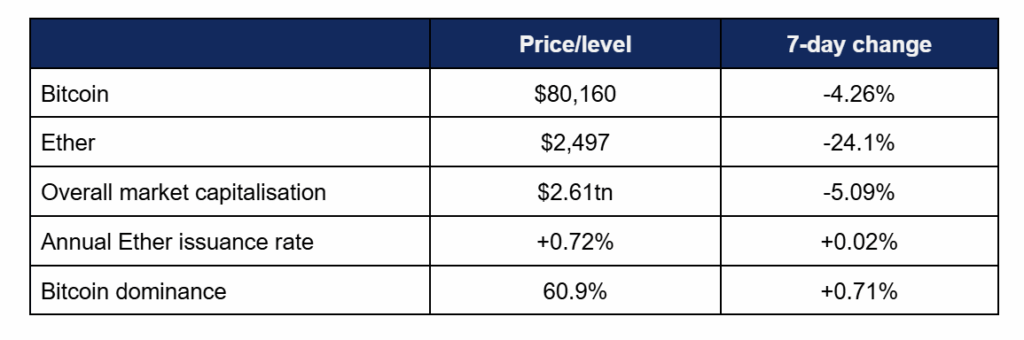

Market Overview

Challenges continued to confront the digital asset market, as the impact of global trade wars managed to counteract the good news of US strategic digital asset reserves.

- Bitcoin continued its recent decline, alongside wider market pullbacks for perceived risk-on assets amidst trade wars and possible fears of recession

- Once again, other markets fell alongside digital assets, including the Dow dropping by almost 900 points

- Bitcoin fell from a Wednesday high of $92,550 to a low of $76,810 in early Tuesday trading

- Ether’s performance represented one of its worst weeks ever, dropping to its lowest levels in over a year, falling from $2,302 on Wednesday to down below $2,000, en route to a low of $1,799 on Tuesday

- Industry sentiment on the Fear & Greed index hit its lowest point in over two years, currently displaying “extreme fear”at 15/100

- Overall industry market capitalisation fell to $2.61tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped around $7bn from last week, down to $86bn

Digital assets now form an official reserve asset in the United States—but economic backlash from the administration’s tariff policies meant that the crypto market couldn’t benefit from this milestone achievement. ETFs continued to experience significant outflows as traders exhibited risk-off behaviour, but elsewhere there was good news, in the form of banking adoption, industry hiring sprees, sector IPOs, and much more.

What happened: USA officially creates strategic crypto reserves

How is this significant?

- Following Donald Trump’s pronounced plans for a digital asset reserve late last Sunday (featuring Bitcoin, Ether, Solana, Cardano, and XRP as initial assets), those plans were turned into action this week with the creation of digital asset reserves for the world’s most powerful economy

- On Thursday, he affirmed this by signing an executive order to create a strategic Bitcoin reserve (separated from a reserve for the other assets), and on Friday the White House hosted an historic “Crypto Summit”, featuring high-level executives from across the industry

- The summit marked the first time digital assets were ever promoted front and centre by the US government, and laid out several key facts concerning the strategic crypto reserves

- Assets already seized via forfeitures “will form the foundation of the new reserves”; however the government is “authorised to develop budget-neutral strategies for acquiring additional Bitcoin, provided that those strategies impose no incremental costs on American taxpayers”

- According to the administration’s “Crypto Czar” David Sacks, current stockpiles are estimated at around 200,000 Bitcoin, although some sources put the figure closer to 187,000

- Separation of Bitcoin from other reserves was greeted with positivity; fintech investor Ryan Gilbert told CNBC ““I do think it will help Bitcoin as a token, as an asset, separate itself from all the others as far as the debate is concerned”

- Trump said they would dismantle the previous administration’s “Operation Chokepoint 2.0” policy of deliberately debanking the industry; a move which was confirmed by the OCC

- He also vowed to “rescind and amend” all previous IRS crypto guidance

- The White House pledged stablecoin legislation support, aiming to pass a bill before the August recess

- Trump said “I want to express my strong support for the efforts of lawmakers in Congress as they work on bills to provide regulatory certainty for dollar-backed stablecoins and the digital assets market”

- Treasury Secretary Scott Bessent supported this philosophy, stating “We are going to keep the US the dominant reserve currency in the world and we will use stable coins to do that”

- President Trump declared that the US would never sell its Bitcoin, whilst Sacks said “Bitcoin is scarce, it’s valuable, and that is strategic for the United States to hold on to this as a long-term reserve asset”

- Sacks added that previous government policies of ad-hoc sales on seized Bitcoin “had cost the American people something like $17bn in lost value”.

- Some observers were admittedly underwhelmed by the market’s response to this news, arguing that the strategic reserve didn’t go far enough due to the lack of specific buying mechanisms

- Whilst some may have expected an instant recovery at this news, the overall macroeconomic conditions simply remain too stressed for most investors to currently consider any potential allocation towards (perceived) risk assets

- Despite the lack of immediate price action, some remained optimistic in the longer-term; CNBC reported that China and gulf nations could be considering their own Bitcoin acquisition strategies (particularly since Trump warned the US must remain ahead of China in crypto)

- Additionally, Texas passed a Strategic Bitcoin Reserve bill, leaving it one step away from becoming law

What happened: ETF News

How is this significant?

- Digital asset ETFs extended their recent losing run, clocking up a fourth consecutive week of outflows

- According to CoinShares data published on Monday, digital asset investment products outflows hit $876m in the week ending Friday the 7th; down from the previous week’s record $2.9bn

- CoinShares chief researcher James Butterfill noted “Although this indicates a slowdown in the pace of outflows, investor sentiment remains bearish”

- Spot Bitcoin ETFs once again suffered major losses, experiencing outflows on four of the last five trading days

- The one day of positive flows (Wednesday) was relatively modest at around $22m, whilst the week’s largest outflows were registered on Friday, following disappointment over a lack of specific buying policy for the USA’s new strategic digital asset reserves

- The largest daily outflows from a single fund were registered by ARK Invest’s ARKB on Friday, as it shed over $160m

- Only two funds registered any actual inflows over the last week; Grayscale’s 0.15% fee mini-ETF accrued $36m on Tuesday, whilst BlackRock’s market-leading IBIT added around $39m on Wednesday

- Spot Ether ETFs added a modest $15m on Tuesday, before experiencing eight-figure outflows for the rest of the week

- Altcoin-centric hedge fund Canary Capital filed another altcoin ETF submission, this time for the Axelar cross-chain protocol

- Meanwhile, the Singapore Exchange (SGX) announced the launch of open-ended Bitcoin and Ether futures contracts

- An SGX spokesperson believed that the perpetual contracts will “significantly expand institutional market access”

What happened: Spanish banking giant BBVA opens digital asset trading

How is this significant?

- Banco Bilbao Vizcaya Argentaria—better known as BBVA—achieved approval from local market regulators this week to offer crypto custody and trading services

- As Spain’s second-largest banking group (and the only one granted digital asset approval by market supervisory body CNMV), this move marks a significant potential shift in digital asset accessibility within the country

- BBVA head of retail banking Gonzalo Rodriguez commented “We want to make it easier for our customers to invest in crypto assets with a simple, accessible offering available directly from their mobile phones, in a fully digital manner. Our goal is to guide them as they explore this new segment of digital assets, backed by the solvency and security assurances provided by a bank like BBVA”

- The bank will now be able to offer digital asset services to retail clients, albeit limited to Bitcoin and Ether

- This follows the rollout of similar services amongst the group’s banks in Switzerland and Turkey

- In a statement, the bank indicated it developed its own storage solutions, rather than recruiting third parties for custody

What happened: Coinbase launching 24/7 futures trading

How is this significant?

- Leading US exchange Coinbase this week revealed that it will imminently launch the first 24/7 Bitcoin and Ether derivatives available to traders in the country

- Additionally, the firm indicated it is currently developing a novel “perpetual-style futures contract”

- In a press release, the exchange indicated active collaboration with the CFTC, and celebrated the thematic suitability for such products for the asset class

- The company stated “Today, US futures markets operate within fixed trading hours–out of sync with the 24/7 nature of crypto. This forces traders to sit on the sidelines during key market moves, limiting their ability to react in real time”

- In other Coinbase news, CEO Brian Armstrong declared that the firm is hiring 1,000 new employees within the US this year, spurred by the more positive regulatory environment

- He told industry publication Coindesk “It’s only been, what, 50 days or something like that [since the new administration took power], and it’s already created enough of a tailwind that we feel more confident in investing in the United States and growing our business here”

What happened: Tokenisation firm receives SEC approval

How is this significant?

- Tokenisation platform Superstate announced its registration as an authorised transfer agent with this SEC this week

- Transfer agents can benefit from tokenisation, as blockchain and smart contracts enable automation of owner registration and dividend distribution

- In a tweet, the firm deemed this as a significant development, stating “This milestone advances our mission to modernize finance by enabling the integration of tokenised securities into the existing regulatory framework”

- It added that “Through this innovative approach, Superstate advances tokenized security compliance while integrating into the existing regulatory regime”

- Superstate currently boasts two major tokenised funds (USCC and USTB) with a combined AUM around $420m, and will support them both in its new capacity as a transfer agent

- In other SEC news, acting chair Mark Uyeda indicated that he’s rescinding regulations from the previous administration that required crypto exchanges to register under alternative trading system rules

- He said “In my view, it was a mistake for the Commission to link together regulation of the Treasury markets with a heavy-handed attempt to tamp down the crypto market”

What happened: International news

How is this significant?

- El Salvador is reportedly continuing its nation-level Bitcoin acquisition strategy, despite a recent IMF loan seemingly discouraging the country from doing so

- President Nayib Bukele tweeted “No, it’s not stopping… it won’t stop now, and it won’t stop in the future”

- An IMF spokesperson told Bloomberg that recent acquisitions (adding about one Bitcoin per day) were “consistent” with the bank’s agreement; indicating that the loan may have been contingent on not accelerating the rate of acquisition, rather than stopping entirely

- EU officials indicated that increased US embrace of digital assets could threaten Europe’s economic development—citing stablecoins as a particularly potent disruptor

- European Stability Mechanism Managing Director Pierre Gramegna commented that “The US administration is favorable toward crypto assets and especially dollar-denominated stablecoins, which may raise certain concerns in Europe… if [mass payment solutions based on dollar-denominated stablecoins] were to be successful, it could affect the Euro area’s monetary sovereignty and financial stability”

What happened: Industry IPO News

How is this significant?

- Bloomberg reported on Friday that crypto exchange Gemini—co-founded by White House Crypto Summit attendees the Winklevoss twins—confidentially filed for an IPO recently

- Sources said that the exchange recruited Citi Group and Goldman Sachs to assist in the process

- The firm could list as soon as this year, becoming the second major American exchange to go public after Coinbase

- Meanwhile, another Bloomberg report suggested that rival exchange Kraken is likely to float on the stock exchange in 2026

- A Kraken spokesperson told the publication “We’ll pursue public markets as it makes sense for our clients, our partners and shareholders”

What happened: Strategy raising $21bn for Bitcoin acquisition

How is this significant?

- Corporate Bitcoin exemplar Strategy—formerly known as MicroStrategy—is increasing its Bitcoin acquisition efforts once more, through issuance and sale of up to $21bn in 8% Series A perpetual strike preferred stock

- Crucially, this move is in addition to Strategy’s previously-publicised 21/21 plan to raise $42bn for Bitcoin acquisition via equity and fixed-income securities

- According to its latest filings, Strategy currently holds 499,096 Bitcoin, purchased at an average price of just over $66,300

- As a stock market proxy for Bitcoin exposure, Strategy’s share price has suffered during the recent market downturn, losing nearly 50% from its recent record highs

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.