February 25th, 2025

Market Overview:

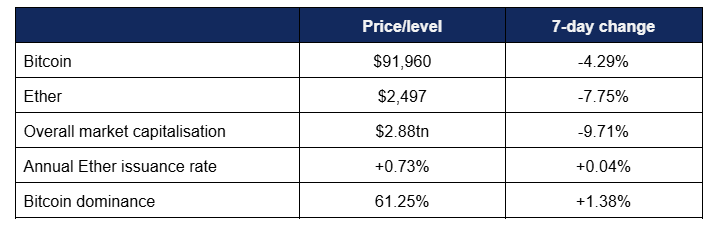

Digital assets experienced losses as continued macroeconomic challenges were compounded by profit-taking and derisking following the largest exchange hack ever.

- Bitcoin declined considerably as wider global markets suffered from tariff concerns and crypto traders hedged risk in the wake of the Bybit hack

- Bitcoin performed well in early trading, peaking at $99,420 on Friday, before the double-setback of macroeconomic downturn and digital asset caution due to Bybit led it to fall as low as $91,030 early on Tuesday

- This drop below $92,000 represents Bitcoin’s lowest levels since November

- Overall industry market capitalisation slid back below $3tn, for a current value of $2.98tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped to $103.5bn

Digital assets faced several significant headwinds this week, both from without (continued global investor caution over tariff wars) and within (Bybit exchange suffering the industry’s largest-ever hack). Market performance reflected this accordingly, but there were still several positive pieces to report, including further stablecoin developments, more tokenisation, major market makers, banks embracing digital asset services, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced a second consecutive week of outflows, as global macroeconomic uncertainty spurred by tariff policy continues to deter traders

- According to CoinShares data published on Monday, digital asset investment products lost $508m in the week ending Friday the 21st; the highest outflows in around half a year

- CoinShares chief researcher James Butterfill commented that “investors are exercising caution following… uncertainty around trade tariffs, inflation and monetary policy… also evident in trading turnover, which has fallen considerably from $22bn two weeks ago to $13bn last week”

- Spot Bitcoin ETFs continued their recent downturn, experiencing four consecutive days of outflows ranging from $61m to $365m

- BlackRock’s IBIT logged the greatest daily inflows of the week—even then, the $68m added on Tuesday remained far below its average post-launch inflows of $147m

- The largest daily outflows from a single fund came courtesy of Bitwise’s BITB, which lost $113m on Tuesday, whilst Thursday witnessed the largest cumulative outflows of $365m

- Spot Ether ETFs featured far more subdued trading volumes and flows than their Bitcoin equivalents, with overall weekly flows in the seven figure range at the time of writing

- In total, Tuesday and Wednesday witnessed $23.6m inflows, before the market turned and Thursday/Friday followed up with $22m outflows

- Finance giant Franklin Templeton launched a new digital asset index ETF (ticker: EZPZ), providing combined Bitcoin and Ether exposure

- Head of ETF and capital markets David Mann commented that “it has the flexibility to add additional coins as they get added to the index, offering broad exposure for investors at a very low cost”

- Elsewhere in ETFs, issuer Canary moved its submissions for Litecoin and HBAR along the approval process by filing 19b-4 forms, leading Bloomberg chief ETF analyst Eric Balchunas to opine that they appear “in pole position” for altcoin approval

- Bloomberg analysts forecast the highest approval odds for “digital silver” Litecoin, at an estimated 90% likelihood

- FOX Business journalist Eleanor Terrett reported from sources that the SEC is “very, very interested” in adding staking services to ETFs, potentially allowing investors to earn passive yield from assets such as Ether

- Japanese regulators signalled they could potentially classify crypto assets as securities and thus enable crypto ETFs to be listed in the country, appealing to retail investors drawn by the sector’s perceived volatility

- In Brazil, regulators moved to launch the world’s first spot XRP ETF

- Although Q1 has suffered a sluggish start, Balchunas praised the performance of Q4 noting “Institutional adoption of the bitcoin ETFs *tripled* in Q4 to $38bn and the percentage of the assets claimed by 13F filers is up to 25-30% for most of them. For context, $GLD is 40% and where I think these will end up (that's the sweet spot between big and little fish)”

- K33 Research found that at the end of Q4 2024, “1576 professional firms ( a quarterly increase of 429) held US spot Bitcoin ETF exposure, with a combined AUM of $26.8bn (+113%). Institutional investors hold 25.4% of the AUM, up from 21.3% in Q3, led by massive IBIT activity”

What happened: SEC drops several digital asset enforcement cases

How is this significant?

- After spending the majority of the Biden administration as an antagonist towards the digital asset industry—accused of defaulting towards regulation by enforcement—the SEC this week signalled a more positive position under Trump

- The agency reduced the size of its dedicated industry enforcement; scrapping its crypto team for a smaller cyber unit with a broader online mandate

- The new unit features around 20 fewer staff than the previous dedicated digital asset team, as part of wider government redundancies under Trump

- Coinbase CEO Brian Armstrong confirmed that the SEC is dropping its case against the exchange, with no fines or changes to the company’s business

- Furthermore, the case is being dropped without prejudice, preventing any potential future refiling

- Armstrong confirmed that the exchange spent no less than $50m fighting the case, showcasing the scale of resources required against a relentless SEC onslaught

- Chief legal officer Paul Grewal commented “Our ending the case will offer a template for the SEC to resolve other cases as well… I think with this announcement, that the case is over, you are going to see Coinbase doubling and tripling down our efforts to bring new products and services to market”

- The SEC also closed its case against trading platform Robinhood’s crypto services, with no action taken

- In other Robinhood news, the platform continued plans to launch crypto services in Singapore this year, following its acquisition of Bitstamp exchange

- VP Johann Kerbrat told Bloomberg “Part of the reason why Bitstamp was attractive was because of their licences with Singapore, in addition to its institutional business”

- In other enforcement news, the Department of Justice levied a $84m fine and $500m forfeiture against OKX, whilst the US Marshals Service was unable to confirm how much Bitcoin it currently holds from seizures and forfeitures

- Several big industry voices spoke about increased optimism regarding legislation, including Binance CEO Richard Teng, who said the US moved from “a bit of oppression” to “a fresh reset”

- Binance’s American subsidiary Binance.US also confirmed that for the first time in two years, customers can transfer funds on and off the exchange in US Dollars

What happened: Bybit suffers largest crypto exchange hack ever

How is this significant?

- One of the biggest stories this week was Bybit exchange experiencing the largest-ever hack within the industry

- In total, the Dubai-based firm lost around $1.5bn worth of digital assets, mostly in the form of Ether

- Hackers exploited the smart contract logic in the exchange’s cold wallet, thus allowing them to take control and transfer funds out

- On-chain sleuths noted the hackers trying to bridge funds between chains in order to obfuscate their tracks, but the transparency of public blockchains enabled the assets to remain traceable

- CEO Ben Zhou moved quickly to assure customers that their funds were safe and that Bybit had the necessary resources to enable withdrawals—but he soon confirmed that the exchange had taken loans to secure said withdrawals in order to withstand the biggest “bank run” since FTX shut down

- Customers withdrew around $4bn in the aftermath of the hack news

- Lazarus Group, a notorious hacking collective were identified as the likely perpetrators behind the attack, and Bybit offered a bounty worth 10% of the total for any individual or entity that helped return the funds

- Although other historical hacks and exploits have lost assets with a greater value at the time of conviction, this incident appears to reflect the largest value at the time of exploit

- The corollary effects of the incident were swift; positive momentum from SEC dismissals was reversed, as prices declined in cascading liquidations and derivatives traders hedged against further downside

- In other news of beleaguered exchanges, the FTX estate began paying out creditors in cash, more than two years after the exchange collapsed

What happened: Invesco fund distributed in tokenised form

How is this significant?

- Singaporean firm DigiFT became the latest to make major moves in the field of tokenisation, enabling on-chain ownership of investing giant Invesco’s $6.3bn private credit fund

- In a press release, DigiFT revealed that institutional investors can purchase shares in the fund via both US Dollars, and dollar-pegged stablecoins USDT (issued by Tether) and USDC (issued by Circle)

- CEO Henry Zhang outlined several benefits of the new fund, stating “This is the first and only tokenised private credit fund offering daily liquidity. Most tokenised private credit funds today have quarterly or even longer redemption cycles, making them less attractive to investors looking for more flexibility”

- Eventually, Zhang aims for instant redemption via blockchain, rather than the existing five-day cycle for the underlying vehicle

- In a report last November, Invesco predicted that tokenised funds could reach $600bn by 2030; around 1% of total mutual and exchange-traded fund AUM

What happened: Memecoin mania cools off following recent challenges

How is this significant?

- This week, so-called “memecoins” came under increasing scrutiny, following a recent scandal where Argentinian president Javier Milei briefly promoted a Solana memecoin called LIBRA, before withdrawing support as value plummeted

- This led to accusations of a “rugpull” (crypto slang for a deliberate scam, as in pulling the rug out from under someone), undermining Milei’s support

- Unlike other digital assets, memecoins aren’t tied to any particular function or service of the token beyond expressing support for cultural phenomena; whether that be memes, individuals, institutions, or even countries

- The technological barrier to memecoin issuance is thus the lowest in the digital asset field, with several plug-and-lay platforms (particularly on the Solana blockchain) allowing users to automatically generate tokens simply by uploading a picture and description into a template

- They’ve generally been perceived as more democratic than tokens developed with VC funding (and thus allocations), but they have been criticised for their lack of function, purely speculative nature, and for diverting liquidity from more serious projects

- Before his inauguration Donald Trump revived interest in the category by launching his own memecoin, gaining worldwide attention and billions in market capitalisation

- Bernstein Research analysts also forecast an expected memecoin downturn, writing that previous attraction to memecoins was partly driven by US regulators pursuing and prosecuting tokens widely believed to provide genuine utility; “forcing the market toward 'useless' memecoins to escape regulatory action”

- Instead, the analysts believe key growth areas based on utility should be stablecoins, tokenised assets, DeFi, and blockchain gaming

What happened: Stablecoin news

How is this significant?

- In the stablecoin space, yield-bearing stablecoins were officially approved in the US this week, when the SEC approved such a token from Figure Markets as a security

- This makes the firm’s YLD stablecoin the first of its kind registered with the regulator, paying out returns on a monthly basis at the “Secured Overnight Financing Rate minus 50 basis points”

- However, these YLD coins (branded as certificates) are issued on the Provenance blockchain, a bespoke chain rather than widely-used public platform like Ethereum

- CEO Mike Cagney commented “It’s really filling a necessary void that we’ve had for a while in the stablecoin space”

- Leading issuer Tether contributed $10m to the seed round of stablecoin startup Mansa, which offers liquidity via a revolving line of credit in stablecoins

- In Europe, crypto exchanges are considering their own proprietary stablecoins ahead of MiCA legislation from March 31st onwards

- Sources told Bloomberg that due to licencing regulations, exchanges such as Kraken and crypto.com will have to delist popular (but unlicenced) stablecoin USDT, and are thus currently developing their own stablecoin solutions

- Meanwhile, DeFi project Ethena raised $100m from investors including Franklin Templeton, to further build on its ecosystem featuring the ENA governance token and USDe Ethena synthetic (dollar-pegged) dollar

- USDe currently provides a 9% yield, generated from backing assets which include not only the larger USDT and USDC stablecoins, but also dynamically-priced digital assets

What happened: DekaBank launches institutional crypto services

How is this significant?

- Hot on the heels of Citi and State Street exploring custody services for institutional investors and large funds, another banking giant took a big step in the institutional digital asset field this week; Germany’s DekaBank

- The $395bn AUM institution launched institutional custody and trading services for clients, as CEO Martin K. Müller told Bloomberg “We have the necessary experience, licences, and infrastructure for both community banks and our institutional clientele”

- DekaBank is only offering the services to institutional investors for now, as they believe them to have the required know-how, resources, and infrastructure to professionally manage risk in the digital asset space

- Other German banks to recently move into crypto assets include the Volks- und Raiffeisenbanken group, and LBBW

- This news is the culmination of a long-running process by Dekabank, including a BaFin crypto custody licence (December 2024) and crypto securities registrar licence (July 2024)