July 1st, 2025

Market Overview:

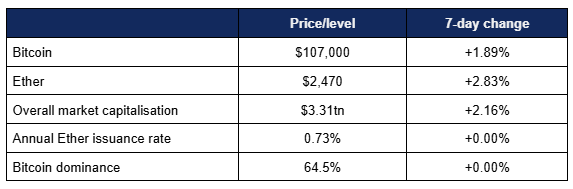

Digital assets recovered from last week’s geopolitical sell-off, showcasing strong growth as Bitcoin approached recent records once more.

- Bitcoin recovered some of its recent losses as market momentum shifted bullish again, capping off a strong H1 for the leading digital asset

- Bitcoin’s share of the total market has grown to its highest point since 2021, according to Coinmarketcap data

- Bitcoin experienced a consistent upward trajectory throughout the week, rising from a Tuesday low of $104,890 to a Monday high of $108,790; approaching its record price of just under $112,000

- Ether displayed more intraweek volatility, but slightly outperformed Bitcoin (partly by virtue of having fallen further during recent market pullbacks)

- Ether increased from a Tuesday low of $2,398 to a Monday high of $2,518

- Overall industry market capitalisation increased to $3.31tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew approximately $3bn, to $113bn overall

Digital assets recovered some of last week’s losses as geopolitical tensions cooled and investor enthusiasm returned to global markets. Bitcoin ended the first half of the year strongly, spurred by an excellent week of ETF performance and multiple major acquisitions for Bitcoin reserves. The US moved towards recognising crypto as collateral for mortgages, bringing Bitcoin full-circle from its birth in response to the 2008 Global Financial Crisis. Elsewhere, stablecoin developments continued rolling in, several firms reached uniform status, a prominent investment advisor went very bullish on his recommended portfolio allocations, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products gained an eleventh consecutive week of inflows, despite global geopolitical tensions

- According to Coinshares data published on Monday, crypto funds added $2.7bn inflows in the trading week ending Friday the 27th

- This more than doubled the previous week’s inflows, as a ceasefire in the Middle East helped diffuse investor nerves

- This brought H1 inflows to $17.8bn, on a par with 2024 when spot ETFs first launched

- Spot Bitcoin ETFs exemplified this strong performance, with all five trading days last week logging nine-figure gains for the funds

- Daily inflows ranged from $227m to $589m, with three of the five days crossing the half-a-billion mark

- Tuesday featured the week’s strongest performance, as ceasefire news restored confidence across global markets

- BlackRock’s IBIT once again dominated volumes and inflows, with positive nine-figure performances ever day last week, including $436m of Tuesday’s overall $589m inflows

- Other nine-figure performers included second-placed FBTC from Fidelity (three days accruing between $106m and $166m) and ARK Invest’s ARKB ($150m on Friday)

- Spot Ether ETFs also performed strongly, drawing inflows on four of five trading days last week, including a (comparatively) rare day of nine-figure inflows

- BlackRock’s ETHA featured the largest single daily inflows at $98m, but was not actually the top performer on the week’s best trading day, when Fidelity’s FETH added $61m of $101m overall across the funds

- Even the single outflow day of the week on Thursday was somewhat mitigated by one fund (Grayscale’s 2.5% fee ETHE fund) effectively accounting for the entirety of outflows, by shedding $27m compared to overall negative flows of $26m

- Elsewhere in ETFs, Bloomberg chief ETF analyst Eric Balchunas noted the approval of the first staking ETF in the US, a Solana product issued by Rex and Ospreay, scheduled to launch on Wednesday

- The fund will invest at least 40% of its capital in non-Solana assets, but the approval of the staking feature led some analysts to suggest a forthcoming “Crypto ETF summer”, including possible inclusion of staking in Ether ETFs

- Strahinja Savic, head of data and analytics at FRNT Financial commented “It’s yet another example of how the Trump Administration is opening the door for crypto to become an integrated part of the US economy via public markets, rather than a pariah asset class that was difficult for traditional investors to access”

- In furtherance of a potential “ETF summer”, Bloomberg analysts increased their spot altcoin ETF (Solana, XRP, Litecoin) approval odds this year to 95%

What happened: US mortgage associations to consider crypto in mortgage applications

How is this significant?

- In a major development late last week, Federal Housing Finance Agency (FHFA) director William Pulte declared "After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count crypto as an asset for a mortgage"

- This announcement is significant for several reasons, not least history; it's generally accepted that the 2008 global financial crisis catalysed Satoshi Nakamoto into developing Bitcoin as a decentralised asset beyond the control of banks and established financial infrastructure

- The crisis of course featured the subprime mortgage crisis, leading to a federal takeover of mortgage associations Freddie Mac and Fannie Mae; and now potentially creating a full-circle moment if they’re forced to acknowledge the asset class which their failures helped create

- Pulte added that the FHFA believes crypto "may offer an opportunity to build wealth outside of the stock and bond markets", and that Fannie and Freddie should "prepare a proposal for consideration of crypto as an asset for... mortgage loan risk assessments, without conversion of said crypto to US dollars"

- The latter point marks a victory for digital asset advocates; allowing them to maintain crypto holdings during a financial assessment, rather than selling off for fiat currency

- The Washington Post reported that this move could "open up a new, and untested, path to getting home loans in the midst of an affordability crisis", and that Pulte said the moves should be implemented “as soon as reasonably practical”

- Binance founder Changpeng "CZ" Zhao responded to the news by saying "the current American Dream is to own a home. The future American Dream will be to own 0.1 BTC, which will be more than the value of a house in the US"

- Bitcoin balance sheet evangelist Michael Saylor meanwhile commented “Bitcoin has been recognized as a reserve asset by the U.S. housing system… A defining moment for institutional Bitcoin adoption and collateral recognition”

- In a possibly-prescient move, Coinbase launched a new advert three weeks ago called "Inflated", commenting on housing price histories in Bitcoin

- In 2012, it took 30,000 Bitcoin to pay for an average home, dropping to 20 Bitcoin a decade later, and just 5 Bitcoin now

- The ad ends by asking "if home prices keep falling in Bitcoin, why do they keep rising in dollars?"

- Tech hub San Francisco is banking on Bitcoin's appeal for property deals; real estate agent Madison Hunter’s Urbane team offers 0.5% of a home's price returned to the buyers in Bitcoin when they complete the dea

- Currently the deal appears limited to the San Francisco metro area, but buyers could soon theoretically have existing Bitcoin holdings backing their mortgage application, and then get a Bitcoin reward upon home purchase

- JP Morgan recently approved BlackRock's IBIT spot Bitcoin ETF as loan collateral for wealth management clients, but this goes well beyond that, as Freddie Mac and Fannie Mae could consider direct crypto holdings as a valid marker of personal wealth for people across all demographics

What happened: Stablecoin news

How is this significant?

- Stablecoin developments continued globally, as US treasury secretary Scott Bessent declared he wants stablecoin legislation done by mid-July

- When quizzed on Bloomberg TV about the appeal of dollar-backed stablecoins versus a digital Euro CBDC, he said “Would you rather have a private stablecoin backed by US Treasuries with US best practice regulation, or an ECB coin that can be shut off? Everyone will choose the US private sector with US regulation all day, every day”

- In keynote remarks at the Money Fund Symposium, State Street Global Advisors’ CEO Yie-Hsin Hung commented “Stablecoins are drawing significant...demand for the Treasury market... stablecoins are growing fast, and most likely, will outpace the growth of Treasury supply”

- According to Bloomberg sources, House Republicans are planning a single vote on the GENIUS stablecoin bill as soon as July 7th

- Trump has urged the house to advance the bill quickly, but perceived presidential personal interests remain an argument used by Democrats against advancing any legislation; this week the Trump-linked World Liberty Financial raised $100m in a token sale to UAE investment fund Aqua 1 Foundation

- Trump-linked American Bitcoin also raised $220m this week for Bitcoin mining infrastructure

- Recently-IPO’d USDC issuer Circle applied for a federal banking licence according to recent Reuters reports

- If granted, Circle would become only the second crypto firm with a banking charter, after digital asset industry bank Anchorage

- This could allow Circle to custody its own backing assets for USDC, rather than with outside custodians

- One organisation which appears cold on such notions is crypto bank Anchorage, which this week, phasing out support for USDC (and rival stablecoin AUSD), citing concerns over regulatory oversight and reserve management in its new “Stablecoin Safety Matrix”

- However, this judgement met with some pushback, as representatives linked to USDC and AUSD argued a vested interest in the methodology, as it promoted the USDG stablecoin, issued by a consortium including anchorage

- Bernstein analysts remain very bullish on the company’s CRCL stock, setting a $230 price target, calling it “an investor must-hold, to participate in the new internet-scale financial system built for the next decade”

- Coinbase shares were another beneficiary of stablecoin furore, as they closed at record levels on Thursday; finally surpassing post-launch highs from November 2021

- Stablecoins have gained momentum in Asia’s largest crypto market, South Korea; payment provider KakaoPay’s shares recently surged 17% on reports it could release its own stablecoin

- According to South Korea’s Yonhap news agency, the Bank of Korea is pausing CBDC development efforts, due to rising momentum for Won-backed stablecoins under the new administration

- The Financial Times reported that “a speculative frenzy in dollar-backed stablecoins has prompted South Korea to lift a 14-year ban on domestic financial institutions buying so-called kimchi bonds [foreign currency debts issued onshore and intended for conversion into South Korean Won] as it seeks to draw in offsetting capital inflows”

- In another article, the FT noted “The wave of retail enthusiasm for the likely issuance of Won-based stablecoins… helped boost the benchmark Kospi Composite index almost 30 per cent this year to a near four-year high”

- It added “US Dollar-pegged stablecoins trading in the country hit Won57tn in the first three months of this year, piling pressure on the Bank of Korea to accelerate”

- The Financial Action Task Force warned against growing international use of stablecoins for illicit activity, arguing “The perceived reduction in volatility, transaction efficiency with low costs, and abundant liquidity in the market that make stablecoins attractive to many consumers and businesses also draw in criminals seeking to reduce their costs”

What happened: Mainland China broker seeks Hong Kong crypto licence

How is this significant?

- TF International Securities Group (a wholly owned unit of Shanghai-listed Tianfeng Securities Co.) applied to Hong Kong’s securities and futures commission (SFC) this week for a variety of crypto services

- TF applied to allow digital asset trading, deposits, and withdrawals, eliminating the need for their customers to use fiat on- or off-ramps when dealing with digital assets

- Additionally, it sought a licence for tokenisation of real-world assets

- When Tianfeng Securities SFC approval for virtual asset trading services in Hong Kong last week, its Shanghai-listed shares experienced 8% growth; indicating possible mainland exposure in Hong Kong investment avenues, despite an official on crypto trading within the PRC

- Another Chinese broker, Guotai Junan experienced its best week ever when its Hong Kong unit was recently granted a licence, as shares rose up to 300%

- Hong Kong analyst Sharnie Wong commented “Guotai looks to have gained a first-mover advantage among Chinese-backed brokers in crypto assets, as well as stablecoin trading and advisory services. Crypto trading is not permitted in the mainland but the license for Guotai Haitong’s HK unit indicates that this could be a viable business opportunity through their overseas operations”

- The special-status city recently released its second policy statement on digital asset development, clarifying plants to “establish a framework for service providers”

What happened: Blockchain-based prediction markets gain unicorn valuations

How is this significant?

- Two major prediction-markets—platforms where users can wager on various events with odds determined by popular consensus—raised funds in the last few weeks putting them at unicorn valuations

- The Wall Street Journal wrote that New York-based Kalshi raised $185m led by crypto-centric VC Paradigm, valuing the firm at $2bn

- Kalshi first gained notoriety after allowing users to wager on the outcome of the US election, a betting market generally banned in the States

- The majority of its post-election volumes have concentrated on sports, and it accepts stablecoins and Bitcoin as forms of deposit

- According to TechCrunch, blockchain-based rival “Polymarket is raising $200 million at around a $1 billion pre-money valuation, led by Founders Fund”

- Representatives declined to comment, but such a raise would double all previous funding undertaken by the firm

What happened: Fintech SoFi reintroduces digital assets to its platform

How is this significant?

- SoFi, a top US consumer fintech firm, announced digital asset trading to its customers this week, having previously removed the asset class in 2023 due to regulatory hostility

- The online bank will also introduce global remittances powered by stablecoins

- CEO Anthony Noto stated “The future of financial services is being completely reinvented through innovations in crypto, digital assets and blockchain more broadly”

- In a press release, SoFi stated “We’re building a future where people can seamlessly send money around the world and have the tools and education to safely use crypto and digital assets to get their money right”

- Noto added that “Crypto and blockchain innovations can and will be threaded through each of our businesses and capabilities, including buying, paying, saving, investing, borrowing, and protecting”

- Although details were scant, the release said stablecoin remittances would run on “well-known blockchains”, “at significantly faster speeds and lower costs compared to the multi-day waiting periods many experience today with traditional services”

What happened: Leading financial advisor recommends up to 40% crypto allocation

How is this significant?

- Following last week’s reports about Spanish bank BBVA recommending wealth clients a 3% to 7% digital asset allocation, leading financial advisor Ric Edelman went several steps further this week

- In a new white paper, the founder of investment advisory firm Edelman Financial Engines ($300bn) recommended a 10% crypto allocation for “conservative” investors, 25% for clients in the “moderate” category… and an eye-watering 40% allocation for those with “aggressive” risk tolerance

- Edelman wrote “the traditional 60/40 stock/bond allocation model is dead”, due to “unprecedented rates of longevity”

- According to Edelman, due to rising lifespans, the traditional portfolio mix is no longer effective when planning for retirement and later life

- He argues that “There’s no logic to omitting an asset class that’s outperformed all others for 15 consecutive years and is widely projected to continue doing so for the next decade or more. Historic performance data show that portfolios with Bitcoin have generated higher returns with lower risks”

- Edelman claims that 50% of investment advisors already own crypto, but only around 20% currently recommend it to clients, but argued “If you’re fearful that recommending crypto could cause a client to fire you, then you’re suffering from a conflict of interest”

- Bloomberg chief ETF analyst Eric Balchunas responded “Holy smokes. This is the arguably the most important full throated endorsement of crypto from TradFi world since Larry Fink. This guy is Mr RIA. Manages $300b for 1.3million clients. Tops the Barron’s list of America Advisors regularly”

- Edelman also opined that “Owning crypto is no longer a speculative position; failing to do so is”

What happened: Germany’s largest banking group to add crypto trading

How is this significant?

- According to reports, Sparkassen-Finanzgruppe—Germany’s largest banking group—plans to offer crypto trading to 50 million customers by 2026

- Reporting across a wide variety of German-language media suggested that the move was catalysed by client demand

- This marks a dramatic about-turn from three years ago, when they actively advised against allowing customers any digital asset exposure

- Retail clients will be able to trade a variety of digital assets, including Bitcoin and Ether, thanks to the European Union’s recent Markets in Crypto Assets (MiCA) regulation

- Despite the reversal of earlier policy, the banking group remains cautious; spokespeople still stressed that they view it as a highly speculative asset class, and won’t be aggressively advertising the offering

What happened: Crypto Treasury news

How is this significant?

- Numerous firms (and even a country!) made further strides this week in pursuit of digital asset treasuries and reserves

- As has become routine in these updates, enterprise software firm Strategy (formerly MicroStrategy) and Japanese hotel chain Metaplanet continued their hard pivots towards pure Bitcoin exposure strategies

- The former acquired nearly $532m of Bitcoin this week, financed through common shares

- This increased the firm’s coffers by another 4,980 Bitcoin, bringing total holdings to 597,325 Bitcoin

- Metaplanet meanwhile purchased 1,005 Bitcoin for $108.1m, making it the fifth-largest public Bitcoin treasury firm in the world, surging ahead of Galaxy Digital and CleansSpark mining

- Florida-based SRM Entertainment staked on the Tron blockchain as part of its $100m Tron (TRX) treasury strategy

- It should however be noted this firm took one of Tron founder Justin Sun’s firms public in the US via a reverse-merger; so its substantial TRX stash was effectively subsidised as part of the deal

- Shareholders of Spanish coffee chain Vanadi backed a strategic shift towards Bitcoin, supporting a $1.17bn crypto acquisition plan

- In an announcement, the Alicante-based firm explained “Similar to companies such as MicroStrategy or Metaplanet, Vanadi Coffee redefines its business model and will use Bitcoin as its main reserve asset and accumulate large amounts of Bitcoin as part of its treasury”

- ProCap BTC, a financial firm run by longtime Bitcoin evangelist Anthony Pompliano, purchased over $500m in Bitcoin within two days, as part of its ambitions for $1bn holdings before a public listing

- Finally, Kazakhstan revealed plans for national crypto reserves, under the auspices of its national bank

- The state reserves will be seeded with confiscated crypto from police operations, as well as nationally-mined assets

- Central bank governor Timur Suleimenov said that Kazakhstan will pursue “sovereign-wealth best practices, including a single-manager setup, transparent books, and audited, secure storage”

- Despite being a lower-profile country on the global crypto development map, Kazakhstan’s abundant natural energy supplies have made it one of the world’s largest mining hubs, accounting for around 13% of the global Bitcoin hashrate in a heavily-monitored and licenced local mining market

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.