Market Overview

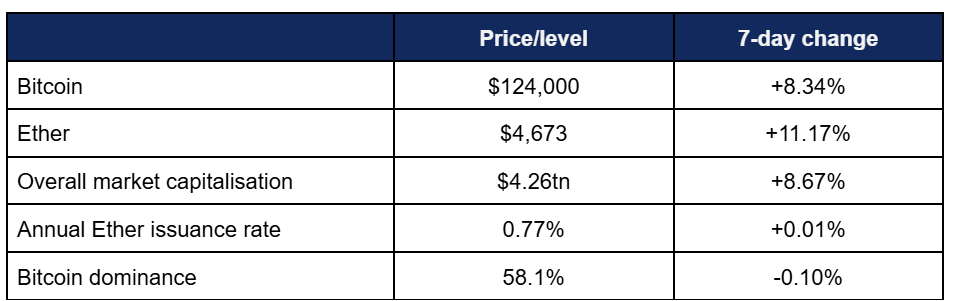

- Bitcoin appreciated steadily throughout the week, gaining over $10,000 in value as it first reached the $125,000 landmark for the first time, before climbing even higher and beyond $126,000

- A variety of factors appear to have contributed to this explosive growth, including Bitcoin’s perception as a safe haven during the US government shutdown, and historically bullish performances throughout the month of October

- Bitcoin rose from a Tuesday low of $112,840 to hit $125,000 for the first time on Sunday, subsequently peaking at its current record high of $126,200 on Monday

- Ether likewise exhibited strong performance and consistent growth, from a nadir of $4,099 on Tuesday to a Monday zenith of $4,736

- The entire market proved buoyant, as only seven of the top 100 coins and tokens by market capitalisation posted weekly losses

- Investor sentiment on the Fear & Greed index reflected these record performance conditions, climbing nearly 20 percentage points to 62/100, moving from “neutral” to “greed”

- Overall market capitalisation reached $4.26tn, with a new intraweek record of $4.32tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi was boosted significantly by the broader market growth of underlying assets, increasing by around $15bn to $173.2bn, approaching record levels

Digital assets had a banner week, with Bitcoin hitting several impressive new record highs as the US government shutdown once again demonstrated the value proposition of a decentralised, transparent, borderless asset class. ETFs also posted record performances as traders fled for the safe haven of Bitcoin and prepared for staking across Ether products. Morgan Stanley analysts formally recommended Bitcoin allocation for growth-centric investors, tokenisation efforts continued globally, one of Japan’s largest asset managers looked to enter crypto trading, Samsung streamlined digital asset access across its devices, and much much more.

What happened: ETF News

How is this significant?

- Digital asset investment products achieved record inflows this week, adding nearly $6bn as traders flocked to Bitcoin as a “safe haven” against the US government shutdown

- According to Coinshares data published on Monday, digital asset funds added $5.95bn during the trading week ending Friday the 3rd, handily eclipsing previous records below the $5bn mark

- This included record flows for Bitcoin products ($3.55bn), US markets ($5bn), Swiss products ($562m), Solana products ($707m), and the second-best result ever for German-listed products ($312m)

- Coinshares head of research James Butterfill stated “We believe this was due to a delayed response to the FOMC interest rate cut, compounded by very weak employment data, as indicated by Wednesday’s ADP Payroll release, and concerns over U.S. government stability following the shutdown”

- This brought total AUM of digital asset investment products to a new record of $254bn

- Spot Bitcoin ETFs recorded a banner week, with five consecutive trading days of comfortable nine-figure flows

- Of these, the “worst”-performing day was Tuesday, which still added $430m across all funds

- Meanwhile, Friday delivered the best results as traders responded to the US government shutdown, accruing $985m in fresh capital

- Although it delivered the only outflows of any fund during the week ($47m on Monday), BlackRock’s market-leading IBIT also predictably led the way for inflows, with four nine-figure days including $792m on Friday

- Fidelity’s FBTC and ARK Invest’s ARKB followed it into the nine-figure flow club, with weekly bests of $299m and $106m respectively

- Bloomberg chief ETF analyst Eric Balchunas noted that IBIT is “now the most profitable ETF for BlackRock by a good amount now based on current AUM”

- Additionally, it sits within $2bn of reaching the $100bn AUM mark in comfortably under 450 days—the current record of reaching that figure sits at 2,011 days

- Spot Ether ETFs likewise performed strongly, featuring four days of nine-figure flows for funds

- Three funds posted nine-figure inflows, as BlackRock’s ETHA, Fidelity’s FETH, and Grayscale’s ETH boasted bests of $207m, $202m, and $100m respectively

- Additionally, ETHA added nine figures on three other trading days, ranging between $128m and $177m

- In other ETF news, US-listed ETFs with staking officially launched on Monday, as the SEC approved Grayscale adding such functionality to its ETHE and ETH products, as well as a converted Solana fund, boasting a combined $8.25bn in assets under management

- Former FOX Business journalist Eleanor Terrett noted that “For ETHE, staking rewards will be paid out directly. For ETH and GSOL, the rewards will be built into the price of the fund over time”

- Grayscale CEO Pete Mintzberg commented “Staking in our spot Ethereum and Solana funds is exactly the kind of first mover innovation Grayscale was built to deliver… we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors”

- Elsewhere, Thai regulators said they expect to launch ETFs for several digital assets early next year, including Bitcoin and Ether

What happened: Morgan Stanley formally recommends crypto allocation

How is this significant?

- Global banking giant Morgan Stanley became the latest major institution to recommend digital asset allocation to investors, specifically in the context of growth-focused portfolios

- According to a new global investment council (GIC) note, Morgan Stanley now advises crypto allocations between 2% to 4% within its client portfolios, depending on risk profile

- This development follows soon after Morgan Stanley confirmed upcoming crypto integration for its E*Trade clients

- The bank’s analysts called it a “speculative and increasingly popular” asset class, suitable for “opportunistic growth” portfolios

- The GIC report focused primarily on Bitcoin, identifying it as a “scarce asset, akin to digital gold”, and recommended allocation primarily through ETFs, with quarterly rebalancings preferred

- This aligns it with the “reasonable range” for Bitcoin allocation as outlined by BlackRock, and sits close to the 5% “optimal allocation” of crypto-native asset manager Grayscale

- The GIC currently steers 16,000 investment advisors managing around $2tn in client wealth and savings, and wrote “Crypto has attracted significant attention in the last few years, given its outsized returns… we aim to support our Financial Advisors and clients, who may flexibly allocate to cryptocurrency as part of their multiasset portfolios”

What happened: China Financial Leasing Group raises funds for crypto investments

How is this significant?

- According to a recent stock exchange filing, Hong Kong-listed China Financial Leasing Group (CFLG) is raising $11m for a digital asset investment fund

- This reflects Hong Kong’s continued evolution as an Asian crypto hub, after rolling out a regulatory regime for the asset class back in June

- The investment firm is raising around $11m for its crypto fund, financed through a new share issuance

- In its filing, CFLG stated “The company intends to focus on establishing a Crypto-AI digital asset investment platform in the group, investing in digital asset exchanges (including stablecoins, Bitcoin, Ether, tokenised real world assets, NFTs, DeFi, and other new digital assets), and building a digital asset management platform”

- CFLG shares rose over 30% off the back off this news on Monday, outperforming the flat overall Hang Seng

- Some analysts believe that Hong Kong is serving as an incubator for possible relaxed crypto access on the mainland, where trading remains officially banned, as several Hong Kong subsidiaries of Chinese firms enable crypto access

What happened: Tokenisation news

How is this significant?

- Standard Chartered is acting as custodian for a new tokenised money market fund launched by Hong Kong-based stablecoin issuer AlloyX

- The RYT fund will trade on Ethereum scaling solution Polygon, and “integrates with decentralized finance (DeFi) to create yield-enhancing strategies, while staying within a compliance framework recognizable to auditors and regulators” according to a press release

- This marks the latest in numerous digital asset involvements by Standard Chartered, and builds on an area the bank has expressed interest in

- ARK Invest, the tech-focused asset manager (and crypto ETF issuer), invested $10m in tokenisation firm Securitize this week

- Securitize is one of the leading firms in the tokenisation space, acting as blockchain partner for BlackRock’s $2.8bn money market fund BUIDL

- Indeed, Securitize will act as tokenisation partner to Ether treasury firm FG Nexus, putting the latter’s common and preferred shares on the Ethereum blockchain

- According to industry publication Coindesk, the preferred stock is “the first U.S. exchange-listed dividend equity to transition fully onto the crypto rails”

- Maja Vujinovic, CEO of Digital Assets at FG Nexus commented “Tokenisation is rapidly changing financial markets through increased efficiency and enhanced investor access. By tokenising our shares, we’re embracing blockchain technology to further enhance the shareholder experience while maintaining the highest standards of regulatory compliance”

- Leading stablecoin issuer Tether is in talks to raise funds for a tokenised gold treasury

- Alongside Antalpha, a company linked to mining hardware producer Bitmain, Tether is reportedly raising $200m for a vehicle to stockpile XAUt, its tokenised gold token

- Speaking at the Token2049 conference in Singapore, World Liberty Financial co-founder Zach Witkoff announced plans to tokenise real estate

- In particular, the creator of the Trump-linked DeFi project (speaking onstage next to Donald Trump Jr) wants to tokenise Trump-owned real estate

- He said “The Trump family has one of the most exciting real estate asset portfolios in the world. What if I told you that you could, you know, go on an exchange and buy one token of Trump Tower Dubai?”

- Witkoff promoted the democratisation potential of fractional ownership, stating “Why don’t you have access to investing in class A real estate? Right? You can only do that today through a REIT or some sort of public corporation”

- Robinhood CEO Vlad Tenev pronounced himself very bullish on tokenisation during a Bloomberg interview

- He claimed “Tokenisation is a freight train and it’ll eat the entire financial system… It really starts to get interesting when all of those assets, public and private, get on crypto technology”

What happened: Nomura plans crypto trading in Japan

How is this significant?

- Japanese financial giant Nomura is looking to leverage the growth of digital asset appetite in Japan, through its Laser Digital subsidiary

- CEO Jez Mohideen told Bloomberg that the firm is applying for a licence to provide institutional clients with crypto trading capabilities, currently in pre-consultation talks with the country’s Financial Services Authority

- Although fully-owned by Nomura, Laser Digital is based in Switzerland, and has thus far concentrated most of its efforts in Europe and Dubai, rather than the parent market of Japan

- According to the Japan Virtual Assets and Crypto Assets Exchange Authority, trading in Japan is booming, as transaction values in the first seven months of the year doubled to $230bn

- Mohideen said that the firm “will launch broker-dealer services for traditional financial firms and crypto companies including digital-asset exchanges in Japan” if its application if approved

- He added “Our entry into Japan reflects our optimism in the Japanese digital-asset ecosystem”

- The news came soon after it emerged that Nomura rival Daiwa Securities introduced digital assets into its service mix, allowing clients to borrow Yen by using Bitcoin or Ether as collateral

- Daiwa is the country’s second-largest securities firm by assets (after Nomura), this reflecting a growing acceptance of digital assets within the traditionally-conservative Japanese investment market

- According to local reporters, “The initiative reflects growing demand among wealthy investors and entrepreneurs. Moreover, these clients prefer not to sell their crypto holdings when seeking liquidity for property, business expansion, or other investments”

What happened: Samsung integrates crypto trading into wallet app across Galaxy devices

How is this significant?

- According to a press release, electronics titan Samsung is integrating crypto trading across its Galaxy suite of devices, thanks to a partnership with Coinbase

- US-based customers will get exclusive access to Coinbase One—a membership-based access with reduced trading fees—integrated directly into the pre-installed Samsung Wallet app

- This provides direct access to Coinbase One to over 75 million devices across the United States

- Coinbase said that access will be increased further in future; “over the next few months, the companies aim to expand this effort globally and explore new opportunities for partnership”

- Samsung Wallet users get a free three month trial of Coinbase One, in addition to exchange credit after completing their first purchase

- Drew Blackard of Samsung America commented “Millions of Galaxy users rely on their smartphone to complete everyday tasks, and that goes far beyond communication… With our Coinbase partnership, Galaxy users have a simple and streamlined way to access crypto from a leader in the industry”

- In other Coinbase news, the exchange applied for a federal trust charter, providing more flexibility for new financial products without cumbersome state-by-state approval processes

What happened: Stablecoin news

How is this significant?

- Reporting around stablecoins was relatively compared to recent months, as the explosive growth of Bitcoin, Ether, and altcoins stole attention from an inherently placid asset class

- Visa is running a pilot program for cross-border transactions, using pre-funded stablecoins

- The payment processor is collaborating with stablecoin issuer Circle on the pilot, using both Dollar- and Euro-denominated tokens

- Visa’s Mark Nelsen told Bloomberg that stablecoins could remedy issues such as underfunded business accounts requiring additional capital over weekends or other periods where traditional payment rails are disrupted

- “We’re giving this immediate ability to get money to the accounts in real time. It’s a more efficient use of capital so you can deploy it as needed as opposed to having to deploy two or three days worth of money in one stop”

- Fintech firm Brex launched a stablecoin platform, catalysed by client demand

- Brex will work with partner Column Bank NA to integrate Circle’s USDC for payments and disbursements

- EVP Erica Dorfman stated “Stablecoins will be a really important rail for money movement in the future. We are, I think in many ways, more flexible than traditional finance organizations”

- She added that market demand drove the move, as “We’ve seen demand from customers primarily who are anchored in the stablecoin and crypto space for their core businesses”

- Standard Chartered analysts predicted a possible $1tn capital shift from emerging bank accounts to stablecoins within the next three years, as “dollar-pegged tokens give households and companies a low-friction path to USD exposure outside local lenders”

- Global head of digital asset research Geoff Kendrick commented “future growth in stablecoin use for savings is likely to expand from a small number of wallets with large balances currently to a large number of wallets with small holdings. At scale, small holdings will be significant; this growth is likely to occur mostly in EM, where demand for a liquid, 24/7, trustworthy alternative to local banks is greater”

- In particular, they identified countries such as Turkey, India, China, Brazil, South Africa, and Kenya as key future adopters of stablecoins

- Within the same timeframe, the bank’s analysts predict a total $2tn stablecoin market

What happened: Walmart-backed fintech adds Bitcoin and Ether trading capabilities

How is this significant?

- CNBC reported this week that OnePay, a fintech co-founded by retail megalith Walmart, will offer users Bitcoin and Ether access later this year, thanks to a partnership with blockchain startup Zerohash

- This places OnePay in line with other popular American finance apps, such as PayPal, Venmo, and Cash App, but OnePay maintains an advantage of direct integration into Walmart payment infrastructure

- Spokespeople declined to comment, but sources told CNBC that crypto inclusion is part of Walmart’s plan to make OnePay an “everything app”, offering a broad range of products and services akin to Chinese super-app WePay

- The news comes shortly after Zerohash confirmed a $104m raise, alongside a partnership with Morgan Stanley to provide crypto capabilities to its E*Trade platform

- In news of other expanded crypto product offerings, asset manager Galaxy Digital launched its new GalaxyOne platform

- GalaxyOne offers customers crypto and stock trading, alongside 4% APY savings accounts and access to an 8% high-income investment note to eligible US accredited investors

- The digital asset offering is limited to Bitcoin, Ether, Solana, and Paxos stablecoins, reflecting the company’s history serving institutional clients

- Whilst the 4% yield is FDIC-insured, the 8% note is powered by Galaxy’s institutional lending business, and is uninsured

What happened: Spanish bank BBVA launches retail crypto trading in Europe

How is this significant?

- One of Spain’s largest banks, BBVA, revealed this week that it will roll out Bitcoin and Ether trading to retail customers across Europe, in partnership with Singaporean fintech SGX FX

- BBVA will offer 24/7 trading of the two largest digital assets, within the same framework used for forex

- SGX FX provides “aggregation, pricing, distribution and risk-management tools”, maintaining numerous data centres across the world to ensure uninterrupted 24 hour service

- Luis Martins, Global Head of Macro Trading at BBVA, said “Digital assets are rapidly becoming an integral part of the global finance system. It’s natural that our customers want to be able to trade these assets using the same trusted system”

- BBVA is one of the most proactive European banks on digital assets, launching the same capabilities for Spanish customers back in July

- In other Spain-adjacent news, Spanish (and Swiss) stock exchange operator SIX is moving its SDX digital asset exchange in-house, under the main exchange’s umbrella

- Digital asset head Marco Kessler commented “We have seen a lot of innovation happen in the post trade space and we wanted to integrate the digital asset capabilities across securities services, starting from custody”

What happened: Crypto Treasury news

How is this significant?

- During a week of new Bitcoin record highs, leading treasury firm Strategy (formerly MicroStrategy) made the rare move of eschewing any buys, but reported $3.9bn of Bitcoin fair value appreciation

- Although it currently lags Bitcoin’s year-to-date performance, Strategy’s share price is nonetheless up around 24% since January at the time of writing

- Top Ether treasury firm BitMine continued adding to its holdings, spending approximately $820m acquiring 179,251 Ether

- This puts the firm’s current stash at 2.83 million Ether, according to a press release on Monday

- BitMine currently holds over 2% of total circulating Ether supply, with a stated acquisition target of 5%

- Avalanche Treasury Co. announced a $675m SPAC merger, outlining plans for a Nasdaq listing and $1bn treasury (based on the Avalanche blockchain’s AVAX token) in 2026

- Nasdaq-listed Solana Company (formerly Helius Medical Technologies) grew its Solana holdings and cash reserves to near-$530m, more than the total gross proceeds of its September private placement

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.