18th August, 2023

Market Overview:

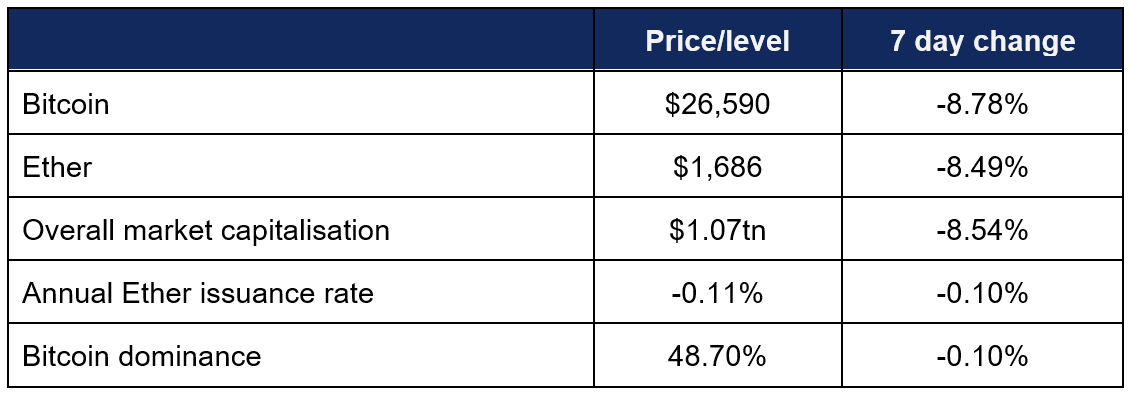

Digital assets suffered major losses this week, amidst broader risk-off behaviour from investors and global macroeconomic concerns following the Evergrande collapse.

- Bitcoin traded in a narrow range throughout most of the week, before dropping hard on Thursday following a cascade of negative global macroeconomic news

- Before the market shock, Bitcoin remained steady between $29,130 and $29,470, with a weekly high of $29,650 on Tuesday

- Current price levels in the $26,500s region are in line with prices from two months ago, and still represent a healthy year-to-date increase of over 60%

- Ether followed the same patterns as Bitcoin, ranging between $1,829 and $1,859 for most of the week, before plummeting to a weekly low of $1,552 on Thursday night

- Mass liquidations and reactive trading led to a spike in Ethereum network usage late on Thursday, briefly spiking gas fees and leading to an increased supply burn, reflected in the weekly decline in the annual issuance rate

- Overall digital asset market capitalisation dropped to $1.07tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week dropped to $38.5bn

- Bitcoin’s decline was exacerbated by several bearish macro items in quick succession from the TradFi press news cycle across Wednesday, Thursday, and Friday; including Michael Burry’s massive short bet on stocks, Evergrande’s bankruptcy, and Elon Musk’s SpaceX selling $373m of (previously undisclosed) Bitcoin holdings

Digital assets experienced major losses late in the week after prior stable performance. Coinbase followed PayPal’s “first corporate stablecoin” from last week by going one better with a “first (public) corporate blockchain” built on top of Ethereum. Visa also continue to build on top of Ethereum, successfully trialling innovative mechanics for improved user experience. There was also big news within the industry from funding rounds, acquisitions, and potential future sales. ETFs attracted attention once again, as Europe’s first spot Bitcoin product launched (more than two years after initial approval) and analysts speculated on the potential impact of a similar product finally arriving in the US.

What happened: Coinbase launches first corporate blockchain

How is this significant?

- Last week’s news cycle was dominated by Paypal’s launch of PYUSD, the first ever "corporate stablecoin" on a public blockchain—but amidst all their fanfare, another major move in corporate crypto flew under the radar of the traditional press

- Coinbase became the first publicly-traded company to launch its own open blockchain; the layer-2 network Base, built on top of Ethereum using Optimism scaling technology

- Base soon did brisk business; nearly $200m of value was bridged to the network within 3 days of launch, and 136,000 daily active users put Base hot on the heels of the leading layer-2 blockchain, Arbitrum

- Within a week of launch, Base actually overtook Arbitrum on the metric of daily transaction numbers

- After initially opening only to developers last month, Coinbase promoted an "onchain summer" upon Base launch "that will make crypto more accessible, fun, and useful than ever before", recruiting mainstream brands like Coca-Cola, Atari, and Showtime to deploy onchain collectables for their fans

- The first potential “killer app” on Base appears to be Friends.Tech, a social network allowing users to speculate on the appeal of Twitter personae and influencers

- Total Value Locked (TVL) on Base has already reached $164m, according to data aggregator DeFiLlama—indicating that around half of the assets bridged to Base were instantly deployed into DeFi protocols in some form to earn yield

- It’s worth emphasising that Coinbase didn't launch its own layer-1 blockchain here; by launching an EVM-compatible layer-2, they ensure that the chain benefits from low transaction costs and times, but remains secured by Ethereum, the largest and most battle-tested smart contract network around

- An additional benefit for corporations launching layer-2 chains is that Ethereum’s underlying Proof-of-Stake consensus mechanism is a more environmentally-friendly proposition than Proof-of-Work networks

- A drawback of launching any open blockchain is the decentralised nature that allows anybody to build on it; within a week of launch, several opportunistic and unscrupulous developers already launched a variety of scam projects designed to fool investors

- In other significant Coinbase news, on Wednesday the exchange secured approval from the National Futures Association to offer customers access to crypto futures

- This comes almost two years after their initial application for a derivatives licence, and grants the company access to a market that accounts for 78% of CEX trading volume, according to CCdata

What happened: BitGo raises funding at $1.75bn valuation

How is this significant?

- In a climate of severely reduced digital asset VC efforts, crypto custodians BitGo bucked the trend this week, concluding a $100m Series C funding round at a $1.75bn valuation

- This was a particularly impressive return, since the valuation exceeded a previous $1.2bn acquisition attempt from Galaxy Digital during much more bullish conditions in 2021

- The Galaxy deal had been signed at the time, but not approved within the US regulatory climate under current SEC administration, as BitGo CEO Mike Belshe noted in a Bloomberg interview

- He added that “Every regulator in every country, every region, is looking at how to deal with digital assets right now… and they’re coming up with similar, but often different, answers”

- Belshe outlined that their strategy with the fresh funds includes several strategic acquisitions (of which two are already in negotiation stages); with more growth forecast in Asia than within the US

- In other funding and acquisition news, Bitcoin development firm Blockstream has spent significant funds on acquiring mass amounts of Bitcoin mining hardware, with the strategy of selling it off to miners when the Bitcoin “halving” event occurs next year

- This (roughly) quadrennial event cuts the rewards for mining a Bitcoin block in half; Blockstream anticipates this will lead to more competition amongst miners and more demand for optimised mining hardware, known as ASICs

- In a Bloomberg interview, Blockstream CEO Adam Back said “We made quite a bit of money buying and selling miners, and then we’re looking at the market and we see that there’s really a financial opportunity here”

- Blockstream will raise multiple $5m tranches of “newly launched investment vehicle[s] so that it can buy, warehouse and then sell ASICs into the market at a premium should Bitcoin’s price rally in the run up to the halving”

What happened: Tokens accused by SEC experience growing trade volumes

How is this significant?

- Several projects previously demonised by the SEC have seemingly benefitted following Ripple Labs’ partial victory in its SEC lawsuit regarding sales of its XRP token

- The ruling by federal judge Analisa Torres found that only direct sales to institutional investors could be construed as constituting an investment contract under the Howey Test; and thus raised doubts over any other tokens accused of being unlicenced securities by the SEC

- In June, the commission identified 19 separate digital assets in their securities lawsuit against Coinbase; according to data by industry research firm CCdata, those assets have now grown from 11% of overall market trade volume (pre-Coinbase suit) to 13% of overall volume (one month post-Ripple judgement)

- However, their cumulative value has also dropped around 20%, although some of this figure is due to overall market declines, rather than performance unique to the tokens

- Industry investor Kyle Doane told Bloomberg; “The tokens that have been named as securities are being traded as a proxy for regulatory clarity. Since the XRP ruling, regulatory clarity has theoretically worsened, resulting in poor price action”

- Also worth noting is that, according to CCdata, US-based exchange volume only accounts for 10% of overall global volume, helping to mitigate the impact on some of the 19 tokens

- CCdata analyst Jacob Joseph commented “While many tokens experienced a notable decline in price in the week following the lawsuit, many have since regained at least half of their drawdown. The impact of the SEC’s lawsuit appears to have been diminished for several assets”

- In other SEC news, on Thursday Judge Torres granted them the right to file an appeal to her ruling, following their interlocutory appeal last week; the SEC now have to file their motion by Friday, at which point Ripple will have until September 1st to file a response to the motion, following which the SEC will have until September 8th for their response

What happened: Bernstein research publishes predictions based on Bitcoin ETF approval

How is this significant?

- A new Sanford C Bernstein report this week made a bullish forecast for the potential of spot Bitcoin ETFs—provided of course that at least one from the current crop of applicants is approved

- As widely expected, the SEC chose to kick the can down the road on the first potential approval, delaying a decision on ARK Invest’s Bitcoin ETF filing after an initial deadline of August 13th

- On Friday, ARK also submitted paperwork for a Bitcoin Futures Fund, the first filing for such a product in the US

- According to Bernstein analyst Gautam Chhugani, the overall chances for spot Bitcoin ETF approval have increased since BlackRock entered the scene; and if such products are approved, they could constitute 10% of Bitcoin’s market value within three years

- One motivation for this forecast is the potential for a “growth flywheel” of retail and institutional inflows

- Speaking on the TechCrunch Chain Reaction podcast, Bloomberg ETF analyst Eric Balchunas seemed to agree, saying “the spot is the holy grail. The spot bitcoin ETF [will be] major”

- However, he added that some caution is prudent, and exact values are almost impossible to predict; “I don’t think it’s going to completely change the face of crypto. I think what it does is offer a portal for a big lump of money that largely would not probably deal with bitcoin, [but] might now”

- Whilst the buying power of the potential new audience is massive, Balchunas cautions against expectations of universal conversion amongst them; “That would be the $30 trillion that financial advisors manage in America… Not everyone is going to cross that bridge, but you’ll certainly find some traffic there”

- In other ETF news, Europe’s first spot Bitcoin ETF finally went live this week, with UK-based Jacobi Asset Management listing the Jacobi FT Wilshere Bitcoin ETF (BCOIN) on Euronext Amsterdam, nearly 2 years after its initial approval

- Late on Thursday, Bloomberg reported that despite the SEC’s historic reticence towards spot Bitcoin ETF approvals, they are unlikely to oppose current filings for Ether futures ETF products, according to sources with knowledge of the matter

- Following BlackRock’s spot Bitcoin ETF filing, interest was reignited in Ether products as well, with nearly a dozen firms currently proposing Ether futures ETFs

- However, unlike spot Bitcoin, Ether futures haven’t captured the public attention; as Bloomberg Intelligence’s James Seyffart says “the hype just isn’t there”

What happened: Visa seeks to simplify blockchain user experience

How is this significant?

- In a recent blog post, payments giant Visa outlined their continued interest in the digital asset space, including efforts to streamline and improve the user experience for people interacting with blockchain technology

- In particular, their recent research has focused on payment of “gas fees”; the on-chain fees (usually paid in a blockchain’s native asset, such as BTC on Bitcoin or ETH on Ethereum) required to broadcast and record transactions on a blockchain

- Visa believes keeping assets aside for transaction fees within wallets could prove “burdensome” to new entrants in the space, and has thus worked on enhancing previous developments under Ethereum’s ERC-4337 standard, which enables account abstraction—the process whereby smart contracts can serve as wallets and thus automate payment process

- Visa seeks to improve upon this standard by implementing a “paymaster contract… a specialised type of smart contract account that can sponsor gas fees for user Contract Accounts (think of these as user-centric smart contracts)”

- Their blog states that this “proposed solution liberates users from the need to hold native blockchain tokens or constantly engage in bridging tokens merely to cover gas fees”

- Visa successfully tested this methodology on Ethereum’s Goerli testnet (a development sandbox environment mimicking the main Ethereum blockchain)

What happened: Industry media platform Coindesk readies for sale by cutting costs

How is this significant?

- According to internal emails viewed by TechCrunch, digital asset publication Coindesk (owned by troubled industry conglomerate DCG) is slashing its workforce ahead of a potential $125m sale first reported in the Wall Street Journal

- Around 16% of employees will lose their jobs; Coindesk CEO Kevin Worth wrote in the internal memo that “Several roles, predominantly in our media team, were impacted by a reduction in force… This was a required step to ensure a financially sound business moving forward and to set us on the path to close the deal to sell CoinDesk, Inc.”

- Coindesk is one of the longest-tenured publications in the digital asset space, founded in 2013, sold to DCG for $500,000 in 2016, and has broken numerous major stories within the space, including the first suspicions of financial impropriety within the fallen FTX empire

- According to the Journal, Coindesk’s acquisition could conclude within the next few weeks, with an investment group “led by Matthew Roszak of Tally Capital and Peter Vessenes of Capital6”

What happened: Contagion latest

How is this significant?

- Former FTX head Sam Bankman-Fried had his bail revoked on Friday, after US District Court judge Lewis Kaplan ruled that he’d “repeatedly misbehaved” thus far; allegations of bail violations include VPN usage, potential witness-tampering, and leaking information about former Alameda CEO Caroline Ellison to the New York Times

- Another ex-FTX executive, former co-CEO Ryan Salame, will “plead the fifth” regarding his alleged campaign finance violations, rendering him “unavailable as a witness” after suggestions last week that he was negotiating a plea deal with authorities

- The US Federal Reserve joined in on legal action against FTX entities, issuing enforcement actions against Farmington State Bank (and holding company FHB Corp)

- The Fed alleges that the bank—which FTX purchased a stake in—changed their business model without informing supervisors, under the influence of Bankman-Fried & Co.

- PayPal is temporarily suspending access to crypto purchases in the UK for the rest of the year, as they work towards compliance within new FCA regulations

What happened: Digital asset startup launches decentralised mobile phone network

How is this significant?

- Tech startup Nova Labs this week demonstrated a potential new application for blockchain technology; using it to create a decentralised mobile phone network

- According to Pitchbook data, the company has thus far raised $250m in funding, including $200m at a $1.2bn valuation last year

- Using Nova’s blockchain-based Helium Network, users will be able to connect to 7,000 5G hotspots throughout the US, although the plan will initially be piloted within Miami

- Homeowners and businesses will be able to purchase 5G hotspots, and earn about 50c worth of Helium tokens for each gigabyte of data their hotspots provide to customers

- When outside of hotspot range, Nova will rely on a partnership with established telecom provider T-Mobile, but at a proposed $5 a month for an unlimited subscription via the Helium hotspots, the company still foresees demand in a market where other mobile providers charge four to eight times as much for unlimited plans

- Nova CEO Amir Haleem stated “This is a completely different economic model for building wireless networks… There’s generally this feeling of discontent with telecom companies, whether it’s home broadband, or whether it’s cell phones”