Market Overview

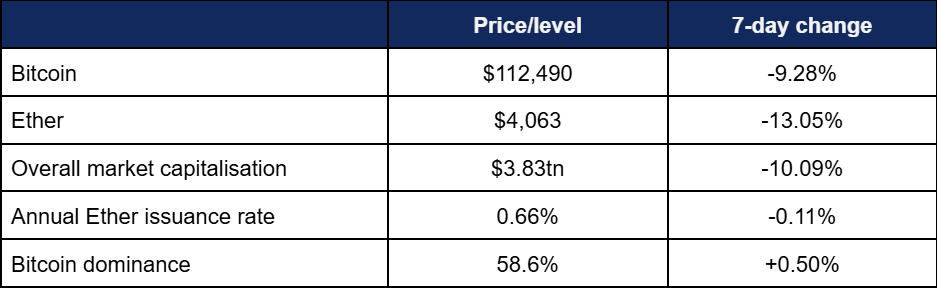

- Bitcoin experienced a major reversal this week, after concerns over a trade war kicked off cascading liquidations across the markets, compounded by profit-taking and high levels of leveraged trades

- After last week’s new record high, Bitcoin dropped around 15% in 24 hours at the worst point of Friday’s market panic, as leveraged bets unwound

- Bitcoin fell from a weekly high of $124,600 on Tuesday to a low of $109,220 on Friday; less than eight hours after it had been trading at $123,000

- It subsequently recovered slightly as Trump dispelled the worst concerns after a few days of uncertainty, rallying to around $116,000 on Monday

- Ether followed suit, gradually declining from a Tuesday high of $4,719 before crashing from $4,390 to $3,504 during the mass liquidation event on Friday

- Altcoins were hit particularly hard after strong growth last week, with only seven of the top 100 projects by market capitalisation green at the time of writing

- Overall market capitalisation dropped as low as $3.65tn, before recovering to the current $3.83tn

- Despite the scale of liquidations, it should be noted that current levels are the same as late September, rather than any further regression

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell around $15bn to $158bn

What happened: Digital assets experience largest one-day liquidations in history

How is this significant?

- Digital assets were shocked by president Trump’s unexpected threats of further tariff sanctions against China on Friday, catalysing a crash that led to the sector’s largest ever one-day liquidations before subsequently rallying as tensions eased

- Traders across most major markets experienced significant losses, with stocks losing over $2tn after Trump posted indications he planned to increase tariffs on China due to dissatisfaction over their rare earth minerals policies

- Analytics firm Coinglass called the subsequent market reaction (which equated to a nearly $500bn drop in market capitalisation at its lowest point) “the largest liquidation event in crypto history”

- It noted that within 24 hours, over $19bn of bets were wiped out ($7bn of which in just one hour), liquidating more than 1.6 million traders

- On the daily candle, Bitcoin fell from around $123,000 to below $110,000, with most altcoins suffering even greater losses percentage-wise

- It appears that this global market crash was compounded in crypto by several other factors, causing cascading liquidations

- It occurred within days of Bitcoin and the overall market hitting new record highs, making it easier for traders to take profit at the first sign of any market uncertainty

- Digital assets trade 24/7/365, giving a prolonged reaction window compared to traditional markets

- Perpetuals markets and leverage bets have grown significantly in digital assets over the last few months; the largest liquidations did not occur on leading CEXes Binance or Coinbase, but on top perpetuals exchange Hyperliquid, which proceed over $350bn of perpetuals trades in August alone

- Some major exchanges such as Binance experienced glitches due to the sheer trading volume, causing mismatches in pricing, and brief de-pegging on some assets such as the USDe “synthetic dollar” stablecoin

- Binance has since paid out around $283m in compensation to users affected by the exchange-based price depegging events

- Several prominent industry figures identified the event as a “wake-up call” for leverage in the industry; analyst Nic Puckrin noted “it remains the only market that trades after hours… In this environment, thin liquidity, overleverage, and the involvement of big players make for a toxic cocktail”

- Some analysts alleged that someone with insider knowledge of the tariff announcement may have taken advantage; a well-heeled “whale” trader opened massive shorts against Bitcoin shortly before the Trump announcement, netting a nine-figure windfall as the market crashed

- However, although this represented the sector’s largest liquidation event by volume, it should be noted that due to the overall growth of the industry over the last few years, this volume still represented a far lower percentage drop than several other past liquidation events, most notably the 2020 Covid Crash

What happened: ETF News

How is this significant?

- Digital asset investment products once again posted strong inflows, as traders flocked to Bitcoin during its recent record run

- According to Coinshares data published on Monday, digital asset funds added $3.17bn during the trading week ending Friday the 10th

- Additionally, year-to-date inflows reached an all-time high of $48.7bn “despite price corrections linked to US–China tariff tensions”, and trading volumes hit a record $53bn (including almost $16bn in Friday’s chaotic trading)

- Coinshares head of research James Butterfill believes that traditional trading hours helped the ETFs avoid the worst of market reaction to the tariff threats, as “Friday saw little reaction with a paltry US$159m outflows”

- Spot Bitcoin ETFs followed last week with another exceptional showing (before a meager $4.5m outflow on Friday), including a ten-figure inflow day

- This occurred on Monday as the funds added over $1.2bn between themselves, including $970m for BlackRock’s IBIT and $112m for Fidelity’s FBTC

- IBIT also posted the week’s second-best result, adding $899m on Tuesday, followed by $426m, $256m, and even a positive $74m despite the market meltdown on Friday

- Bloomberg chief ETF analyst Eric Balchunas was effusive in his praise of IBIT on Wednesday, stating “$IBIT is #1 in weekly flows among all ETFs with $3.5bn which is 10% of all net flows into ETFs. Also notable is the rest of the 11 original spot Bitcoin ETFs all took in cash in the past week… Two steps forward mode [editor’s note: before presciently adding] Enjoy while it lasts”

- He also noted that IBIT’s one year return despite the Friday crash is 84%, and it still sits close to (by far) the record for fastest fund to reach $100bn AUM “Inches away.. $IBIT got to $99.5bn last week before pullback. It could taste the extra digit. It’s still an inevitable milestone imo but wild just how close it got. Two steps forward, one step back in effect”

- Spot Ether ETFs showcased slightly weaker performance as Bitcoin’s run to a new all-time high stole the spotlight—but they nonetheless featured two days of nine-figure inflows worth $182m and $421m

- These figures were dominated by BlackRock’s ETHA, which added $93m, $438m, and $149m in fresh capital on the week’s first three trading days

- The next-best performers were Fidelity’s FETH and Bitwise’s ETHW, neither of which posted a daily return above $30m

- Ether funds featured far heavier outflows on Friday than their Bitcoin brethren, shedding $175m (led by $80m from ETHA)

- In other ETF news, filings for crypto-related ETFs continue pouring in, with Bloomberg analyst James Seyffart paying particular attention to expected imminent approvals for Solana staking products, alongside funds for altcoins HBAR and Litecoin

- UK regulators opened retail investor access to Bitcoin and Ether ETPs last week, undoing a 2021 ban by the FCA

What happened: Citibank entering digital asset custody

How is this significant?

- CNBC reported on Monday that Citi Group seeks to introduce crypto custody services for clients in 2026, joining the likes of BNY Mellon and Standard Chartered as major global banks storing digital assets

- Biswarup Chatterjee, services division global head of partnerships and innovation, told the channel “We have various kinds of explorations… and we’re hoping that in the next few quarters, we can come to market with a credible custody solution that we can offer to our asset managers and other clients”

- He added that the bank is pursuing a hybrid approach in order to provide the best possible solution for different assets

- “We may have certain solutions that are completely designed and built in-house that are targeted towards certain assets and certain segment of our clients, whereas may we may use a… third party, lightweight, nimble solution for other kind of assets”

- On Friday, Bloomberg revealed that Citi has joined a banking coalition for a Euro stablecoin, alongside industry contemporaries like DekaBank, ING, and Unicredit

- Citi is thus far the only non-European bank present in new entity based in the Netherlands, which aims to launch its Euro-denominated coin in the second half of next year

- Additionally, it also joined Visa as an investor in stablecoin payments company BVNK, which processes around $20bn in payments annually

What happened: Deutsche Bank predicts central bank crypto reserves

How is this significant?

- A recent report by Deutsche Bank posited that central banks may hold significant amounts of Bitcoin alongside gold in their reserves by 2030

- According to analysts Marion Laboure and Camilla Siazon, “A strategic Bitcoin allocation could emerge as a modern cornerstone of financial security, echoing gold’s role in the 20th century. Assessing volatility, liquidity, strategic value and trust, we find that both assets will likely feature on central bank balance sheets by 2030”

- They noted recent “de-dollarisation” of reserves, and argued this can help Bitcoin (with its predictable code-based supply mechanics) gain wider appeal

- “The dollar’s share in global reserves slid from 60% in 2000 to 41% in 2025… The behavior we saw toward gold in the 20th century has clear parallels with how policymakers are now debating Bitcoin”

- Laboure identified several shared characteristics of the two assets; “a low correlation with traditional assets, historically high volatility (although sharply decreasing for Bitcoin), and a role as a safe haven during times of instability”

- Meanwhile, blockchain data firm Chainalysis crunched the numbers on the amount of crypto that may be available to governments via asset forfeiture, and estimated the figure at $75bn

- CEO Jonathan Levin stated “This brings asset forfeiture potential to a completely different level to what we’ve seen in the past. It does change how countries think about that”

What happened: Tokenisation news

How is this significant?

- BNY Mellon is exploring tokenised deposits to enable client payments via blockchain

- The bank’s treasury platform lead Carl Slabicki claims that tokenised deposits help banks “overcome legacy technology constraints, making it easier to move deposits and payments across their own ecosystems—and eventually, across the broader market as standards mature”

- Tokenisation firm Securitize is reportedly going public via an SPAC merger with a firm founded by Cantor Fitzgerald, according to Bloomberg sources

- A merger would give Securitize a unicorn valuation of $1bn for the firm which helped to launch BlackRock’s successful tokenised money market fund BUIDL

- The UK government plans to catalyse tokenisation initiatives within the country by appointing a “digital markets champion”

- According to Treasury secretary Lucy Rigby, this new champion role will “lead, join up and coordinate private sector work on tokenizing wholesale financial markets in the UK”

- Speaking at the Digital Assets Week conference in London, she added that they will work alongside a “Dematerialisation Market Action Taskforce” eliminating paper share certificates from the market, building on the government’s Wholesale Financial Markets Digital Strategy

What happened: SoftBank invest in Binance’s Japanese venture

How is this significant?

- Following last week’s news of financial giant Nomura entering crypto trading, another major financial institution in Japan moved to increase its access to the digital asset sector

- SoftBank, one of the country’s largest investment managers, secured a 40% stake in Binance Japan via its digital payment processor subsidiary PayPay

- Although a joint statement did not disclose the value of the investment, the companies confirmed they “aim to launch integrated services that will allow users to purchase crypto assets within the Binance app using PayPay Money and withdraw funds into PayPay Money”

- This opens access to PayPay’s 70 million users and widespread merchant network for Binance, potentially allowing exchange users to directly pay for purchases via digital assets

- Binance Japan GM Takeshi Chino commented “This strategic alliance represents a significant step toward the future of digital finance in Japan… By combining PayPay’s extensive user scale with Binance’s innovative technology, we will be able to make Web3 more accessible to people across the country and deliver secure, seamless digital assets services”

- In other news of digital asset venture investments, Bitcoin life insurance firm Meanwhile secured an $82m funding round, featuring participation from Bain Capital, Haun Ventures, Apollo, Northwestern Mutual Future Ventures, and Pantera Capital

- Bain Capital’s Stefan Cohen told Bloomberg “As the collateral and alternative asset gets better and better and more widely adopted, individuals will want financial products like life insurance that are not expressed in fiat terms that are expressed in Bitcoin terms”

- Digital investment firm Galaxy Digital secured a $460m private investment towards expanding its data centre business from an unnamed “major asset manager”

What happened: Blockchain-based prediction market secures record $2bn investment

How is this significant?

- The Wall Street Journal broke the news this week that Intercontinental Exchange (ICE), the parent company of the NYSE, announced a $2bn all-cash strategic investment in blockchain-based prediction platform Polymarket

- This figure represents the largest private investment ever in a crypto company, values Polymarket at over $8bn (pre-money), and makes founder Shayne Coplan the youngest self-made billionaire in the world

- The popular predictions platform allows users to wager on the outcome of real-world events, including within the realms of sport and politics

- Polymarket first came to global prominence during the last US election, when it (or rather, its users) correctly predicted the outcome of a Trump victory far more accurately than traditional polling

- ICE CEO Jeffrey Sprecher stated “There are opportunities across markets which ICE together with Polymarket can uniquely serve and we are excited about where this investment can take us”

- Just a few days later, competing predictions market Kalshi secured $300m investment at a $5bn valuation, within weeks of announcing intentions to integrate with “every major crypto app” in the next 12 months

What happened: Crypto firm HashKey considers Hong Kong stock exchange listing

How is this significant?

- Licenced Hong Kong crypto operator HashKey may go public this year, according to Bloomberg sources

- The firm has reportedly confidentially filed for an IPO, which would make it the first crypto-native company to float since the city announced its aim to become a major regional crypto hub

- The sources claim HashKey “could list as soon as this year” at a valuation of around $500m

- HashKey currently runs Hong Kong’s largest locally-licenced digital asset exchange, although details on potential valuation are still subject to change, pending ongoing discussions

- If it does go public, HashKey could serve as a bellwether for crypto market demand in Asia, after the likes of Coinbase and Circle already proved investor appetite in North America

What happened: State Street reports outlines institutional attitudes towards crypto

How is this significant?

- State Street published its digital asset outlook report on crypto this week, revealing the positive evolution of institutional attitudes towards the asset class

- They have identified growing confidence in digital assets; 60% of institutional investors plan to increase their allocation in the coming year, and average exposure is expected to double within three years

- A majority of respondents believed that “10–24% of institutional investments to be executed through tokenised instruments”, with private equity and fixed income identified as key candidates for the shift

- Additionally, “40% of institutional investors have a dedicated digital assets team or business unit, and nearly a third say digital operations (e.g., blockchain) are now integral to their organisation’s wider digital transformation strategy”

- Respondents listed numerous advantages behind the shift towards digital assets, including transparency (i.e. visibility of key data), faster trading, and reduced compliance costs

- Around half believe that adopting digital asset infrastructure can cut costs by around 40%

- State Street’s investment services president Joerg Ambrosius commented “The acceleration in adoption of emerging technologies is remarkable. Institutional investors are moving beyond experimentation, and digital assets are now a strategic lever for growth, efficiency, and innovation”

- Chief product officer Donna Milrod added “Clients are rewiring their operating models around digital assets… The shift isn’t just technical—it’s strategic”

What happened: Luxembourg becomes first Eurozone nation to reveal crypto strategy

How is this significant?

- This week, Luxembourg became the first Eurozone nation to officially invest in crypto, as Finance Minister Gilles Roth revealed that its Intergenerational Sovereign Wealth Fund (FSIL) now allocates 1% of its capital towards Bitcoin, via ETFs

- National broadcaster Radio-Television Luxembourg reported that this signalled “a significant shift” for the Grand Duchy, usually viewed as a fiscally conservative nation

- Director of the Treasury Bob Kieffer explained the move thusly; “Recognising the growing maturity of this new asset class, and underlining Luxembourg’s leadership in digital finance, this investment is an application of the FSIL’s new investment policy”

- This new policy allows allocation of up to 15% of FSIL’s capital towards alternative investments such as crypto

- He added that they are “sending a clear message about Bitcoin’s long-term potential” and that “ETFs allow us to avoid the risks associated with holding Bitcoin directly”

- Local MP Laurent Mosar applauded the move, saying “As a country with a long-term vision, this is a logical step. It sends a strong signal to institutional investors”

What happened: Stablecoin news

How is this significant?

- A consortium of major international banks including Bank of America, Citi Deutsche, Goldman Sachs, Santander, BNP Paribas, MUFG, TD Bank Group, and UBS are jointly exploring “a 1:1 reserve-backed form of digital money that provides a stable payment asset available on public blockchains”

- In particular, the proposed coin would be pegged to G7 currencies reflected by the wide geographic spread and regulatory knowledge of the banks

- In a new research note, JP Morgan analysts eschewed concerns that stablecoins could undermine the US Dollar, arguing “Rather than accelerating de-dollarisation, growth in stablecoin adoption has the potential to reinforce the dollar’s role in global finance”

- Their strategists forecast a (very) wide range for the potential market capitalisation of stablecoins by 2027; US rates strategists predict a $500bn value, whilst emerging market equity strategists predict a $2tn market

- Scott Lucas, global head of markets digital assets at JP Morgan, told CNBC on Monday that the bank is exploring stablecoins alongside its existing proprietary blockchain; “There’s a real opportunity for us to think about how we can offer different services for our clients on the cash side, as well as responding to client demand to do things on stablecoins”

- However, he cautioned “that strategy is still emerging because it’s only really been a few months since we’ve had some more clear regulation around what the opportunity looks like”

- Fortune reported that both Coinbase and Mastercard have held talks to acquire stablecoin payments infrastructure firm BVNK (the same company that secured an investment from Citi this week)

- According to the reports, potential valuation could lie between $1.5bn and $2.5bn, eclipsing the record $1.1bn Stripe spent acquiring stablecoin platform Bridge

- North Dakota could follow in Wyoming’s footsteps as the second US state to issue its own stablecoin

- The “Roughrider Coin” would be issued by the state-owned Bank of North Dakota, with CEO Don Morgan commenting “We see this affecting the industry and continue to affect the industry, and so we’re getting involved”

- North Dakota governor Kelly Armstrong added “As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens”

What happened: Crypto Treasury news

How is this significant?

- Leading treasury firm Strategy (formerly MicroStrategy) made its most expensive Bitcoin purchases ever this week, spending $27m at an average price of $123,561 before the steep market correction on Saturday

- Founder Michael Saylor remained unperturbed by short-term price action, tweeting “No tariffs on Bitcoin” in response to market panic over possible global trade wars

- Top Ether treasury firm BitMine meanwhile kept its powder dry before “buying the dip” after prices crashed

- Chairman Tom Lee stated “The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of”, as it added over 202,000 Ether at a cost of around $828m

- Lee added “Volatility creates deleveraging and this can cause assets to trade at substantial discounts to fundamentals, or as we say, ‘substantial discount to the future’ and this creates advantages for investors, at the expense of traders”

- Nasdaq-listed Prestige Wealth raised $150m to build a treasury based on Tether’s xAUT tokenised gold coin

- Finally, Beijing-based investment bank China Renaissance Holdings is raising $600m for a public vehicle to invest in Binance-related assets, particularly the exchange’s proprietary BNB token

- Binance founder Changpeng “CZ” Zhao’s family office, YZi Labs, will invest $200m into BNB alongside China Renaissance, according to Bloomberg sources

- Bitcoin experienced a major reversal this week, after concerns over a trade war kicked off cascading liquidations across the markets, compounded by profit-taking and high levels of leveraged trades

- After last week’s new record high, Bitcoin dropped around 15% in 24 hours at the worst point of Friday’s market panic, as leveraged bets unwound

- Bitcoin fell from a weekly high of $124,600 on Tuesday to a low of $109,220 on Friday; less than eight hours after it had been trading at $123,000

- It subsequently recovered slightly as Trump dispelled the worst concerns after a few days of uncertainty, rallying to around $116,000 on Monday

- Ether followed suit, gradually declining from a Tuesday high of $4,719 before crashing from $4,390 to $3,504 during the mass liquidation event on Friday

- Altcoins were hit particularly hard after strong growth last week, with only seven of the top 100 projects by market capitalisation green at the time of writing

- Overall market capitalisation dropped as low as $3.65tn, before recovering to the current $3.83tn

- Despite the scale of liquidations, it should be noted that current levels are the same as late September, rather than any further regression

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell around $15bn to $158bn