August 16th, 2024

Market Overview:

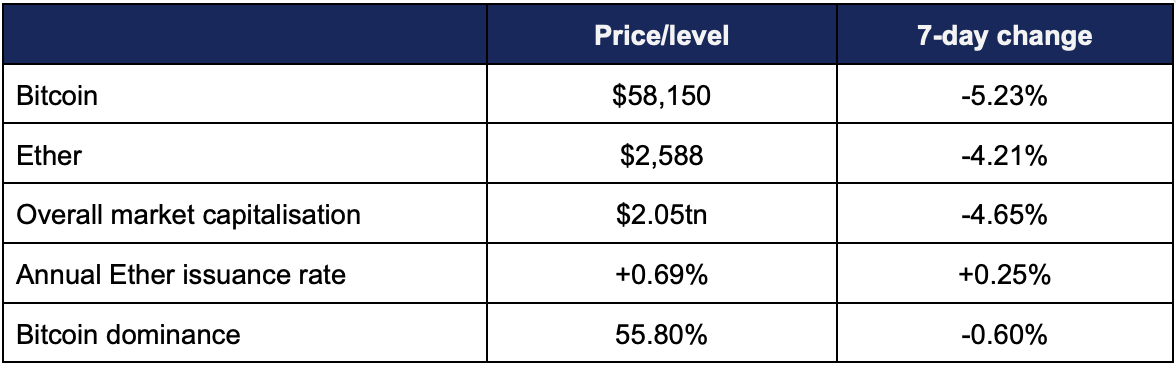

Digital assets pulled back further this week after the rally that followed last week’s macro-driven decline stalled.

- Bitcoin peaked at $61,490 on Wednesday but fell sharply to record a weekly low of $56,630 late on Thursday

- Ether exhibited similar chart movements, hitting a weekly high of $2,775 on Wednesday, before dipping down to $2,539 in late Thursday trading

- Both of the leading digital assets achieved mixed results in spot ETF trading this week, as range-bound trading led to decreased enthusiasm amongst traders

- Overall digital asset market capitalisation decreased to $2.05tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi decreased slightly to $82.6bn

Digital assets experienced another challenging week in the markets, with mixed performance across spot ETFs and uncertainty around the potential crypto policies of US presidential candidate Kamala Harris. Elsewhere, the picture was much brighter; over 700 firms (including major banks and hedge funds) reported digital asset exposure in the latest 13F form filings, crypto VC raises increased in a “flight to quality”, a major miner made a quarter-billion dollar Bitcoin acquisition, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced mixed weeks of trading, with both Bitcoin and Ether registering both daily net inflows and outflows

- According to CoinShares data, digital asset investment products (dominated by spot ETFs) moved back into net inflows last week, gaining a total of $176m, with CoinShares analysts speculating that “investors saw recent price weakness as a buying opportunity”

- Spot Bitcoin ETFs saw major inflows last Thursday, with BlackRock’s IBIT and WisdomTree’s BTCW both registering nine-figure gains

- IBIT’s $157m inflows were the largest of the day, but BTCW’s $118.5m were—by far—the largest in its history

- As the smallest fund amongst the “newborn nine” ETFs, WisdomTree has averaged $1.3m daily inflows; this $118.5m now accounts for over half of its total $201m inflows

- Bitcoin ETFs saw net inflows on Monday and Tuesday, before cooling off with outflows on Thursday as Bitcoin dropped in price

- Spot Ether ETFs featured much more modest figures, with the top weekly inflow day being held by BlackRock’s ETHA at $49.1m on Tuesday, as part of three consecutive inflow days this week

- This puts ETHA on course to imminently hit $1bn of inflows, marking a “top six launch this year”according to ETF Store’s Nate Geraci (who adds that four of the five funds above it are spot Bitcoin ETFs)

- The run of inflows in Ether was helped by Grayscale’s converted Ethereum Trust (ETHE) registering its first day of net zero flows, after 13 consecutive (and often significant) days of outflows since launch

- Analysts were broadly positive on the performance of new Ether funds, noting that downward market momentum “hasn’t stopped them from gathering assets… eight of the nine funds that launched toward the end of July have seen money come in, with the cohort cumulatively amassing $2bn”

- Bloomberg senior ETF analyst Eric Balchunas noted that US Bitcoin ETFs are on track to top the list of Bitcoin holders in October, overtaking wallet addresses associated with pseudonymous Bitcoin developer Satoshi Nakamoto (last seen in 2011, leading to the assumption that their 1.1 million Bitcoins are effectively out of circulation)

- BlackRock’s IBIT is already the third-largest Bitcoin holder in the world, behind only Satoshi, and Binance exchange

- Year-to-date net inflows on spot Bitcoin ETFs currently stand at an all-time high of $19bn, despite Bitcoin’s recent price decrease

- On Thursday, Nasdaq withdrew its proposals for options trading on Bitcoin and Ether products, but Bloomberg ETF analyst James Seyffart believes this is a good sign; likely indicating an intention to refile based on feedback provided by the SEC

- Adjacent to Bitcoin ETFs, Defiance launched a 1.75x leveraged MicroStrategy ETF—the enterprise software firm being noted as a key corporate Bitcoin advocate, and fifth-highest holder on the aforementioned list

- This ETF debuted to record trading volume for a leveraged ETF, indicating that even broad proxies for Bitcoin exposure are benefitting from ETF appetite

What happened: Political news

How is this significant?

- Digital assets continued to feature in reporting around the US presidential election, as a presumed partisan divide appeared to re-emerge following recent hopes of a more conciliatory Democratic party position

- More details emerged around last week’s late-breaking news of a White House conference call with industry leadership, and they painted a mixed picture of a potential Harris administrations attitude and relationship towards digital assets

- FOX Business’ Eleanor Terrett reported that said meeting “turned ugly Thursday morning, underscoring the uphill battle progressive crypto advocates are having trying to glean industry support for the presidential candidacy of Kamala Harris”

- According to sources, the meeting was largely a venting session for an industry that felt aggrieved at egregious mistreatment by the current White House; “Executives didn't hold back on telling the administration reps how much damage they've done to the crypto industry and to the Democrat Party with their actions against digital assets”

- However, Terrett also reported more positive feedback from hedge fund manager and crypto advocate Anthony Scaramucci, alongside Coinbase chief legal officer Paul Grewal

- The former noted “It’s encouraging that these high-level officials took the time to show up and listen… My colleagues in the crypto space understandably want action now, but I think we’re making steady progress”

- Grewal meanwhile noted the call wasn’t with the Harris campaign itself; “This was a Biden administration meeting, but the focus now has to be on the Harris campaign and what they're willing to do. She's the perfect candidate to be a strong new face for crypto and make a break with the past”

- Whether this break from the past happens remains to be seen; Galaxy Research head Alex Thornappeared unconvinced, suggesting that Harris advisors Brian Deese and Bharat Ramamurti had a history of anti-crypto sentiment and rhetoric during the Biden administration

- However, it is worth remembering that the Harris campaign also recently appointed several digital asset industry alumni as crypto advisors; David Plouffe and Gene Sperling (formerly of Binance and Ripple respectively)

- On Wednesday, Senate Majority Leader Chuck Schumer (a Democrat who voted for the FIT21 bill) spoke at the party’s grassroots “Crypto4Harris” meeting, and said he hoped to pass “sensible, long-lasting legislation” for the industry this year

- He said “I want to bring members on both sides of the aisle here in the Senate together to create momentum so we can pass sensible legislation that helps the United States maintain its status as the most innovative country in the world…I believe we can make that happen. Crypto is here to stay, no matter what”

- Elsewhere in the realms of political restrictions and acceptance, Binance re-entered the Indian marketafter a seven-month absence to register with the country’s Financial Intelligence Unit and comply with regulatory requirements

- Meanwhile, Coinbase returned to Hawaii not after a seven-month absence, but a seven-year absence

- The financial infrastructure of the US allows separate states to set out separate guidelines for operations, leading Coinbase to exit the Aloha State due to restrictive requirements regarding cash reserves equal to digital asset value

- Those requirements were dropped last month, allowing Coinbase to offer services in the only US state missing from its business

- Amongst legal analysts, there was reporting that the SEC’s recent failure in its case against Ripple—where it lost or dropped most charges and was awarded just 6% of its requested fine in the sole successful charge—”could already be helping to shape the future of crypto legal cases”

What happened: Major banks and hedge funds reveal digital asset exposure

How is this significant?

- Digital asset exposure is increasing amongst major hedge funds and banks, illustrating “growing institutional demand” for the asset class

- Following Wednesday’s deadline to file second-quarter 13F reports with the SEC, Bloomberg tallied 701 funds holding spot Bitcoin ETFs (spot Ether ETFs only launched in July, and thus fall outside the reporting period)

- Major names to reveal Bitcoin exposure included Capula Investment Management, Schonfeld Strategic Advisors, Point72 Asset Management, the State of Wisconsin Investment Board, and “market makers among firms crossing geographies from Hong Kong to the Cayman Islands, Canada, and Switzerland”

- Industry analyst Noelle Acheson noted the growth in exposure as particularly positive, given Bitcoin declined by 13% in Q2, and the fact that only last week were the first wealth advisors reportedly approved to recommend Bitcoin exposure to clients

- She commented “This reflects a mix of conviction and investors taking time to ‘do the work’... So far, Morgan Stanley is the only one of the large wirehouses whose financial advisers can recommend BTC spot ETF diversification positions. But others will follow, bringing not just more demand but also a longer-term view”

- Morgan Stanley itself held nearly $190m worth of Bitcoin exposure through BlackRock’s IBIT ETF, making it a top-five holder for the fund

- On Tuesday, competitor Goldman Sachs revealed an even larger exposure—amounting to $239m of IBIT shares, and $419m of total Bitcoin ETF holdings

- In a new filing, DRW Venture Capital disclosed $150m of Ether ETF exposure

- Hunting Hill Global Capital founder Adam Guren was bullish on the potential for future exposure across a broader range of crypto assets; “Given the current political tailwinds, we anticipate the introduction of more products in the US, including options on Bitcoin ETFs, Solana ETFs, and potentially others”

What happened: TON blockchain announces $40m venture fund for adoption

How is this significant?

- TON (The Open Network, a blockchain originally developed by and still closely linked to popular messaging app Telegram) recently revealed a $40m venture fund aimed at bolstering adoption across its ecosystem

- This funding was provided by former members of the TON Foundation, and will concentrate on early-stage crypto projects

- In a blog post announcing the new fund, the Ton Foundation stated that Telegram would also support selected projects with advertising across its platforms, and that the fund’s “goal is to empower founders with the tools and infrastructure required to create applications with the potential for mass adoption and long-term sustainability. In addition to financial backing, the selected projects will benefit from the team's extensive experience, global network, and hands-on support”

- TON has grown significantly this year through adoption of blockchain gaming, increasing total funds on the blockchain from $71m to $1.14bn

What happened: Crypto VC funding increases in Q2 “flight to quality”

How is this significant?

- A new quarterly report by venture capital analytics firm Pitchbook indicates that despite a decline in market capitalisation and fewer deals, digital asset VC in Q2 actually increased its quarterly raise

- Although the number of deals struck in the quarter declined by 12.5%, the total amount raised ($2.7bn) increased by 2.5%

- Pitchbook senior analyst Robert Le told industry publication Coindesk that this suggests a more curated approach with investors backing promising projects in bigger amounts

- Said Le “Investors are concentrating capital into a smaller range of opportunities. There’s a flight to quality. A few years ago, their investments were more spread out across the space”

- In total, Le forecast a 20% annual increase in 2024 VC, raising approximately $12bn-$14bn (compared to $10bn raised in 2023)

- Rob Hadick of crypto VC Dragonfly was somewhat more guarded, and stated “While still far below the 2021 and early 2022 highs, VC investing in crypto reached somewhat of a fever pitch in March and April. Later stages have continued to be soft and as the market turned in late April and into May, the VC market slowed again”

What happened: Mining firm Marathon Digital raises $300m for Bitcoin

How is this significant?

- Marathon Digital, a leading publicly-listed Bitcoin miner, announced a plan this week to sell $250m of 2.125% convertible notes in order to fund Bitcoin purchases—only for the oversubscribed issuance to raise $300m instead

- This follows on from a $100m Bitcoin purchase just last month, when Marathon cited growing institutional adoption as fuel for returning to a “hodl” (industry lingo for “hold”) policy, looking to follow in the footsteps of MicroStrategy and Semler Scientific, treating Bitcoin as a strategic reserve asset

- After the new convertible note issuance, Marathon purchased 4,144 Bitcoins at a cost of $249m, bringing its total holdings to 25,000 Bitcoins

- The recent quadrennial “halving” event has reduced block rewards for miners and thus increased competition; Marathon stated that “by strategically evaluating the price of Bitcoin relative to mining costs, we are optimising our methods to efficiently expand our holdings across various conditions”

- In a press release, the company said its excess raise is intended “to acquire additional Bitcoin and for general corporate purposes, which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations”

What happened: Stablecoin issuer Tether moves to double headcount

How is this significant?

- Tether, the largest stablecoin issuer in the digital asset space, is continuing its recent growth pattern, having announced a plan to double its workforce within a year

- By mid-2025, the company aims to have 200 employees, with the bulk of new additions working within the finance and compliance departments

- CEO Paolo Ardoino stated that despite the increase in size, Tether’s recruitment policy focused on quality over quantity; “We are very proud of the fact that we are very lean and we want to remain lean because we want to be flexible. We are very careful when we hire people, we hire only senior people”

- He also announced an intention for the stablecoin issuer to provide stable employment; “There is nothing that I hate more than all those companies, especially Silicon Valley companies, that hire hundreds of people during the bull runs to fire them as soon as there is a downturn in the market. That I think is one of the most unfair things you can do to employees”

- High interest on assets such as government bonds—used as backing assets in the creation of new stablecoins—has led to a surge in revenues and profits for the firm; its latest financial attestations logged a record half-year profit of $5.2bn and its highest treasury bill ownership ever

What happened: Franklin Templeton expands tokenised funds onto Arbitrum

How is this significant?

- TradFi titan Franklin Templeton this week increased its DeFi footprint yet further, by deploying its tokenised money market fund, FOBXX, onto popular Ethereum layer-2 scaling solution Arbitrum

- The Nasdaq-listed fund trades with the token name BENJI on-chain, and was the first US-registered fundto use a public blockchain to record fund ownership and transfer

- According to a press release, “The collaboration will accelerate the integration of decentralised finance within traditional financial services. By onboarding the Arbitrum network to the Benji Investments platform, Franklin Templeton will further extend the compatibility of FOBXX within the digital assets ecosystem”

- As an Ethereum layer-2, Arbitrum provides faster and cheaper transactions than the core blockchain, thus cutting margins on assets designed to mirror the US dollar in value

- Roger Bayston, Franklin Templeton’s Head of Digital Assets stated “Expanding into the Arbitrum ecosystem is an important step on our journey to empower our asset management capabilities with blockchain technology. We are enthusiastic about the opportunities this partnership will unlock for our firm and our clients”

- He also told industry publication Decrypt “The cost of using the network [and] the resiliency and the scalability of the network are all… factors that we take into consideration when we are building [our] wallet infrastructure into various blockchain ecosystems. We're all about listening to the consumer and the client and giving them what they want”

- This marks just the latest move in expanded adoption of tokenised assets; blockchain oracle provider Chainlink recently summarised various reports on the matter, from sources including EY, McKinsey,Standard Chartered (which predicts a $30.1tn tokenised asset market by 2034), KPMG, and Roland Berger