17th May, 2024

Market Overview:

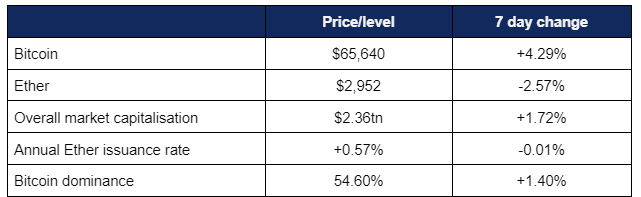

Digital assets continued their recent recovery, as new corporate filings revealed widespread institutional exposure to Bitcoin.

- Bitcoin declined sharply heading into the weekend, hitting a weekly low of $60,320 late on Friday, before broadly-positive CPI figures and bullish ETF activity led to growth and a weekly high of $66,440 late on Wednesday

- This brought Bitcoin within touching distance of a new monthly high, after briefly hitting $67,000 on the 23rd of April

- Ether however experienced a weekly decline, as continued pessimism around spot ETF approval chances may have led to investors “selling the news” ahead of the SEC’s May 25th decision deadline

- Ether registered its weekly high of $3,050 on Friday, before a steep decline and volatile weekly performance including a Wednesday low of $2,866

- Overall digital asset market capitalisation increased to $2.36tn, as Bitcoin’s growth more than offset Ether’s pullback

- According to industry monitoring site DeFi Llama, total value locked in DeFi declined slightly to $91.7bn, driven by Ether’s drop

Digital assets continued recent growth, as ETFs performed positively and quarterly disclosure deadlines revealed the scope of institutional Bitcoin exposure. The CME Group was reportedly working on adding spot Bitcoin trading for its customers, metrics on South Korean crypto activity continue to climb, the US Senate pushed back against SEC accounting requirements perceived as draconian, El Salvador revealed the success of its geothermal Bitcoin mining endeavours, and much more.

What happened: ETF News

How is this significant?

- As of last Friday, CoinShares data revealed that digital asset investment products registered their first net weekly inflows in five weeks

- However, CoinShares pointed out that these volumes were in the context of lower overall trading volumes and volume share compared to April’s weekly average; “representing 22% of total volumes on global trusted exchanges relative to 31% last month”

- This weekly momentum reversal was backed up by several strong trading days this trading week

- According to data from analytics firm Farside, Monday saw $66m inflows, Tuesday $100.5m, and Wednesday more than tripled the previous day’s total to $303m

- Interestingly, all three days featured zero flows from BlackRock’s top-performing IBIT, but were led instead by Fidelity’s FBTC, and ARK Invest’s ARKB

- Nevertheless, IBIT remains the greatest success in overall inflows, growing from zero AUM on launch day to $16.5bn as of Thursday

- Meanwhile chief Bloomberg ETF analyst Eric Balchunas maintained the firm’s gloomy prognosis on Ether ETF approval

- Citing SEC comments “literally buried 50 feet deep in a pile of legalese”, some applications saw the SEC ask commenters if they “have properly filed their ETF listing proposals as commodities”, indicating an SEC position that views Ether as a non-commodity

- Additionally, Fox Business journalist Eleanor Terrett pointed out that that ARK/21Shares removed the potential for Ether staking from their joint spot Ether filing

- This could be either specifically in response to the SEC taking umbrage with Ether’s staking facility, or as a pre-emptive attempt to remove a potential differentiating factor from Bitcoin ETFs

- In news peripherally related to ETFs, investment managers Vanguard—perhaps the most high-profile firm to openly distance themselves from Bitcoin products—announced Salim Ramji as its new CEO this week

- The significance of this is that not only is Ramji an alum of BlackRock—the firm at the (pun intended) vanguard of digital asset ETF adoption—but he headed the firm’s iShares ETF business which lobbied for and won approval of spot Bitcoin ETFs

- However, crypto advocates shouldn’t expect Vanguard to offer Bitcoin ETF exposure in the near future; in an interview with Barron’s, Ramji indicated an intention to remain “consistent with Vanguard’s investment philosophy”

What happened: Quarterly filings showcase increasing institutional Bitcoin exposure

How is this significant?

- The deadline for Q1 13F SEC filings for firms with more than $100m in investments was this Wednesday, leading to a consistent disclosure of institutional Bitcoin exposure (via ETFs) throughout the week

- As Bitwise CIO Matt Hougan pointed out in a Monday blog post “563 professional investment firms reported owning $3.5 billion worth of Bitcoin ETFs as of last Thursday”

- He cited examples including:

- Hightower Advisors: the 2nd-largest RIA firm in the US. according to Barron’s, with $122bn AUM, including $68m in Bitcoin ETFs.

- Bracebridge Capital: a Boston-based hedge fund that manages money for Ivy League universities, holding $434m of Bitcoin ETFs

- Cambridge Investment Research: established more than four decades ago, with $170bn AUM and $40 million in Bitcoin ETFs

- These filings are impressive, but perhaps even more so when one considers two facts; that they only reflect data up to March 31st, and we still remain very early in the due diligence process

- The 13F forms represent products on the market for less than 3 months at the time of filing; as Hougan points out, “most professional investors take 6-12 months to evaluate crypto. It is extremely rare that a client allocates to the space immediately after an initial meeting”

- More big institutional names emerged with Bitcoin exposure; Morgan Stanley disclosed $270m, after head of digital assets Andrew Peel noted in January that the ETFs provided a “paradigm shift in the global perception and use of digital assets”

- Hedge funds revealed large allocations too; billionaire Izzy Englander’s Millennium Management ($64bn AUM) led the way with $2bn spread across multiple Bitcoin ETFs, Paul Singer's Elliott Capital held nearly $12 million in IBIT, and Apollo Management Holdings bought $53.2 million worth of ARKB

- Another significant entrant was the State of Wisconsin Investment Board, which held $163m in IBIT and GBTC

- In terms of banks, Wells Fargo dipped their toe into the water with $143,000 allocations, and America’s largest bank JP Morgan Chase also reported exposure; though perhaps through the role of a market maker, as suggested by Bloomberg’s James Seyffart

- Nevertheless, for many industry loyalists, it presented validation following JP Morgan CEO Jamie Dimon’s infamous 2017 declaration that he’d fire any employees found trading Bitcoin

- Swiss bank UBS and Canada’s Bank of Montreal represented some of the international investors in the products, albeit at more modest levels

- The board is a state agency that manages investments for public retirement and other trust funds, making this the first case of an American state (and by extension state pension) officially invested in Bitcoin

- Additionally, the board’s portfolio also included shares in digital asset industry firms, including Coinbase, Marathon Digital, Riot Platforms, Block, Cipher Mining, Cleanspark and MicroStrategy

- Bloomberg chief ETF analyst Eric Balchunas was impressed by the breadth of ETF holders, writing “What is also notable IMO is the sheer number of holders that each has so far… $IBIT ended up with 414 reported holders in its first 13F season, which is mind boggling, blows away record. Even having 20 holders as a newborn is highly rare…. That's bonkers for first quarter on market”

- He also noted that the only institution type missing from IBIT was endowments, adding “Normally you don't see this long a list of holder types till years after launch and mega liquidity (which IBIT already has)”

- In total across all ETFs, 937 professional firms reported allocations, compared to 95 professional firms that held gold ETFs in their first 13F quarter

- In other news of institutional allocations, new Australian Taxation Office data revealed about around $1bn in crypto allocations across the country’s self-managed pension sector; ahead of expected approval for Australian spot Bitcoin ETFs later this year

What happened: CME Group to start spot Bitcoin trading

How is this significant?

- The FT reported on Thursday that leading futures exchange CME Group is planning to launch Bitcoin trading in order to capitalise on the broader crypto market recovery

- This would bring spot Bitcoin trading alongside the futures trading which CME has hosted since 2017, enabling the creation of basis trades on one regulated marketplace

- CME didn’t comment on the story, but according to FT sources, the exchange is in discussions with traders, touting its regulated status as a key selling point in the proposition

- The exchange has already gained from bullish market behaviour, as the FT notes “CME has been one of the biggest beneficiaries of the wave of renewed institutional interest, overtaking Binance as the world’s largest bitcoin futures market”

- According to those with knowledge of the plan, trading “would be run through the EBS currency trading venue in Switzerland, which has extensive regulations governing the trading and storing of crypto assets”

- Speaking to an industry trading executive, the paper noted that whilst some efficiencies may be lost by the spread of venues, it may mean that “exchanges could soon accept crypto-related collateral, such as tokenised money market funds, to make more timely margin calls”

- In other regulated exchange news, European crypto platform Bitpanda returned to profit after a €130m loss in 2022, and currently forecasts record yearly returns thanks to the general market recovery

- Founder and CEO Eric Demuth told Bloomberg “We can withstand long bear markets and scale significantly with high profit margin in bull markets”

What happened: Semi-annual report reveal growing South Korean digital asset activity

How is this significant?

- South Korea further cemented its status as a key global digital asset market this week, following the publication of a new report revealing new adoption data

- Local market behaviour tends to be comparatively insular, as traders are restricted to the use of local platforms, rather than popular global exchanges

- The latest report on industry businesses by the Korea Financial Intelligence Unit (KOFIU) showed that active users of registered exchanges in Korea increased by 390,000 to 6.45 million by the end of 2023, meaning over 10% of the population actively trade digital assets

- KOFIU stated that “Trading volume, market capitalisation, operating income of exchanges, deposits in Korean won all increased compared to the first half due to the rise in crypto prices and recovery of investor sentiment… The number of crypto trading users rebounded from the first half of 2023”

- Previously, we reported the Korean Won overtaking the US Dollar as the largest (direct, non-stablecoin) fiat trading pair in Q1 this year, and local exchange Upbit cracked the top five global exchanges by volume despite being limited in international scope

What happened: Senate votes to overrule SEC requirements on crypto custody

How is this significant?

- Following last week’s US House of Representatives vote to repeal SAB121 (an SEC directive requiring banks custodying crypto assets for customers to hold them on their own balance sheets), the US Senate passed a measure on Thursday to overturn the accounting standards

- However, the 60:38 Senate vote was not large enough to rule out a presidential veto, which Joe Biden has claimed he would enact to protect SAB121

- Nevertheless, the vote did include several Democrats backing the measure, despite crypto generally being viewed as a partisan issue in Washington; favoured by pro-business small-government Republicans, and undermined by protection-first Democrats

- As noted by TheBlock, “the Government Accountability Office (GAO) said SAB 121 is subject to the Congressional Review Act…[as] the bulletin met the definition of a rule and, under the CRA, the SEC should have submitted a report on the rule to lawmakers. However, the SEC has said the bulletin did not meet the definition of a rule and is not subject to the CRA”; once again illustrating a disconnect between the SEC’s perceived clarity of particular rules, and the beliefs of other bodies regarding said opinions

- Previously, House Financial Services Committee chair Patrick McHenry, SAB121 “made a joke of the rulemaking process and ignored other regulatory agencies… a massive deviation for how highly regulated banks are traditionally required to treat assets on behalf of their customers”

- Cody Carbone, VP of policy for the Chamber of Digital Commerce industry group commented “I hope the President looks at the bipartisan support of this Resolution not as a rebuke on the administration, but as consensus that no independent regulator is above the law and consumer protection should always trump personal vendettas against a disfavoured industry”

- Before the vote, Democratic representative Wiley Nickel broke from the (broad) party lines along which digital asset legislation is currently delineated, publishing a letter claiming the “SEC is turning crypto into a political football & forcing the president to unnecessarily choose sides on an issue that matters to many Americans”

- In total, Bloomberg believes that four crypto-related SuperPACs have raised about $85m in donations to fund pro-crypto candidates this election cycle; but analysts believe overall influence of crypto policies will likely have a minimal effect on voting patterns

- In other custody-based news, professional custody firm Fireblocks is seeking approval from the New York Department of Financial Services (NYDFS) to establish a limited-purpose trust company in order to provide US-based clients with crypto cold storage [i.e. offline] solutions

- Additionally, the firm is launching a Global Custodian Partner program across multiple markets, including the UAE, Britain, Singapore, Thailand, and Australia

What happened: JP Morgan revises post-halving Bitcoin production cost estimate

How is this significant?

- JP Morgan analysts led by Nikolaos Panigirtzoglou published a new research note on Thursday, revising previous estimates on the cost basis of mining new Bitcoin’s in a post-halving environment

- The recent Bitcoin halving cut mining rewards per block (as the name suggests) in half, leading to increased cost-per-Bitcoin for miners

- Specifically, the analysts revised their cost upwards, stating “We previously anticipated a significant drop in the hashrate post halving as unprofitable Bitcoin miners exit the bitcoin network. This appears to be happening, albeit with some delay”

- In the long run, they still anticipate the cost of production to settle around their previous (February) estimate of $42,000, but this would require more inefficient miners to exit the field, leaving a greater proportion of new mining hardware

- Nevertheless, at current prices of around $65,000 per Bitcoin, this remains a profitable endeavour

- In other Bitcoin mining news, industry analytics firm Kaiko Research published a new report forecasting increased selling pressure from miners, in case those with large holdings sell off some of their previously-mined coins to offset lower rewards from incoming blocks

- The report wrote “If miners were forced to sell even a fraction of their holdings over the coming month this would have a negative impact on markets...Trading activity typically slows down and liquidity dries up over the summer months”

What happened: Stablecoin issuer Circle prepares for American IPO

How is this significant?

- Circle, issuers of the popular USDC stablecoin, are currently legally domiciled in Ireland; but the firm now seeks to put down roots in the US, ahead of its planned IPO

- According to court filings seen by Bloomberg, the firm has applied to move its legal base to the US, as confirmed by a company spokesperson

- This would likely mean a higher taxation rate for the firm, but re-domiciling could streamline the process of going public

- Circle is the second-largest stablecoin issuer in the market after Tether, and has already secured backing from numerous major firms including including Goldman Sachs, BlackRock, Fidelity Management and Research, and Marshall Wace

What happened: Munich Re insures crypto and DeFi wallet firm

How is this significant?

- German insurance giant Munich Re made a foray into the digital asset sphere this week, providing crime and cyber threat coverage to crypto wallet firm Fordefi

- The DeFi-centric application arranged the coverage deal in collaboration with blockchain experts from insurance brokers Lockten

- In a blog post announcing the move, Fordefi revealed that the coverage is not intended as a smart contract audit, but rather as guaranteed protection and recompense in the case of cyberattacks and human malfeasance like internal fraud or collusion

- Additionally, individual customers can opt in for extra cover from the insurance firm

- Fordefi CEO Josh Schwartz stated that Munich Re “is getting involved with the most active players in DeFi, starting with a framework that they are comfortable with, i.e. the security of the private keys and the wallet components”

What happened: El Salvador “Bitcoin Office” discloses scale of national mining success

How is this significant?

- El Salvador was the first nation to adopt Bitcoin as legal tender back in September 2021; and it thus makes sense it would also be the first to officially feature a “National Bitcoin Office” as a government entity

- Said office reported this week that El Salvador currently holds 5,750 Bitcoins worth around $373m at the time of writing

- Although the vast majority of these Bitcoins were purchased, El Salvador also confirmed it had mined 473.5 Bitcoins (worth over $29m) since the country officially adopted Bitcoin

- The electricity to mine these coins was generated with geothermal energy from the country’s Tecapa volcano, making El Salvador one of the few countries to officially mine the asset as a matter of political policy

- In other national-level mining news, publicly listed miner Marathon Digital revealed that it has been consulting with the government of Kenya on incentivising expansion of renewable energy through crypto mining

- Jayson Browder, the firm’s VP of government affairs, told Coindesk “We've been working closely with the Kenyan government on how to optimise and monetise renewable energy assets… The technology is modular, we can co-locate these really anywhere, and if they're an intermittent source, like wind or solar, we're able to turn off our machines when the grid needs it, so we can balance the grid”

- Browder added that these initial consultations on energy usage have expanded into further discussions regarding a national crypto regime

- He stated “The Kenyan government wants to be leaders in the technology and innovation space. Investing internally and bringing in leading companies to support this growth…. This includes building the right regulatory framework around digital assets to include a potential development of a [government-regulated] crypto exchange (government or private sector). We're excited about supporting the Kenyan government's forward-thinking”