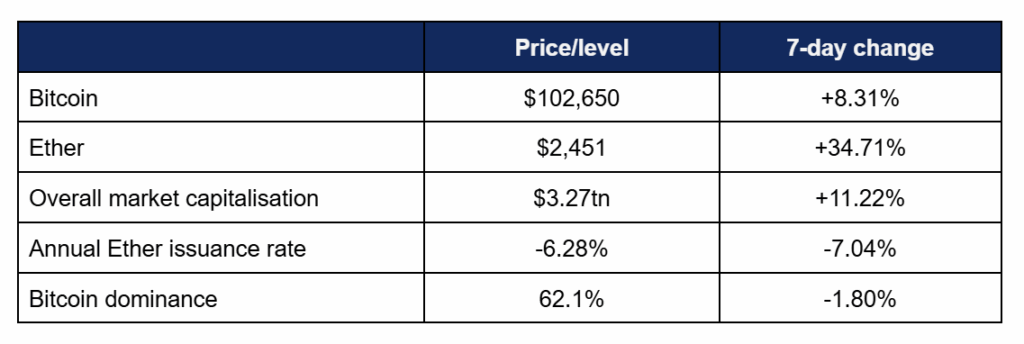

Market Overview

- Bitcoin soared above $100,000 once more, its best performance since January

- This price level returned Bitcoin (at the time of writing) to a $2tn asset

- Bitcoin increased throughout the week, growing from a Tuesday low of $93,850 to a Monday high of $105,620

- Ether shifted into near-unprecedented bullishness this week, following on from the blockchain’s performance-boosting Pectra upgrade

- This upgrade led to a record drop in annual supply issuance dynamics (based on average activity over the last seven days), with large increases in Ether burned from transaction fees

- Indeed, Ether posted both its best day and best week since 2021, increasing by as much as 42% on a weekly basis during certain points in the last seven days and contributing to widespread cascading liquidation of shorts

- Ether grew from a Tuesday low of $1,765 to a peak of $2,610 on Monday

- Altcoins benefited from the wider market boom, as only trhee of the top 100 projects by market capitalisation declined on the weekly candle—of which two were tokenised gold projects bound to the price (and thus declines) of physical gold

- Overall industry market capitalisation moved above $3tn, peaking at $3.37tn before cooling off slightly to current levels of $3.27tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased by around 15% to $115.6bn

Digital assets experienced a week of historic (positive) performance, led by Ether’s best day since 2021 following a network upgrade. Stablecoin legislation was stalled in the senate but surged significantly elsewhere as several issuers increased their scope. Coinbase experienced a banner week featuring the industry’s largest acquisition and TradFi recognition, multiple states passed Bitcoin reserve bills, US crypto banking restrictions were relaxed, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products carried on recent bullish performances, marking four consecutive weeks of gains

- In total, the products added $882m of inflows, or which $867m came from Bitcoin ETFs

- According to Coinshares data published on Monday, Bitcoin ETFs accounted for around $1.8bn of this figure

- This brought US ETFs to a cumulative $69.2bn net inflows since launch; a new record

- Spot Bitcoin ETFs continued the recent trend of nine-figure inflows, adding over $100m on four of the last five trading days

- At the time of writing, eleven of the last thirteen trading days featured nine-figure flows; the best run for ETFs this calendar year

- BlackRock’s market-leading IBIT once again boasted the largest inflows of the trading week, adding $531m last Monday, and $356m on Friday

- ARK Invest’s ARKB posted the next-best performance, adding $55m on Wednesday

- The week’s biggest outflows came on Tuesday, as Grayscale’s converted GBTC fund dropped $90m, contributing to the only day of net negative flows across all funds ($86m)

- IBIT has now added $5.1bn over the last twenty days, as Bloomberg’s chief ETF analyst Eric Balchunas recognised its status as the runaway category leader

- Latest filings revealed Goldman Sachs is now the largest holder of IBIT shares, increasing its Q1 holdings by 28% for a current value of $1.8bn

- It also increased its holdings of Fidelity’s FBTC shares, to a current value of $315m

- Goldman recently acknowledged digital assets in its annual shareholder letter for the first time

- Spot Ether ETFs displayed an opposite pattern, as the last five trading days (at the time of writing) included three days of eight figure outflows, one day (Friday) of eight-figure inflows, and a day of net zero change

- As is tradition, flows and volume were modest compared to Bitcoin vehicles, with the majority of daily inflows and outflows coming from just one fund, as other ETFs posted net zero flows

- Bloomberg ETF analyst James Seyffart revealed that BlackRock recently filed to allow in-kind redemption for its Ether ETF (and IBIT), potentially allowing clients to withdraw and hold the digital asset itself, rather than selling it off for cash before redemption

- In other ETF news, Tidal Financial Group filed to launch a pair of long-short funds pairing gold and Bitcoin—often dubbed digital gold

- Dhaval Joshi, chief strategist at Counterpoint commented “This is a kind of ‘victory’ for me… [I believe] Bitcoin will gradually grab market share from gold. So long BTC/short gold should trend higher over time, while short BTC/long gold will trend lower”

What happened: Stablecoin news

How is this significant?

- The biggest news concerning stablecoins this week essentially turned out to be a lack of news—as expected stablecoin legislation was delayed by congressional concerns connected to the Trump family’s crypto links (and profiteering)

- Senators couldn’t muster enough votes to bring the GENIUS stablecoin bill to a vote imminently, as prominent senate Democrats introduced legislation seeking to ban senior political officials from profiting off crypto

- Prominent congressional crypto critic Elizabeth Warren proposed including said legislation in the stablecoin bill, potentially slowing any potential bipartisan compromise on current content

- White House Deputy Press Secretary Anna Kelly commented “President Trump is dedicated to making America the crypto capital of the world and revolutionising our digital financial technology. His assets are in a trust managed by his children, and there are no conflicts of interest”

- Treasury Secretary Scott Bessent criticised congress for its gridlock on the stablecoin bill, as senate Democrats also sought more information regarding Trump’s crypto activities and possible ties to leading exchange Binance

- Bessent claimed the bill “represents a once-in-a-generation opportunity to expand dollar dominance and US influence in financial innovation”

- Elsewhere in stablecoins, developments were more positive; payment processor Stripe confirmed Stablecoin Financial Accounts launching in 100 countries

- The new accounts will integrate Circle Financial Group’s USDC token, as well as the USDB stablecoin developed by recent Stripe acquisition Bridge

- Stripe co-founder John Collison told Bloomberg “We should be very dissatisfied with the state of financial services today. In financial services you can look at invoice fraud, which is a big problem for businesses, and phishing attacks and things like that. This is a new product but it’s an opportunity for us over time to deliver much more safety”

- Stablecoins have transformative potential on the global stage, as explained by Stripe head of product William Gaybrick; “So much of the world is subject to unstable currencies and unreliable types of infrastructure and that caps the GDP of the Internet. Now users in Argentina, Vietnam and everywhere in between can hold stablecoins, receive and send funds on both crypto and fiat rails”

- Citi analysts predicted the stablecoin market could grow from its current $240bn market capitalisation to $1.6tn by 2030

- Ronit Ghose, Citi Institute’s global head of Future of Finance, stated “We’re looking at the integration of stablecoins into what you call the mainstream economy… stablecoins could be the cash leg for tokenised financial assets, or for payments by SMEs and large corporates…Stablecoins allow people all over the world to hold Dollars or Euros in an easy, low cost way”

- Although this represents a significant increase, it still trails behind Standard Chartered’s predictions of a $2tn stablecoin market by 2028

- Federally-chartered crypto bank Anchorage Digital confirmed the acquisition of yield-bearing stablecoin issuer Mountain Protocol

- Nathan McCauley, co-founder and CEO of Anchorage commented “Stablecoins are becoming the backbone of the digital economy. With recent regulatory progress and new institutional use cases, our long-term vision is clear: every business will be a stablecoin business”

- Fortune magazine reported that Meta (parent company of Facebook) is re-entering the stablecoin space in order to manage payouts, after abandoning its Diem stablecoin project back in 2022

- Meanwhile, leading stablecoin Tether reached a new landmark, hitting a $150bn market capitalisation for the first time

What happened: Coinbase acquires derivatives platform for $2.9bn, joins S&P 500

How is this significant?

- Leading US exchange Coinbase had a banner week, including both a multi-billion acquisition, and TradFi recognition

- On Thursday, Coinbase confirmed its purchase of leading digital asset derivatives platform Deribit for $2.9bn, as a “major step in [its] global expansion strategy”

- This marks the largest-ever acquisitions within the crypto industry, as Deribit boasted $1.2tn trading volumes last year

- According to reports, the deal “includes $700 million in cash and 11 million shares of Coinbase Class A common stock”

- Deribit will enhance Coinbase’s presence in the US options market, which the exchange avoided entering during the regulatory climate of the previous administration

- One day after the acquisition, Coinbase Derivatives confirmed the launch of 24/7 futures trading for retail and institutional customers

- Late on Monday, a press release confirmed Coinbase’s ascension to the hallowed halls of the S&P 500, replacing Discover Financial

- This could prove a boon to Coinbase, as its stock will be added to funds tracking the index—early reactions supported this, as COIN shares traded up 8% following the news

- CNBC noted that Coinbase’s recently-published Q1 earnings revealed a 24% growth in revenue, to $2.04bn

- In other Coinbase news, CEO Brian Armstrong disclosed that the exchange purchased $153m of crypto (primarily Bitcoin) for its investment portfolio in Q1

What happened: US states officially pass Bitcoin reserve bills into law

How is this significant?

- Both New Hampshire and Arizona passed bills this week to create strategic crypto reserves; the first such legislation in the United States

- New Hampshire was first across the line, passing HB 302, allowing the state treasury to invest up to 5% of its state funds into precious metals and digital assets with a market capitalisation of at least $500bn (a classification for which only Bitcoin currently qualifies)

- State governor Kelly Ayotte signed the bill to pass it into law, tweeting “First in the nation!”

- Arizona soon followed suit, creating a “state-controlled Bitcoin reserve fund, which will also custody any other crypto assets handed over to the Arizona revenue department” and eventually convert them to Bitcoin

- It however could have been even better for Arizonan crypto supporters, as Governor Katie Hobbs vetoed a separate bill to invest 10% of state public funds into Bitcoin

- Both governors represent different parties, indicating bipartisan demand for such legislation, and in other state-level news, New Jersey Democratic gubernatorial hopefuls actively voiced support for digital assets as a matter of policy

- Across the river, New York mayor Eric Adams voiced his desire to make New York a “global crypto capital”

- The mayor famously converted his first three paycheques into Bitcoin and Ether, and announced he would host the city’s first crypto summit in a week

What happened: Digital asset ETFs receive bipartisan support in South Korean elections

How is this significant?

- Amidst the recent political chaos and division in South Korea, it would appear that one of the few unifying themes amongst parties and candidates is a support for more digital asset trading via spot crypto ETFs

- Both leading candidates—Kim Moon-soo of the right-wing People Power Party and Lee Jae-myung of the left-wing Democratic Party of Korea—indicated a desire to approve crypto ETFs as a matter of policy

- Lee stated “I will introduce spot virtual asset ETFs and establish an integrated monitoring system to create a safe virtual asset investment environment”

- South Korea remains one of the top digital asset markets in the world, boasting over 16 million crypto investors—more than stock traders

What happened: OCC allows banks to conduct crypto activities via third parties

How is this significant?

- A key theme of the year in crypto thus far as been an easing of banking restrictions; we saw custody complications were removed when the SEC rescinded SAB 121, and recently the Federal Reserve struck off guidance restricting banks from interacting with the asset class

- Now in new interpretive letters the OCC actively confirmed that national banks (and federal savings associations) can offer the following digital asset services;

- Trading (at customer’s direction)

- Custody (of multiple digital asset forms)

- Record-keeping, tax, or reporting services

- In a video announcement, Rodney Hood, Acting Comptroller of the Currency commented “More than 50 million Americans hold some form of crypto…. This digitalisation of financial services is not a trend—it is a transformation”

- Crucially, the banks can “outsource to third parties bank-permissible crypto-asset activities including custody and execution services, subject to appropriate third-party risk management practices”

- As Starkware’s Katherine Kirkpatrick Bos (formerly at Cboe) noted “These letters signal a shift in the OCC’s approach… [and the approval for third parties] is a boon to regulated crypto native service providers”

- One key vector of accessibility may be Morgan Stanley’s E*Trade, which the FT recently reported will soon open up access to digital assets for its customers

What happened: New SEC chair Paul Atkins outlines goals for crypto regulation

How is this significant?

- New SEC chair Paul Atkins spoke this week about plans for digital asset regulation under his tenure, indicating a more common-sense and less adversarial approach than under his predecessor

- “It is a new day at the SEC… Policy-making will no longer result from ad hoc enforcement actions. Instead, the Commission will… set fit-for-purpose standards for market participants”

- Atkins said that the unpopular “special-purpose broker dealer” authorisation introduced by Gary Gensler would be scrapped, as only two firms have thus far applied for it due to significant limitations in scope

- Speaking at a crypto roundtable hosted by the SEC, Atkins stated “Broker-dealers are not, and never were, restricted from acting as a custodian for non-security crypto assets or crypto-asset securities”

- Additionally, he revealed hedge funds will likely be granted permission to custody their own crypto in future

- Atkins did clarify that any recent guidance should be viewed as “extremely temporary” before the commission can dedicate proper time for fully-formed guidelines

- Roundtables are proving a popular means for the industry to gain clarity and engage with the SEC; but asset management giant BlackRock also met separately with the commission’s crypto task force, according to a new memorandum

- Particular areas of discussion included staking and options on its ETFs

- In other SEC news, it moved to finally settle its long-running action against Ripple, officially concluding the legal saga

- According to an SEC statement, they and Ripple “will jointly ask a federal court in Manhattan to dissolve an injunction against Ripple and release more than $125 million in civil penalties in an escrow account, according to a settlement agreement filed Thursday. Of that, $50 million would go to the SEC and the rest would be returned to Ripple”

- This would represent a significant victory for Ripple, especially as the SEC under Gensler initially pursued $2bn in fines

- In other enforcement news, former Celsius CEO Alex Mashinsky was sentenced to 12 years in prison for fraud after the company collapsed during 2022’s crypto winter, giving im the second-biggest industry sentence after Sam Bankman-Fried

What happened: Bitcoin Treasury news

How is this significant?

- Several more significant developments occurred this week in and around the Bitcoin (and crypto) treasury space, as the asset class continues to gain the trust and favour of institutions

- Vivek Ramaswamy’s Strive Enterprises created a Bitcoin treasury firm via a reverse-merger with Asset Entities, according to a Wednesday press release

- According to the release, “it plans to expand to at least $1 billion post-closing to support Bitcoin accumulation through both registered equity and debt offerings, to be used when accretive to common equity”

- Additionally, “Strive Asset Management intends to use all available mechanisms to build a Bitcoin war chest in a minimally dilutive manner to common shareholders and build a long-term investment approach designed to outperform Bitcoin, by using Bitcoin itself as the hurdle rate for capital deployment”

- A key technological solution to Bitcoin scaling is the Lightning Network, and Lightning struck twice, as another firm was formed for Bitcoin treasury purposes via a merger

- Medical company KindlyMD (KDLY) merged with Nakamoto Holdings, according to a Monday press release, creating a firm dedicated to “accumulating Bitcoin and growing per-share Bitcoin holdings through equity, debt, and structured offerings”

- The merger includes $710m of financing to buy Bitcoin, the largest launch amount thus far, and led to KDLY shares surging 650%

- Nakamoto Holdings founder David Bailey commented “Traditional finance and Bitcoin-native markets are converging… We believe a future is coming where every balance sheet—public or private—holds Bitcoin. Nakamoto seeks to be the first publicly traded conglomerate designed to accelerate that”

- Leading Bitcoin balance sheet advocate Strategy (formerly MicroStrategy) made another major Bitcoin purchase this week, adding $1.34bn worth of digital gold to its holdings

- In total, Strategy added 13,390 coins in the latest purchase, bringing its total holdings to 568,840 Bitcoin

- This follows its recent “42/42” plan designed to raise a total of $84bn for Bitcoin buys via common stock and convertible note offerings

- Japanese Bitcoin treasury firm Metaplanet purchased another 1,241 Bitcoin pushing its total holdings ahead of El Salvador

- Metaplanet spent $126.7m on the acquisition, and its Bitcoin balance now sits at 6,796 BTC; worth over $700m at the time of writing

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.