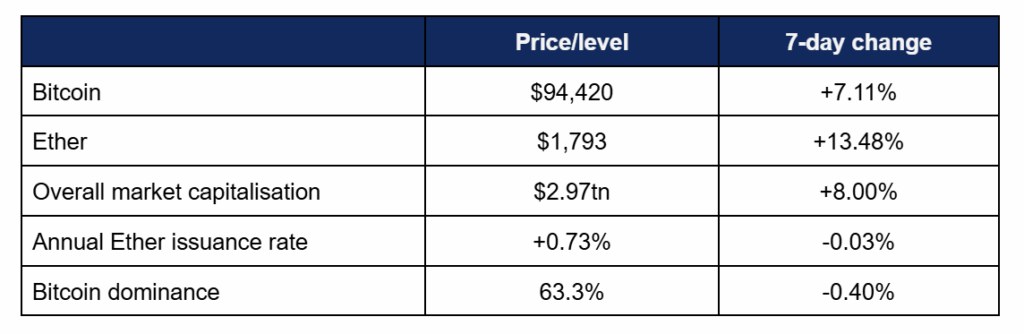

Market Overview:

- Bitcoin experienced another week of significant growth, breaking above the $90,000 mark and beyond

- Bitcoin grew consistently throughout the week as investors moved back into risk-on assets—growing from a Tuesday low of $88,230 to a Friday top of $95,560; its largest weekly gain since Trump’s election, and highest valuation since February

- Ether also moved bullishly, from a Tuesday low of $1,584 to a weekly high of $1,847 on Sunday

- Altcoins outpaced Bitcoin this week as many posted double-digit growth, with only four of the top 50 assets by market capitalisation losing value over in the last seven days

- Industry sentiment on the Fear & Greed index improved markedly from “fear” territory into “neutral” sentiment, at 53/100

- Overall industry market capitalisation approached the $3tn landmark, rising to $2.97tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew by over $10bn, crossing the $100bn threshold once more

Digital assets experienced one of their best weeks this year, approaching a $3tn industry market capitalisation once again. Stablecoins were a major area of focus from both multiple major companies, ETFs racked up nine-figure inflows, several major TradFi and DeFi institutions joined forces for a new Bitcoin venture, new SEC chair Paul Atkin outlined a different approach to his predecessor Gary Gensler, Arizona moved just one gubernatorial signature away from the first official state-level Bitcoin reserve, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced a significant surge in inflows, logging the third-best weekly performance on record

- According to Coinshares data published on Monday, overall ETF flows in the week ending 25th April reached $3.4bn; the most since December 2024

- CoinShares Head of Research James Butterfill wrote “We believe concerns over the tariff impact on corporate earnings and the dramatic weakening of the US Dollar are the reasons investors have turned towards digital assets, which are being seen as an emerging safe haven”

- Spot Bitcoin ETFs logged five consecutive trading days of nine-figure inflows at the time of writing—including two days with over $900m added

- Tuesday registered the largest inflows at $937m, followed by Wednesday’s $917m

- The lowest daily flows were $380m on Friday; a figure still far in excess of the average $119m daily inflows since launch

- BlackRock’s market-leading IBIT provided the top performance of the week, adding $643m on Wednesday (the best performance of any ETF across all industries that day), and $327m on Thursday

- Other top performers were ARK Invest’s ARKB and Fidelity’s FBTC, which accrued $267m and $254m respectively on Tuesday

- This provided IBIT with the four largest daily inflows of the entire week; Fidelity’s FBTC featured the next-best performance, adding $26m on Thursday

- However, FBTC was also amongst the week’s biggest losers, shedding $114m the day before—just ahead of $113m outflows from ARK Invest’s ARKB

- At the time of writing, provisional Monday data suggested that IBIT may have experienced one of its best trading days ever on Monday, logging nearly $1bn inflows, at $970m added

- This counteracted the only nine-figure outflows of the week from ARKB, as early reporting indicated $591m Monday inflows

- Spot Ether ETFs logged their first inflows in several weeks, including (low) nine-figure inflows on Friday, as the former added $54m and $40m and the latter $36m and $33m on their best trading days

- Friday inflows stood at $104m, the highest in recent memory for the funds

- Bloomberg chief ETF analyst Eric Balchunas commented on the overall performance of crypto ETFs by saying “ETFs are on a Bitcoin bender… what’s really notable is how fast flows can move from first gear to fifth gear”

- His colleague James Seyffart moved to quell reports that XRP ETFs had been officially approved for trading this week; but added that “we believe they will launch—and likely launch in the short or possibly medium term.”

What happened: Stablecoin news

How is this significant?

- Numerous major institutions from both the DeFi and TradFi sides of the spectrum progressed their presence within the stablecoin space, setting themselves up ahead of anticipated US legislation

- PayPal moved to increase adoption of its proprietary PYUSD stablecoin, allowing users to gain a 3.7% yield on PYUSD balances within its app

- According to Bloomberg reports, this service will launch by summer, with interest accrued daily and paid out monthly

- At the time of writing, PYUSD ranks as the seventh-largest stablecoin by market capitalisation, and the company plans to integrate stablecoin payments across more services

- PayPal CEO Alex Chriss commented “We are thinking a lot about how we can change the expense profile of the payments landscape by using stablecoins”

- In related news, Coinbase announced free conversion of US Dollars into PYUSD

- Fellow payments processor Stripe meanwhile is opening a stablecoin payment pilot project to international users

- CEO Patrick Collisson confirmed the company has considered stablecoins for nearly a decade, and can now integrate such assets thanks to its recent $1.1bn acquisition of stablecoin development platform Bridge

- Dutch banking giant ING is leading a consortium for a new Euro-dominated stablecoin under the single market’s new MiCA digital asset regulations

- Sources told industry publication Coindesk “ING is working on a stablecoin project with a few other banks. It’s moving slow as multiple banks need board approval to set up a joint entity”

- Mastercard expanded support for stablecoin payments, working alongside exchange OKX and Circle for wallet enablement, card issuance, merchant settlement and on-chain remittances

- Chief product officer Jorn Lambert stated “When it comes to blockchain and digital assets, the benefits for mainstream use cases are clear. To realise its potential, we need to make it as easy for merchants to receive stablecoin payments and for consumers to use them. We believe in the potential of stablecoins to streamline payments and commerce across the value chain”

- Mastercard also stated that customers’ stablecoin balances can be directly withdrawn to their bank accounts, and that stablecoin payments will be accepted at 150 million merchants worldwide

- According to a new statement by leading stablecoin issuer Tether, its gold-backed stablecoin XAUT is currently secured by 7.7 tons of gold held in vaults by the firm, making it “the highest market-cap, most secure, and compliant tokenized gold product in the market”

What happened: Cantor and Softbank team up with crypto firms for new Bitcoin venture

How is this significant?

- Early reports last week indicated institutional titans Cantor Fitzgerald and Softbank, joining forces with crypto powerhouses Tether and Bitfinex in order to build a new Bitcoin-based company

- Later reports confirmed a new firm called Twenty One Capital Inc. (named in allusion to the maximum mineable Bitcoin supply of 21 million), founded by the above enterprises

- Twenty One is expected to launch with a hoard of 42,000 Bitcoin (sourced internally) worth over $3.9bn, instantly elevating it to the third-largest corporate Bitcoin treasury in the world

- Cantor Fitzgerald (formerly led by current commerce secretary Howard Lutnick) is participating through a SPAC called Cantor Equity Partners

- News of Twenty One was positively received by the market; Cantor Equity Partners’ stock surged nearly 200% in light of the development

- Twenty One CEO Jack Mallers told Bloomberg “We intend to raise as much capital as we possibly can to acquire Bitcoin… my one rule to our shareholders is: Our Bitcoin-per-share will grow”.

- According to Bloomberg “Twenty One and Cantor Equity Partners have entered into agreements with investors to raise $585 million of additional capital, consisting of $385 million in convertible senior secured notes and $200 million of common equity… the latest spin on the business model of [Michael] Saylor’s [Micro]Strategy… that has amassed about $45 billion of the digital asset”

- Mallers confirmed the corporate role model, stating “We were very inspired and encouraged by what [Micro]Strategy and other public companies have been doing in the public market space. We’re not a pivoting business… We are a Bitcoin company and we wanted to deliver this blue-chip type of credibility”

- Strategy itself continued leading by example, adding yet more Bitcoin ($1.42bn worth at an average price of $92,737 per unit) to its considerable coffers

What happened: New SEC chair outlines digital asset philosophy under current regime

How is this significant?

- Speaking at a public roundtable, new SEC chair (and noted digital asset supporter) Paul Atkins outlined his vision for digital assets under his leadership, indicating a less antagonistic approach than his predecessor Gary Gensler

- He suggested that the commission has “ample room to maneuver” in regulating the asset class even prior to legislative confirmation, but added that compared to Gensler’s tenure, his SEC wouldn’t try to act as unilaterally

- Atkins commented “It’s always good to have Congress’s input; if there’s a statute to back up what we’re doing, I think that’s all the better”

- He was critical of the previous approach, saying innovation had been stifled, and “The market itself seems to indicate that the current framework badly needs attention”

- Custody requirements will likely be less restrictive under the new regulatory regime (as indicated by rescinding SAB121), as Atkins said “A regulatory approach should recognize the differences across qualified custodians exist for some crypto assets. But for others, self custody might be the safer option”

- The Federal Reserve officially removed crypto-related guidance for banks, softening its regulatory stance

- Former Binance CEO Changpeng “CZ” Zhao noted a “more relaxed” approach from US regulators, and is using it to recommend lawmakers elsewhere adopt a similar stance to digital assets

What happened: Arizona passes bill for first strategic state Bitcoin reserve

How is this significant?

- Arizona legislators passed a bill to establish a state Bitcoin reserve—leaving it just one governor’s signature away from officially passing into law

- If the governor signs the bill, it will become the first state in the union to approve public funds for investment in digital assets

- The Arizona Strategic Bitcoin Reserve Act would allow “the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin”

- Other states are currently evaluating their own state reserves, albeit a few steps back in the legislative process

- The bill noted that it “represents an emerging approach by a state government to integrate cryptocurrency into public financial management, reflecting the growing mainstream acceptance of digital assets”

What happened: Crypto drives strong profits for neobank Revolut

How is this significant?

- According to Revolut’s latest annual report, net profits grew to $1bn in 2024; and digital assets drove a significant portion of this growth

- The company’s new Revolut X digital asset exchange was identified as a standout performer for the bank, as TechCrunch wrote “The exchange is part of Revolut’s Wealth group, which saw revenue grow 298% to $647 million from just $158 million in 2023”

- The publication also noted “That new crypto exchange could end up playing a role there. Revolut has found it challenging to break into the US market up to now, but the U.S. government’s moves to free up activity around cryptocurrency could pave the way for Revolut to drive up users through the newer product”

- Fellow trading platforms Coinbase and Robinhood are noted as other beneficiaries of increased digital asset trading last year, set to report earnings in the near future

- Meanwhile, staking service Ether.fi is going the other way to Revolut, launching a neobank in order to broaden the range of services offered to users, including the issuance of cash cards

What happened: Standard Chartered analysts predict new Bitcoin record in Q2

How is this significant?

- Analysts from international banking giant Standard Chartered sounded a bullish note on Bitcoin this week, predicting a return to record highs this quarter

- Global head of digital assets research Geoffrey Kendrick believes that Bitcoin’s status as a truly borderless asset should prove especially attractive in the current economic climate dominated by uncertainty around nation-level fiscal policy

- He wrote that “strategic reallocation away from US assets” could be a key vector of Bitcoin appreciation

- In a new report, Kendrick wrote “A number of indicators support our view that Bitcoin is headed for the next leg higher. US Treasury term premium (which has a close correlation to BTC) is at a 12-year high. Time-of-day analysis suggests that US-based investors may be seeking non-US assets. Meanwhile, Bitcoin accumulation by ‘whales’ (major holders) has been strong and ETF flows in the past week suggest safe-haven reallocation from gold into BTC”

- Regarding gold vs Bitcoin as that edging assets, Kendrick opined “we would argue that Bitcoin is more effective in this regard because of its decentralized nature”

- He predicted a run to $120,000 in Q2, and maintained Standard Chartered’s previous $200,000 prognostication for 2025

- Bernstein analysts also foresee new record prices, arguing that “the Bitcoin accumulation game is becoming competitive…[as] approximately 80 companies now hold a combined 700,000 BTC or 3.4% of Bitcoin’s total 21 million supply.”

What happened: Coinbase to launch institutional Bitcoin yield fund

How is this significant?

- Leading American digital asset exchange Coinbase announced a new product this week for institutions; a means to officially earn yield on Bitcoin

- On Monday, the exchange’s Coinbase Asset Management arm revealed its new Coinbase Bitcoin Yield Fund, offering estimated annualised returns of 4% to 8% on Bitcoin holdings

- The fund will launch in May for non-US investors, and earn its yield through the basis trade (or rather the “cash and carry trade” crypto version), exploiting imbalances between spot prices and perpetual swaps

- According to division president Sebastian Bea in a company press release, “Coinbase AM believes that the next cycle needs better products to enable institutional investment in digital assets. We believe the Bitcoin Yield Fund is particularly well suited to the task, given its conservative and compliant investment strategy”

- In other Coinbase news, the company extended a $100m credit facility to mining company Riot Platforms, using Riot’s Bitcoin holdings as collateral

- Rival exchange Binance also moved to add institutional products, providing asset managers with “fund accounts”, allowing them to pool investors’ assets and provide “a more TradFi experience”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.