October 21st, 2025

Market Overview

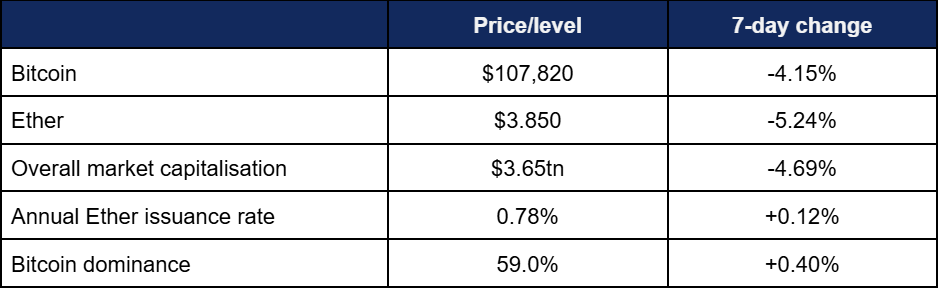

Digital assets continued last week’s decline as ongoing global macroeconomic uncertainty drove investors away from perceived risk-on assets.

- Bitcoin experienced mixed performance this week, rallying early before a steep weekend decline, followed by more rally-and-pullback volatility

- Bitcoin peaked at $113,560 on Wednesday, but fell as far as $104,010 on Friday, before President Trump struck a more conciliatory tone over tariffs and calmed markets slightly

- Ether showcased similar patterns on its weekly chart, hitting a high of $4,204 on Wednesday, before declining to $3,694 on Friday

- Altcoins once again suffered more than the leading assets, with a third of the top 100 projects by market capitalisation logging double-digit declines at the time of writing

- Overall market capitalisation now sits at $3.65tn, with an intraweek low of $3.53tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell just over $5bn to $152.8bn

Digital assets experienced another bearish week in the markets, as rapidly shifting statements on US tariff policy left traders increasingly risk-averse. In terms of adoption, news was generally more positive—whilst central banks spoke out against stablecoins, private and retail banks continued to recognise their benefits and pursue development efforts. CEOs of both BlackRock and Charles Schwab spoke out in favour of digital assets, several new firms with significant funding emerged, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products moved into outflow mode as investors further hedged their risk following escalating global tariff tensions

- According to Coinshares data published on Monday, digital asset funds lost $513m during the trading week ending Friday the 17th October 2025

- However, outflows were concentrated purely across Bitcoin products, as Ether and newly-launched ETFs for Solana ($156m) and XRP ($74m) experienced healthy inflows despite uncertain global market conditions

- Coinshares Head of Research, James Butterfill, stated “Investors saw the price weakness in Ethereum as a buying opportunity, seeing US$205m inflows, with the largest weekly inflows being into a 2x leveraged ETP totalling US$457m, highlighting conviction amongst investors”

- Spot Bitcoin ETFs logged a tough trading week, facing nine-figure outflows on four out of five days

- On Tuesday, the sole positive performance of the week, funds added $103m, thanks to Fidelity’s FBTC accruing $133m in fresh capital

- This helped Fidelity usurp IBIT’s usual spot for the best daily return, as BlackRock’s market-leading fund managed $60m inflows on Monday, before logging four straight days of outflows; including $269m on Friday

- Despite its uncharacteristically red week, IBIT remains by far the industry’s leading ETF, averaging over $146m in daily inflows since Bitcoin ETFs launched last year; around five times as much as the nearest competitor, FBTC

- At the time of writing, early results of Monday trading suggested a return to inflows for spot Bitcoin ETFs

- Spot Ether ETFs meanwhile performed better, returning two days of nine figure inflows, although rough Monday trading (the first full trading day after Trump’s tariff threats) still led to overall losses for spot products

- Both BlackRock’s ETHA and Fidelity’s FETH achieved nine-figure daily inflows, as the former added $164m on Tuesday whilst the latter grew by $155m on Monday

- Tuesday proved the best day of the week, as funds added $236m, bouncing back somewhat after losing $429m on Monday

- This Monday performance included a $310m capital outflow from ETHA, one of the biggest one-days losses for spot Ether funds since launch

- In other ETF news, new Solana- and XRP-based products debuted to strong trading, alongside a slew of filings from several issuers for leveraged crypto ETFs based on the performance of assets including Hyperliquid, Bitcoin, Ether, Solana, and XRP

What happened: Banking bodies make statements on stablecoins

How is this significant?

- Several central banks and banking industry bodies this week commented on the emergence and proliferation of stablecoins, as their growth could increasingly be viewed as a potential threat to traditional banking rails

- The Bank of England said it is considering imposing limits on overall holdings of “systemic” stablecoins, until such a time as they stop “posing a threat to the economy”

- Deputy Governor Sarah Breeden claimed recent stablecoin growth “risked causing ‘significant’ outflows of deposits from banks, which could then prevent credit reaching businesses and households”

- She added that upper limits would be reversible, and certain cash-heavy businesses such as supermarkets could be exempted from such restrictions

- Speaking at a panel in Washington alongside IMF meetings, Breeden added “We will consult later this year on our requirements for sterling-denominated stablecoins used in systemic payment systems. That will put us in a position to finalise our regulatory regimes next year—as is the aim in the US”

- The chair of the Basel Commission on Banking Supervision, Erik Thedéen, also acknowledged the asset class’ rapid growth, and they could “prompt global policymakers to re-evaluate new bank capital standards for crypto assets”

- Thedéen (also Governor of the Swedish Riksbank) was speaking at the same conference as Breeden in Washington, stating “The talk of the town is stablecoins…[they have grown significantly since we developed crypto capital rules in 2022]... That’s one reason why we might need to discuss and evaluate”

- Pierre Gramegna, the European Union’s Stability Mechanism Managing Director was interviewed at the event in Washington, and commented “We think that if stablecoins become mainstream, and if they’re not guaranteed as central bank money, then obviously there’s a risk to the whole financial system… It’s not that we’re against stablecoins, but it must be in a framework that is safe for consumers and financial actors”

- He added “As 99% of stablecoins are denominated in Dollars, if Europe doesn’t produce stablecoins denominated in Euros we will lose an opportunity… there is a possibility of coexistence of cash, digital currency, and stablecoins”

- The International Monetary Fund expressed caution concerning stablecoins in its semiannual financial stability report

- IMF analysts wrote “Because stablecoins may be subject to run risk, fire sales of their reserve assets—such as bank cash deposits and government securities—could spill over into bank deposits and government bond and repo markets. This could increase volatility and require central bank intervention”

- However, despite these warnings, systemic global banks such as Deutsche Bank, Goldman Sachs, and Santander are collaborating on blockchain-based money, and nine European banks are collaborating on a Euro-denominated coin, as reported last week

- Elsewhere in stablecoins, Japan’s Nikkei news agency reported that financial giant Mitsubishi (MUFG), Sumitomo Mitsui, and Mizuho Financial Group are jointly developing stablecoins due to increased institutional interest

- According to the report, they are building “a shared framework for issuing and transferring stablecoins among their corporate clients”, with the first such coins set to be pegged to the Japanese Yen

- Speaking on a recent earnings call, BNY Mellon confirmed it is looking into stablecoins, but doesn’t have any imminent plans to launch its own

- CEO Robin Vince said “We’re in the infrastructure, capital markets enablement business. We partner with stablecoins. We enable other people’s stablecoins, and that’s really the heart of our strategy”

- He added “We’ll remain agile. I think the sweet spot is enabling the ecosystem—connecting cash, collateral, mobility and infrastructure—rather than issuing something ourselves”

- US Bank, America’s fifth-largest bank by assets, released a statement confirming creation of a new “Digital Assets and Money Movement organisation to accelerate development of and grow revenue from emerging digital products and services such as stablecoin issuance, crypto asset custody, asset tokenisation and digital money movement”

- ODDO BHF, a French bank with over €150bn AUM, announced the launch of a new Euro-based stablecoin, EUROD

- Fellow French banking giant Societe Generale meanwhile is collaborating with Austrian crypto exchange BitPanda, partnering to offer SocGen’s Euro-pegged EURCV directly to retail traders throughout Europe

- As per industry publication Coindesk, SG-FORGE CEO Jean-Marc Stenger, said “the collaboration marks a ‘decisive step forward’ in bringing regulated assets into DeFi”

- Adjacent to the space, S&P Global partnered with blockchain oracle project Chainlink to bring its stablecoin risk assessments directly on-chain

- This will initially launch on Ethereum layer-2 blockchain Base, with further integrations to follow

- S&P’s criteria are “designed to measure operational and structural stability”, and “factor in asset quality, liquidity, redemption mechanisms, regulatory status and governance”

What happened: Cantor Fitzgerald eyes significant Tether windfall

How is this significant?

- Following recent news that stablecoin giant Tether is raising at a $500bn valuation, one potential beneficiary is investment bank Cantor Fitzgerald

- After acquiring 5% equity in a reported $600m convertible bond deal, Cantor now stands to gain $25bn from the same stake

- This would equate to more than twelve times the bank’s annual revenue

- According to calculations by Bloomberg, the biggest winner if Tether achieves its $500bn target would be its chairman Giancarlo Devasini, who would be worth around $224bn in that scenario

- As Cantor Fitzgerald founder Howard Lutnick currently serves in the Trump government as Secretary of Commerce, a successful raise could embolden further stablecoin support from the administration

- If Tether does reach its $500bn goal, it would be “one of the most lucrative balance-sheet bets by a Wall Street firm in recent history” according to Bloomberg

What happened: Digital asset market deals with fallout from liquidations

How is this significant?

- After experiencing its largest-ever single-day liquidation by volume last week, the digital asset market stabilised somewhat this week, allowing time for analysis, introspection, and recriminations across the industry

- In a Monday research note, TD Cowen analysts wrote that last week’s “flash crash” proved the industry’s overall resilience

- They wrote “While cognisant that the recent episode caused intense financial hardship for many investors, what strikes us is how well the underlying ecosystem functioned. Though it was the largest single-day liquidation ever, with open interest halved across venues, most crypto exchanges operated with little or no downtime”

- TD Cowen added “While less-reputable tokens were decimated, Bitcoin and Ethereum held up well enough, in our estimation”

- However after initially paying out more than $280m to victims of systems failures during the flash crash liquidations, leading exchange Binance announced it would distribute another $300m in stablecoins and $100m in low-interest loans to help “severely impacted” institutions recover

- Binance’s new “Together Initiative” recognised the chaos wrought by price de-pegging on its platform during the mass sell-offs and liquidations on October 10th, acknowledging “technical issues” that led to losses

- However, Donald Wilson, founder of trading firm DRW, said the industry neither did enough to prepare, nor respond

- In a commentary, the market-making giant wrote “That’s the kind of operational fragility that must be fixed for TradFi to function on these new rails… If crypto markets aspire to institutional credibility, then exchanges need to be just that: neutral venues for trading”

- He took particular umbrage against exchanges providing their own liquidity, tweeting “Exchanges can’t be all the things. In fact, they shouldn’t be anything other than a neutral venue for trading. The minute they are providing liquidity or generating revenue from liquidation events, we’ve passed what should be a bright line... In traditional finance, that’s a bright line. In crypto, it’s often blurred, and that’s a problem”

- Crypto VCs identified the market’s relation to leverage as the main issue, particularly in exposing the actual mechanics thereof

- Industry publication TheBlock noted “Pai of Robot Ventures called for exchanges to overhaul opaque auto-deleveraging systems. Framework Ventures’ partner Brandon Potts added that ‘smarter liquidation engines unwind positions gradually’

- They also cited the need for “liquidity buffers that adjust to volatility and depth could prevent similar spirals… This event showed how hidden risk and leverage can build up. More transparency is the best way to fix that fragility”

What happened: US government seizes record $15bn in crypto assets

How is this significant?

- The US government successfully completed one of the largest asset hauls ever last week, confiscating around $15bn in Bitcoin when it closed down a long-running criminal fraud ring

- The Justice Department unsealed its indictment against Cambodian-British businessman Chen Zhi, Head of the “Prince Group”; a vast network of scammers since 2015, leading to “the largest forfeiture in its history”

- The criminal network primarily operated so-called “pig butchering” scams, earning the confidence of victims before extracting money from them

- UK authorities acted in tandem with their American counterparts, seizing 19 London properties worth over £130m

- In total, 127,271 were seized in the operation

What happened: Ghana anticipates imminent digital asset legislation

How is this significant?

- Speaking at the IMF’s recent meetings in Washington, Ghanaian officials indicated the West African nation would soon be one of the first on the continent to implement specific digital asset regulations

- Bank of Ghana’s Governor Johnson Asiama said the government is forming a new department and building expertise to deal with the growth of the asset class

- He said “It is an important area, and we have to step up to regulate and monitor these transactions. We have put together the regulatory framework and have a new bill to regulate virtual assets. That bill is on its way to parliament, hopefully before the end of December, we should be able to regulate crypto in Ghana”

- One reason for digital asset growth in Ghana has been as a hedge against persistent local inflation, currently sitting around 9.4%

- Back in July, Asiama targeted September as the delivery date of the bill, stating “We are actually late in the game”

What happened: Crypto industry veterans set up major acquisition vehicles

How is this significant?

- Several significant industry personae this week announced plans for major new ventures designed to acquire digital assets

- Arthur Hayes, the Founder of derivatives platform Bitmex, is raising $250m for a private equity fund to buy established crypto firms

- His family office Maelstrom is undertaking the raise, planning to deploy between $40m and $75m per firm

- Managing Partner Akshat Vaidya told Bloomberg he anticipates interest from investors “that want exposure to the high-cash flow, high-growth crypto sector but lack the capabilities in-house to do this themselves.”

- Meanwhile, Li Lin, the Founder of digital asset exchange Huobi, is looking to raise quadruple the amount of Maelstrom’s ambitious goal

- According to Bloomberg sources, Li “is joining forces with some of Asia’s earliest Ethereum backers to launch a new digital-asset trust that will buy Ether tokens”

- The project has already raised $1bn, and will likely launch publicly via the acquisition of a Nasdaq-listed shell company

- Ripple plans the same course of action in establishing the world’s largest XRP treasury

- Sources said $1bn will be raised through an SPAC, later confirmed through a press release by Evernorth Holdings, which “is expected” to trade on Nasdaq as XRPN from Q1 2026 onwards

- The deal includes a $200m commitment from Japanese financial giant SBI

- Ripple also acquired treasury software provider GTreasury for $1bn on Thursday, marking a busy week for one of the top digital asset developers

- CEO Brad Garlinghouse stated “For too long, money has been stuck in slow, outdated payments systems and infrastructure, causing unnecessary delays, high costs, and roadblocks to entering new markets—problems that blockchain technologies are ideally suited to solve”

- Analysts said the deal “strengthens Ripple’s ability to connect with Fortune 500 chief financial officers and treasurers to manage and provide additional liquidity for tokenized deposits, stablecoins and other digital assets”

- Crypto exchange Kraken also made acquisition moves, expanding its US derivatives presence by purchasing licenced futures platform Small Exchange from IG Group for $100m in cash and stock

- Co-CEO Arjun Sethi commented “Under CFTC oversight, Kraken can now integrate clearing, risk, and matching into one environment that meets the same standards as the largest exchanges in the world”

What happened: BlackRock CEO Larry Fink expects increased tokenisation efforts

How is this significant?

- Speaking to CNBC Squawk Box following BlackRock’s latest earnings call (featuring a record $13.5tn AUM, bolstered by IBIT’s growth), company CEO Larry Fink claimed “We’re at the beginning of the tokenisation of all assets”

- He expanded “We are investing ahead of client needs… I do believe we have some exciting announcements in the coming years on how we could play a larger role on this whole idea of the tokenisation and digitisation of our assets”

- Fink also forecast that the digital asset market (assessed at $4.5tn under BlackRock’s definition) will grow “significantly” within the next few years

- In a call with analysts, Fink and CFO Martin Small said BlackRock is busy developing its own digital asset technology, with a particular focus on tokenisation

- Small said BlackRock “eventually wants to replicate everything that currently sits with traditional wealth management in digital wallets, so investors can access long-term investments like stocks and bonds via blockchain technology”

- One statistic which certainly seems to support Fink’s predictions is the growth of tokenised gold on Ethereum, which has increased over 100% year-to-date

What happened: Charles Schwab CEO declares crypto “a topic of high engagement”

How is this significant?

- Charles Schwab CEO Rick Wurster also spoke about his company’s burgeoning digital asset ambitions with CNBC this week, following a record quarter for Schwab

- He told the presenters “Our clients own 20% of all crypto exchange-traded products in the country”

- Wurster also revealed that visits to Schwab’s crypto site have increased 90% in the last year

- During the company’s third quarter earnings call, he indicated an increased presence in the space is imminent, offering spot Bitcoin trading from 2026 onwards

- Wurster explained that the company’s current crypto strategy “focuses on offering both advanced trading platforms like ThinkorSwim and guidance for new investors, making crypto accessible and understandable for a broader audience”

- He also praised the appeal for the asset class amongst younger generations, noting Schwab’s strong presence amongst Gen Z investors; “I think crypto will be additive, but we’re already winning with them”

What happened: Crypto Treasury news

How is this significant?

- Leading treasury firm Strategy (formerly MicroStrategy) made further Bitcoin purchases this week, adding a comparatively modest $18.8m worth to its corporate coffers

- These were purchased at an average price of $112,051, substantially down from last week’s (pre-flash crash) purchases in the $123,000 range

- Top Ether treasury firm BitMine now holds a combined $13.4bn in crypto, cash, and equity

- This includes $800m worth of Ether purchases (around 200,000 tokens at the time) over the last week, bringing its total holdings to 3.24 million Ether; accounting for around $13bn of the company’s total assets at the time of writing

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.