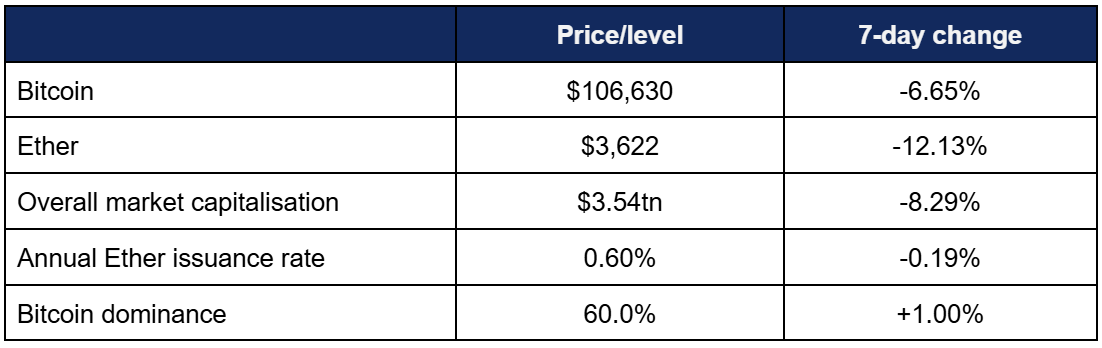

Market Overview

- Bitcoin dropped back below $110,000 as traders responded negatively to Federal Reserve chairman Jerome Powell’s latest statements, widely regarded as more hawkish than expected

- Bitcoin declined steadily throughout the week, peaking at $115,520 on Tuesday, losing $10,000 en route to a Monday low of $105,490 as profit-taking and cascading liquidations wiped out leveraged traders

- This led to the first negative October performance in seven years, although it still remains up around 14% since December

- Ether echoed Bitcoin’s movements, falling from a Tuesday high of $4,164 to a Monday low of $3,570

- Investor sentiment on the Fear & Greed index fell sharply back into “negative” territory 27/100, due to continued market uncertainty

- Overall market capitalisation erased all of last week’s gains, dropping around $300bn

- According to industry monitoring site DeFi Llama, total value locked in DeFi suffered a steep drop in line with Ether’s performance, falling to $143.3bn

Digital assets surrendered last week’s gains as the Federal Reserve positioned itself more hawkishly than expected, leading to widespread investor uncertainty and cascading liquidations. Despite this reversal of market momentum, adoption continued positively, including involvement from BlackRock, Goldman Sachs, Mastercard, major stablecoin projects, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products experienced losses, marking four consecutive weeks of oscillation between in- and outflows

- According to Coinshares data published on Monday, net outflows across all funds totalled $360m, although Ether products achieved $58m inflows globally

- Coinshares’ Head of Research James Butterfill interpreted it thusly; “investors interpreted Fed Chair Jerome Powell’s comments on the likelihood of another cut in December as ‘not a foregone conclusion’. This hawkish tone, combined with a notable absence of key US economic data releases, appears to have left investors in a state of limbo”

- However, amidst the outflows for Bitcoin products, Bloomberg chief ETF analyst Eric Balchunas still noted appetite for new digital asset ETFs, with Bitwise’s Solana staking ETF (BSOL) proving the week’s leader with $417m inflows

- Spot Bitcoin ETFs exhibited mixed performance, with two days of nine figure inflows followed by three days of (larger) nine-figure outflows

- Inflows ranged between $149m and $202m, whilst daily outflows sat between $192m and $488m

- BlackRock’s IBIT had a rare off-week, lagging behind ARK Invest’s ARKB (two days of $76m inflows) for positive performance, whilst leading the line in outflows (shedding $291m on Thursday)

- The next-highest outflows came from Fidelity’s FBTC, at $164m on Wednesday

- Spot Ether ETFs fared slightly better, as funds managed weekly net inflows of around $17m thanks to two days of nine-figure inflows

- Monday and Tuesday added $134m and $246m of fresh capital, before outflows ranging between $81m and $184m across the rest of the week

- Fidelity’s FETH logged the best daily performance ($99m on Tuesday), followed by BlackRock’s ETHA ($76m) and Grayscale’s ETH mini-ETF ($73m)

- The largest outflows came from ETHA as well, which experienced a $118m flight on Thursday

- In other ETF news, significant new altcoin ETFs officially debuted; top performer was the BSOL Solana ETF, followed by Canary’s Litecoin and HBAR funds

- However, Roxanna Islam, Head of Sector and Industry Research at TMX VettaFi, cautioned “The crypto ETF market, however, is already oversaturated, which could hinder some of the smaller or more obscure crypto funds from gaining significant inflows”

What happened: BlackRock and Goldman Sachs amongst heavyweights in Arc blockchain trial

How is this significant?

- Several of the world’s premier financial institutions were confirmed as participants in trials for the new Arc blockchain, developed by stablecoin issuers Circle

- Amongst the names confirmed in a press release are Apollo, Anthropic, BlackRock, Goldman Sachs, HSBC, Invesco, Standard Chartered, State Street, and NYSE parent company Intercontinental Exchange

- The Arc blockchain is built to directly execute stablecoin payments, although it is built to be fully EVM (Ethereum Virtual Machine) compatible, simplifying the migration of existing DeFi applications built around the Ethereum blockchain’s smart contract ecosystem

- The list of firms involved indicating the scale of interest and enthusiasm for the growing stablecoin space, described as a “new economic system” by Circle CEO Jeremy Allaire

- BlackRock’s Head of Digital Assets, Robert Mitchnick, commented “Exploring Arc will provide insight into how stablecoin-denominated settlement and onchain FX capabilities might enable more efficient capital markets”

- Bloomberg analysts wrote that stablecoins “have drawn particular interest from banks and other large financial institutions as they are seen as potential faster and cheaper alternative payment rails. They could also be used as the settlement-leg of transactions involving tokenised assets”

- In other BlackRock news, CEO Larry Fink promoted the role of crypto as an alternative asset class in an uncertain world

- Speaking at the Future Investment Initiative in Riyadh, he said “Owning crypto assets or gold are assets of fear. You own these assets because you’re frightened of the debasement of your assets. You’re worried about your financial security. You’re worried about your physical security”

What happened: Mastercard to acquire Zerohash for $2bn

How is this significant?

- Payment processing giant Mastercard is set to acquire crypto and stablecoin infrastructure firm Zerohash for a deal valued between $1.5bn and $2bn

- Fortune originally broke the news, noting that the deal is still in discussion stages, but would “represent one of the biggest bets yet on stablecoins” if completed

- Zerohash recently more than $100m investment from Interactive Brokers and Morgan Stanley

- Some analysts believe Mastercard is moving for Zerohash after losing out in a bidding war against Coinbase for the acquisition of stablecoin startup BVNK

- Such a deal would make Mastercard the latest payments giant to enter the space, following PayPal’s development of its own proprietary stablecoin, and Stripe’s $1.1bn acquisition of stablecoin platform Bridge back in February

- Meanwhile, payments leader Visa was dubbed “the stablecoin of stablecoins” by Japanese investment bank Mizuho, as it now boasts over 130 stablecoin-linked card programs in over 40 countries after embracing the technology early

- If executed at the upper end of the valuation it could also equal the largest institutional investment ever, a month after Intercontinental Exchange secured a $2bn stake in predictions platform Polymarket

What happened: Nordea bank opens up to digital assets in significant shift

How is this significant?

- Nordic bank Nordea confirmed a policy shift on Thursday, and has “decided to allow customers to trade in an externally manufactured crypto-linked product on its platforms”

- The product in question will be a synthetic ETP issued by CoinShares, available for purchase without specific advice from the bank

- Having previously urged a “cautious approach” due to a lack of regulation, Nordea now writes that the asset class “has matured”

- In a statement, it wrote “the market for crypto-related investment products especially exchange-traded products (ETPs) with crypto as the underlying asset, has grown rapidly in Europe as institutional and retail investors seek to gain exposure to digital assets within established financial markets”

- Headquartered in Finland, Nordea has reflected a broader conservative Nordic institutional attitude towards the asset class, but that cold attitude appears to thawing, as Danish bank Danske and Sweden’s SEB recently announced their participation in a pan-European stablecoin initiative

What happened: Ripple investments reach $4bn following latest acquisition

How is this significant?

- XRP developers Ripple acquired crypto custody and wallet firm Palisade this week, enhancing its offering “for fintechs and corporates”

- Under the terms of the deal, Palisade’s wallet-as-a-service will be integrated into Ripple’s existing custody solution

- According to its press release, Ripple has now invested “approximately $4 billion into the crypto ecosystem”

- This includes two ten-figure deals this year, acquiring prime broker Hidden Road for $1.25bn, and GTreasury for $1bn

- Ripple’s President Monica Lang commented “Corporates are poised to drive the next massive wave of crypto adoption. The combination of Ripple’s bank-grade vault and Palisade’s fast, lightweight wallet makes Ripple Custody the end-to-end provider for every institutional need, from long-term storage to real-time global payments and treasury management”

- She added that the company is benefitting from broader stablecoin growth across the market, as “Palisade offered the best set of capabilities to complement what we have built with Ripple Payments, which has been growing tremendously this year with stablecoin payment proliferation”

What happened: Stablecoin news

How is this significant?

- Stablecoin market leader Tether published its Q3 attestation report this week, outlining continued record performance

- According to the report, year-to-date net profit surpassed $10bn, and global users exceeded 500 million “amidst world’s macroeconomic uncertainty”

- Current reserves stand at over $181bn for $174bn worth of tokens issued

- Additionally, “Tether’s total exposure to US Treasuries, direct and indirect, reached an all-time high of approximately $135bn, making Tether one of the world’s largest holders of US government debt and surpassing South Korea to rank 17th among Nations holding US Treasuries”

- The attestations were prepared by accountancy firm BDO, but the firm’s continued use of attestations rather than audits remains a bone of contention for some industry analysts concerned over transparency

- Following dramatic growth across the stablecoin market this year, banking regulators are reportedly reviewing rules on crypto holdings, after a “US-led pushback against original measures”

- The 2022 guidelines by the Basel Committee on Banking Supervision “were largely interpreted by banks as a signal to avoid crypto since they imposed a heavy capital burden” according to Bloomberg analysts

- Under those proposed rules, risk charges for holding permissionless crypto assets would be 1,250%, more than thrice the 400% penalty for other assets

- Now, according to sources, “the US has been leading calls to amend the standards, arguing that they are incompatible with the industry’s evolution, particularly in the area of stablecoins”

- VC firm Andreessen Horowitz is backing stablecoin firm ZAR, which concentrates on stablecoin integration via neighbourhood stores in Pakistan (the third-largest unbanked population in the world) and other emerging economies

- ZAR enables local venues to issue stablecoins for cash via simply scanning a QR code, reducing friction and barriers to entry

- A ZAR spokesperson said “Across Asia, Africa, and Latin America, over a billion people live in cash economies where traditional banking services are unreliable, savings dwindle from inflation, and access to stable currencies like US Dollars is limited… widely used for international transactions, online purchases, and cross-border business, yet for many people hard to reach”

- Sources say Coinbase is in advanced discussions to acquire stablecoin infrastructure firm BVNK for $2bn

- The exchange’s VC arm already invested in BVNK, alongside other institutional heavy-hitters like Citi Ventures, Visa, and VC firm Haun Ventures

- CEO Brian Armstrong stated that the firm plans to build an “everything app”, with tokenisation and prediction market plans to be announced on December 17th

What happened: Public listing news

How is this significant?

- Several firms in the digital asset space announced or moved closer to public listing plans, as more companies look to capitalise on the success of firms like Circle this year

- CNBC reported that BlackRock’s tokenisation partner, real world assets (RWA) firm Securitize, will go public through a SPAC merger through a firm owned by Cantor Fitzgerald

- CEO Carlos Domingo told the broadcaster “Tokenisation is what everybody’s talking about … but there’s nobody publicly traded that does it. We will do well in the public market because people want to index themselves to tokenisation the same way that people are buying Circle because they want to index themselves to stablecoins”

- He added “The crypto industry needs to consolidate. If you’re publicly traded and you have access to stock capital markets as well as cash, you can be on the side that is consolidating and not be consolidated by somebody else”

- Fellow tokenisation firm tZero is “readying for a 2026 IPO” according to reports

- CEO Alan Konevsky told Bloomberg the firm is currently selecting bankers to work with on the IPO, and simultaneously exploring a pre-IPO fundraising round

- Digital asset investment firm Animoca Brands will list on Nasdaq via a reverse-merger with Singapore-based Currenc Group

- According to an SEC filing, Animoca shareholders will own 95% of the new merged company

- Animoca co-founder Yat Siu commented that the move “will result in the world’s first publicly-listed, diversified digital assets conglomerate, giving investors on Nasdaq direct access to the growth potential of the trillion-dollar altcoin digital economy through a single, diversified vehicle spanning DeFi, AI, NFTs, gaming, and DeSci”

- Investors reacted favourably to the plans, as Currenc shares doubled over the last week in anticipation of the new entity—although the deal isn’t expected to close until Q3 2026

What happened: Crypto Treasury news

How is this significant?

- Leading treasury firm Strategy (formerly MicroStrategy) made another Bitcoin purchase in line with last week’s buys, acquiring 397 Bitcoin for $45.6m

- Additionally, it filed to sell 3.5 million shares of its euro-denominated perpetual preferred stock (STRE) with a 10% annual cumulative dividend as a means of funding for future Bitcoin purchases

- Top Ether treasury firm BitMine bought another 82,353 Ether, bringing its holdings to 2.8% of total Ether supply

- Two of the main backers of the Canton blockchain are reportedly in talks to raise $500m for a listed vehicle to form a digital asset treasury based around the Canton Network’s native CC token

- Trading powerhouse DRW Holdings alongside Liberty City Ventures will supply the majority of the capital via their existing CC holdings

- An additional $100m to $200m will come from outside investors according to reports by undisclosed Bloomberg sources

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.