Market Overview

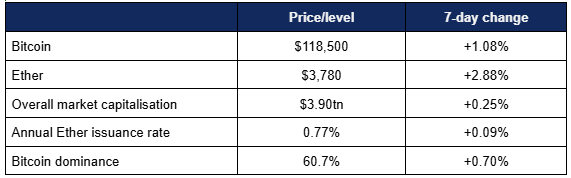

- Bitcoin predominantly traded in a relatively narrow range this week as profit-taking from recent record highs continued to stifle any momentum for further breakouts above $120,000 levels

- Bitcoin spent the majority of the week between around $117,600 and $118,800, briefly breaking above $120,000 again for a Wednesday peak of $120,240, before a short-lived weekend dip down to $114,970 (still well above pre-July records) on Saturday

- Ether cooled off somewhat after an historic performance last week, but still continued its growth pattern, briefly approaching the $4,000 mark before pulling back

- Ether experienced volatile early trading before moving back into bullishness from Friday onwards, rising from a Thursday low of $3,538 to highs of $3,940 on Monday

- Altcoins surrendered most of their recent gains after some set records last week, as investors either took profit, hedged ahead of interest rates announcements, or rotated directly into Ether due to stablecoin category momentum

- Overall industry market capitalisation remained nearly unchanged, as losses in stablecoins counteracted minor gains from Ether and Bitcoin

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew slightly to $140bn, reaching a three-year high thanks to recent Ether appreciation

Digital assets had a comparatively sedate week after a run of historic performances, but nonetheless managed to post modest growth. Tokenisation came to the fore once more as Goldman Sachs and BNY announced a new money market project, Ether ETFs outperformed spot Bitcoin funds, one of the masterminds behind BlackRock’s dive into digital assets moved to a crypto treasury firm, stablecoin development continued, Christie’s launched a new division for digital asset real estate deals, and much, much more.

What happened: Goldman Sachs and BNY team up in tokenisation drive

How is this significant?

- Tokenisation gained attention once again this week, as banking giants Goldman Sachs and BNY Mellon revealed collaboration on the tokenisation of money market funds

- BNY announced on Wednesday that it would offer institutional investors tokenised versions of its money market fund share classes through its LiquidityDirect platform, with transactions and ownership recorded on Goldman Sachs Digital Asset Platform’s blockchain (GSDAP)

- In a statement, BNY said it would also “maintain the official books, records and settlements for the funds within currently approved guidelines”

- Mathew McDermott, global head of Digital Assets at Goldman Sachs commented “Using tokens representing the value of shares of money market funds on GS DAP would enable us to unlock their utility as a form of collateral and open up more seamless transferability in the future”

- Laide Majiyagbe, BNY’s global head of liquidity, financing and collateral, added in a CNBC interview that “The step of tokenising is important, because today that will enable seamless and efficient transactions, without the frictions that happen in traditional markets”

- BlackRock, Dreyfus, Federated Hermes, Fidelity, and Goldman Sachs will all participate in the launch

- JP Morgan analysts wrote in a client note that the move is a “significant leap forward” for the $7tn money market industry

- JPM strategist Teresa Ho explained “The true takeaway from this is beyond the typical way we see money funds being used as a cash management asset class—they can now use it as collateral… you can post money-market shares and not lose interest along the way. It speaks to the versatility of money funds”

- In a report last year, McKinsey estimated that the tokenisation market could reach $2tn by 2030

What happened: ETF News

How is this significant?

- Digital asset investment products logged a fifteenth straight week of inflows, making July the best-ever month for ETFs even before Monday’s opening bell

- According to Coinshares data published on Monday, crypto asset funds accrued $1.9bn inflows in the trading week ending Friday the 25th

- This was down considerably from the previous week’s record $4.39bn inflows, but featured an historic event; Ether funds outperforming Bitcoin funds for the first time

- Ether accounted for $1.59bn of the total inflows, as the asset’s institutional appeal continues to rise following successful stablecoin legislation in the US

- This equates to Ether’s second-best week on record

- There was also strong performance for investment vehicles of other digital assets such as Solana and XRP, which Coinshares chief of research James Butterfill believes indicates anticipation of future altcoin ETF approvals

- Spot Bitcoin ETFs logged below-average inflows as Ether stole the spotlight and recent record highs led to continued profit-taking

- The week’s trading painted a mixed picture; three days of outflows followed by two days of inflows

- Outflows ranged from $68m to $131m, and were led by Fidelity’s FBTC, which surrendered $227m on Wednesday

- The next-largest outflows came from ARK Invest’s ARKB ($78m on Monday) and Grayscale’s GBTC ($51m on Friday)

- When trading turned bullish on Thursday and Friday, funds added $227m and $131m respectively, maintaining another green weekly candle for spot ETFs

- BlackRock’s IBIT had the week’s largest inflows at $143m, followed by $107m by Fidelity’s FBTC

- Speaking about the impact of Bitcoin ETFs, Bloomberg chief ETF analyst Eric Balchunas wrote “Since BlackRock filing Bitcoin is up like 250% with much less volatility and no vomit-inducing drawdowns. This has helped it attract even bigger fish and gives it fighting chance to be adopted as currency… You could almost divide bitcoin’s history into two eras: BE and AE. Before ETF and After ETF”

- Spot Ether ETFs continued their run of uninterrupted nine-figure inflows, as daily performances ranged between $231m and $534m

- BlackRock’s ETHA and Fidelity’s FETH were responsible for the lion’s share of these flows, as each boasted multiple days of nine-figure inflows

- The best performance closed out the week, as ETHA accrued $440m inflows

- Only one fund experienced outflows above $1m; Grayscale’s converted ETHE fund, which is hamstrung by its 2.5% management fees (at least ten times above any other funds’ fees)

- ETHA hit $10bn AUM within a year of launch, making it the third-quickest ETF of all time to reach that figure—after Bitcoin ETFs IBIT and FBTC

- Balchunas pointed out “Amazingly ETHA went from $5bn to $10bn in just ten days (the ETF asset equivalent of a God candle)”

- Elsewhere in ETFs, the SEC approved (but paused launch of) crypto index ETFs from Grayscale, and several issuers filed to allow in-kind redemption of their Bitcoin and Ether ETFs

What happened: Ether treasury firm hires BlackRock executive as new CEO

How is this significant?

- SharpLink Gaming, the company which recently pivoted towards a strategy of forming the largest Ether treasury in the world, has headhunted BlackRock for its new (co-)CEO

- Joseph Chalom, BlackRock’s former head of digital asset strategy, will initially work alongside incumbent SharpLink CEO Rob Phythian, before the latter transitions to a new role as president according to a press release

- SharpLink chairman (and Ethereum co-founder) Joseph Lubin commented “Few executives in the world have had the kind of impact Joseph has had in unlocking institutional adoption of digital assets, having pioneered BlackRock’s strategic entry into the space”

- Chalom is a two decade veteran of BlackRock, and helped lead the companies push into digital assets and crypto ETF launches

- Lubin added “His decision to join SharpLink is a resounding validation of our ETH treasury strategy and vision for Ethereum to drive profound, transformative change across the global digital economy”

- The shift towards an Ether strategy appears to be paying off for SharpLink thus far, with shares up around 180% year-to-date

What happened: Hedge fund billionaire Ray Dalio recommends 15% Bitcoin allocation

How is this significant?

- Speaking on this week’s CNBC Master Investor podcast, hedge fund billionaire Ray Dalio advised investors to increase their allocations towards both gold and its digital equivalent; Bitcoin

- He argued that western economies are too complacent about government borrowing, and that assets like gold and Bitcoin should act as “an effective diversifier” against possible currency crashes

- Dalio, founder of Bridgewater associates, commented that “If… you were optimizing your portfolio for the best return-to-risk ratio, you would have about 15% of your money in gold or Bitcoin”

- Whilst he said that he personally preferred gold, it’s “up to you” which of the two options investors could choose, and he personally does own “some” Bitcoin

- Outlining his thesis further, he explained “The issue is the devaluation of money, [which has happened] in times of excess debt and geopolitical problems. Just go back and study history, study the British pound, study the Dutch guilder—you would find that in all such periods [of currency devaluation, gold] is an effective diversifier”

- In other news around hedge funds and digital assets, David Bailey’s 210k Capital posted a 640% net annual return recently “after investing in about a dozen companies that turned themselves into Bitcoin buyers” according to Bloomberg sources

- President Trump credited Bailey with turning him into a digital asset believer, and 210k has leveraged the recent rise in appetite for crypto as a treasury asset in order to deliver outsized returns

What happened: Stablecoin news

How is this significant?

- Development in the stablecoin category continued apace following the recent passage of the GENIUS stablecoin act

- Federally-chartered bank Anchorage Digital will launch a stablecoin issuance platform following increased enthusiasm around the assets due to the new political reality of regulation

- Synthetic dollar issuers Ethena Labs will be the inaugural clients of the platform, according to a press release announcing their partnership

- Ethena’s USDtb, predominantly backed by BlackRock’s onchain money market fund BUIDL, will be issued through the Anchorage platform to comply with GENIUS regulations

- Anchorage CEO Nathan McAuley stated “The passage of the GENIUS Act provides the regulatory clarity that enables federally regulated institutions like Anchorage Digital Bank to fully participate in the stablecoin ecosystem”

- Ethena co-founder Guy Young commented “While we’ve already seen strong demand for USDtb, we expect GENIUS compliance to empower our partners and holders to significantly expand its use across new products and platforms”

- Tether CEO Paolo Ardoino indicated that the firm—which relocated its headquarters from the US to El Salvador earlier this year—is formulating its new US strategy following GENIUS

- He told Bloomberg TV “We are well in progress of establishing our US domestic strategy. It’s going to be focused on the US institutional markets, providing an efficient stablecoin for payments but also for interbank settlements and trading”

- Tether is the largest stablecoin by market capitalisation, but has faced criticism over a lack of transparency, publishing attestations rather than audits; operating within the US could allay these fears

- Meanwhile, bank technology provider Fidelity National International Services (FIS) partnered with Tether’s largest competitor, USDC issuer Circle

- The partnership will “offer financial institutions the ability to conduct transactions using Circle’s stablecoin”, with a particular focus on cross-border payments

- FIS corporate strategy head Himal Makwana stated “This time it’s no longer a fringe thing, it’s becoming foundational to all parts of financial services… [stablecoins are] much more mature and grounded in actually solving client-end problems”

- Speaking of cross-border payments, remittance giant Western Union is considering stablecoin integration, according to a Bloomberg interview with CEO Devin McGranahan

- Western Union’s chief executive said “We see stablecoin really as an opportunity, not as a threat. We’re 175 years old, and we’ve been innovative across [those] 175 years. And stablecoin is just yet one more opportunity to innovate”

- He identified three key benefits of stablecoin adoption; “faster cross-border transfers, facilitating conversion between stablecoins and fiat currencies, and offering a store of value for customers in volatile economies”

- Standard Chartered’s Zodia Markets raised $18.25m in a Series A funding round, to fuel international expansion and improve stablecoin capabilities

- CEO Usman Ahmad commented that stablecoins could “reengineer traditional foreign exchange capital flows with real time stablecoin settlement across borders… Institutional capital shouldn’t have to wait for banking hours or be held back by manual workarounds”

- However, JP Morgan counselled that exuberance around the stablecoin market may be slightly irrational; particularly regarding Treasury Secretary Scott Bessent’s recent $2tn market forecast

- In a new client note, analysts led by Teresa Ho argued “We find it hard to believe that the market could grow substantially larger over the next few years as the infrastructure/ecosystem that supports stablecoins is far from developed and will take time to build out. While adoption is poised to grow further, it might be at a slower pace than what some might anticipate”

What happened: Ghana licences crypto firms amidst surging demand

How is this significant?

- Ghana became the latest country to move towards digital asset regulation this week

- The nation’s central bank is creating a framework for government by September, according to governor Johnson Asiama

- He argued that the draft law “will allow the nation to leverage crypto assets, boost cross-border trade, attract strategic investment and collect financial data”

- Ghana’s real rate (the spread between policy rate and inflation) is currently at its highest rate in 20 years, boosting the appeal of digital assets for citizens as a potential inflation hedge

- Asiama commented “We are actually late in the game… Many of the country’s economic agents make and receive payments in cryptoassets but they are not being captured in the nation’s financial accounts because of the absence of regulatory oversight… it has implications for the local currency”

What happened: Christie’s opens real estate purchases via crypto

How is this significant?

- According to the New York Times on Thursday, Christie’s International Real Estate is launching a new division dedicated entirely to realising property deals in digital assets

- The move “follows several high-profile deals, including a $65 million Beverly Hills transaction where crypto was used exclusively”

- Christie’s new division will allow privacy-conscious high-end clients to execute deals directly in a peer-to-peer manner, without relying on banks as intermediaries for the transactions

- Division chief Aaron Kirman believes that digital assets could feature in a third of US real estate deals within the next five years, following recent statistics claiming that 14% of Americans own crypto

- Kirman claims the new brokerage’s property listing portfolio accepting digital assets is currently valued at $1bn, including a marquee $118m Bel Air property

- Although this may be the first enterprise aimed at the intersection of luxury real estate and digital assets, it isn’t the first meeting of property and crypto

- Last month, Freddie Mac and Fannie Mae were ordered to consider crypto in the asset calculations for mortgages, and San Francisco real estate firm Madison Hunter offers Bay Area buyers 0.5% of a property’s purchase price back in Bitcoin

What happened: PNC bank partners with Coinbase for customer crypto access

How is this significant?

- PNC, one of the ten largest banks in America, agreed a deal with crypto exchange Coinbase this week, to provide banking clients access to digital asset services

- According to a press release announcing the partnership, “PNC and Coinbase will work together to develop an initial offering that will allow clients to buy, hold and sell crypto assets”

- The bank’s CEO William S. Demchak stated “This collaboration enables us to meet growing demand for secure and streamlined access to digital assets on PNC’s trusted platform”

- In an interview, head of treasury management Emma Loftus added that the deal was driven by direct demand; “This partnership with Coinbase enables us to explore where we think the market holds the most promise, where there’s the most demand and frankly where our clients are really most interested in”

- She added that, in light of recent regulatory progress, “it makes sense for us to prioritise this now” and the services will probably be rolled out to wealth management clients first before a broader deployment

What happened: PayPal expands crypto payment options for US-based merchants

How is this significant?

- Payment processing giant PayPal extended its crypto capabilities further this week, allowing US merchants to accept 100 different digital assets as payment

- The new Pay With Crypto service will allow customers to use a variety of crypto assets and wallets, including third-party interfaces like Coinbase wallet and the Metamask browser extension

- CEO Alex Chriss said that digital assets are a powerful tool for supporting businesses internationally; “Businesses of all sizes face incredible pressure when growing globally, from increased costs for accepting international payments to complex integrations”

- In its press release, PayPal wrote “Businesses around the world lose billions annually in cross border fees while navigating a complex banking system… with a transaction rate of 0.99%, Pay with Crypto decreases the cost of transactions by up to 90% when compared to international credit card processing”

- Chriss argued that through crypto, businesses and users can “increase their profit margins, pay lower transaction fees, get near instant access to proceeds, and grow funds stored as PYUSD at 4% when held on PayPal”

- After customers make a payment via crypto, the assets will automatically be converted into fiat or stablecoins before transfer to the merchant, including PayPal’s own proprietary PYUSD stablecoin

- PayPal has one of the most significant histories with digital assets of any corporation, arguably kicking off institutional adoption in 2020, when it first allowed customers to buy, hold, or sell crypto directly from their PayPal accounts

What happened: US crypto ownership increases eight-fold since 2018

How is this significant?

- According to a new survey by US polling giants Gallup, digital asset ownership in the United States has increased substantially over the last few years, growing more than eight-fold since 2018

- Current crypto ownership rates among investors (with allocations above $10,000) within the US sit at 17% according to the poll, up from just 2% in 2018

- Looking back to the previous bull run in 2021, only 6% of investors owned digital assets,meaning ownership rates have nearly tripled in the last four years

- This compares to 14% ownership within the general population, indicating rising popularity of the asset class amongst institutional rather than just retail investors

- Currently, around 60% of adults own stocks or real estate, showcasing more room for growth as an investment class for crypto

- Demographically, digital assets are most popular amongst men between 18 and 49 (25% ownership), college graduates, and high income earners

- However, 55% of investors in the survey still considered digital assets “very risky”

What happened: Crypto Treasury news

How is this significant?

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) didn’t report any purchases this week, holding steady at 607,770 Bitcoin on its balance sheet

- However, it did sell $2.5bn of variable-rate preferred stock, likely earmarked to finance further future Bitcoin acquisitions

- The firm’s new so-called “Stretch” stock offers 9% annual payouts

- Japanese AI firm Quantum Solutions revealed plans for a 3,000 Bitcoin treasury over the next year

- These investments will be executed by a Hong Kong-based subsidiary, as the company decided on Bitcoin reserves “in order to efficiently manage surplus funds generated from existing businesses, diversify our asset portfolio to strengthen our financial base, preserve value over the medium- to long-term, and reduce foreign exchange risks”

- Compatriot firm Metaplanet brought its Bitcoin holdings to $2bn, following a $92.5m buy

- BitMine Technologies, dubbed “The MicroStrategy of Ethereum” increased its Ether holdings to around $2bn

- Cathie Wood’s ARK Invest evidently supports BitMine’s thesis, buying $182m worth of company shares

- CEO Tom Lee revealed in a press release that the firm aims to hold and stake around 5% of total Ether supply

- Competing Ether treasury firm SharpLink meanwhile purchased $295m of Ether, bringing contemporary holdings to around $1.7bn

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.