15th March, 2024

Market Overview:

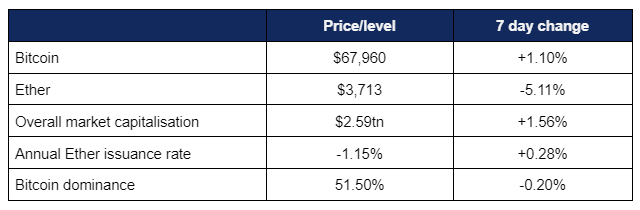

Digital assets continued their recent bullish momentum, with Bitcoin breaking new records, and Ether exceeding $4,000 for the first time since 2021, before a late macro-driven pullback.

- Bitcoin broke more records this week, peaking at $73,750 on Thursday, before high inflation figures led to pullbacks across multiple investment markets

- Bitcoin experienced several steep rises throughout the week, starting off from a low of $66,470 on Friday

- ETF trading on Monday helped propel Bitcoin from below $69,000 to above $72,000 within a day

- Once again, each new record level was swiftly followed by profit-taking

- Bitcoin traded above $70,000 for several days, before falling early on Friday as a market-wide pullback drove it below its old record of $69,000 and minimised the weekly candle

- Despite this late (and significant) pullback, Bitcoin remained above last week’s snapshot at the time of writing

- Ether breached $4,000 for the first time since December 2021, en route to a weekly high of $4,084 on Tuesday

- Ether pulled back hard, hitting a weekly low of $3,666 amidst the macro-driven selloff early on Friday, following multiple weeks of double digit growth

- Despite the late pullback, several major altcoins still posted strong weekly performance; Binance’s BNB coin, Solana, Avalanche, Telegram’s TON coin, and NEAR protocol were all top-20 market cap projects which posted weekly growth above 20%

- Digital asset investment products exceeded $100bn in AUM for the first time ever, according to new CoinShares data

- Overall digital asset market capitalisation rose as high as $2.78tn, before dropping down to $2.59tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi pulled back from a weekly peak of $104.6bn to current values of $99.2bn

Digital assets performed strongly throughout the majority of the week, with Bitcoin setting several new all-time highs, before broader market sell-offs in the face of challenging US macro conditions led to a broadly unchanged weekly market (at least, compared to the major growth of the previous few weeks. Nonetheless, there was plenty of good news for industry observers to cheer; ETFs broke more records (although analysts remain uncertain on the on the chances of SEC approval for Ether ETFs), multiple analysts made positive predictions, MicroStrategy executed major Bitcoin acquisitions, a who’s who of TradFi successfully concluded an enterprise blockchain and tokenisation trial, and a UK high court judge struck down long-running claims of a programmer purporting to be Bitcoin developer Satoshi Nakamoto.

What happened: Bitcoin breaks more records

How is this significant?

- Bitcoin carried on its record-breaking momentum this week, leaping from the previous cycle’s record of $69,000 to almost $74,000

- According to Coinmarketcap data, Bitcoin hit a new peak of $73,750 on Thursday, before higher-than-expected PPI figures in the US led to profit-taking and a pullback amidst concerns over continued hawkish Fed behaviour

- En route to its new all-time high, Bitcoin of course breached several other levels for the first time ever; crossing from $69,000 to $72,880 on Monday alone, as US markets reopened for ETF trading

- Even the FT, traditionally a voice for more conservative (or dismissive) takes on Bitcoin, reported this week that “Bitcoin bulls are not the bigger fools”

- Bloomberg reported that “technical indicators point to growing interest among both institutional and retail investors. Open interest on CME Group’s Bitcoin futures market has jumped 44% from this year’s low, while a rebound in the so-called funding rate signals that traders are increasingly willing to pay a premium for opening leveraged long positions in Bitcoin”

- Meanwhile, JP Morgan analysts, led by Nikolaos Panigirtzoglou published a new research note on Thursday, positing a mix of both retail and institutional investors in spot and futures were driving the rally; “Beyond retail investors, speculative institutional investors such as hedge funds, including momentum traders such as CTAs [commodity trading advisors], appear to have also propagated the rally by purchasing both gold and bitcoin futures since February, perhaps even more heavily than retail investors”

- Notional CME Open Interest hit a new record this week, exceeding 150,000 Bitcoins for the first time

- However, they also cautioned against overheated conditions caused by massive purchases from entities such as MicroStrategy; “We believe debt-funded bitcoin purchases by MicroStrategy add leverage and froth to the current crypto rally and raise the risk of more severe deleveraging in a potential downturn in the future”

- According to data from analytics firm Kaiko Research, Bitcoin’s growth “is creating around 1,500 new millionaire wallets every day”

- As Bitcoin has already grown around 70% year-to-date (by mid-March, mind you), it isn’t surprising to see existing wallet addresses cross over into millionaire territory; but the pace is actually far below the 4,000 new millionaire wallets daily during the 2021 bull run

- Kaiko analysts explain that “In 2021, there was a huge influx in capital as all manner as bull sought to benefit from the crypto hype… This time around, whales could be taking a more cautious approach, waiting to see if the gains have legs before investing”

- New data suggested that El Salvador (the first country to accept Bitcoin as legal tender) currently sits on around $84m of (unrealised) profit on Bitcoin holdings since it began a policy of Bitcoin acquisition

- This represents a 69% increase on the average purchase price—but president Nayib Bukele suggested on X (formerly Twitter) that the nation’s Bitcoin holdings may be even higher, noting Bitcoin-based revenue streams from diverse sources such as mining, conversion to USD for businesses, and payment for government services

- His suggestions appeared to hold water; early on Friday, reports emerged that the country had moved over 5,600 Bitcoin (worth over $400m) into a secure cold wallet, held in a physical vault

- Bukele tweeted the country had moved “a big chunk” of its Bitcoin holdings into “our first #Bitcoin piggy bank”; and the amount moved far exceeded the 3,000 or so Bitcoin estimate that most public trackers had attributed to El Salvador

- However, not all government-level officials are as keen to celebrate Bitcoin as Bukele; Erik Thedeen, governor of Sweden’s Riksbank, told reporters this week his position on the asset; “I want as little Bitcoin as possible in the Swedish financial system. It’s an instrument that is impossible to value, and in practice it’s based on pure speculation”

What happened: ETF news—records continue to fall

How is this significant?

- Another week of trading led to another week of records for spot Bitcoin ETFs (and crypto investment products in general)

- On Monday, a new report by CoinShares revealed record weekly inflows across digital asset investment products, at a total of $2.7bn

- The report also showed that “Weekly trading turnover reached US$43bn for the week, smashing last week’s record US$30bn”

- On Wednesday, CoinShares head of research James Butterfill updated the figures to announce that “Digital Assets ETFs/ETPs have smashed the 2021 record, with inflows following the last few days now sitting at US$12bn ytd compared to US$10.6bn for the whole of 2021”

- NB: That record is based on 2024 inflows only, meaning that the record of the 2021 bull market has been broken within the first two-and-a-half months of the year

- Butterfill posted additional research this week outlining CoinShares’ belief on a “Bitcoin demand shock”; “So far, the launch of the ETFs on the 11th of January has led to an average daily demand of 4500 Bitcoins (trading days only), while only an average of 921 new Bitcoin were minted per day”

- NB: The number of new Bitcoins minted every day will be cut in half in April, following the forthcoming “Bitcoin halving” event

- As always, Bloomberg ETF analysts Eric Balchunas and James Seyffart had much to report on

- Balchunas pointed out on Thursday that halfway through March, volumes for the ten spot ETFs already stand at $65bn, smashing February ($40bn) and January ($30bn) volumes

- K33 Research head Vetle Lunde noted that BlackRock’s IBIT surpassed 200,000 Bitcoins in holdings, leading to a rather striking chart of BlackRock overtaking MicroStrategy as leading corporate Bitcoin holders

- On Monday, spot ETFs recorded their second-best day ever, with IBIT registering twice the volume of the leading gold ETF

- This included a massive $500m of outflows from GBTC, as it continues to sell of shares owned by companies such as Genesis in bankruptcy claims

- ETFs hit a new record of over $1bn net inflow on Tuesday, with a record $848m inflow for BlackRock’s IBIT

- Although IBIT dominates coverage as the largest new holder (plus the effect of its BlackRock heritage), Balchunas believes that all ten spot ETFs will still exist within a year, pointing out that “Even the least in AUM, $BTCW, has a healthy $74m. Out of the 108 ETFs launched in 2024 so far it ranks 16th (top 15%). That's how insane all this is”

- GBTC now accounts for the second-highest outflows of any ETF in the last 15 years, meaning that its share of the spot ETF AUM has now fallen below 50% for the first time since the products launched

- Grayscale may finally be feeling the heat from outflows caused by GBTC’s high fees; on Tuesday it filed with the SEC to allow a “mini GBTC” spinoff, which would be seeded by a percentage of existing GBTC shares, and offer lower fees

- One lesser-spotted ETF which recorded significant inflows this week was VanEck’s HODL, which registered over $200m in inflows after waiving fees for the next year

- VanEck now manages about $516 million in bitcoin, of which around $333 million is net inflow

- On Monday, Bitwise became the fifth fund to exceed $2bn in Bitcoin holdings

- As Bloomberg’s Seyffart notes, this puts Bitcoin ETFs in the upper echelon of performance for such products; “Out of around 3,500 US ETPs there are only 445 with over $2 billion in assets. Going a step further—only 157 have more than $10 Billion. $GBTC & $IBIT are there. $FBTC [Fidelity] is getting close”

- Bitcoin’s performance has also spelled success for leveraged ETFs; Volatility Shares’ BITX 2x Bitcoin Strategy Fund registered $630m of monthly inflows, behind only BlackRock and Fidelity’s spot products

- A report by K33 Research noted “The massive uptick in flows to 2x leveraged BTC ETFs illustrates the huge demand for leveraged long exposure in BTC of late and is consistent with the increased risk appetite witnessed in BTC derivatives”

- JMP Securities analysts forecast large potential inflows for spot Bitcoin ETFs over the next three years

- In a research report on Wednesday, the firm suggested that inflows by 2027 could hit $220bn, which would have the effect of quadrupling Bitcoin’s price to around $280,000 in their modelling

- The analysts wrote “activity (and flows) experienced thus far is likely still the tip of the iceberg”, and that approval was just the first step in a “longer process of capital allocation”

- JP Morgan analysts were rather more modest in their forecasts, estimating a total Bitcoin ETF market of around $62bn (based on the assumption that Bitcoin’s higher volatility compared to gold will lead to challenges in displacing the latter asset from portfolios)

- Some Democratic senators wrote to the SEC spurred by Bitcoin ETF success, requesting that the agency reject future crypto ETFs; Seyffart believes the analysis the politicians cited was likely fed to them by the SEC itself

- This has led Seyffart to sound a pessimistic note on odds for Ether ETF approval

- Over the pond meanwhile, UK financial regulators announced they were open to crypto ETNs (albeit only for institutional investors)

- On Monday, the London Stock Exchange (LSE) said it will begin accepting applications for crypto-based ETNs from the second quarter of the year onwards

- Potential listings do have to fulfil some requirements though; funds must be unleveraged, backed by Bitcoin or Ether, hold at least 90% of assets in offline cold storage, and be custodied by entities subject to UK, EU, Swiss, or US anti-money laundering regulations

What happened: Ethereum blockchain deploys “Dencun” network upgrade

How is this significant?

- The Ethereum blockchain successfully underwent a major network upgrade this week, lowering transaction costs across all Layer-2 networks deployed on Ethereum

- Layer-2 networks exist as scaling solutions for Ethereum, and under the improvements within the “Dencun” upgrade, most had their transaction costs (already far lower than the main Ethereum chain) cut by at least 90%

- Roberto Bayardo, an engineer on Coinbase-developed Layer-2 Base, commented “This one is going to overshadow them all. The Merge was super critical and super important, but users didn’t notice much. From the perspective of the end user, this change is going to be much more dramatic and spur much more innovation on the application side”

- Now, instead of Layer-2s storing data directly on the main Ethereum chain, they will store them in new data depositories known as blobs

- This in turn frees up space on Ethereum itself, meaning less network congestion and as a corollary, more reasonable Layer-1 fees (although still far in excess of the more specialised and streamlined Layer-2s)

What happened: Bernstein Research makes bold prediction on industry market capitalisation

How is this significant?

- A new report released on Monday by Bernstein analysts sounded an optimistic note for the digital asset industry, based on their observations of early ETF performance, amongst other factors

- Analysts Gautam Chhugani and Mahika Sapra outline a $150,000 price prediction for Bitcoin by mid-2025, and recommend mining firm stocks (as well as regulated brokers such as Robinhood) as an additional form of Bitcoin exposure

- In their report, they wrote “With Bitcoin climbing new highs of $71K, we expect institutional interest in Bitcoin equities to finally tip over, and Bitcoin miners to be the largest beneficiaries”, although they cautioned that the latter trade would require more patience, as “winners” of the post-halving issuance reduction may not be immediately clear

- They also predicted a “monster of a crypto cycle” across 2024 and 2025, referring to “an 18-24 month window, to ride the crypto comeback”

- In Bernstein’s view, this “crypto comeback” could result in a tripling of industry market capitalisation, to $7.5tn

- Chhugani and Sapra believe this performance will be driven by professional investors; “The crypto market is amidst unprecedented institutional adoption,” Chhugani said. “We expect continued success of the Bitcoin ETF and a likely launch of an Ethereum ETF within 12 months… In short, we are bullish crypto and we believe, Robinhood’s crypto business resurgence will restore its fortunes back again with investors”

What happened: MicroStrategy buys $800m of Bitcoin, shares surge

How is this significant?

- MicroStrategy moved quickly to realise last week’s announcement of $700m senior notes issuance towards Bitcoin purchases—and added even more on top, for a total $821m purchase of 12,000 Bitcoins

- This brought MicroStrategy’s total holdings to 205,000 Bitcoins, leaving them in a neck-and-neck race with BlackRock for the world’s largest corporate holdings

- Michael Saylor’s firm doesn’t appear content with those reserves though; on Wednesday it announces its second senior notes issuance within a fortnight; this time to the tune of $500m

- Since Saylor began a policy of Bitcoin acquisition as an inflation hedge in 2020, the leading digital asset is up by 675%

- MicroStrategy’s status as a proxy for Bitcoin exposure has been a major boon in 2024; year-to-date stock price is up over 170%, with paper losses for short-sellers now standing around $3.3bn

What happened: South Africa prepares for mass crypto platform approvals in March

How is this significant?

- South Africa is the latest country to realise a regulatory regime for digital assets, with around 60 crypto asset platforms expected to gain licences from the country’s Financial Sector Conduct Authority (FSCA) later this month

- 60 licensees may sound significant, but it represents only around one-fifth of applicants for such licences, according to a source who spoke to Bloomberg on the matter

- FSCA commissioner Unati Kamlana commented “We are processing those licencing applications and we’re doing so in a phased kind of manner given the numbers”

- Rather than developing separate crypto-bespoke rules, the FSCA will treat digital assets under the existing Financial Advisory and Intermediary Services Act; Kamlana argued that it was better to act now, as perfect is the enemy of done; “If you wait for the Rolls-Royce kind of regulatory framework, you still have those risks anyway”

- However, Kamlana did acknowledge that learnings could inform future legislation tied to the particular properties of digital assets; “As we licence and supervise, we will discover that perhaps there are gaps that cannot be closed by the existing regulatory framework, the FAIS Act… we might need to build on that as we discover what those are”

What happened: Coinbase shares return above direct listing price

How is this significant?

- Following a resurgence across the digital asset market this year, Coinbase shares (COIN) reached their highest point since December 2021 this week

- Closing at $256 on Friday, COIN exceeded its initial reference price of $250 when the firm first went public in 2021

- Over the last year, COIN has rallied by around 300%, echoing a wider recovery in the crypto market

- However, unlike Bitcoin, shares do still remain significantly below their 2021 high, which saw COIN trading at $350 in November 2021

- On Tuesday, Coinbase announced a $1bn convertible bond sale, thus avoiding equity dilution of existing shareholders via any new share issuance

- In its press release, Coinbase said it “may use proceeds from its transaction to repay debt, pay for potential capped call transactions and possibly to acquire other companies”

What happened: Bitcoin mining metrics hit new records

How is this significant?

- Bitcoin miners have been key beneficiaries of Bitcoin’s recent rise, with record prices for the digital asset also equating to record revenues for the miners securing its blockchain

- According to CryptoQuant data, miner revenues hit $78.6m on March 7th, exceeding an April 2021 record from the last bull market

- Miners haven’t only secured gains from higher prices on newly-mined Bitcoins, but also increased trading activity leading to more competition amongst traders—and thus higher transaction fees for miners to process transactions

- The Valkyrie Bitcoin Miners ETF has more than doubled over the last year, reflecting the general momentum of Bitcoin

- Bitcoin’s upcoming halving may lead to greater consolidation amongst miners according to some analysts, as well as the possibility of greater miner-held selloffs as firms either raise funds for more hardware, or realise profits and exit the industry

- Current competition remains fierce; Bitcoin’s mining difficulty reached a new record high, reflecting more miners active on the network

What happened: Judge rules against programmer’s long-standing “I am Satoshi” claims

How is this significant?

- One of the longest-running sagas in the Bitcoin community appears to have reached an end this week, as a UK high court judge conclusively ruled against an Australian computer scientist who wished to be legally recognised as Satoshi Nakamoto—the pseudonymous developer of Bitcoin and author of its original white paper

- Craig S Wright has claimed to be Satoshi since 2016, making several aggressive legal claims to the effect, including copyright claims on the Bitcoin white paper, the pursuit of Bitcoin held in trusts, and the intimidation of developers still working within the Bitcoin ecosystem

- The trial included involvement from a collective of crypto companies known as the Crypto Open Patent Alliance (COPA), who alleged several fabrications in evidence presented by Wright, including traces of editing software that didn’t exist at the time Wright’s documents were allegedly authored

- Judge Mellor seemingly agreed, making the highly unusual move of issuing his verdict within seconds of the trial’s conclusion, rather than recusing himself to consider matters

- He stated that “having considered all the evidence and submissions presented to me in this trial, I’ve reached the conclusion that the evidence is overwhelming”

- Wright has long been a controversial figure in the digital asset field for his claims, including the hard fork Bitcoin SV (Satoshi’s Vision), which he engineered and exerted significant control over

What happened: Goldman, BNY, Visa amongst participants in enterprise blockchain trial

How is this significant?

- Several major TradFi institutions confirmed their participation in the Canton Network this week, an enterprise-level blockchain aimed at tokenisation efforts

- The pilot program “involved 15 asset managers, 13 banks, four custodians and three exchanges”, and featured settlement of tokenised assets alongside “fund registry, digital cash, repo, securities lending, and margin management transactions”

- Aimed at interoperability, the Canton blockchain features smart contracts written in the DAML language of blockchain firm Digital Asset

- Digital Asset CEO Yuval Rooz commented “Canton allows previously siloed financial systems to connect and synchronise in previously impossible ways while abiding by the current regulatory guardrails”

- The focus of the blockchain is very much on enterprise usecases and adoption; a Canton spokesperson stated “The successful execution of over 350 simulated transactions proved how a network of interoperable applications can seamlessly connect to enable secure, atomic transactions across multiple parts of the capital markets value chain. It also demonstrated the potential benefits of using such a network to reduce counterparty and settlement risk, optimise capital, and enable intraday margin cycles”

- Participants included Goldman Sachs, BNY Mellon, Oliver Wyman, BNP Paribas, Cboe Global Markets, Commerzbank, DTCC, Generali Investments, Harvest Fund Management, Nomura, Northern Trust, Standard Chartered, State Street, and Visa