December 27th, 2024

Market Overview:

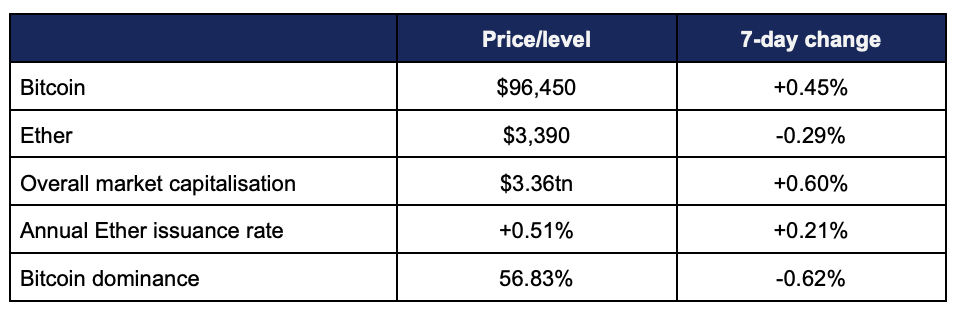

Digital assets experienced interweek volatility during reduced trading around the festive period, before pulling back to end up near-unchanged from the previous week.

- Bitcoin traded across a broad range this week, falling just short of the landmark $100,000 level as trading activity declined during the festive period in the US

- The overall trend this week was one of slight growth, but interweek activity was marked by volatility; rising from a low of $92,280 on Friday, to high of $99,700 on Thursday

- At the time of writing, Bitcoin’s 2024 growth stands at around 128% despite the late decline from new record levels

- Ether displayed similar volatility with a Friday low of $3,101 building to a Saturday peak of $3,548, before ending the week virtually unchanged

- Industry sentiment on the Fear & Greed index pulled back into “neutral” territory at 54/100, as trader caution increased towards year-end

- Overall industry market capitalisation increased slightly to $3.36tn

- Although Bitcoin and Ether logged virtually unchanged performances on the weekly candle, several major altcoins managed double-digit gains, as 12 of the top 20 projects by market capitalisation showcased growth above 10%

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped to $122.5bn

Digital assets traded across a broad range, before recovering to levels slightly beyond last week’s figures. Trading and reporting entered its traditional festive lull as activity wound down during the holiday season. However, there were still several significant developments, including new Trump administration appointments, nine-figure inflows for Ether ETFs, record profits for stablecoin issuers Tether, and more.

What happened: Political news

How is this significant?

- Although political reporting around digital assets calmed down for the festive period, there were nonetheless several significant developments before politicians embarked on their Christmas holidays

- It was reported (via new Financial Services Committee chair French Hill) that the upcoming Congress would prioritise crypto legislation

- He told industry publication TheBlock “Should FIT21 and stablecoin legislation not pass during the lame duck, both bills will be a top priority for me in the 119th Congress”

- Ron Hammond of The Blockchain Association added “We will see a reintroduction of a lot of bills that we are very, very familiar with”

- Elsewhere, incoming president Donald Trump made two more appointments related to the digital asset sphere

- He appointed congressman Bo Hines as as executive director of the Presidential Council of Advisers for Digital Assets, which will be headed by the first-ever “Crypto Czar”, former PayPal executive David Sacks

- Additionally, Michael Kratsios and Lynne Parker were appointed to tech policy roles including a crypto remit, reporting to Sacks

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced truncated trading for the holiday season, with a mixture of large-scale outflows and inflows for Bitcoin products, and consistent inflows for Ether ETFs

- According to CoinShares data published on Monday, digital asset investment product inflows dropped off significantly following hawkish Fed statements, but managed to remain net positive

- Overall inflows in the week ending 20th December stood at $308m, down from over $3bn the week before

- Total year-to-date inflows now stand at $44.8bn

- Spot Bitcoin ETFs bore the brunt of skittish trader behaviour after Jerome Powell’s forecast of fewer rate cuts, with four straight trading days of nine-figure outflows from the 19th to the 24th, before bouncing back with strong inflows on Boxing Day

- BlackRock’s IBIT—the largest fund on the market—experienced the greatest outflows this week, shedding $189m on Christmas Eve

- However, it bounced back with $57m inflows on Thursday, although this was dwarfed by other funds; Fidelity’s FBTC added $254m, and ARK Investments’ ARKB increased by $187m

- Although cumulative trading activity this week (excluding Friday) was marked by overall outflows, Boxing Day’s inflow figures of $475m trumped any single day of outflows

- Bloomberg’s chief ETF analyst Eric Balchunas stressed the incredible performance of Bitcoin ETFs despite a few off-days, telling industry publication DeCrypt “This stuff is an anomaly in physics. There has never been a launch like this, and there will never be another one”

- He added that ETFs brought “excitement, anticipation, opportunity, [and] legitimacy” to the asset class, encouraging many institutions and Wall Street veterans to seek exposure

- ETF Store founder Nate Geraci agreed, saying they “obliterate[d] every ETF launch record out there” and “net inflows into these products has exceeded even my extremely optimistic expectations”

- Spot Ether ETFs outperformed their Bitcoin brethren on a trend-basis, posting inflows every trading day this week, adding $131m, $54m, and $117m

- BlackRock’s ETHA and Fidelity’s FETH dominated inflows, adding $90m and $83m on Monday and Thursday respectively

- Elsewhere in the digital asset ETF complex, the year closed out with late approval for new combo Bitcoin-Ether ETFs from issuers Franklin Templeton and Hashdex, offering exposure based on market capitalisation of the two assets (an approximate 80/20 split)

- Additionally, issuers Bitwise and Strive Financial (co-founded by Vivek Ramaswamy) filed for an ETF investing in companies that have “adopted the Bitcoin standard”

- Bitwise defines this as firms “holding more than 1,000 BTC and meeting basic size and liquidity requirements: a market capitalisation of over $100m, average daily liquidity of over $1m, and a public free float of less than 10%”

What happened: Former Revolut executives launch new crypto trading app

How is this significant?

- Three former high-ranking executives at leading global e-Bank Revolut this week announced a new trading app to make crypto assets more accessible

- Phuc To (former global head of product), Mikael Peydayesh (ex-head of core payments), and Arthur Johanet (previously head of card payments and crypto) decided to branch off from the bank and create Neverless

- The new app is meant to streamline and simplify the onboarding process for new crypto users, including access to lower-liquidity “memecoins”; assets which may flare out quickly, but offer higher potential rates of return due to lower market cap

- Neverless allows direct purchase of crypto via Apple Pay or Google Pay, removing a point of friction across many digital asset exchanges

- Additionally, the app claims to offer “automated trading strategies that revolve around high-frequency arbitrage and market-making”, with the company pocketing a share of the yield generated from the assets as a fee

- Neverless has secured a MiFID license, allowing it to operate within Europe ahead of upcoming MiCA regulations

What happened: Tether logs $10bn net profit in 2024

How is this significant?

- Leading stablecoin issuer Tether closed out a record year by reporting record earnings, as CEO Paolo Ardoino claimed $10bn net profits for 2024

- In an interview, Ardoino stated that (primarily via the USDT stablecoin) the company added $50bn in market capitalisation this year to an overall $140bn

- A key source of earnings has been the backing assets for Tether, including US Treasuries and other securities—so Ardoino may have been one of the few within the industry to greet Jerome Powell’s recent railing against rate cuts with glee

- Ardoino also outlined plans for the firm to grow larger via reinvestment of profits; “Next year we plan to deploy at least half of the profits in investments. Our investment is just at the beginning”

- AI is a particular area of investment focus, with Ardoino tweeting plans about a Q1 deployment for “Tether’s AI platform”

- Details beyond the potential date remain scarce, but Ardoino told industry publication Coindesk “Our upcoming AI platform is just the beginning of a long journey that will see very important investments by Tether in this sector. Tether's focus as always, will remain, building technology solutions that focus on freedom, independence and resilience”

What happened: Singapore pulls ahead of Hong Kong in “crypto hub” race

How is this significant?

- In the battle of two finance-centric city-states courting the digital asset industry, Singapore may have ended the year pulling ahead of regional rival Hong Kong, despite the latter’s strong overtures to the retail sector

- Bloomberg reported that Singapore more than doubled the amount of licences granted to crypto firms this year, issuing 13 to a broad range of global firms, including exchange titans OKX and Korea’s Upbit

- In contrast, Hong Kong currently sits at seven officially-licenced firms, with approvals slower than forecast during early enthusiasm this year which included local ETF launches

- In total, Hong Kong ETFs have accrued around $500m; less than half a percent of the $120bn held by US counterparts

- Whilst Hong Kong recently pledged more licences within its regulatory regime, it nonetheless appears that Singapore currently leads as a regional destination for firms

- As policy advisor Angela Ang of TRM Labs explains “Hong Kong’s regulatory regime for exchanges is more restrictive in a number of ways that matter—such as custody of customer assets and token listing and delisting policies. This may have tipped the balance in Singapore’s favour”

- Ben Rogers of market makers B2C2 told Bloomberg that Singapore’s supportive regulatory regime makes it a “safe, long-term choice” for a “risk-adjusted approach”

What happened: KULR Technologies becomes latest firm in Bitcoin treasury drive

How is this significant?

- American energy management firm KULR Technology became the latest firm to adopt Bitcoin as a treasury asset this week, purchasing a symbolic $21m worth (reflecting the code-based maximum supply of Bitcoin)

- In a press release, KULR stated the buy was part of its “Bitcoin Treasury strategy… allocating up to 90% of its surplus cash to Bitcoin”

- It added that ”the $21 million of BTC purchased since the announcement is the first of ongoing purchases the Company intends to make going forward”

- In total, this first buy accounted for 217.18 Bitcoin, at an average price of $96,556.53 per BTC

- This news was greeted enthusiastically by the market, as KULR shares increased almost 40% to reach a new all-time high following the press release

- KULR now joins several other American firms in recent major Bitcoin purchases; most prominently amongst them MicroStrategy, Bitcoin miners including Marathon Digital and Hut8, and firms beyond the crypto industry including Semler Scientific and Japan’s Metaplanet (which recently became Asia’s second-largest corporate holder of the asset following a record 620 Bitcoin purchase)