Market Overview:

Digital assets pulled back after a fortnight of recovery, as tariff tensions escalated and disrupted global markets once again.

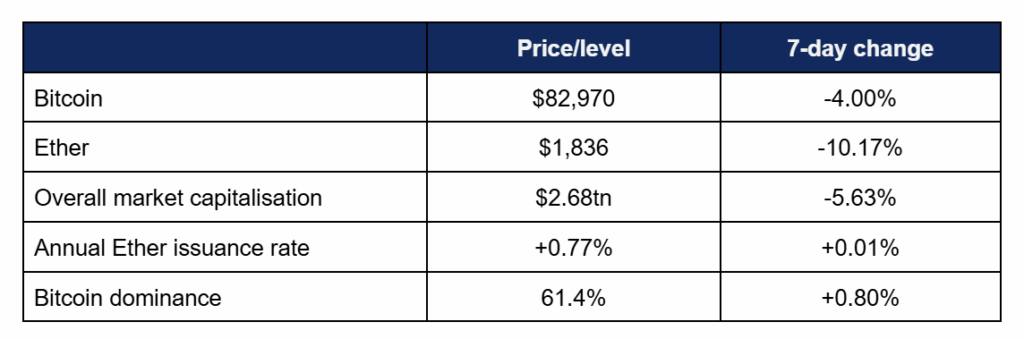

- Bitcoin pulled back from the last couple weeks of growth, as more tariff tensions served to cause the worst trading quarter in over two years across markets

- Bitcoin declined consistently throughout the week, dropping from a Tuesday high of $88,460 to a Monday low of $81,440

- Ether continued to underperform Bitcoin, shedding more of its recent recovery as ETFs suffered from lacklustre volumes

- Ether fell alongside Bitcoin, from a Tuesday high of $2,080 down below the recently-recovered $2,000 level to depths of $1,786 on Monday

- Industry sentiment on the Fear & Greed index dropped strongly into the lower echelons of overall “fear” territory at 24/100, following market-wide hedging

- Overall industry market capitalisation dropped down to $2.68tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell below $100bn, to $94.9bn

Digital assets pulled back from recent gains, as markets once again moved into risk-off sentiment following concerns over US tariff policy. Fidelity, Wyoming, and a firm linked to Donald Trump entered the stablecoin space, BlackRock CEO Larry Fink suggested Bitcoin could threaten the US Dollar as a reserve asset, a state-owned French investment bank announced a new fund to bankroll crypto token acquisitions, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced another week of inflows, including a long-awaited positive performance by altcoins

- According to CoinShares data published on Monday, digital asset investment products accrued $226m inflows in the week ending 28th March, “suggesting a positive but cautious investor”

- Of this, $33m came from altcoin funds; the first time in a month that non-Bitcoin products posted inflows

- At the time of writing, spot Bitcoin ETFs ended their consecutive inflows streak at 10 trading days, before experiencing losses on Friday (and early Monday results)

- Last week’s inflows were however at relatively modest levels; modest meaning all in the eight-figure range (between $29m and $89m), but below the historical average of $119m flows

- The largest weekly flows came from BlackRock’s market-leading IBIT, which added $108m on Wednesday, followed by Fidelity’s FBTC with $97m on Thursday

- Friday’s shift into outflows came entirely from FBTC, which shed most of the previous day’s gains with $93m withdrawals, whilst all other funds posted net zero flows

- Spot Ether ETFs displayed very modest volumes and flows, as no day shifted the needle by more than $7m in either direction

- However, the week did at least feature the first inflows for Ether funds in several trading weeks, courtesy of minor gains for Grayscale and Fidelity’s funds

- BlackRock’s head of digital assets, Robert Mitchnick, told CNBC that the performance of spot Ether ETFs should likely improve when regulators allow issuers to pass staking yields on to customers

- He said “There’s obviously a next phase in the potential evolution of [Ether ETFs]… There’s no question it’s less perfect for ETH today without staking. A staking yield is a meaningful part of how you can generate investment return in this space, and all the [ether] ETFs at launch did not have staking”

- Mitchnick added that the “elevator pitch” for Ether ETFs (and the underlying asset) to institutional investors was slightly more complex than Bitcoin, but still compelling; “There are three [use cases] that we focus on that have a lot of resonance with our client base: it’s a bet to some extent on tokenisation, on stablecoin adoption, and on DeFi… It does take a fair bit of education, and we’ve been on that journey, but it’s going to take more time”

What happened: Political news

How is this significant?

- Although President Trump’s aggressive tariff policies have led to risk-off behaviour amongst digital asset investors, is administration (and family) continued to exhibit great support for the asset class this week

- In particular, Bitcoin and stablecoins appear to be endorsed by Trump and associated figures

- Both the CFTC and FDIC formally withdrew advisories against risks associated with digital assets

- The CFTC stated that it withdrew advisories to prevent any notion that “regulatory treatment of digital asset derivatives will vary from its treatment of other products”

- The FDIC meanwhile issued a statement that prior approval from the agency is no longer necessary, and “FDIC-supervised institutions may engage in permissible activities, including activities involving new and emerging technologies such as cryptoassets and digital assets, provided that they adequately manage the associated risks”

- World Liberty Financial (WLF), the DeFi project boasting several of Donald Trump’s family in advisory roles, featured in reporting this week thanks to news that it will launch its own “USD1” stablecoin on both Ethereum and Binance Smart Chain

- The project disclosed that USD1 will be “100% backed by short-term US Treasuries, dollar deposits and other cash equivalents” custodied by BitGo

- WLF co-founder Zach Witkoff called it “a digital dollar stablecoin that sovereign investors and major institutions can confidently integrate into their strategies for seamless, secure cross-border transactions”

- The development of a stablecoin by a Trump-linked entity was of little surprise to industry observers, as two stablecoin bills—endorsed by the president—are currently working their way through Congress, potentially passing before August

- Stablecoins could also be issued at the state (rather than federal) level, as Wyoming governor Mark Gordon plans to launch a state-supporting stablecoin, the WYST, by July

- According to Bloomberg, WYST “will be fully backed by US Treasuries, cash and repurchase agreements, and maintain no less than 102% capitalisation”

- The WYST token can generate income for the state through interest from reserve assets, “which the state said can be used to fund education and infrastructure”

- However, there was also opposition to Trump-linked stablecoin efforts; Senator Elizabeth Warren called USD1 “Donald Trump’s latest grift with major consequences for the stability of our financial system”, and Reuters pointed out that the Trump family now owns about 60% of WLF’s holding company

- The “First Family” also launched an American Bitcoin mining venture with US-based firm Hut8

- “American Bitcoin Corp” aims to realise President Trump’s lofty campaign promise to ensure that Bitcoins should be “Made in America”

- Alabama Senator Tommy Tuberville praised “the crypto president’s” “deregulation agenda” for the industry, and announced he was introducing the Financial Freedom Act, which would allow Americans to invest retirement funds in digital assets

- According to Nikkei reports, Japan’s Financial Services Authority is currently considering classifying crypto assets as financial products, enhancing its remit to prosecute digital asset scams

- Insider trading was highlighted as a particular concern, although Nikkei suggested that crypto assets will have a unique category separate from other securities

- Data from the Nikkei report indicates that Japan currently has over 7.5 million user accounts actively trading digital assets

What happened: BlackRock CEO suggests Bitcoin could replace US Dollar as reserve asset

How is this significant?

- In his annual chairman’s letter to shareholders, BlackRock CEO and chair Larry Fink made a bold claim, warning that—as US national debt soars to record levels—dollar hegemony as the global reserve asset is not guaranteed, and could be replaced by assets such as Bitcoin

- Fink wrote “I’m obviously not anti-digital assets… It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the Dollar”

- He went on to praise the firm’s IBIT Bitcoin ETF, lauding it as the most successful ETF launch of all time, accruing $50bn AUM within a year of launch

- This made IBIT “the third-highest asset gatherer” in the entire ETF complex, only exceeded by S&P 500 index funds

- Fink also continued his long-standing praise of tokenisation, claiming that it democratises investing through fractional ownership

- He added “Every stock, every bond, every fund—every asset—can be tokenised. If they are, it will revolutionise investing. Markets wouldn’t need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilised by settlement delays could be reinvested immediately back into the economy, generating more growth”

- In other BlackRock news, it appears the asset management giant is increasing its industry involvement yet further, after it posted four executive-level sector roles on its recruitment website, including Director of Digital Assets

What happened: Korean exchange Bithumb registers record profits

How is this significant?

- According to reports in local media, one of South Korea’s largest crypto exchanges, Bithumb, confirmed its largest-ever profits in 2024 thanks to the digital asset sector’s recovery

- In total, it booked $110m net profits—a 560% year-on-year increase

- Such results could buoy interest in the exchange, which is allegedly considering an IPO with a planned Nasdaq listing

- In other recent reports, the nation’s largest exchange, Upbit, generated $671m net profit last year, up 85% from 2023

- Korea is unique amongst the digital asset industry for several reasons; users are restricted to locally-registered exchanges due to capital controls (thus causing historic price premiums), the Korean Won overtook the US Dollar as the top fiat trading pair, and traders favour altcoins to a greater degree than other markets

- Recent figure’s from the nation’s Strategy and Finance Committee indicate that over 16 million South Koreans trade digital assets; 32% of the population

What happened: French state bank to invest in digital assets

How is this significant?

- Bpifrance, a state-owned investment bank, is launching a €25 million ($27 million) crypto asset strategy

- According to a Thursday statement, the bank’s investments will aim for “a strong French footprint”, and target token purchases rather than company equity

- The bank said “Having the ability to invest directly in digital assets is a significant step forward for Bpifrance and a pioneering initiative among sovereign wealth funds”

- Deputy CEO Arnaud Caudoux claimed that securing direct token exposure became “much more urgent” in light of evolving US regulatory policies

- He added that France cannot be left behind in the global digital asset race

- At a press conference, he explained “The new US policy is creating massive attractivity for all crypto companies from across the world… We want to keep those companies here because we strongly believe that it’s very important in the future to have our own ecosystem.”

What happened: Tether diversifies business holdings further

How is this significant?

- USDT stablecoin issuer Tether (identified as the world’s most profitable company per capita) continued its recent strategy shift of business diversification this week, disclosing several significant investments in other industries

- On Thursday, the company confirmed a 30% stake in Italian media company Be Water for about $11m

- Said stake will involve “collaborations to develop innovative ways to produce and distribute content”

- In another thread of diversification, Tether increased its stake in South American agriculture and farming firm Adecoagro (AGRO)

- Adecoagro is currently valued at around $1.12bn, and Tether further solidified its place as largest shareholder, growing ownership from 51% to 70%

- CEO Paolo Ardoino commented “Our investment aligns with Tether’s broader strategy to back infrastructure, technology, and businesses that advance economic freedom and resilience”

- These deals follow a broad range of previous investments, including social media platform Rumble, and Italian football club Juventus

What happened: Fidelity plans proprietary stablecoin

How is this significant?

- Following last week’s fund tokenisation filing, $5tn asset manager Fidelity delved deeper into digital assets, as the Financial Times revealed that the firm is developing its own stablecoin

- The impetus for stablecoin development appears at least partly informed by softening regulatory conditions, as “Washington begins sweeping changes in the oversight of cryptoassets following the election of President Donald Trump”

- According to the FT sources, the new stablecoin is currently in the testing phase, and will be managed through its digital assets arm

- Fidelity would be the largest traditional finance firm to launch its own stablecoin—but not the first, following in the footsteps of PayPal, whose proprietary PYUSD has a market capitalisation of over $750m as of writing

- Bloomberg reports that Robinhood and Revolut are amongst the other finance firms currently mulling their own stablecoin launches

- In other stablecoin news, Fortune magazine reported that USDC issuer Circle officially recruited Citi and JP Morgan to manage its forthcoming IPO, with a planned late April filing date

What happened: NYSE parent company explores tokenisation deployments

How is this significant?

- ICE, the parent company of the New York Stock Exchange (NYSE) and Circle are exploring both USDC stablecoin and USYC tokenised fund implementations for capital markets

- Details on the exact nature of the partnership remains vague, but reports stated the firms will “explore using Circle’s stablecoins and products within ICE’s derivatives exchanges, clearinghouses, [and] data services”

- Additionally, a press release said that ICE could “build new markets” based on USDC

- NYSE president Lynn Martin commented “We believe Circle’s regulated stablecoins and tokenised digital currencies can play a larger role in capital markets as digital currencies become more trusted by market participants as an acceptable equivalent to the US dollar”

- In other tokenisation news, CME Group revealed it “is exploring tokenisation as a way to improve capital market efficiency”

- This initiative is being undertaken alongside Google Cloud, which recently launched its own Universal Ledger blockchain

- CME Group CEO Terry Duffy commented “As the President and new Administration have encouraged Congress to create landmark legislation for common-sense market structure, we are pleased to partner with Google Cloud to enable innovative solutions for low-cost, digital transfer of value… Universal Ledger has the potential to deliver significant efficiencies for collateral, margin, settlement and fee payments as the world moves toward 24/7 trading”

What happened: Strategy buys nearly $2bn of Bitcoin

How is this significant?

- Institutional Bitcoin advocate Strategy (formerly MicroStrategy) further added to its record Bitcoin stockpiles this week, with another major purchase—one of its largest ever

- According to its latest SEC filings shared on Monday, Strategy purchased 22,048 Bitcoin for approximately $1.92 billion (an average price of $86,969) last week

- Company founder Michael Saylor shared that his firm now owns around 2.5% of all Bitcoin; a total of 528,185 Bitcoin—bought at an average price of $67,458

- At the time of writing, the company’s Bitcoin holdings were valued above $43 billion, with an overall cost of around $35.63 billion

What happened: FTX to begin paying off main creditors in May

How is this significant?

- Administrators of FTX, the crypto exchange which infamously collapsed following the fraud of founder Sam Bankman-Fried, confirmed that main creditors will begin receiving their payments from May onwards

- These funds are taken from the exchange’s current cash hoard of $11.4bn, secured by recovering and selling off numerous company assets

- However, since compensation is paid in dollars rather than crypto, and based on the fiat value of digital assets when the exchange shut down, numerous creditors are upset; the value of Bitcoin has increased more than four-fold following FTX’s failure

- FTX lawyers wish to conduct the payouts to legitimate claimees as quickly as possible, “because the interest rate FTX is earning on the $11.4bn is smaller than the 9% rate creditors earn while waiting for their cash”

- In other American exchange news, publicly-listed Coinbase shares posted their worst quarter since the collapse of FTX in 2022, as economic tensions led to depressed performances across many markets in Q1 2025

- Oppenheimer analyst Owen Lau commented “Many people in the community understand that this is not driven by fundamental reasons… This is mainly driven by the macro reasons because of the tariffs, potential trade war, people worried about a recession coming in”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.