March 18th, 2025

Market Overview:

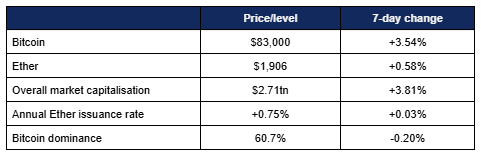

Digital assets regained some of their recent losses, as traders cautiously returned to markets following better-than expected US economic data.

- Bitcoin returned to growth after several weeks of decline, as a degree of optimism returned to the market

- Bitcoin grew from a Tuesday low of $79,360 to hit a weekly high of $85,160 on Friday

- Ether also posted weekly growth, but its performance continues to lag behind Bitcoin, leading Standard Chartered analysts to revise their year-end target for the asset down considerably

- Ether recovered from a weekly low of $1,815 on Thursday to $1,955 on Saturday

- Overall industry market capitalisation grew to $2.71tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew by almost $5bn, to $90.8bn

Digital assets exhibited some growth this week, as markets and tariff panic eased off slightly in the face of positive CPI data. Stablecoin legislation advanced in the US, Binance attracted a $2bn investment from the UAE, Cantor Fitzgerald launched its long-await Bitcoin financing business, and multiple nations increased their utilisation of digital assets, alongside much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs once again experienced significant overall outflows, although several trading days actually posted net inflows

- According to CoinShares data published on Monday, digital asset investment products outflows hit $1.7bn in the week ending Friday the 14th; extending the run of outflows to a record five weeks

- During this run, the various funds outflows hit $6.4bn

- CoinShares chief researcher James Butterfill noted that net outflows across all digital asset investment products (including, but not limited to, spot ETFs) reached 17 consecutive days—the most since 2015

- Spot Bitcoin ETFs managed two inflow days last week, albeit at much more modest levels than the outflow days

- ARK Invest’s ARKB led the way inflows-wise (following the largest losses the week prior), adding around $83m on Wednesday, and $101m on Friday

- This contributed to net weekly inflows for ARKB, the only fund to boast such performance

- Wednesday and Friday registered overall inflows of $13m and $41m respectively; however Monday, Tuesday, and Thursday all registered nine-figure outflows

- BlackRock’s IBIT and Fidelity’s FBTC experienced the largest daily losses, at $151m and $134m

- Early Monday reporting (incomplete at the time of writing) indicated a strong performance, with at least five funds posting inflows (including $127m for Fidelity’s FBTC)

- Spot Ether ETFs could not register any net inflows, as only two of the lower-ranked funds (VanEck and Invesco) registered daily inflows—and even then, barely above $1m each

- In a positive development for Ether funds, CBOE filed to allow staking in Ether ETFs from various issuers, potentially creating passive income streams for holders

- Bitwise CIO Matt Hougan commented “ETPs should stake. We’ve seen in Europe that staking ETPs work and help increase investor returns and boost network security”

- On Wednesday, Franklin Templeton became the largest issuer to propose a spot Solana ETF

- Established issuer VanEck also increased its altcoin interest, filing for a spot Avalanche (AVAX) ETF

- Bloomberg chief ETF analyst Eric Balchunas pointed out that despite the unprecedented run of outflows, historic performance remains impressive; “ETF inflows are down to $35bn (from peak of $40bn). Based on $115bn of AUM that means more than 95% of investor cash has held strong despite a painful 25% decline”

- According to reporting by industry publication TheBlock, current SEC crypto ETF filings number around 60 across various assets—however no approvals are expected before proposed chair Paul Atkins is confirmed in the role

What happened: Stablecoin bill advances in US Senate Banking Committee

How is this significant?

- During the recent White House crypto summit, Donald Trump declared a desire to pass stablecoin legislation by August—such wishes came one step closer to fruition this week

- The Senate Banking Committee advanced “landmark” stablecoin legislation this week, despite some opposition from long-time congressional crypto critic Elizabeth Warren

- The bipartisan bill passed through the committee with an 18-6 vote, and aims to “govern privately issued, dollar-based stablecoins”, as congressional crypto advocate Cynthia Lummis commented “This is an innovative, important financial product that has safeguards built in”

- In other legislation news, representative Byron Donalds introduced a bill on Friday to codify the digital asset strategic reserve executive order issued by Trump at the crypto summit

- The bill would enshrine and protect the policies, ensuring that they cannot be cancelled by any future executive orders from other presidents

- Donalds defiantly declared “For years, the Democrats waged war on crypto. Now is the time for Congressional Republicans to decisively end this war”

- In other stablecoin news, USDC issuer Circle announced via press release that it would bring recently-acquired Hashnote tokenised money market fund (USYC) under its existing Bermuda-based Digital Assets Business Act (DABA) licence

- Digital asset payment firm Mesh closed an $82m Series B funding round to help build out its network

- According to a press release, the raise was led by Paradigm VC, and primarily paid in PayPal’s proprietary PYUSD stablecoin, as “the benefits of using stablecoins for VC funding are that it's instant, cheap, transparent, and available 24/7”

- Digital asset firm Moonpay acquired stablecoin platform Iron in a deal reportedly worth $100m

- Moonpay CEO Ivan Soto-Williams commented “With Iron’s technology, we’re putting the power of instant, programmable payments into the hands of enterprises, fintechs and global merchants”

What happened: Binance attracts new investment from multiple entities

How is this significant?

- Binance, the largest digital asset exchange in the world, has secured significant investment for different divisions of its business this week, according to reports

- Emirati investment fund MGX paid $2bn for a minority stake in the exchange, marking the first-ever institutional (and largest-ever)investment for Binance

- MGX was founded by UAE sovereign wealth fund Mubadala, indicating possible interest on a national level

- Additionally, the Wall Street Journal disclosed that Donald Trump’s family is (reportedly) set to acquire a stake in the exchange’s American subsidiary, Binance.US

- Multiple sources also indicated that Trump-backed DeFi project World Liberty Financial held discussions with Binance concerning various matters, including the possible development of a dollar-backed stablecoin

- Bloomberg wrote that “Doing business with Binance would be an escalation of the Trump family’s involvement in the crypto industry as the Trump administration is currently rewriting regulations that would affect Binance and its competitors”

- The reports also indicated that Binance founder Changpeng “CZ” Zhao—still its largest shareholder—could seek a presidential pardon for the KYC shortfalls he pled guilty to under the previous administration

What happened: European Central Bank declares concerns over US crypto support

How is this significant?

- European Central Bank governing council member (and Bank of France governor) Francois Villeroy de Galhau criticised the United States this week for its embrace of digital assets

- Speaking to French publication La Tribune Dimanche, he claimed that “By encouraging crypto-assets and non-bank finance, the American administration is sowing the seeds of future upheavals”

- He also advocated for greater international use of the Euro, suggesting a “a powerful savings and investment union, capable of attracting international investors to our currency”

- Following the recent White House crypto summit, growth of dollar-backed stablecoins was identified by some EU politicians and legislators as a potential risk for the continent

- European Stability Mechanism Managing Director Pierre Gramegna opined that “dollar-denominated stablecoins... may raise certain concerns in Europe… if [mass payment solutions based on USD stablecoins] were to be successful, it could affect the Euro area’s monetary sovereignty and financial stability”

- Villeroy (and other ECB leaders like Christine Lagarde) advocate for an ECB-created Digital Euro, in stark contrast to the US where Trump pledged to avoid and CBDCs

What happened: Cantor Fitzgerald launches $2bn Bitcoin financing business

How is this significant?

- Cantor Fitzgerald this week announced the signing of Anchorage Digital Bank and London-based Copper as crypto custodians for Cantor’s new Bitcoin financing business, following initial reports of the service last summer

- In a press release, Cantor’s Head of Bitcoin Financing Michael Cunningham stated “We are launching with $2 billion in initial financing and expect to substantially grow the operation over time”

- Anchorage Digital founder Nathan McAuley commented “Our partnership marks a major step forward for the Bitcoin financing ecosystem—built on the safety and security of federally regulated digital asset custody… we are expanding the horizon of what is possible for institutions in Bitcoin”

- “Institutional investors are increasingly looking to diversify their portfolios and identify secure routes into the digital asset market," said Amar Kuchinad, CEO of Copper. "This significant partnership with Cantor Fitzgerald will meet the growing demand for sophisticated financing solutions… providing a complete toolkit for secure and strategic asset handling”

- Cantor currently manages the US Treasuries backing value for stablecoin issuer Tether, and was led by current Secretary of Commerce Howard Lutnick until his appointment by Trump

- Bloomberg reported that Lutnick’s new position had put Cantor “a few laps ahead” thanks to the firm’s crypto exposure, as “the political winds have shifted at just the right time”

- Cantor co-CEO Sage Kelly told Bloomberg that the new Bitcoin financing service is “one of the most transformative moments in the 30 years I’ve been doing investment banking”

What happened: Bahraini digital asset exchange enters $1bn tokenised gold market

How is this significant?

- Bahraini crypto exchange ATME revealed in a press release this week that it has entered the field of tokenised asset issuance, via gold-backed tokens

- The tokens are only available to accredited investors, as each corresponds to a kilogram of gold held in secure custody

- ATME CEO Alex Lola commented “By combining the timeless value of gold with blockchain technology, we are unlocking new ways for investors to access and trade high-value assets”

- According to tokenisation tracker rwa.xyz, tokenised gold recently hit a record market capitalisation of around $1.2bn, partly boosted by recent market nervousness over tariff wars, and the presence of established institutional players like HSBC in Hong Kong

What happened: Bolivian state energy firm uses crypto to pay for imports

How is this significant?

- Bolivian state energy firm YPFB this week told Reuters that it would use digital assets to pay for energy imports, as the nation struggles against both dollar and fuel shortages

- Dwindling exports exhausted Bolivia’s foreign currency reserves, but crypto represents a means for the country to maintain cross-border payments and thus enable national fuel subsidies

- A spokesperson told the news agency “From now on, these (crypto asset) transactions will be carried out”

- YPFB President Armin Dorgathen said in a local interview that “We have the resources, what we lack are foreign currencies, whilst Hydrocarbons Minister Alejandro Gallardo agreed in a press conference, stating “the main problem we face is obtaining foreign currency to pay our various suppliers”

- Bolivia had initially banned all digital assets back in 2014 due to lack of central issuing parties, but reversed course last year amidst increased economic hardship and currency concerns

- Reuters also reported last Friday that Russia is allegedly using digital assets for payments in its oil deals with China and India, planning to continue the practice even if currency sanctions are lifted by the west

What happened: BlackRock’s tokenised money market fund exceeds $1bn in value

How is this significant?

- The world’s largest asset manager achieved another landmark metric in the digital asset field, maintaining BlackRock’s spot at the forefront of institutional crypto adoption

- Last week, its tokenised money market fund BUIDL surpassed $1bn in capital, following a recent $200m allocation by synthetic dollar protocol Ethena

- This represented growth of around 50% in the last month, crossing the $1bn value milestone after just 358 days fromm launch

- Industry analysts suggest numerous advantages for the practice of tokenisation; it “enhances liquidity but also introduces faster settlement times and increased transparency”

- BUIDL’s achievement was soon followed by its closest competitor, as Ondo Finance’s OUSG and USDY tokens achieved a cumulative $1bn just one day later

- Industry CEO Todd Ruoff explained the trend thusly; “The rapid growth of tokenized Treasuries to $4.4bn shows just how much demand there is for real-world assets in digital finance,tokenised RWAs [real world assets] offer a rare mix of liquidity, transparency, and yield—all while bridging the gap between DeFi and traditional finance in a way that feels more accessible than ever”