July 19th, 2024

Market Overview:

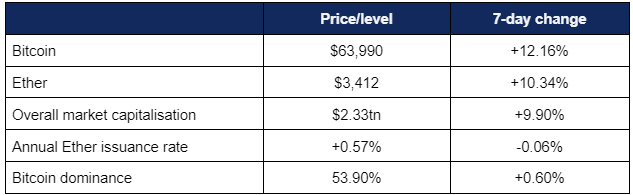

Digital assets staged a strong recovery from recent declines, as consistent ETF inflows and news around Ether ETFs combined with political optimism for the sector.

- Bitcoin built significantly on last week’s recovery, displaying a steady upward trajectory throughout the week en route to double-digit growth

- Bitcoin rose from from a Friday low of $56,810 to a weekly peak of $66,070 on Wednesday

- However, Bitcoin was unable to sustain prices above the $66,000 level and swiftly pulled back into the $61,000 to $64,000 range

- Bitcoin’s current price now sits at levels last seen in late June, after the early-July decline saw it back down to February levels

- Ether performed similarly, bouncing from a Friday low of $3,052 to $3,506 on Wednesday, before dropping down slightly into the $3,300 to $3,400 range

- Overall digital asset market capitalisation gained over $200bn for a current value of $2.33tn

- A second week of recovery boosted the crypto industry fear/greed index from “fear” territory back into “neutral” sentiment at 57/100

- This overall market bullishness included strong performances by numerous altcoins, including Ripple’s XRP

- According to industry monitoring site DeFi Llama, total value locked in DeFi remained increased by over $9bn to 97.3bn

Digital assets built on last week’s recovery with even more bullish momentum, fuelled by positive news in the ETF space (from both Bitcoin and Ether products) and increased optimism around political prospects. Elsewhere, Larry Fink praised Bitcoin on CNBC, State Street moved into stablecoin development, a VC began raising for a new $500m Web3 fund, and much more.

What happened: ETF news

How is this significant?

- Bitcoin ETFs traded strongly this week, registering a ninth consecutive day of inflows

- This included $422.5m total inflows on Tuesday, the largest intake since June 5th

- BlackRock’s IBIT performed particularly powerfully, posting four consecutive days of nine figure inflows; ranging from $110m to $260m

- Fidelity’s FBTC also managed a nine-figure inflow day, taking in $115m on Friday

- Other notable performances included Bitwise ($28.4m) and ARK ($29.8m), as all issuers excluding WisdomTree—including Grayscale’s historically outflow-prone GBTC—registered at least one day of inflows

- Overall, crypto investment products saw $1.44bn in inflows for the week ending July 12th, of which Bitcoin products accounted for $1.35bn, according to CoinShares data

- This marked the fifth-largest weekly inflow on record

- Bloomberg senior ETF analyst Eric Balchunas identified current Bitcoin ETF performance as “two steps forward mode” after recent declines were seen as “one step back”

- Despite this strong Bitcoin ETF performance, reporting was dominated by news around imminent spot Ether ETFs, as three issuers indicated trading will begin on Tuesday July 23rd

- The news led to a wide range of analyst predictions on possible Ether performance; K33 Research forecast that it would mirror Bitcoin’s post-ETF behaviour (falling immediately after launch as a “sell the news” reaction before recovering strongly) whilst Citigroup estimated $4.7bn to $5.4bn inflows within the first six months

- By comparison, spot Bitcoin ETFs have accrued nearly $16bn of inflows in the same timeframe

- A new batch of (final) S-1 filings also revealed the proposed fee structures of spot Ether ETF issuers; ranging from $2.5% to 0.15%

- Grayscale actually sits at both extremes of the spectrum; its converted Ethereum Trust will likely mirror GBTC’s performance, cashing in money from its high 2.5% fee whilst bleeding AUM $9bn of Ether it holds

- However, Grayscale will also spin off 10% of its existing trust into a “mini ETF”, with the lowest fees at 0.15%

- BlackRock, Fidelity, and Invesco all sit at around 0.25% fees, whilst Franklin has the lowest fees of TradFi issuers at 0.19%

- However, all issuers are also enticing early customers with reduced early fees (or complete waivers) between the first six and twelve months of trading

- Industry analyst Noelle Acheson urged caution around potential performance of the products, noting that SEC limitations could hamstring their appeal; “after all, the ETFs won’t be distributing staking rewards, which essentially makes the opportunity cost of holding these products quite high”

- FRNT Financial CEO Stephane Ouellette echoed her sentiments, noting that Canadian spot Ether ETFs underperformed their Canadian spot Bitcoin counterparts after launching way back in 2021

- SEC commissioner Hester Peirce (a noted pro-crypto voice in the agency) identified staking “or any feature of the product” as “open to reconsideration” in the future, alongside the possibility of in-kind redemption for Bitcoin ETFs

- Kraken head of strategy Thomas Perfumo still identified the upcoming launches as “a big deal”, telling Bloomberg “that brings a lot of attention on crypto again, it brings a lot of capital flows; it’s a ‘rising trend lifts all boats’ story”

- In addition, Direxion announced two new long and short ETFs based on an index of the crypto industry as a whole, with the meme-friendly tickers $LMBO (Lamborghini) and $REKT (wrecked)

What happened: Larry Fink describes Bitcoin as “legitimate financial instrument”

How is this significant?

- In a new CNBC interview, BlackRock CEO Larry Fink continued his ringing endorsement of digital assets, identifying Bitcoin as a “legit financial instrument”

- He also declared himself a “major believer” in the leading crypto asset, marking an evolution in his attitudes around the asset class

- Fink acknowledged “I was a sceptic—a proud sceptic!—and I studied it, learned about it, and I came away saying, you know, my opinion five years ago was wrong”

- He identified its potential role in providing “uncorrelated or non-correlated type of returns”, as well as a status as an instrument “you invest in when you’re more frightened, when you believe countries are debasing their currencies”

- Fink added “I believe there is a role for Bitcoin in portfolios, I believe you’re going to see that as one of the asset classes we all look at, I look at it as digital gold… and I do believe there’s a real need for everyone to look at it as one alternative”

- Bloomberg analyst Eric Balchunas underlined the importance of Fink’s endorsement, saying “Hard to overstate how big a deal it is for Larry Fink, who runs $10.6tn [AUM across BlackRock], to keep giving these full throated endorsements of Bitcoin as legit asset class for everyday portfolios. Buy in from BlackRock—as well as other legacy firms like Fidelity—gives boomer advisors comfort and cover to make the allocation”

What happened: Digital assets benefit from “Trump Trade”

How is this significant?

- One of the biggest global news stories this week outside of the crypto industry was the attempted assassination attempt on former US president Donald Trump at a campaign rally; but the event also appears to have catalysed the industry

- Crypto assets rallied following the news, on the presumed belief that the failed attempt could strengthen his appeal to voters, as Trump is generally viewed to be more pro-crypto than the incumbent Joe Biden

- The shooting occurred shortly after Trump reaffirmed his pro-crypto credentials by being announced as a speaker at the upcoming Bitcoin 2024 conference on July 27th

- Bloomberg report that “Trump has cast himself as friendly to crypto in a bid to court undecided voters, a sharp contrast with Biden administration regulators who remain sceptical of digital assets”, identifying crypto assets and digital asset stocks like Coinbase or Bitcoin miners as potential beneficiaries of a Trump administration

- Analysts believe that the Trump campaign has identified crypto as a “wedge issue”, as campaign advisor Brian Hughes stated “Crypto innovators and others in the technology sector are under attack from Biden and Democrats. While Biden stifles innovation with more regulation and higher taxes, President Trump is ready to encourage American leadership in this and other emerging technologies”

- Republican senator Bill Hagerty told Bloomberg he believes crypto could be a “defining issue” for the election; “I’ve spent a good deal of time with the president talking about this industry and what we see… We have innovative DNA here that goes beyond any other nation. We should capitalise on that”

- According to a new survey conducted by Paradigm VC, “13% of Republicans who were not planning to vote for Trump say his new pro-crypto stance may change their views”

- In a recent Bloomberg Businessweek interview, Trump declared an intention for the US to take a leading role in the industry; “If I throw it aside, it’s going to be picked up in another country, most likely China—they’re pretty advanced in that sphere. So you have to look at it—what I want, again, is what is good for the country”

- This illustrates a dramatic turnaround in Trump’s public views on digital assets—from undermining and calling it “a scam against the dollar” in 2021, to actively accepting crypto donations, meeting with miners, and now addressing “the future of the American Bitcoin industry” in 2024

- The Wall Street Journal reports that crypto donations still represent a small minority of Trump’s overall fundraising; but that figure appears likely to grow, with pro-crypto VC Andreessen Horowitz joining industry heavyweights like the Winklevoss brothers in supporting the Trump campaign

- Trump’s newly-announced VP candidate JD Vance also appears to support the digital asset industry, with Politico reporting that “Vance, who serves on the Senate Banking Committee, hopes to improve on Republican-led legislation [FIT21] that the House passed last month with support from 71 Democrats”

- The Winklevoss brothers donated $1m each to the campaign of John Deaton, a Republican candidate to unseat Senator Elizabeth Warren—one of the most vitriolic crypto critics in Congress—in Massachusetts

- In other political news, the resignation of Senator Bob Menendez was greeted with amusement by some industry analysts

- The senator was a vocal critic of crypto, who alleged Bitcoin was “an ideal choice for criminals”—before being found guilty of corruption and accepting bribes in cash and gold

- Additionally, on the regulatory front, South Korea’s first comprehensive crypto legislation came into effect on Thursday, known as the Virtual Asset User Protection Act

What happened: Bitcoin miner considers sale amidst acquisition interest

How is this significant?

- Cipher, a publicly-listed Bitcoin miner in the US, is currently considering a sale due to high levels of takeover interest, according to Bloomberg sources

- Shares increased almost 20% on Wednesday as the news broke (creating a valuation around $2.2bn), as many Bitcoin miners are currently attractive acquisition targets, due to their prolific processing power also able to support the burgeoning AI industry

- This represents the latest in several recent takeover stories within the crypto mining industry, most notably the (rejected) $1bn offer that CoreWeave made for Core Scientific

- Bitcoin mining did increase in profitability last month according to Jefferies, as decreased mining difficulty (from firms fleeing the space after the recent quadrennial halving event reduced block rewards) combined with rising Bitcoin prices, perhaps creating less urgent incentive for firms to accept buyout offers

- In other mining news, Loka Mining launched a protocol allowing institutional investors to buy future mining rewards at a discount in exchange for (current) operational capital

- Loka founder Andy Fajar Handika noted “We’ve seen tremendous interest from larger investors seeking better ways to access bitcoin, and thanks to [sustainable mining firm] Hashlabs’ supply of hashrate and access to miners, we’re providing that—with no counterparty risk”

What happened: Moody’s credit rating joins Project Guardian tokenisation incubator

How is this significant?

- Credit rating giant Moody’s became the latest major participant in the Monetary Authority of Singapore’s (MAS) ongoing blockchain, crypto, and tokenisation incubator, known as Project Guardian

- In a press release, Moody’s announced it would provide risk analysis in the realm of fixed-income products, “including stablecoins, tokenized deposits, fractionalized funds and other digital asset securities”

- Tokenisation is an area of particular interest for the firm, as its Digital Economy head of strategy Rajeev Bamra told industry publication TheBlock “At its core, tokenisation merges digitalisation with physical assets to redefine traditional asset ownership and transactional frameworks…. tokenisation has the potential to catalyse significant growth”

- He identified several potential benefits of tokenisation, adding “These advancements democratise access to traditionally illiquid assets, enhance transactional transparency, and offer new avenues for fractional ownership and global market participation”

- Fabian Astic, Moody’s Managing Director and Global Head of Digital Economy stated “Project Guardian is a testament to the power of transparency in the financial industry and as we join other leaders in this initiative, we are excited about the potential of tokenization to transform the financial landscape”

- Moody’s is in good company within Project Guardian’s fixed-income development research; industry publication Ledgerinsights reports other participants including “Citi, DBS, JP Morgan, SBI, SGX, Standard Chartered, T Rowe Price and UBS”

What happened: State Street considers stablecoin issuance

How is this significant?

- State Street, the largest custodian bank in the world, is currently exploring the development of its own stablecoin and blockchain settlement mechanisms, according to sources

- Bloomberg reported that alongside a State Street stablecoin, the TradFi titan is “also considering creating its own deposit token, which would represent customer deposits on a blockchain”

- Additionally, the source told them that “State Street is also evaluating joining digital-cash consortium efforts and is looking at settlement options through its investment in Fnality, a blockchain payment startup that’s expanding into the US”

- PayPal has already launched its own proprietary stablecoin, which recently surpassed a $500m market capitalisation, whilst Visa and Mastercard enable blockchain settlement and JP Morgan is developing deposit token mechanisms

- State Street has itself recently been intensifying digital asset adoption; the bank partnered with Galaxy Digital to develop crypto trading products, and declared an intention to begin tokenising ETFs

- In other stablecoin news, Hong Kong’s central bank announced on Wednesday that the city will introduce a licencing regime for stablecoin issuers, following a consultation

- Christopher Hui, secretary of the Financial Services and the Treasury Bureau said this will “further strengthen” Hong Kong’s digital asset regulatory environment, as the latest step in a push to become a global crypto hub

What happened: Morgan Creek Digital seeks $500m for new crypto venture fund

How is this significant?

- Industry publication Coindesk reported on Friday that investment form Morgan Creek Digital (MCD) is currency in the process of creating a new Web3 fund, targeting up to $500m in capital

- According to company spokespeople, the firm is “talking to sovereign and institutional investors, corporate officers, and industry subject matter experts in Europe, the Middle East and Africa (EMEA) and in Asia-Pacific”

- The new fund will focus on international investments across Web3, with co-founder Mark Yusko commenting “With the global reach of Web3, MCD will be spending more time in international markets looking to connect with the best CEOs and partners”

- This fund (if fully subscribed) would more than double the entire $440m that the firm has raised since its founding in 2018

- Additionally, a press release on Thursday revealed that MCD will participate in an accelerator program within Latin America, targeting local Web3 startups across a 12 week timeframe

- In other VC news, blockchain payment network Partior closed a $60m Series B round this week

- The project is a joint venture between Singapore’s DBS, JP Morgan, and Standard Chartered, aimed at “establishing unified blockchain-based interbank payment rails for instant clearing and settlement”

- The Series B round was led by Peak XV Partners, and included participation from Valor Capital Group and Jump Trading Group, alongside existing contributors JP Morgan, Standard Chartered, and Singaporean sovereign wealth fund Temasek

What happened: Payment processor Stripe enables crypto purchases in EU

How is this significant?

- Fintech firm Stripe, one of the world’s largest payment processors, enabled crypto purchases via credit or debit card within the EU this week, according to reports in the Irish Independent newspaper

- Online vendors using Stripe services will be able to add crypto-purchasing widgets to their sites, with Stripe handling all the technological integration

- Stripe Head of Crypto John Egan told the paper “This expansion allows crypto companies to help European consumers buy cryptocurrencies quickly and easily. Now, merchants who rely on Stripe’s onramp for things like conversion optimisation, identity verification, and fraud prevention can reach a more global audience. This lets them focus on growing their business and helping their customers”

- According to its last financial updates, the firm processed over $1tn in payments in 2023, taking its valuation to $70bn

- This is the latest move in a gradual crypto reentry for the firm, which began accepting stablecoin payments in April this year following a six-year hiatus from the industry