September 20th, 2024

Market Overview:

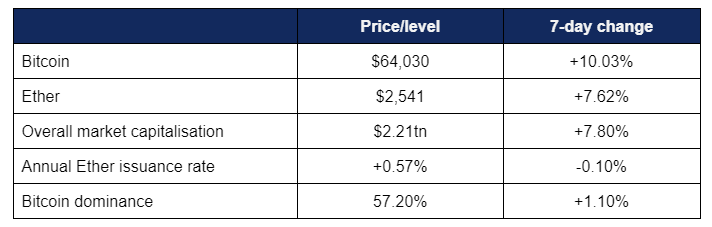

Digital assets performed strongly this week, as the market rallied following the first Federal Reserve rate cut in four years.

- Bitcoin performed steadily throughout the week, gaining momentum following confirmation of long-awaited rate cuts from the Federal Reserve

- Bitcoin dipped to a weekly low of $57,570 on Tuesday before confirmation of Fed policy, surging to a high of $64,080 early on Friday in the wake of the 50 basis point reduction

- This brought Bitcoin to its highest levels in September, just under the $64,500 mark achieved in late August

- Ether also shook off its recent lacklustre performance, rising from a Monday low of $2,264 to a high of $2,547 in early Friday hours

- Overall digital asset market capitalisation increased to $2.21tn, with strong performance across the market as only eight of the top 100 projects by market capitalisation regressed in value over the course of the week

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased in line with Ether’s growth, rising to $83.7bn

Digital assets performed bullishly across the board, buoyed by long-awaited rate cuts from the Federal Reserve. The Republican side of the presidential race vocally supported crypto and DeFi, whilst advocates on the other side of the aisle attempted to influence Harris away from another Gensler-led SEC administration after the agency was forced to admit misleading terminology in its crypto prosecutions. Elsewhere, BlackRock praised Bitcoin as a “unique diversifier”, more nine-figure funds were raised, Bhutan emerged as a potential Bitcoin powerhouse, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs showcased mixed performance, as Bitcoin ETFs responded strongly to expectations of rate cuts, whilst Ether products continued their comparatively-subdued post-launch performances

- According to CoinShares data, digital asset investment products rebounded strongly in the week ending September 13th, as $436m worth of investment flowed in, led by Bitcoin ETFs

- Spot Bitcoin ETFs experienced four consecutive days of inflows (including two days of nine-figure inflows) before the streak was snapped on Wednesday

- BlackRock’s IBIT experienced its first day of inflows in over two trading weeks on Monday, following a prolonged run of net-zero flows

- Fidelity’s FBTC once again led the way for inflows, boasting growth of $102m on Friday, and $57m on Tuesday

- Other funds also added considerable capital to their coffers; Bitwise’s BITB and ARK’s ARKB both experienced over $40m inflows on Tuesday

- Spot Ether ETFs continued underperforming their Bitcoin brethren, logging (very) modest inflows on Friday before a continuous run of outflows this trading week

- BlackRock’s ETHA led the way with numerous inflow days throughout the week, albeit all at sub-$5m levels

- Grayscale’s converted ETHE trust (trading with a 2.5% fee) kept up its general trend of post-launch outflows, but a silver lining is that these daily flows shrunk below $20m this week, as compared to $40m and $50m outflow days earlier in the month

- Further afield, there may be some innovations afoot in the Ether ETF space; speaking at the Token2049 summit in Singapore, Blockdaemon VP Andrew Vranjes revealed his firm was working with Hong Kong regulators on inclusion of Ether staking for ETFs

- Vranjes stated “It wouldn't surprise me if we saw an announcement around Ethereum staking for ETFs in Hong Kong before the US, for example. That would not surprise me”

- In other ETF news, a new leveraged ETF based on the performance of popular Bitcoin proxy MicroStrategy debuted this week, to “legit volume right off the bat”

- The T-REX 2X Long MSTR Daily Target ETF exceeds the 1.75X leverage of the original MicroStrategy-based ETF from issuers Defiance; and according to Bloomberg’s chief ETF analyst Eric Balchunas, the new 2X product is already performing within the top 1-2% of new ETF launches

- Meanwhile, DBS (Singapore’s largest bank) opened up Bitcoin and Ether options trading and structured notes for institutional and wealth management clients

What happened: Political news

How is this significant?

- Digital asset reporting continued to feature in coverage on both sides of the US presidential race, albeit with a greater focus on the Republican side of the aisle this week

- In a live Spaces session on X (formerly Twitter), Donald Trump and several of his sons shared some details (to an extent) about their new DeFi venture, World Liberty Financial

- According to discussion in the Spaces, the firm will issue its own WLFI token, providing governance rights within the platform

- In the whitepaper for the project, Donald Trump was listed as “chief crypto advocate”, Eric and Donald Jr as “Web3 ambassadors, and Barron Trump (absent from the Spaces) as “chief DeFi visionary”

- In the US, the platform will only be available to accredited investors—but some industry analysts are already cautioning against exposure, citing the DeFi experience (or lack thereof) of those behind the platform, as well as incentives to raise lots of money fast; warning it could be a “pump and dump” or “rugpull”, as the tokenomics structure gives an outsized allocation to the Trump family and project team

- Trump stressed during the broadcast that the US must take a leadership role within the digital asset space; “If we don’t do it, China is going to do it. China is doing it anyway. But if we don’t do it, we’re not going to be the biggest, and we have to be the biggest and the best”

- Later in the week, Trump became the first (former) US president to make a payment via Bitcoin (via the Lightning Network scaling solution), paying the tab for patrons in Greenwich Village’s Pubkey Bar

- Asked about the payment, Trump said “very easy. It goes quickly and beautifully”

- The Bloomberg Voternomics podcast noted that whilst Trump has made overt overtures towards the industry, the Harris campaign has yet to really say anything specific regarding digital assets

- Former Trump press secretary (and hedge fund millionaire) Anthony Scaramucci said during the Token2049 summit that he and other crypto advocates were working to direct the Harris campaign away from Gary Gensler, perceived as an enemy to the industry

- For those who do believe the SEC is politicised against crypto, there may have been some vindication this week, as the agency was forced to admit that terminology it has used to prosecute the industry doesn’t actually make sense

- The SEC extensively litigated against firms citing crypto-asset securities, suggesting tokens are inherently securities; but following a string of legal losses now “regrets any confusion it may have invited” through the term

- Ripple's chief legal officer Stuart Alderoty tweeted "the SEC finally admits that 1/ ‘crypto asset security’ is a made up term and 2/ to prove a ‘crypto asset security’ is an investment contract, the SEC needs evidence of a bundle of "contracts, expectations, and understandings"? Think it's time for the SEC to admit it has become a twisted pretzel of contradictions"

- Scaramucci also predicted that “We are going to get pro-cryptocurrency, Bitcoin, and stablecoin legislation in the first part of the next congressional term in the US”, expressing optimism for the sector under a potential Harris presidency

- Speaking at the same panel, Circle CEO Jeremy Allaire stressed his belief that digital assets are inherently non-partisan

- He said “Circle is purple, and crypto is purple [i.e. a combination of Republican red and Democrat blue]. This is technology, and this technology keeps getting built and the innovation around it is global… Technology does not care about politics. It doesn’t matter who wins the presidential election”

- Elsewhere globally, Sony was identified as the latest in a long line of Japanese businesses pushing for greater blockchain adoption—putting pressure on the national government for more integration of the technology

- According to Bloomberg, other Japanese conglomerates “exploring various blockchain-related initiatives include the likes of Nippon Telegraph & Telephone [NTT], Toyota, and Mitsubishi UFJ Financial Group Inc [Japan’s largest bank]”

- However, as prime minister Fumio Kishida’s tenure nears its end, it remains as-yet uncertain whether his successor will prove a similarly strident supporter of the Web3 industry within Japan

What happened: Stablecoin news

How is this significant?

- Several more major stablecoin stories hit the headlines this week, as adoption of the unique crypto subclass continues to gain momentum

- Two Coinbase and Circle alumni launched a new exchange this week—using PayPal’s proprietary PYUSD stablecoin as its “preferred token for transactions”

- The TrueX exchange will be stablecoin-native and institutionally-focused, leveraging the growth of stablecoins as a means for institutions to shield themselves from volatility between transactions

- Co-founder Vishal Gupta said the team’s experience provides a compelling proposition for institutional investors seeking crypto exposure; “Our goal is to continue to innovate in the market space… who better to do it than a team who has built many matching engines, who have run broker dealers, have worked at Goldman Sachs, launched one of the largest stablecoins in the world and run one of the biggest crypto exchanges in the world?”

- According to sources, e-banking giant Revolut is developing its own stablecoin, following in the footsteps of corporate stablecoin issuer PayPal

- A spokesperson told industry publication Coindesk that the licenced bank wants to expand its crypto services within a compliance-first strategy, adding “Crypto is a big part of our belief in banking without borders and we have a clear mission to become the safest and most accessible provider of crypto asset services”

- Wyoming continued educational efforts on its proposed state stablecoin, scheduled for release in 2025

- The state is investing $5.8m in the project, with the aim of reducing costs to businesses from payment processors; “according to Anthony Apollo, executive director of the Wyoming Stable Token Commission, credit card purchases typically cost merchants around 2% in swipe fees charged by banks and card networks like Visa and Mastercard. But, the average cost per transaction on public blockchains is fractions of a penny”

What happened: BlackRock releases new report on Bitcoin as “unique diversifier”

How is this significant?

- BlackRock, the world’s largest asset manager, this week published a report dubbing Bitcoin “a unique diversifier”, featuring contributions from several senior executives

- The authors stated that whilst Bitcoin may be viewed as “risky” on a standalone basis, “most of the risk and potential return drivers Bitcoin faces are fundamentally different from traditional ‘risky’ assets, making it unfitting for most traditional finance frameworks – including the ‘risk on’ vs. ‘risk off’ framework employed by some macro commentators”

- Additionally, they identified it (echoing CEO Larry Fink) as a potential “flight to safety”, given its “nature as a scarce, non-sovereign, decentralised global asset”

- BlackRock notes that Bitcoin outperformed all major asset classes in seven of the last ten years

- Its finite nature could become increasingly compelling as narrative around US national debt and monetary policy come into focus, boosting “the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the US Dollar”

- The report also showcased Bitcoin’s comparative strength (versus the S&P 500 and gold) in times of major geopolitical uncertainty

- Bitcoin was the only listed asset with three positive 10 day performances after seven listed events, and five positive performances 60 days after the events (a statistic which actually reflected positive performance in five out of six events, since the 60 day deadline for the Yen carry trade crisis hasn’t been reached)

- This included major outperformance; the best 60D reaction from the S&P500 was 12% after US election challenges in November 2020; a timeframe when Bitcoin posted its best 60D return of 131%

What happened: Dragonfly raising new $500m crypto VC fund

How is this significant?

- Digital asset-centric venture capital firm Dragonfly re-entered the funding arena this week, announcing the goal of $500m for a new crypto raise

- This is the firm’s fourth fund, with half the desired amount already pledged by investors

- The firm has already invested in over 100 digital asset projects, and its previous fund, raised at the height of crypto VC activity in 2022, was worth $650m, indicating ongoing caution and consideration around inflated valuations compared with the previous bull run

- Speaking at the ongoing Token2049 summit in Singapore, general partner Robert Hadick said “The market today is a lot healthier than it was last year, the year before… we’ve seen this uptick in venture capital funding this year that I think is going to serve us really well going into next year”

- He identified tokenisation and stablecoins as a particular area of growth within the industry, with plans for the new fund to focus on the infrastructure side of blockchains

- In other VC news, asset managers Borderless Capital announced the successful conclusion of a third raise focused on decentralised physical infrastructure (DePIN)

- DePIN “refers to physical infrastructure networks built using blockchain technology and token incentives which other projects can use without having to buy and run their own equipment”

- The $100m fund included contributions from the Solana Foundation and Jump Crypto, according to a spokesperson

- Borderless Capital partner Alvaro Garcia commented on the category’s potential; “DePIN will become the global standard for deploying physical infrastructure, coordinating human resources, and generating billions in passive income while at the same time providing easy access and lower cost for the users”

- Moody’s appeared to agree, publishing a report praising DePIN’s potential for improved network efficiencies, but cautioning that “there are significant obstacles to widespread adoption, including regulatory and interoperability issues, cybersecurity risks and the need for substantial investments in infrastructure and skills”

What happened: MicroStrategy makes largest Bitcoin purchase since 2021

How is this significant?

- Enterprise software firm MicroStrategy—the largest corporate holder of Bitcoin—recently completed a $1.1bn Bitcoin acquisition, its largest purchase since 2021

- 18,300 Bitcoin were added to the firm’s reserves between August 6th and September 12th, according to a new SEC filing

- This brings the firm’s total holdings to around 244,800 Bitcoin, with an average purchase price just under $38,600

- However, this doesn’t appear to have stilled chairman Michael Saylor’s appetite; on Monday MicroStrategy announced a new $700m convertible senior note issuance (due 2028) to redeem secured senior notes and fund the purchase of more Bitcoin

- As a leading advocate of Bitcoin reserves on corporate balance sheets, MicroStrategy has long been treated as a proxy to direct Bitcoin exposure (particularly before the launch of spot ETFs earlier this year)—its shares have doubled since the turn of the year alongside a resurgent Bitcoin

What happened: Blockchain analytics suggest Bhutan holds considerable Bitcoin reserves

How is this significant?

- The small Himalayan nation of Bhutan is probably more connected with its unique Gross National Happiness development strategy than digital assets—but new data suggests it may in fact be a major beneficiary of Bitcoin

- According to blockchain analytics firm Arkham Intelligence, Bhutan has one of the largest state-owned Bitcoin stashes in the world, via the country’s investment arm Druk Holdings

- The address associated with Druk Holdings has over 13,000 Bitcoin (placing it fourth in national terms), worth nearly $820m at the time of writing

- Druk itself has identified “digital assets” as a key focus area within a tech-driven investment strategy

- As a mountain nation of under 800,000 inhabitants, this represents a significant value in comparison to its annual GDP of under $2.8bn

- Unlike other nations (excluding El Salvador), Bhutan’s Bitcoin bonanza doesn’t come from asset seizures, but rather direct generation; the country has leveraged its hydroelectric power surplus to build numerous Bitcoin mining facilities

- Bhutan began its Bitcoin mining operations back in 2019 according to reports in local papers, when Bitcoin was only valued around $5,000

- This decision was particularly helpful when the Coronavirus pandemic disrupted tourism, a major source of income for the kingdom

- In May last year, the country sought $500m to expand its mining operations, concluding the funding this July

- In other Bitcoin mining news, miners Cathedra have adopted a strategy of increasing Bitcoin per share by reallocating processing power towards data centres, and using the profits to directly purchase Bitcoin

- In a post-halving landscape of lower block rewards, Cathedra executives believe that “By repositioning the company away from the Bitcoin mining business, toward one with more predictable cash flows and which generates attractive returns on capital—developing and operating data centres—... will enable Cathedra to generate meaningful growth in Bitcoin per share over time”

What happened: Swiss stock exchange explores crypto exchange venture

How is this significant?

- The FT reported this week that SIX—Switzerland’s national stock exchange—is currently “exploring the creation of a venue in Europe for trading crypto assets”

- Bjørn Sibbern, global head of exchanges at SIX Group, told the Financial Times “Crypto has become more and more a recognised asset class… [we’re exploring] a platform where we can help facilitate trading, whether it’s [spot] crypto or whether it’s derivative”

- Switzerland’s developed infrastructure and regulations regarding digital assets could be a major selling point, as Sibbern said “We are looking at other ways for us to expand in Europe and as a part of that, we are also looking at [whether] crypto should be a part of it”

- He added that these considerations were all directly demand-driven, as “We see the trend that more and more global banks and institutions are looking at crypto”