertainty over a December US interest rate cut” as key causes of the capital flight

- Bitcoin products accounted for the majority of total outflows, shedding $932m

- Spot Bitcoin ETFs experienced four days of nine-figure outflows last week, with Thursday providing the only daily inflows (240m) to break the streak

- Daily outflows stood between $137m and $566m, with Tuesday delivering the worst performance, followed closely by Friday

- BlackRock’s IBIT led the losses, featuring three days of nine-figure outflows, followed by Fidelity’s FBTC and ARK Invest’s ARKB, which featured two negative nine-figure days each

- The three aforementioned funds did however also provide the week’s best inflows, topping out at $112m, $113m, and $83m respectively

- Spot Ether ETFs also struggled, logging three days of nine figure outflows, with maximum daily inflows of $12.5m

- The bulk of losses came from BlackRock’s market-leading ETHA fund, which posted consecutive daily outflows of $82m, $111m, and $147m

- In other ETF news, Treasury Secretary Scott Bessent posted that the US and IRS “issued new guidance giving crypto exchange-traded products (ETPs) a clear path to stake digital assets and share staking rewards with their retail investors

- He added “This move increases investor benefits, boosts innovation, and keeps America the global leader in digital asset and blockchain technology”

What happened: Digital asset lending reaches records

How is this significant?

- The crypto lending sector achieved new records in Q3 this year, thanks to an increase in both volume of loans and value of the underlying assets

- Total value of crypto loans in the third quarter reached $73.6bn, handily eclipsing the previous record of $69.4bn from Q4 2021

- Particularly striking is the rate of growth in the sector, showcasing strong growth since Q1, and nearly tripling in value since Q1 2024, when spot Bitcoin ETF approval signalled a shift in institutional and regulatory attitudes

- Bloomberg calls crypto lending “one of the key indicators for market sentiment as retail investors use lending to add leverage and enhance returns and traders such as hedge funds tap into lending for short-term liquidity to execute trades”

What happened: New report finds increase in hedge fund crypto exposure

How is this significant?

- A new report by PwC and the Alternative Investment Management Association (AIMA) published this week showcased several signs of increased digital asset adoption amongst institutions and hedge funds

- The survey was conducted in the first half of the year, between 122 fund managers overseeing nearly $1tn collective AUM

- According to the 7th Annual Global Crypto Hedge Fund Report, traditional hedge funds (i.e. those with less than 50% of AUM in digital assets) holding crypto increased from 47% in 2024 to 55% this year

- 47% of respondents said that regulatory support from the current US administration encouraged them to increase their allocation to the asset class

- AIMA managing director of asset management regulation James Delaney commented “For most of these funds, regulatory uncertainty has been a major barrier. This year those barriers are starting to be removed. This year’s report maybe marks a turning point in terms of overcoming these barriers”

- Crypto fund managers said these regulatory shifts resulted in “a greater willingness to invest (57%), growing investor interest (29%), improved access to banking services (14%) and expanding US operations (14%)”

- 86% of specialist crypto hedge funds hold Bitcoin, followed by Ether (80%) and competing smart contract blockchain Solana (73%), before a significant drop-off to the fourth-most held asset, XRP (37%)

- 47% of fund managers disclosed a rising investor demand

- General hedge funds allocated an average 7% AUM towards digital assets, up from 6% last year

- Additionally, 43% of traditional funds with crypto exposure want to increase their DeFi involvement within the next three years, capitalising on automation and yield opportunities within the decentralised finance landscape

What happened: Tokenisation news

How is this significant?

- Several significant global names featured in tokenisation developments this week, as the technology continues to attract institutional interest

- Swiss banking giant UBS confirmed its first on-chain redemption of a tokenised fund, working alongside blockchain oracle project Chainlink

- Using Chainlink’s Digital Transfer Agent standard, UBS were able to redeem their own tokenised money market fund; the Ethereum-based UBS USD Money Market Investment Fund Token (uMINT)

- This represents UBS’ first tokenisation steps in the $100tn global fund industry, and Group Chief Technology Officer Mike Dargan stated “smart contract-based technologies and technical standards enhance fund operations and the investor experience. As the industry continues to embrace tokenised finance, this achievement illustrates how these innovations drive greater operational efficiencies and new possibilities for product composability”

- VanEck and Securitize brought their VBILL tokenised treasury fund to Horizon; the new real-world asset (RWA) institutional platform of DeFi project AAVE

- Institutions will be able to borrow stablecoins against VBILL holdings, enabling new collateral opportunities

- Securitize CEO Carlos Domingo said “Integrating VanEck’s VBILL with Aave and Chainlink expands access to one of the most trusted forms of onchain collateral and demonstrates how regulated assets can now move fluidly through DeFi”

- Hong Kong’s South China Morning Post (SCMP) newspaper reported the city’s first tokenised money market fund, courtesy of Franklin Templeton

- The asset manager’s Asia Pacific Head Tariq Ahmad commented “This launch reflects our ongoing commitment to delivering innovative investment solutions that address the needs of modern investors by expanding the accessibility of tokenised products in this dynamic market”

- The SCMP identified the launch as “a major development” in the city’s recent Fintech 2030 plan to become a global finance and crypto powerhouse

- On Thursday, Tether’s tokenisation venture Hadron, Bitfinex Securities, and asset manager KraneShares announced a new ETF tokenisation initiative

- According to industry publication Coindesk “The initiative plans to create tokenized versions of exchange-traded products and build the systems needed for them to trade on regulated digital asset platforms”

- KraneShares CEO Jonathan Krane identified it as a proactive forward-looking move “We believe our business in the next three to four years will be 100% tokenised, and this strategic agreement represents an important step toward that future”

What happened: Ripple secures $500m investment at $40bn valuation

How is this significant?

- XRP token developers Ripple Labs confirmed a major new funding round this week, collecting $500m at a $40bn valuation

- Participants in the round included Ken Griffin’s Citadel Securities, Fortress Investment Group, Pantera Capital, Galaxy Digital and leading hedge funds Brevan Howard and Marshall Wace

- The developers identified institutional access as a key area of growth with the new funds, including “expansion into custody, stablecoins and prime brokerage services”

- During an interview at the firm’s Ripple Swell Conference in New York, Ripple President Monica Long said “Given the momentum, the overall industry is really opening up to and glomming onto stablecoin payments, which has been core to our strategy all along…So within that part of the business alone, we’ve doubled our customers quarter on quarter”

- The development comes just a week after Ripple acquired crypto custody and wallet firm Palisade, and adds fresh finance to the firm after recent major acquisitions including prime broker Hidden Road for $1.25bn, and GTreasury for $1bn

What happened: Coinbase launches platform for digital asset launches

How is this significant?

- On Monday, the Wall Street Journal reported a major new string to Coinbase’s bow, as it launched a new platform for digital token offerings, allowing investors to secure token exposure before projects are officially listed and trading on the exchange

- Also known as ICOs (Initial Coin Offerings), digital token offerings are a popular means of securing funding for new projects, offering supporters access at a fixed price pre-launch before tokens officially begin trading

- However, after finding great success in the 2017 bull market, ICO activity subsequently dwindled due to regulatory concerns, causing more projects to launch directly on decentralised exchanges, resulting in smaller liquidity pools

- In a blog post, Coinbase said that US users will have access to the platform, which is designed to reward longer-term (by digital asset standards) investors

- Coinbase aims to conduct around one launch per month on the new platform, prioritising highly-anticipated and vetted tokens

- According to the post, “Users that sell their tokens shortly after they get listed (less than 30 days) may receive smaller allocations in subsequent sales. This is designed to prioritise access to a project’s real users”

- New layer-1 blockchain Monad will serve as the debut project on the platform, which will conduct its raises in the USDC stablecoin

- In other Coinbase news, the company announced a UK savings account this week, in conjunction with Clearbank

- The account offers 3.75% AER and £85,000 deposit protection, in what Coinbase UK CEO Keith Grose called part of its strategy to be “an exchange for everything”

What happened: Prediction markets forecast to boost digital assets

How is this significant?

- Following the recent success and funding of blockchain-based prediction platform Polymarket (and crypto-inclusive competitor Kalshi), the category was identified as a potential growth catalyst for digital assets more broadly

- Google revealed that it will include results from both prediction markets into its search results and Google Finance tools

- The framing of prediction wagers as peer-to-peer “event contracts” has allowed prediction markets to sidestep some concerns over gambling, in what Google’s blog post called “harnessing the wisdom of crowds”

- According to the announcement, users can “ask something like ‘What will GDP growth be for 2025?’ directly from the search box to see current probabilities in the market and how they’ve changed over time”

- In a new report, Bernstein analysts identified prediction markets as “a viable asset class… backed by real capital, real users and regulatory approval”

- Analysts including Gautam Chhugani wrote “By letting markets decide probabilities for key events, more mainstream investors can factor these information signals in their portfolios. Increasing political polarity in media and the growing AI slop in content has further blurred signal from noise”

- Established firms like Interactive Brokers have launched their own prediction markets, and Robinhood processed $2.3bn in predictions volume in Q3, and the analysts identified them as a “potential growth driver” for Robinhood and Coinbase, which aims to launch its own prediction market

- Bloomberg sources claim that Winklevoss-founded exchange Gemini also plans to launch its own prediction market “as soon as possible”

- Ahead of its September IPO, Gemini disclosed plans to provide event contracts for “economic, financial, political and sports forecasts”

What happened: JP Morgan increases Bitcoin exposure

How is this significant?

- Finance giant JP Morgan this week disclosed a major increase in its Bitcoin exposure via holdings of BlackRock’s market-leading IBIT ETF

- According to its latest 13-F filing with the United States SEC, JP Morgan now holds 5.28 million IBIT shares, up 64% from 3.22 million shares in June

- Although this represents significant value ($333m at the end of Q3), it still lags behind its fellow banking titan Morgan Stanley, believed to be the largest holder of IBIT shares

- This increase appears to reflect the bank’s own predictions for the leading digital asset; a recent report by JP Morgan analysts led by Managing Director Nikolaos Panigirtzoglou forecast that Bitcoin could hit $170,000 within the next 12 months “as leverage resets and its relative volatility versus gold improves”

- The analysts claimed that deleveraging in perpetual futures appears to have largely concluded, and that they believe Bitcoin is currently undervalued compared to gold

What happened: Regulatory news

How is this significant?

- Several nations and jurisdictions made progress in regards to digital asset regulation this week, across three continents

- The Bank of England outlined its plans for stablecoins in the UK on Monday, with one of the most notable aspects proving a proposed £20,000 (per coin) personal limit for stablecoin holdings

- Deputy Governor Sarah Breeden stated “Our aim is to make sure that our regime is up and running, just as quickly as the US…[it’s] really important that we do this together and it’s a fabulous opportunity”

- Other proposals include a £10m stablecoin holding limit for businesses, and allowance for up to 60% of short-term government debt as backing assets for stablecoin issuance

- There is however the caveat for “stablecoin issuers which are recognised as systemic at launch, to temporarily hold up to 95% of their backing assets in sterling-denominated UK government securities”

- In Japan, reports from the Nikkei news agency suggested the country’s Financial Services Agency (FSA) is considering more stringent standards for crypto custody

- According to the report, “the FSA plans to mandate that custody and trading services providers register with authorities and that exchanges use only systems provided by those registered custodians”

- This follows several recent regulatory developments in Japan, including the first Yen-pegged stablecoin, and a joint stablecoin pilot between the country’s three major banks

- The Financial Times reported that the Swiss government has launched a consultation on local stablecoin issuance, “marking a step towards a future where confidence in Swiss reliability can be expressed not only in a numbered account, but in a blockchain token”

- The proposal creates new licence categories for “payment instrument institutions” and “crypto institutions” in order to integrate the new asset class into Swiss financial law

- According to Fireblocks Policy Director Dea Markova, “Switzerland has taken its time to learn lessons—from the EU, the US and others… The game changer for Switzerland will be building the market for tokenised assets and bonds. To have that market, you need tokenised money—cash on chain—and that’s what this framework is really about”

- Meanwhile, the US Senate released its draft of a proposed crypto market structure bill, unveiled in a bipartisan effort including Agriculture Chair John Boozman (Republican) and Senator Cory Booker (Democrat)

- The bill proposes an oversight shift from the SEC to the CFTC, a move generally favoured within the digital asset industry (particularly bearing in mind its thorny relationship with the SEC under the previous administration)

- Boozman stated that “the CFTC is the right agency to regulate spot digital commodity trading, and it is essential to establish clear rules for the emerging crypto market while also protecting consumers… This discussion draft advances those goals and lays an important marker as we work toward final policy language”

What happened: Crypto Treasury news

How is this significant?

- Leading treasury firm Strategy (formerly MicroStrategy) once again added to its considerable Bitcoin coffers, adding 487 Bitcoin for around $50m

- Founder Michael Saylor tweeted that this brings the average purchase price of its (approximately $68bn) Bitcoin holdings to $74,079

- Top Ether treasury firm BitMine “bought the dip” on Ether’s recent price crash, growing its holdings to 2.9% of the total Ether supply through the purchase of another 110,288 Ether

- BitMine Chairman Tom Lee saw recent market turmoil as an opportunity, pointing out that “we acquired 34% more ETH than last week”

- Finally, Bloomberg reported Kazakhstan’s creation of a national digital asset reserve fund using seized or repatriated coins and tokens

- Central bank Governor Timur Suleimenov estimated a January launch for the fund, to be managed by a state investment vehicle

- Industry publication TheBlock noted that “rather than holding Bitcoin or other tokens directly, the fund will invest in exchange-traded funds and crypto-focused companies”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.