Market Overview

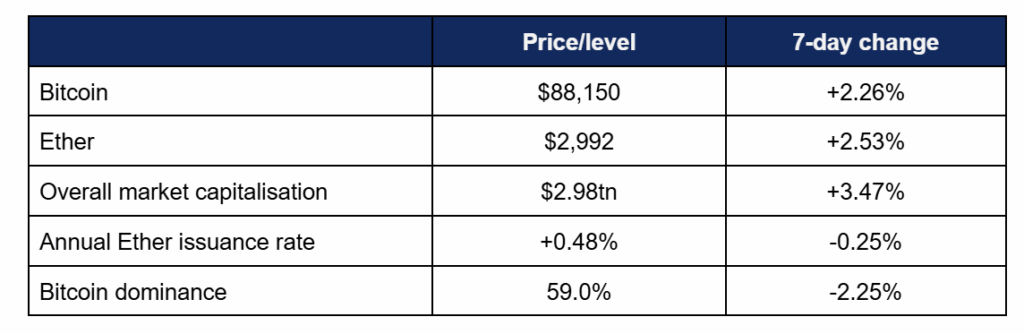

Digital assets recovered from last week’s decline, although trading activity remained cautious as markets calmed slightly heading into the festive period.

- Bitcoin spent the week on a gradual upward trajectory with isolated episodes of intraweek volatility, rising from a Friday (19/12) low of $84,460 to a Monday (22/12) high of $90,260

- Price performance since the mass liquidations in October has led some analysts such as CryptoQuant to announce the arrival of a bear market, although they couch those suggestions by adding “Downside reference points suggest a relatively shallow bear market”

- Ether also bounced back from last week’s losses, slightly outperforming Bitcoin and briefly returning back above $3,000

- Ether grew from a $2,888 Friday (19/12) low to peak at $3,065 on Monday (22/12)

- Overall market capitalisation briefly hit an intraweek high of $3.04tn, before pulling back slightly to current levels

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased by almost $2bn to $120.2bn

Digital assets bounced back from last week’s decline, despite outflows across the ETF complex. JP Morgan continued its growing involvement with the blockchain space, DTCC announced a plan for widespread asset tokenisation, the New York Stock Exchange moved towards more crypto industry investment, regulatory efforts continued globally, and much more.

ETF News

What Happened?

- Digital asset investment products broke their recent inflow streak, as investors began selling off and withdrawing ahead of year-end

- According to Coinshares data published on Monday 22nd December, net outflows hit $952m in the trading week ending Friday 19th

- Coinshares’ Head of Research James Butterfill pinpointed several factors behind the reversal, including delays in market structure legislation; “We believe this reflected a negative market reaction to delays in passing the US Clarity Act, which has prolonged regulatory uncertainty for the asset class… it now appears highly unlikely that ETPs will exceed last year’s inflows, with total assets under management standing at US$46.7bn compared with US$48.7bn in 2024”

- Spot Bitcoin ETFs primarily experienced losses, contrasting four days of nine figure outflows with just one day of nine figure inflows

- The inflows came on Wednesday (17/12), at $457m and this exceeded any daily outflows for the rest of the week

- Fidelity’s FBTC dominated those daily inflows, adding $392m for its best day in multiple months

- BlackRock’s IBIT made up the remainder of Wednesday inflows, accruing $111m in fresh capital

- FBTC and IBIT also posted the largest daily outflows, of $230m and $211m respectively, alongside outflows in the $170m range

- Spot Ether ETFs suffered more, starting the week with two consecutive outflows of $224m, as only two funds all week posted any inflows whatsoever – at extremely modest levels below $3m

- BlackRock’s ETHA, dominated outflows, registering three days of nine-figure withdrawals between $102m and $221m

- However, ETF issuer Grayscale says it is looking forward to 2026 as “the dawn of the institutional era”,

Crypto Treasury news

What Happened?

- Leading Bitcoin treasury firm [Micro]Strategy increased its cash reserve to $2.19bn this week, financed through a $748m common share sale

- This covers the company’s interest and dividends for the next 32 months, leading TD Securities analysts to write “the move underscores the company’s balance sheet strength and should alleviate concerns about its ongoing viability, even in a prolonged ‘crypto winter’ scenario”

- Leading Ether treasury firm BitMine spent around $300m securing another 98,852 Ether, bringing its total holding to over 4m Ether

- The company currently sits at $3bn in unrealised losses due to the sharp post-October price pullback, but chairman Thomas Lee remains bullish, writing “We continue to make progress on our staking solution known as The Made in America Validator Network (MAVAN). This will be the ‘best-in-class’ solution offering secure staking infrastructure and will be deployed in early calendar 2026”

- However, other digital asset treasury firms are currently feeling the pinch of market conditions; Peter Thiel’s ETHZilla is refocusing on real-world tokenisation, and sold nearly $75m of Ether to pay off debt

Stablecoin news

What Happened?

- Stablecoins experienced less reporting than average this week, as firms slowed down their activity ahead of the Christmas holiday

- SoFi Bank became the first US bank to “offer open access to its stablecoin infrastructure” via the launch of its own SoFiUSD for internal use this week, before rolling out to customers in future

- The coin is directly backed by cash held at the Federal Reserve (rather than Treasuries)

- SoFi CEO Anthony Noto stated “Blockchain is a technology super cycle that will fundamentally change finance, not just in payments, but across every area of money… Companies today struggle with slow settlement, fragmented providers, and unverified reserve models. SoFi is helping address these gaps”

- New data revealed that Tether settled $156bn of payments valued below $1,000 this year, suggesting the increased use of stablecoins as a legitimate purchasing method

- Payment processor PayPal launched a savings vault for its PYUSD stablecoin, allowing holders to earn yield

- The vaults are run by decentralised lending platform Spark, which generates the return through overcollateralised loans and investments

- In other stablecoin news, EU governments agreed on a common position for the Digital Euro CBDC, supporting the ECB’s development efforts

- Danish Economy minister Stephanie Lose commented “The Digital Euro is an important step toward a more robust and competitive European payment system, and can contribute to Europe’s strategic autonomy and economic security, as well as a strengthened international role for the euro”

Crypto Litigation News

What Happened?

- The administrators of Terraform (the developers of the Terra Luna blockchain ecosystem that collapsed in 2022 and kicked off a year-long crypto contagion) are suing Jump Trading for $4bn amidst allegations “illegally profiting from… and accelerated” Luna’s collapse, as part of an attempt to maximising the recovery of capital for creditors

- This represents a tenth of Terraform’s total value before collapse, and follows a week after Terraform’s former head (and Terra Luna developer) Do Kwon was sentenced to 15 years imprisonment for his role in the collapse

- In other litigation news, Coinbase brought lawsuits against Michigan, Illinois, and Connecticut over their attempts to regulate prediction markets such as Polymarket and Kalshi (whom Coinbase is partnering with on its own newly-announced prediction market venture), arguing that it is a matter of federal CFTC oversight, rather than individual state regulation

What happened: DTCC to roll out tokenisation services for assets including Treasuries

How is this significant?

- Clearing house leader DTCC announced in a press release that its subsidiary DTC has been authorised by the SEC to “offer, under federal securities laws and regulations, a new service to tokenise real-world, DTC-custodied assets in a controlled production environment”

- This represents a potential $100tn market of tokenised assets (more than 33 times the current market capitalisation of all digital assets)

- DTCC has gained approval to launch a tokenisation service via a No-Action Letter (NAL) from the SEC

- An NAL significantly expedites the service launch (expected H2 2026) compared to standard processes, removing a lot of the red tape that affected early digital asset/SEC interactions

- The NAL indicates that the SEC is (as chief Paul Atkins has said) fully behind tokenisation as a crucial evolution of existing financial markets

- In practical terms, the NAL allows “a limited production environment tokenisation service across L1 and L2 providers”

- Layer-1 blockchain Canton (built with a focus on finance and privacy) appears to be an early winner, announcing a deal to tokenise US treasuries as the first phase of DTCC’s plan and digital strategy

- This continues recent momentum for the finance-centric chain, just weeks after it received strategic backing from BNY, Nasdaq, and S&P Global

- DTCC president Frank La Salla said “Tokenising the U.S. securities market has the potential to yield transformational benefits such as collateral mobility, new trading modalities, 24/7 access and programmable assets”

- He added “DTCC’s partnership with Digital Asset and the Canton Network is a strategic step forward as we collaborate across the industry to build a digital infrastructure that seamlessly bridges the traditional and digital financial ecosystems and provides unmatched scalability and safety”

What happened: JP Morgan explores crypto trading for institutional clients

How is this significant?

- Building on last week’s news that banking giant JP Morgan is entering fund tokenisation, reports this week indicated it is increasing its digital asset integration further

- Bloomberg sources say that the financial powerhouse “is assessing what products and services its markets division could offer to expand its footprint in crypto assets”

- According to the anonymous source, such services “could include spot and derivatives trading”

- This would potentially see JP Morgan following in the footsteps of other global banks such as Morgan Stanley, Standard Chartered and Intesa SanPaolo

- Bloomberg analysts believe that “a crypto trading move would be the latest sign of how banks have started warming up to digital assets following the return of Donald Trump to the White House”

- Meanwhile, the bank also commented that a recent addition of deposit tokens to public chains (specifically Ethereum Layer-2 Base) was driven by client demand

- Speaking to industry publication Coindesk, the bank’s Head of Blockchain Products, Basak Toprak, commented “Right now, the only cash or cash-equivalent option available on public chains are stablecoins. There is a demand for making payments on public chains using a bank deposit product. We thought this was particularly important for institutional customers”

- She added “Deposits are obviously the dominant form of money today in the traditional world, and we think very strongly that they should have their place in the onchain world as well”

What happened: NYSE owner seeks investment in crypto payment firm

How is this significant?

- Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is reportedly preparing to purchase a stake in crypto company MoonPay

- Sources say that MoonPay is close to concluding its funding round at a $5bn valuation, up from a $3.4bn valuation during its last raise in 2021

- This marks the latest major digital asset investment from NYSE, after it committed $2bn to prediction platform Polymarket earlier this year in one of the largest industry funding deals ever

- MoonPay itself has been on an acquisition spree this year, taking over four separate firms, and launching its own stablecoin business as the sector gathers steam

- In other MoonPay news, the firm achieved a major hiring coup this week, announcing acting CFTC chair Caroline Pham as its new chief legal officer

What happened: Senate confirms digital asset supporter as new head of CFTC

How is this significant?

- Following crypto advocate Paul Atkins’ appointment as SEC chair, sister agency CFTC finally cemented its new leadership, as Trump nominee Michael Selig was officially confirmed as the new chairman by the US Senate

- In his first statement after the confirmation, Selig said “Today begins a new chapter for the CFTC… Congress is poised to send digital asset market structure legislation that will cement the US as the Crypto Capital of the World to the President’s desk”

- Selig is widely viewed by digital asset observers as a positive appointment, given his experience as chief counsel for the SEC’s crypto task force earlier this year

- Legal analysts expect a specific focus on the digital asset industry from the SEC, as the agency is poised to become lead regulator of the sector according to current formulation of the US Senate’s CLARITY crypto market structure bill

- Meanwhile, fellow crypto supporter Travis Hill was confirmed as the new head of the FDIC

- In other regulatory news, the Federal Reserve rescinded 2023 guidance limiting banks from interacting with crypto, citing an “evolving view of risks”

- Ghana passed a law legalising crypto assets, regulating them via the new Virtual Asset Service Provider Bill

- Central bank governor Johnson Asiama said the law “lowers costs for banks, improves customer experience, supports small and medium-sized enterprises and traders” in a country where a reported 17% of the population hold crypto

- Bhutan pledged 10,000 Bitcoin to build a new economic hub in the country’s south

- The $880m (at the time of writing) Bitcoin development pledge “positions Bitcoin as a strategic national asset rather than a speculative holding, with officials exploring responsible approaches such as collateralization, treasury strategies or long-term holding to fund development while preserving value”

- Bhutan is one of the global forerunners in Bitcoin, building up national stockpiles by mining the asset with surplus hydroelectric power

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.