14 July, 2023

Market Overview:

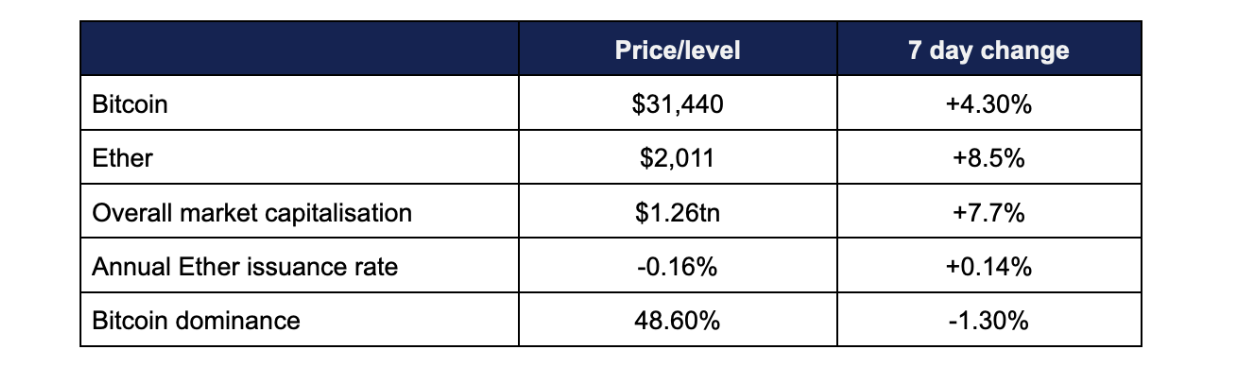

Digital assets performed strongly this week, boosted by positive inflation news and particularly by positive news from a US courtroom.

- Bitcoin reached another new yearly high on Friday, reaching $31,810; its highest value since May 2022

- Bitcoin traded above $30,000 for the entire week, boosted first by lower-than-predicted CPI data, and then market-wide enthusiasm after the Ripple ruling

- Bitcoin spent most of the week trading between $30,200 and $30,800, with a weekly low of $30,020 on Monday

- Ether outperformed Bitcoin, surging above $2,000 following the court ruling, which boosted perceptions around the security status of non-Bitcoin digital assets

- Ether reached a weekly high of $2,026 on Friday, after trading mostly between $1,850 and $1,887, with a low of $1,846

- Excluding stablecoins, only 5 of the top 100 projects by market capitalisation declined in value over the week

- Altcoins surged following a US judge ruling against several SEC allegations of unlicenced securities sales by XRP issuers Ripple Labs

- XRP itself was the key beneficiary of these judgements, surging over 60% in 24 hours as a result

- Several other tokens previously deemed securities by the SEC experienced 20%+ growth following the court ruling

- Overall digital asset market capitalisation currently sits at a 7-day peak of $1.26tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week increased by almost $2bn (helped by Ether’s late price appreciation), to around $45.9bn

Digital assets surged upwards this week, following a combination of positive macroeconomic and industry-specific news. The late-breaking news of Ripple Labs scoring several victories against the SEC in their long-running lawsuit around the XRP token catalysed the market by appearing to imply that digital asset tokens are not automatically in and of themselves securities. Elsewhere, Europe moved into the spot Bitcoin ETF race, Google revised app store guidelines to enable more digital asset integration, Coinbase saw its best stock performance since launch day, PwC released a new report on hedge fund attitudes to the asset class, and regulatory efforts continued rolling on.

What happened: US judge rules for Ripple Labs and XRP in multiple SEC lawsuit claims

How is this significant?

- In 2020, the SEC filed a lawsuit against Ripple Labs, issuers of the XRP digital asset, alleging that $1.4bn of XRP sales by the company constituted unregistered securities—this Thursday, US Judge Analisa Torres ruled against the SEC on multiple counts

- In the Southern District of New York court, Judge Torres published a 34 page summary judgement, finding that direct sales from Ripple Labs to institutional buyers “constituted the unregistered offer and sale of investment contracts”, but she crucially ruled that “programmatic sales” (i.e. sales on crypto exchanges) did not meet those criteria

- Torres stated that “XRP, as a digital token, is not in and of itself a 'contract, transaction, or scheme' that embodies the Howey requirements of an investment contract”

- Reuters noted that “It was the first time a U.S. judge ruled in favour of a cryptocurrency company to deem certain digital assets sales as falling outside of U.S. securities law”

- Alongside exchange-based sales, Judge Torres also denied the SEC’s claims regarding securities violations through “other distributions" such as sales from tokens used in employee compensation, top Ripple executive allocations, or grants to developers building on the XRP ledger

- Torres said these distributions failed to satisfy several prongs of the Howey Test, particularly the first (“investment of money”) and third (“a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others”)

- She thus ruled against four of the five avenues in which the SEC claimed tokens were sold as securities; although it should be noted that direct institutional sales did account for about half of the total value outlined in the lawsuit

- The Wall Street Journal commented that the early dismissal of the allegations “could support other crypto firms’ claims that regulators have too aggressively policed [the] market”

- Judge Torres cited several factors supporting her ruling that sales to the general public on crypto exchanges weren’t securities, stating “An Institutional Buyer knowingly purchased XRP directly from Ripple pursuant to a contract, but the economic reality is that a Programmatic Buyer stood in the same shoes as a secondary market purchaser who did not know to whom or what it was paying its money”

- In the case of “blind bid/ask transactions” (the norm on crypto exchanges) buyers "could not have known if their payments of money went to Ripple, or any other seller of XRP."

- Additionally, she argued against the SEC’s claims of speculation as a key motivator for XRP token purchases, ruling that “a speculative motive on the part of the purchaser or seller does not evidence the existence of an ‘investment contract’ within the meaning of the [Securities Act]”

- She also pointed out direct corporate sales to professional investors were governed by written contracts with lockup provisions, and informed by a myriad of sales materials outlining the issuing company’s involvement in the token; a context far removed from purchases in the “blind bid/ask” environment of digital asset exchanges

- Torres ruled that: “There is no evidence that a reasonable Programmatic Buyer, who was generally less sophisticated as an investor... could parse through the multiple documents and statements that the SEC highlights”

- Although SEC chair Gary Gensler has routinely said that the regulatory environment is unambiguous, and claimed in a February interview that “Every token other than Bitcoin is a security”, Judge Torres said otherwise, suggesting it is the context of a token sale—rather than the mere occurrence of a purchase, or the token in and of itself—that determines security status

- The market responded positively to the news, with XRP hitting a daily high of 88 cents per token after sitting at 47 cents prior to the judgement

- As well as benefiting XRP, the ruling boosted other altcoins which were previously identified as securities by the SEC, since it opened the door to doubts about the SEC’s assessments

- Cardano, Solana, and Polygon, three top-10 projects deemed securities in recent SEC lawsuits, all experienced 24 hour gains of more than 20% in the wake of the ruling

- Coinbase relisted the XRP token on its exchange within hours of Judge Torres’ ruling—and they themselves may have been buoyed by the judgement that a token claimed as a security “did not violate federal securities law by selling… on public exchanges”

- Indeed, shares of Coinbase surged following the summary judgement, rising by as much as 25% within 24 hours

- The WSJ commented that “The decision could buttress claims made by other cryptocurrency companies that are fighting similar allegations by the Securities and Exchange Commission”

What happened: Ripple ruling reception

How is this significant?

- Ripple chief legal officer Stuart Alderoty was predictably enthused by the result; “A huge win today—as a matter of law—XRP is not a security. Also a matter of law—sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions—to developers, to charities, to employees are not securities. The only thing the Court found constitutes an investment contract is past direct XRP sales to institutional clients. There will be further court proceedings only on these institutional sales per the Court’s order”

- Industry personae enthusiastically welcomed the judgement; Coinbase chief legal officer Paul Grewal commented “Most days I love being a lawyer. Today’s one of them”, Sheila Warren, CEO of the trade group Crypto Council for Innovation stated “This fundamentally undercuts the SEC’s argument that it has the authority over these underlying assets and that regulatory clarity already exists”

- Digital asset lawyer David Brill said it was a “watershed moment for the classification of digital assets… It undermines the SEC’s position that tokens sold on Coinbase’s platform were sales of unregistered securities”

- Gemini exchange co-founder Tyler Winklevoss opined that “The Ripple ruling today confirms that the SEC and Gary Gensler are not the regulator of crypto”

- Industry publication The Block featured commentary from a variety of lawyers, who leaned towards interpreting Torres’ ruling as a “wake-up call to the SEC that its legal authority may not be as clear as it believed”, arguing that “by holding that the programmatic sales are not investment contracts, she is holding that secondary market transactions in crypto assets are not securities” and “The logical conclusion is that secondary sales of XRP are not securities transactions”

- Politicians also weighed in; House of Representatives Majority Whip Tom Emmer tweeted that the ruling established "a token is separate and distinct from an investment contract it may or may not be part of. Now, let’s make it law"

- SEC sources chose to focus on the direct institutional sales and frame that as a victory, despite the other rulings possibly undermining their current lawsuits elsewhere; “We are pleased that the court found that XRP tokens were offered and sold by Ripple as investment contracts in violation of the securities laws in certain circumstances”

- The SEC is entitled to an appeal, and spokespeople said it is currently reviewing its options

What happened: Europe to launch spot Bitcoin ETF before US

How is this significant?

- Europe appears set to beat the US in the race for a spot Bitcoin ETF—albeit a year later than previously planned

- The Financial Times reported on Thursday that the ETF would launch this month; after its issuers, Guernsey-based Jacobi Asset Management, delayed its initial launch in July last year, believing that “the time wasn’t right” in the wake of last year’s contagion

- However, in the context of the current race for a US spot ETF, and the fact that “demand has shifted since last summer”, Jacobi decided that the time was now right to launch in July 2023

- Jacobi COO Peter Lane was keen to tell the FT that this is the first true ETF in Europe, rather than previous Bitcoin products which were ETNs; “There has been so much misinformation and misuse of the term ETF by [ETN] issuers, presumably to obfuscate the risks that are inherent in acquiring and investing in ETNs”, adding that ETNs carry “significant counterparty risk“ in comparison

- The ETF will be listed as BCOIN on Euronext Amsterdam, stating on their website “This will be the first Bitcoin ETF on Euronext. All other currently existing products in our segment are exchange-traded notes. With our ETF, fund investors directly acquire and own the units of the fund that owns the Bitcoin”

- The Bitcoins will be custodied by Fidelity Digital Assets, and Jacobi told industry publication The Block “This is why we now believe the institutions can finally come and adopt digital assets as part of their diversified portfolio”

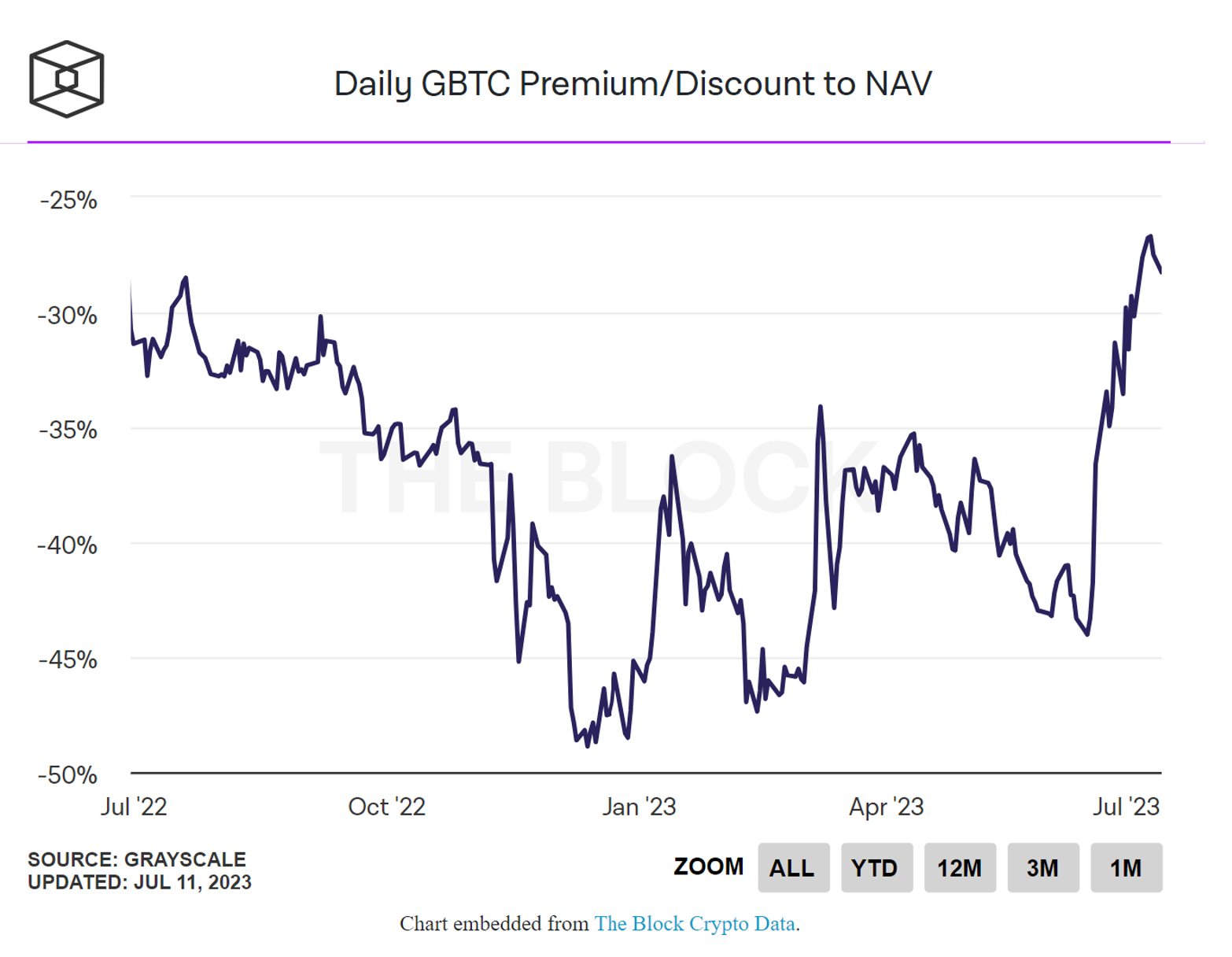

- In other ETF news, Bloomberg Intelligence analysts commented on Grayscale’s current lawsuit against the SEC to allow their GBTC fund to be converted into an ETF, estimating a 70% chance of a Grayscale victory

- Speaking on CNBC, Grayscale CEO Michael Sonnenschein described the entry of TradFi giants into the ETF race as “a moment of validation”, adding “To see literally the largest asset manager in the world publicly commit to advancing their crypto efforts only lends validity to the asset class and its staying power”

- Following heightened interest since BlackRock’s ETF filing, Grayscale’s own GBTC fund has narrowed its trading discount to the lowest levels in a year

- A Fidelity spokesperson told Bloomberg that “a meaningful portion” of its customers are interested in crypto, and an investor survey last year revealed “a Bitcoin ETF is the most appealing idea in the US for a new digital asset product, and more than three-quarters of high-net-worth investors, family offices and financial advisers want to buy digital assets”

- However, JP Morgan analyst Nikolaos Panigirtzoglou cautioned against too much expectation; believing that overall Bitcoin funds “attracted little investor interest” over the past two years, “failing to benefit from investor outflows from gold ETFs”

- Former SEC chair Jay Clayton, speaking in a CNBC interview, said that enhanced surveillance agreements could force the SEC’s hand; “If they’re right that that the spot market has similar efficacy to the futures market, it would be hard to resist approving a Bitcoin ETF”

What happened: Crypto custodians Copper partner with perfORM

How is this significant?

- Crypto custodians Copper announced this week that they have become the first digital asset custodian to receive an operational due diligence report

- This was achieved through partnering with London-based firm perfORM Due Diligence Services Limited

- In a press release, Copper stated that the partnership was motivated by a desire “to provide our clients and partners with continued transparency of Copper’s key operational pillars via a perfORM ODD Report”

- The due diligence report focused on institutional products, including Copper’s ClearLoop system for off-exchange settlement, addressing a desire for reduced counterparty risk following last year’s FTX collapse

- Copper noted that “PerfORM has helped streamline an extremely complex process as the network of exchanges under Clearloop continues to expand at rapid pace and demand”

What happened: Regulatory news

How is this significant?

- Alongside the landmark XRP ruling that “a digital token, is not in and of itself a 'contract, transaction, or scheme' that embodies the Howey requirements of an investment contract”, several other significant regulatory events occurred this week

- A day before the court judgement, SEC chair Gary Gensler pushed back against industry suggestions that his statements regarding tokens other than Bitcoin being securities displayed bias and required he recuse himself from crypto actions

- Gensler said he took an oath to “to enforce the law that Congress passed and how the courts interpret it”; he has yet to comment on Judge Torres’ ruling

- Bipartisan political duo Kirsten Gillibrand and Cynthia Lummis released an updated version of their previous proposal for a US crypto regulation bill

- Originally floated last June, the new version of the bill has been updated to include provisions intended to prevent repeats of events like last November’s FTX collapse

- Measures in the update include proof-of-reserves requirements, segregation of client assets, third-party custody obligations, and new advertising standards

- Senator Lummis told CNBC that the legislation would end ambiguity across the industry; “This legislation is not only needed to protect consumers, but so there are rules of the road for these companies”

- Dubai’s Virtual Assets Regulatory Authority (VARA) this week reprimanded local exchange BitOasis, beginning enforcement actions against them

- VARA stated “BitOasis is under review for not meeting mandated conditions, required to be satisfied within 30-60 day timeframes prior to being permitted to undertake any VARA regulated market activity”

- Both House and Senate Republicans and the Blockchain Association industry group requested an investigation of Prometheum Ember Capital, the digital asset firm that recently testified before congress about registration pathways after securing a special-purpose broker-dealer (SPBD) licence

- Republicans voiced concerns over Prometheum receiving investments from a firm linked to the CCP, alleging “false or misleading statements in [Prometheum] SEC filings”

- The Blockchain Association meanwhile asked the SEC inspector-general to check whether “the Commission granted Prometheum a ‘sweetheart’ deal in exchange for support of the Commission’s policy goals, or [if] Prometheum is leveraging personal connections with the Commission to gain an unfair advantage in the market”

- Despite securing their SPBD licence in May, Prometheum has yet to list any assets for sale, reinforcing the industry view that their registration pathway is not tenable or relevant to most digital asset businesses

- European Banking Authority (EBA) spokespeople advised stablecoin issuers to begin compliance efforts for the EU’s MiCA regulations coming into effect next year

- Under MiCA, “stablecoin operators will be required to hold a licence from a national financial regulator in at least one member state by June 2024”

- The Wall Street Journal published an opinion piece on Friday co-authored by former SEC chair Jay Clayton and former CFTC chair Timothy Massad, arguing that the SEC’s focus on enforcement lacked nuance and should only form one aspect of regulation

- They stressed the need for cooperation between the SEC and CFTC on developing investor and market protection standards, as well as the need for legislative clarity on issues like trading of non-security digital assets

- Clayton and Massad proposed the creation of “a self-regulatory organisation, shifting funding responsibility to the industry”

- South Korean regulators will require local firms to disclose digital asset holdings under new accounting rules coming into effect next year

- On Tuesday, the country’s Financial Services Commission stated that “The government is enhancing accounting transparency in virtual asset transactions by requiring companies to disclose detailed information, following the passage of the Virtual Assets Act in parliament on June 30”

What happened: Tim Draper outlines continued enthusiasm for Bitcoin

How is this significant?

- VC billionaire Tim Draper gave an interview to Bloomberg this week, in which he explained his current views on Bitcoin

- He said, “Bitcoin is here to stay…it’s a great system, it’s a great currency, it’s a great way to operate”.

- One of the key motivators for his bullishness is the radical transparency of blockchain; “I can't wait until I can raise a fund all in Bitcoin, invest it all in Bitcoin, have my portfolio companies all pay their employees and suppliers all in Bitcoin and have taxes all paid in Bitcoin... Because then there's no accounting, there's no auditing, there's no bookkeeping, it's all done on the blockchain. It's all honest and it's all straight”

- He believes that retailers should adopt Bitcoin on a wider scale when they realise the possible savings compared with paying commission to credit card companies

- Draper also promoted the Lightning Network scaling solution to bring Bitcoin back to its original digital cash proposition, without having an environmental impact

- As part of his enthusiasm, Draper speculated a $250,000 Bitcoin price point by 2025

- Draper also voiced his enthusiasm for the wider crypto sphere, celebrating XRP’s court ruling as “a big win for freedom”

What happened: US Government moves $300m of seized Bitcoin

How is this significant?

- On-chain data this week indicated that the US government moved over $300m of Bitcoin across three separate transactions on Wednesday morning

- The movements came from two wallets linked to the government holding seized Silk Road Bitcoin, some of which it sold in March for $215m

- The appreciation of Bitcoin’s price since the last sale led to some concern amongst observers that another large sale could be forthcoming; the price of Bitcoin dropped almost 1% after the transactions were sent, but has since recovered back over those levels

What happened: Nomura crypto arm expands VC efforts

How is this significant?

- Laser Digital, the crypto subsidiary of Japanese banking giant Nomura, expanded its VC capabilities recently with the appointment of industry veteran Florent Jouanneau as a new partner

- Jouanneau told industry publication The Block “In 2022, we have seen a slowdown in the market, especially when 2021 was an incredible year in terms of fundraising with big institutions [participating]... now we are seeing a lot of valuations being dragged down by effectively the lack of capital to be deployed”

- He added that “From a risk-reward perspective and frankly from a VC perspective, it’s definitely a good time to invest and for institutions to invest in several VCs that are taking that view”

- Laser Digital general partner stated “We fundamentally believe that more institutions will come into the space… We see almost 100 deals per month, so we are extremely selective when it comes to assessment of those opportunities. We tend to prioritise projects that are really focusing on institutional use cases”

What happened: Contagion latest

How is this significant?

- Bankrupt lender Celsius, and its former CEO Alex Mashinsky were both charged by the SEC this week; Mashinsky was arrested and accused of artificially inflating the price of their proprietary CEL token to enrich himself

- Authorities allege that “Mashinsky and his company made misleading statements to encourage investors to purchase its token, CEL, and to put money into the firm’s Earn Interest Program”

- Gemini exchange co-founder was unimpressed with the SEC’s press release declaring their enforcement, tweeting “You’re only 12 months too late. Your press release is not a victory lap, it’s a loser lap. You totally failed to protect investors”

- On Thursday, the FTC announced a settlement with Celsius, including “a ban on handling consumer assets and a $4.7 billion fine”—the latter being suspended while customers continue seeking fund recovery during the bankruptcy process

- Gemini exchange made good on its recent threat to sue Digital Currency Group and CEO Barry Silbert, filing a lawsuit alleging “fraud and deception… touting Genesis’s purportedly robust risk-management practices and a supposedly thorough vetting process of the counterparties to which it re-lent the assets”

- The Wall Street Journal reported federal investigations into possible campaign finance violations by former FTX executive Ryan Salame, regarding the 2022 New York congressional race of his girlfriend Michelle Bond

- Current FTX leadership seek to recover more than $320m from the purchase of Swiss firm Digital Assets AG (later FTX Europe), alleging that Bankman-Fried massively overpaid and failed to perform due diligence as a close associate worked there

- Teneo, the liquidators of collapsed hedge fund Three Arrows Capital, announced intentions to claw back $1.2bn from the Digital Currency Group and lenders BlockFi, alleging that the payments were made with liquidation imminent but before the progress formally began

- Stablecoin issuer Circle announced layoffs in non-core activities “to maintain a strong balance sheet”, but still aims to grow headcount overall according to a WSJ interview

What happened: Google revises app policies to allow more NFT integration across games

How is this significant?

- Google announced revisions to its Google Play app store policies this week, officially allowing app developers to integrate digital assets such as NFTs into their games

- TechCrunch reported that “a select group of developers are helping to test out the new policy ahead of its wide rollout to all developers on Google Play later this year”

- The company’s group project manager Joseph Mills noted that disclosure and responsible behaviour were a key requirement within the new framework; apps must be “transparent with users about tokenised digital assets” and developers cannot “promote or glamourise any potential earning from playing or trading activities”

- This includes current store-wide restrictions on “real-money gambling” activities, as well as the sale of randomised “loot boxes” providing the chance of yielding specific NFTs

- Although the NFT market has declined significantly year-on-year, it should be noted that the first wave of NFT mania was driven primarily by collectible digital art, whereas integration into games and apps opens up a variety of other use-cases

What happened: Coinbase stock surges following Cboe agreement on ETF approvals

How is this significant?

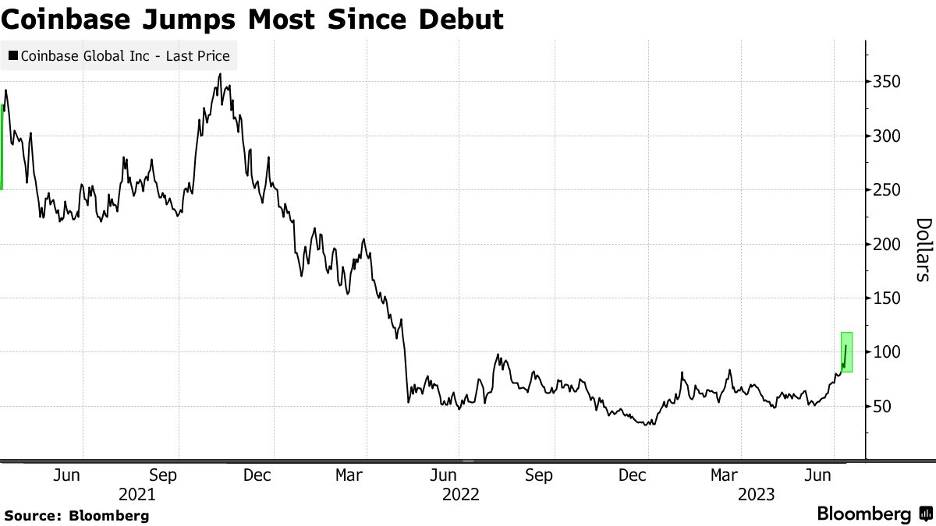

- Coinbase was the beneficiary of multiple news items this week, leading to strong rallies in its publicly traded stock

- Firstly, the recent rush towards ETFs solidified its place as the perceived American exchange of record, as CBOE filed amendments to five spot Bitcoin ETF applications, confirming a partnership with Coinbase regarding surveillance sharing agreements

- As the largest American exchange (and with growing institutional volume), Coinbase appears to be viewed as the most trusted partner by the TradFi institutions filing for spot ETFs

- This partnership confirmation led to a 10% jump on Tuesday, which Cathie Wood’s ARK Invest took advantage of by registering their first sell of COIN stock in over a year

- Crypto bull Cathie Wood’s flagship ARK innovation fund is up 58% year-to-date partly thanks to COIN exposure, outperforming the S&P 100’s 38% return—but lagging far behind the 150%+ return of Coinbase

- Wood may regret her timing slightly; on Thursday Coinbase experienced its best trading day since its public debut, following the SDNY court ruling on XRP

- Shares rallied 24% as the judgement implied secondary market listings do not imply securities sales; as lawyer Daniel Tramel Stabile points out “Coinbase is a secondary market exchange, and this type of opinion really calls into question whether the SEC’s approach with respect to secondary market exchanges make sense"

- At worst, the ruling indicated that classification isn’t as clear-cut as the Commission claims, which works in favour of a secondary market accused of selling securities; legal counsel Michael Selig stated “the order affirms the view that the same crypto asset may be sold as both a security and a non-security, depending on facts and circumstances”

What happened: Standard Chartered bank issues updated Bitcoin forecasts

How is this significant?

- Standard Chartered bank (co-owners of institutional digital asset exchange Zodia) recently published their updated forecast on Bitcoin, indicating a rather bullish attitude going forward

- On Monday analysts wrote that recent price appreciation could have a positive corollary; “Increased miner profitability per BTC mined means they can sell less while maintaining cash inflows, reducing net BTC supply and pushing BTC prices higher”

- Analyst Geoff Kendrick wrote “At recent prices, they [miners] have been selling 100% of new BTC; at USD 50,000 we think they would sell 20-30%”

- Standard Chartered also noted the additional supply shock of next year’s “halving”, the first since before the previous bull market

- The quadrennial “halving” event, as the name implies, halves the amount of Bitcoin generated as block rewards; so, entry of new Bitcoin into circulating supply will be slowed

- Given these factors, Standard Chartered speculated price could “hit $50,000 by the end of this year before jumping to as much as $120,000 in 2024”

What happened: PwC releases new report on crypto hedge fund attitudes

How is this significant?

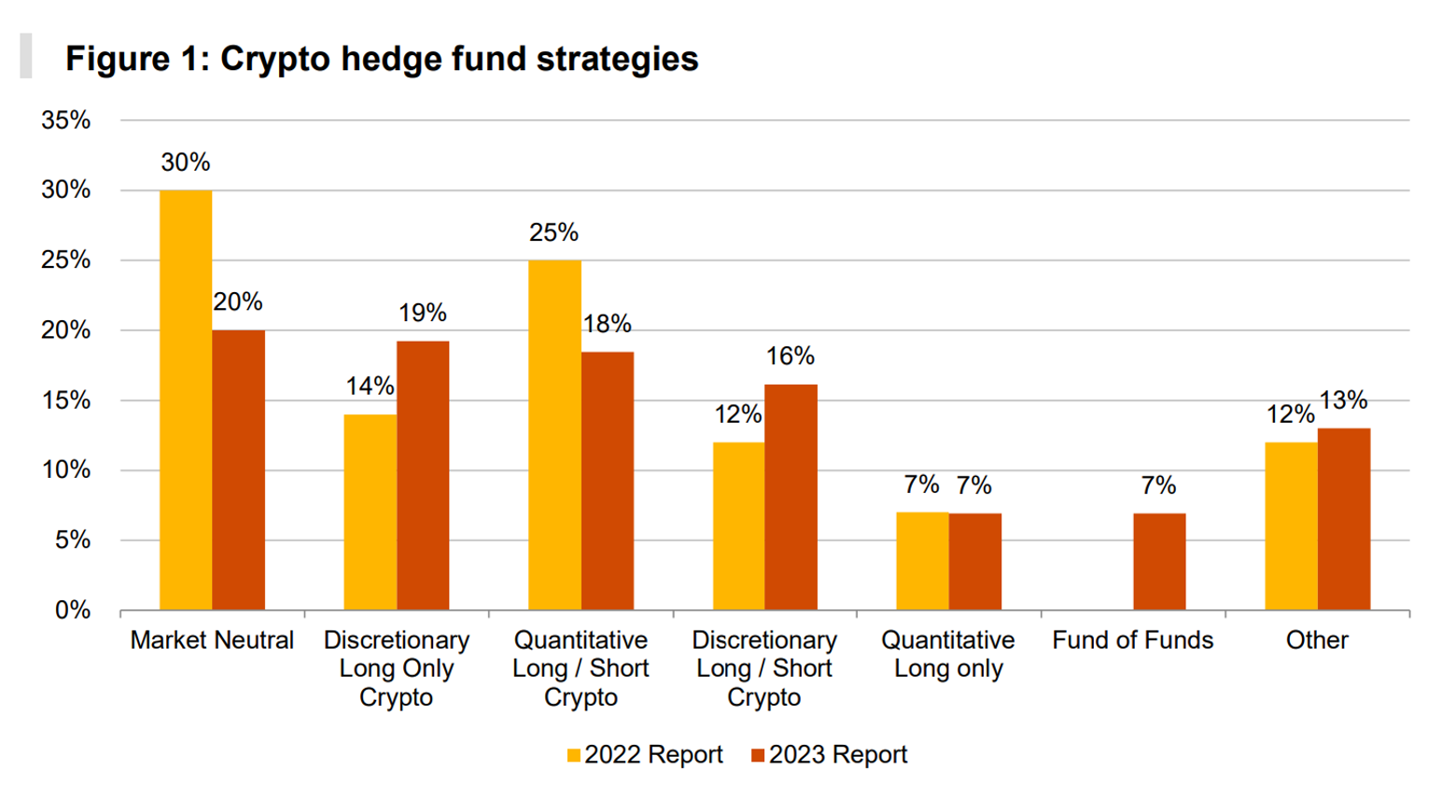

- PwC published the results of their 5th annual hedge fund survey into digital assets this week

- Titled “Rebuilding Confidence in Crypto”, the report found that “While the percentage of traditional hedge funds investing in crypto-assets fell from 37% in 2022 to 29% in 2023, the confidence in the value proposition and long-term sustainability of crypto-assets appears robust”

- Despite the year-on-year decline in exposure, no funds planned to decrease exposure this year, possibly indicating growing optimism after a brutal 2022

- PwC’s global financial services leader John Garvey commented “traditional hedge funds, committed to the market in the longer term, are not only increasing their crypto-assets under management, but also maintaining—if not increasing—the amount of capital deployed in the ecosystem”

- “Long-only” saw year-on-year growth as a guiding investment strategy

- Other key findings include the fact that:

· 25% of traditional hedge funds—including those without crypto exposure—are exploring tokenisation

· An overwhelming 93% of crypto hedge funds expect the market capitalisation of crypto assets to be higher at the end of 2023 than 2022

· 12% of crypto hedge funds are considering relocating from the US to crypto-friendly jurisdictions

· 75% of all survey respondents said that mandatory segregation of assets, making it the most-desired regulatory requirement