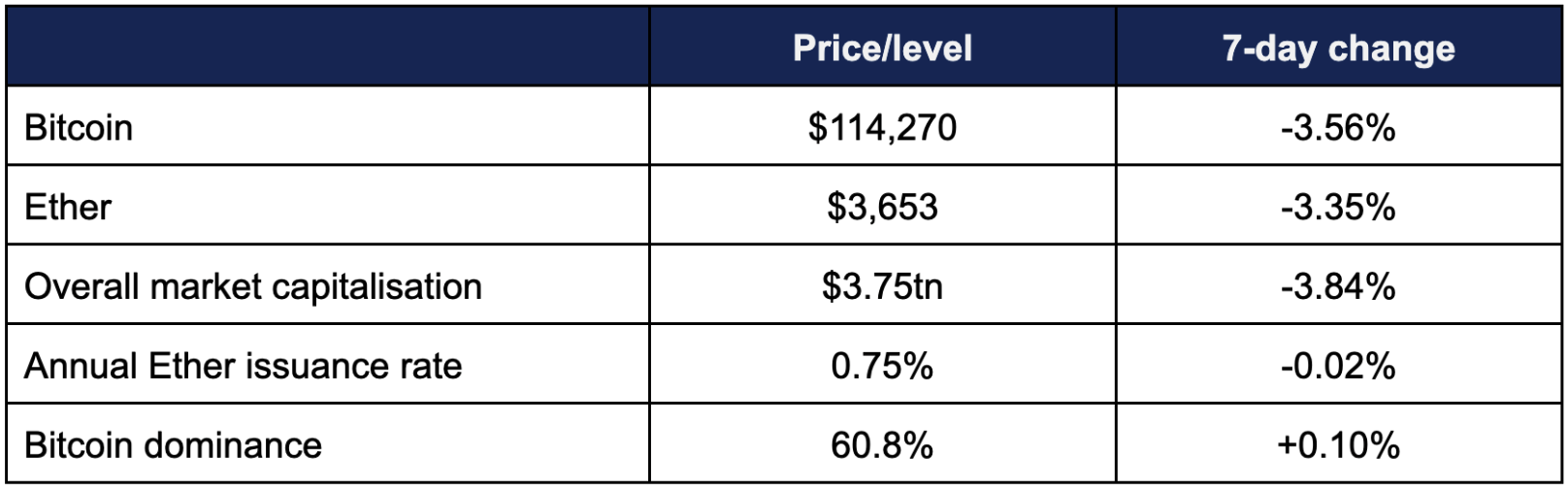

Market Overview

- Bitcoin pulled back to its lowest levels in three weeks, but remains well above its pre-July record highs

- Several analysts believe recent drops were driven by investor uncertainty (and profit-taking) after negative economic data in the US and hawkish statements by Federal Reserve chairman Jerome Powell

- Bitcoin performed best in early trading, peaking at $119,040 on Tuesday, before steadily declining from Thursday onwards to a weekly low of $112,040 on Saturday

- Ether fared slightly better, but also cooled off following the macro-driven selloff

- Ether reached highs of $3,872 on Thursday, before hitting lows of $3,373 on Sunday

- Overall industry market capitalisation dropped to $3.75tn, as altcoins faced greater losses than the top two during wider risk-off investor behaviour

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped to $137.6bn, down just over $2bn in total

Digital assets experienced some losses after their recent record run, after hawkish Fed positioning led to increased investor caution. However, good news continued in the realms of adoption, as JP Morgan Chase teamed up with Coinbase, the SEC promoted “Project Crypto” to create regulations and bring markets on-chain, several firms made IPO plans, crypto treasuries gathered momentum, and much more.

What happened: JP Morgan and Coinbase team up to facilitate crypto purchases

How is this significant?

- Two of the largest forces in TradFi and DeFi joined forces this week, as banking giant JP Morgan and leading US crypto exchange Coinbase announced a partnership

- Under the collaboration, customers of JP Morgan’s Chase bank will be able to link their bank accounts and credit cards directly to Coinbase accounts and crypto wallets, greatly facilitating digital asset purchases

- In a press release, JP Morgan declared that the strategic partnership “makes buying crypto easier than ever”, and that from autumn onwards, “customers will have the ability to fund their Coinbase accounts using Chase credit cards”

- Thanks to the direct link between bank and exchange accounts, they are able to cut out data aggregators, enhancing customer privacy

- JP Morgan Chase Head of Payments and Lending Innovation Melissa Feldsher added that loyalty points will also be eligible for Coinbase redemption from 2026; “With Ultimate Rewards, the most flexible loyalty program in the industry, our customers can now seamlessly and securely convert their points into crypto assets”

- Meanwhile, Coinbase celebrated a “lower barrier to entry” for crypto access, courtesy of JP Morgan Chase’s significant retail presence

- This follows on from several recent evolutions in JP Morgan’s digital asset footprint, including plans to issue loans against customers’ Bitcoin and Ether holdings

What happened: ETF News

How is this significant?

- Digital asset investment products posted net outflows for the first time in 16 weeks, as new US economic data and Jerome Powell proclamations led to widespread profit-taking as investors hedged against policy risk

- According to Coinshares data published on Monday, crypto asset funds shed $223m in the trading week ending Friday the 1st of August

- This was led by net outflows of $404m from Bitcoin, but head of research James Butterfill rationalised “Given we have seen $12.2bn net inflows over the last 30 days, representing 50% of inflows for the year so far, it is perhaps understandable to see what we believe to be minor profit taking”

- Outflows across crypto funds were particularly pronounced on Friday, after weak payrolls data led to over $1bn in outflows

- Despite the losses from Bitcoin funds, Ether continued its recent bullish momentum, logging a 15th consecutive week of inflows

- Spot Bitcoin ETFs performed positively in early trading, before macroeconomic concerns led to widespread outflows, including $812m on Friday

- The largest share of these outflows came from Fidelity’s FBTC and ARK Invest’s ARKB, which lost $331m and $328m respectively on Friday

- The two above funds also suffered the largest losses on Thursday, shedding $54m and $90m on a day when overall outflows stood at $114m

- Trading on Monday through Wednesday was more positive, albeit with lower inflows than during recent record growth

- BlackRock’s IBIT was the only fund to achieve nine-figure inflows this week, adding $147m and $158m on Monday and Tuesday

- Spot Ether ETFs continued their run of net weekly inflows, as strong early trading helped to counteract the macro-driven sell-offs in later trading

- However, the run of daily nine-figure inflows halted on Monday, with only one day last week (Tuesday) reaching those levels

- BlackRock’s ETHA dominated flows, with net growth of $132m on Monday and $224m on Tuesday; the latter of which exceeded the overall daily net inflows as other funds lagged

- On Friday, profit-taking hit the ETFs, as net $152m outflows were spread across multiple funds, led by Grayscale ($85m across both funds) and Bitwise’s BITW ($40m)

- Bloomberg’s chief ETF analyst Eric Balchunas commented on recent Ether product momentum, tweeting “Top 3 ETFs (out of 4,432) in one month flows: $VOO [Vanguard’s S&P 500 index fund], $IBIT, and $ETHA. I used to say ‘Beta with a side of Bitcoin’ to describe this (which was most of 2024 leaderboard) but need a new phrase, ideally an alliteration, to include Ether”

- This included over $4bn of monthly inflows for ETHA alone, thanks to renewed appetite for the Ethereum blockchain after stablecoin regulation

- Elsewhere in ETFs, the SEC approved a crucial change in fund structures, allowing for in-kind creation and redemption of crypto ETFs

- Bloomberg commented that “Taken together, the moves signal something larger—an agency that once kept crypto at arm’s length is now laying the plumbing to usher it deeper into Wall Street”

- Under the new rules, investors will no longer need to accept cash value of their investment on redemption, meaning the underlying assets must no longer be sold off on the customer’s behalf

- Balchunas commented “The biggest takeaway is symbolic. It means there is a new sheriff in town,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “Gensler’s SEC did not want this to happen. This is the first of what will be several steps toward a more pro-crypto SEC”

What happened: Digital assets achieve fastest-growth segment in alternative asset market

How is this significant?

- In new data on year-to-date investment flows, digital assets emerged as the fastest-growing class within the alternative asset market, outpacing private equity, private debt, hedge funds, and real estate

- According to the data from a variety of sources including Barclays, JP Morgan, and Pitchbook, digital assets account for their largest share ever amongst alternative assets, whilst private credit is on course for its worst year since 2018

- JPMorgan analyst Nikolaos Panigirtzoglou commented “Within alternative asset classes, digital assets and hedge funds have been seeing an acceleration of inflows this year, in sharp contrast to the weak fundraising seen in private equity and private credit”

- Digital assets “attracted $60bn through July 22 after a record $85bn cash injection last year”, as the sector was buoyed by positive regulatory news in the form of the GENIUS Stablecoin Act

- Analysts also cited Circle’s successful IPO as a factor behind more bullish sentiment around digital assets

- Crypto now accounts for 8.73% of alternative asset market inflows, up from 7.20% last year

What happened: Digital asset firm Bullish raising $629m for IPO

How is this significant?

- Bullish, a digital asset firm backed by billionaire Peter Thiel amended its recent confidential IPO filing, revealing that it plans to raise up to $629m in share sales

- According to the new filing, the company is issuing 20.3 million shares, indicating a valuation of up to $4.2bn

- JP Morgan and Jefferies are the lead underwriters of the proposed public float, as the recent successful Circle float has improved IPO sentiment across the digital asset space

- Rather than simply adding raised funds to its balance sheet, Bullish plans to convert a portion of net IPO proceeds into stablecoins, boosting the liquidity on its own exchange

- In the company prospectus, CEO Tom Farley commented “We now intend to IPO because we believe that the digital assets industry is beginning its next leg of growth,… We also believe that becoming a publicly-traded company provides our business with key benefits: additional credibility… access to capital; and an equity currency with which to make strategic acquisitions”

- Bullish currently owns and operates an institutional crypto exchange (of the same name), alongside industry media platform Coindesk

What happened: SEC declares digital assets a priority with “Project Crypto”

How is this significant?

- In a speech on Friday, new SEC chair Paul Atkins outlined digital asset regulation as a key priority for his agency, calling for “American Leadership in the Digital Finance Revolution”

- He announced “Project Crypto; the SEC’s north star in aiding President Trump in his historic efforts to make America the crypto capital of the world”

- In essence, the project amounts to “a Commission-wide initiative to modernise the securities rules and regulations to enable America’s financial markets to move on-chain”

- Atkins also said he’s directed commission staff to develop clear frameworks to eliminate the previous administration’s confusion around the status of digital assets

- He stated “Despite what the SEC has said in the past, most crypto assets are not securities. But confusion over the application of the ‘Howey test’ has led some innovators to prophylactically treat all crypto assets as such”

- Plans to move financial markets on-chain were cited as a continuation of “American entrepreneurs… harnessing blockchain technology to modernise a broad range of legacy systems and instruments”

- America cannot afford to lag in adoption, as “The future is arriving at full speed—and the world is not waiting. America must do more than just keep pace with the digital asset revolution. We must drive it”

- He also stressed the potential of “super apps” such as WeChat and AliPay to fulfil a broad range of financial services for Americans, but called for “efficient licensing structure” rather than multiple agencies addressing different services

- The Atkins speech followed soon after the White House released a new report titled “Strengthening American Leadership in Digital Financial Technology”, recommending “a pro-innovation mindset” in approaching the industry

- Amongst other recommendations, the 168-page report said that the US digital asset stockpile would be funded with confiscated assets from forfeiture proceedings, and that Bitcoin “will be maintained as a reserve assets of the United States utilised to meet governmental objectives”

- A fact sheet attached to the Presidential Working Group’s report claimed that “by implementing these recommendations, policymakers can ensure that the United States leads the blockchain revolution and ushers in the Golden Age of Crypto”

- Bernstein analysts called Project Crypto “the boldest and the most transformative crypto vision ever laid out by a sitting SEC chair”

- They added that bringing markets on-chain could prove transformational to market structure; enabling “automated market makers and tokenized lending protocols to operate within the regulated financial system… [a] gateway to 24/7 markets, instant settlement, and cross-asset collateralisation”

- There have already been significant resources invested into improving legacy financial infrastructure through blockchain implementations

- According to a new report commissioned by Ripple, banks have invested $100bn in blockchain since 2020, and more than 90% of executives polled believe blockchain will have at least a “significant” impact on finance by 2028

- Sister agency the CFTC announced a “Crypto Sprint” to implement recommendations from the new White House report

- The CFTC stated it “is wasting no time in fulfilling President Trump’s vision to make America the crypto capital of the world. Providing regulatory clarity now and fostering innovation in digital asset markets will deliver on the Administration’s promise to usher in a Golden Age of Crypto”

What happened: Stablecoin news

How is this significant?

- Stablecoin news and development continued in the wake of recent US stablecoin legislation

- USDT stablecoin issuer Tether reported more strong profits thanks to its status as the largest company in the industry, claiming $4.9bn Q2 net profits

- In its latest attestation report, Tether said its US Treasuries “exceeded $127bn (~$8bn increase compared to Q1 2025) at the end of Q2 2025, placing Tether among the largest holders of U.S. government debt globally”

- Additionally, accountancy firm BDO attested its excess reserves currently stand at $5.4bn

- Stable, a blockchain development firm creating a “stablechain” around USDT, raised $28m in a seed round including Franklin Templeton

- This chain would use Tether’s own USDT to pay transaction fees on the blockchain, rather than the proprietary token of other chains it operates on, as is currently the case

- Stable CEO Joshua Harding said “Payments infrastructure around the world needs an overhau… to achieve fast, reliable and secure digital payments… Stable was developed to take advantage of the potential behind stablecoins like USDT to offer instant and seamless payments, directly addressing problems with current payment rails”

- German joint venture AllUnity has launched a new Euro-denominated stablecoin, approved by the country’s BaFin regulator and compliant with EU-wide MiCA regulations

- The collaboration between DWS, Galaxy, and Flow Traders will be issued as an ERC-20 standard token on Ethereum, under the ticker EURAU

What happened: Blockchain-based loan provider files for IPO

How is this significant?

- Figure, a leading blockchain-based lender, became the latest industry firm to file for an IPO this week

- According to a Monday press release, the company is not yet disclosing the number of shares or proposed valuation—but as evidenced by Bullish earlier, that could all change within a few weeks

- A previous attempt at an IPO in 2023 was underwritten by Goldman Sachs, JP Morgan, and Jefferies

- The firm is one of the leading players in real-world asset (RWA) tokenisation, with over $16bn in home equity credit put on blockchain, and has also developed a yield-bearing stablecoin (YDLS) that functions as a tokenised money market fund

What happened: Broker FalconX expands to Brazil amidst growing digital asset demand

How is this significant?

- Digital asset prime broker FalconX is expanding its international reach, entering the Brazilian market to capitalise on growing Latin American demand for digital assets

- FalconX will offer its services in partnership with initial partners including local banking giant BTG Pactual and e-commerce institution MercadoLibre’s Mercado Bitcoin

- The broker’s Americas chief Josh Barkhordar told Bloomberg that “Latin America is one of the fastest-growing regions for crypto adoption. The regulatory frameworks in the region along with the forward-thinking institutions and real economic drivers [such as hyperinflation] are driving adoption of digital assets”

- According to a report on Latin American digital asset adoption by blockchain forensics firm Chainalysis, “institutional crypto activity in Brazil increased by 48% between the last quarter of 2023 to the beginning of 2024”

- Barkhordar confirmed that this move was a simple case of following the money “We are expanding into those regions because we are seeing very strong demand from traditional institutions while also seeing great volume. The trend is not isolated to Latin America and we think it will continue globally because there is clearly demand that is yet to be met”

What happened: Crypto Treasury news

How is this significant?

- Adoption of digital asset treasuries continued to gain steam, featuring several consistent adopters alongside entirely new names

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) made its third-largest Bitcoin purchase ever, adding to its considerable corporate coffers

- The firm bought $2.46bn of Bitcoin, financed by a recent preferred stock series

- This marked its largest buy of 2025, and brought its total holdings to 628,791 Bitcoin

- Bitcoin treasury firm Twenty One, backed by Cantor Fitzgerald and SoftBank, has increased its projected launch holdings to 43,500 Bitcoin (1,500 more than initially budgeted)

- This makes it the third-largest corporate Bitcoin holder after Strategy and Bitcoin mining firm Marathon

- Speaking of Marathon, it completed a $950m raise (via 0.00% convertible senior notes), with around $940m going directly towards additional Bitcoin acquisition

- Ether treasury strategies also continued to grow via new entities; The Ether Machine made its first Ether purchase (worth $57m), with $400m still held in reserve

- Fellow newcomers ETHzilla secured $425m funding to pivot towards an Ether acquisition strategy, aiming to generate yield from Ether staking

- Nasdaq-listed Gamesquare added $10m in Ether to its balance sheet