15th September, 2023

Market Overview:

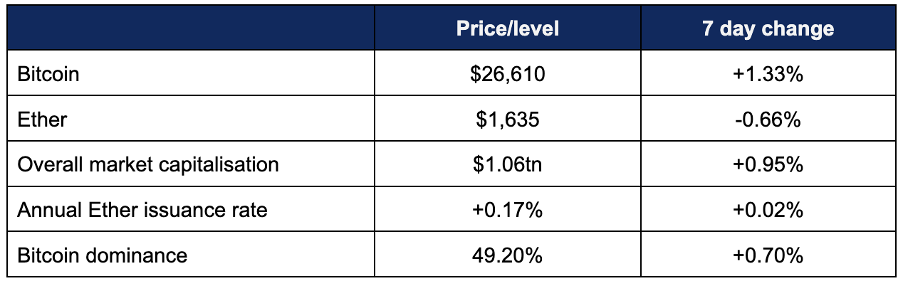

Digital assets continued last week’s slight recovery, with growth in late trading after an early-week decline.

- Bitcoin bounced from a steep Monday drop and weekly low of $25,000 to hit a weekly high of $26,750 on Thursday

- Ether peaked at $1,650 last Friday, dropping to doldrums of $1,541 late on Sunday

- Decreased levels of network activity also meant that Ether moved to mildly inflationary (+0.03%) annual issuance when extrapolated from the most recent 30 day dataset

- Following the second straight week of divergence between Bitcoin and Ether performance, Bitcoin dominance (the overall percentage of digital asset market capitalisation attributed to Bitcoin) experienced its largest weekly increase since May, approaching 50% of market share

- Overall digital asset market capitalisation increased slightly to $1.06tn, fuelled primarily by Bitcoin’s rise

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week declined slightly to $37.8bn

Digital assets increased slightly this week, with adoption news rolling in around the globe. Germany’s largest bank struck a deal for custody and tokenisation services with a Swiss digital asset specialist, Franklin Templeton entered the US spot Bitcoin race, institutional adoption continued across Asia (with a special focus on Hong Kong, Singapore, and Korea), PayPal boosted their involvement in the space, a British luxury goods family office decided to allocate capital to the sector, and CBDCs experienced both support via new SWIFT interoperability programs and opposition from US politicians wary of the centralised nature a “digital dollar” could carry.

What happened: Deutsche Bank finalises deal to enable digital asset custody services

How is this significant?

- German banking giant Deutsche this week finalised a deal with Swiss digital asset firm Taurus, allowing them to leverage the latter’s expertise and services in matters of crypto custody and asset tokenisation

- This follows a $65m investment into Taurus from Deutsche in February, alongside Credit Suisse, Pictet, and Arab Bank Switzerland

- According to a press release announcing the partnership, “Deutsche Bank will integrate Taurus’ market-leading technology to establish digital asset custody and tokenization services”, indicating an intent to participate in multiple facets of digital assets

- Paul Maley, Deutsche Bank’s global head of securities services, communicated a bullish long-term view from the bank as a catalyst for the partnership; “As the digital asset space is expected to encompass trillions of dollars of assets, it’s bound to be seen as one of the priorities for investors and corporations alike. As such, custodians must start adapting to support their clients”

- In the press release, Taurus called the partnership “a natural extension of Deutsche Bank’s recent digital asset initiatives”, linking a 2020 WEF paper on digital assets in which Deutsche forecast a potential $24tn market for asset tokenisation, and aimed “to develop a fully integrated custody platform for institutional clients and their digital assets providing seamless connectivity to the broader cryptocurrency ecosystem”

- Reuters reported that digital asset trading was not in Deutsche’s “immediate plans”, but that “supporting clients in the overall digital asset ecosystem” is, as the bank proceeds “cautiously and in line with the spirit and the letter of the regulations governing this asset class”

What happened: Franklin Templeton enters spot Bitcoin ETF race

How is this significant?

- Franklin Templeton became the latest major asset manager to file for a spot Bitcoin ETF, following heavyweight contemporaries and competitors BlackRock and Fidelity

- The $1.4tn AUM firm filed its application with the SEC on Tuesday, indicating plans for Coinbase to handle Bitcoin custody whilst BNY Mellon custodies cash

- This move follows not just BlackRock’s application—which sparked a flurry of filings from other TradFi giants—but Grayscale’s August victory in court which ruled that the SEC had been “arbitrary and capricious” in rejecting its request to convert the GBTC fund into a spot Bitcoin ETF

What happened: Digital asset exchange Bullish applies for Hong Kong licence

How is this significant?

- Gibraltar-registered digital asset exchange Bullish revealed ambitions for the Hong Kong market this week, becoming the latest blockchain business to be attracted by the city’s open and progressive regulatory stance towards the asset class

- Speaking at a conference in Singapore, Bullish CEO Tom Farley said that the firm already has almost half of its global headcount in Hong Kong—110 out of 260 employees

- Local exchanges HashKey and OSL were the first to be granted licences for retail trading under the new Hong Kong regulatory regime for digital assets, but Farley hopes to join those ranks soon

- He told conference attendees “We are going through the process of applying for a licence in Hong Kong. We have been there building an exchange for four years. It’s our biggest office”

- He cited the city’s regulatory attitude as a key reason for shifting their business there, lamenting the fragmented legal landscape in the US; “We have chosen not to engage in commercial activity in the US. We are approved in many states. We could do it tomorrow. But the environment in the US is not terribly friendly. It’s frustrating.”

- Alongside the 110 staff in Hong Kong, Bullish also claims 75 staff in the USA and 40 in Singapore (which unlike Hong Kong has reduced retail access to digital assets)

- Asia has generally been a beneficiary of US regulatory uncertainty this year; Ripple CEO Brad Garlinghouse told Bloomberg TV that 80% of their hiring will be outside America this year, as in several major Asian economies such as UAE, Hong Kong, Singapore, and Japan “governments are partnering with the industry and you’re seeing leadership, they’re providing clear rules and you’re seeing growth”

What happened: Stablecoin issuers Circle partner with South East Asian “superapp” Grab

How is this significant?

- Speaking at the Token2049 Conference in Singapore, Circle CEO Jeremy Allaire promoted “real world utility and emerging tokenisation of real world assets” when speaking of his company’s new partnerships with local super-app Grab and LatAm online retailer MercadoLibre

- Circle, issuers of the USDC stablecoin, are able to provide benefits in the form of cross-border settlements, remittances, and efficient value-flow for Latin American consumers—stablecoins pegged to major international currencies can also help them hedge exposure to local currencies undergoing hyperinflation

- In terms of their partnership with Grab—a Singaporean equivalent to China’s wildly-popular WeChat—Circle provides a Web3 wallet infrastructure for Grab’s app to enable unique offers, rewards, and NFT-based vouchers

- The pilot program with Grab actually leverages the Singapore central bank (MAS) Project Orchid, which aims to create “purpose-bound money”

- Grab currently boasts 180 million users across the South East Asia region, branching out from its initial ride-sharing services to include other capacities such as delivery and digital payments

- Allaire called the partnership “an indicator of new types of user experience that are becoming possible because of Web3 that prior to technology like this was not easily accessible to people”

- He added “I think it’s gonna be very easy for us to imagine a world next year where we can take a billion users and have access to Web3, and therefore have access to transacting stablecoins”

- The initial phase of the pilot will officially launch during the Singapore Grand Prix on September 17th

What happened: Dunhill family office makes bear market bet on digital asset recovery

How is this significant?

- The family office of the Dunhill luxury goods dynasty appears to be diversifying their portfolio to include digital asset exposure, according to a Coindesk interview this week with Piers Dunhill, great-great-grandson of company founder Sir Alfred Dunhill

- He told the publication that he believed a contrarian stance in a period of decreased investment, trading, and VC activity could yield long-term dividends

- Dunhill said “Now that no one is really investing in crypto and it’s hard to get money, that’s why I'm investing. I like to try and do the opposite of everyone else. The bear market sentiment right now is why I’m looking to invest.”

- Dunhill Ventures and the Dunhill Financial subsidiary will initially deploy $3m into Liechtenstein-based VC Mocha Ventures, making up approximately 1/10th of a planned new fund for DeFi and crypto payment rail investments

- Mocha general partner Renato Brioni said that Dunhill’s involvement went further than just its own investment; “The Dunhill family office has kindly invited Mocha Ventures into their inner circle of family offices in Singapore, Hong Kong and Dubai, where we will jointly work on closing the fund”

What happened: Korea Blockchain Week reveals growing institutional adoption in Asia

How is this significant?

- Attendees of the recent Korea Blockchain Week echoed sentiments from Singapore’s Token2049 conference, telling TechCrunch+ that institutional adoption in Asia is being boosted thanks to greater regulatory clarity than in the US

- Hong Kong, Japan, Singapore, Korea, and the UAE were cited as economies with particularly proactive approaches towards the industry and asset class

- Jason Atkins of market making firm Auros told reporters at the event that “Crypto is addressing a lot of questions for existing financial institutions and banks,”

- Meanwhile, Justin Kim (head of Korea at Ava Labs) said that Asian firms are more willing to listen to industry participants and educate themselves on the underlying technology, whilst “other regions cross their arms and want to wait and see”

- Charles d'Haussy, CEO of the dYdX Foundation (a funding vehicle for DeFi platform dYdX), said that there was a snowball effect in the region; as more crypto companies gain regulatory approval in Asia, institutional interest and appetite grow as a corollary

- Additionally, family offices in Asia—particularly those serving a younger clientele—have proven more willing to allocate capital towards digital assets compared with American or European contemporaries

- Speaking via video-link at the Token2049 conference, Binance CEO Changpeng “CZ” Zhao acknowledged that Singapore remained crypto-friendly overall despite having limited retail access to the asset class following last year’s FTX collapse

What happened: CBDC news

How is this significant?

- Several significant developments occurred in the realm of central bank digital currencies (CBDCs) this week, both in favour and against the proposed digitisation of cash

- In the United States, a bill co-sponsored by over 50 members of congress sought to ban the issuance of any digital dollar CBDC by the Federal Reserve

- Republican House Majority Whip, Tom Emmer, introduced the CBDC Anti-Surveillance State Act, arguing that a CBDC could impinge on fundamental American values and financial freedom

- He warned that “unlike decentralised crypto assets like Bitcoin”, a CBDC is government-controlled and runs the risk of creating “government-controlled programmable money that, if not designed to emulate cash, could give the federal government the ability to surveil Americans' transactions and choke out politically unpopular activity”

- Emmer added that “If not designed to be open, permissionless, and private, a government-issued CBDC is nothing more than a CCP-style surveillance tool that would be used to undermine the American way of life”

- His bill seeks to prevent the Federal Reserve from issuing a CBDC to individuals directly or through intermediaries, as that could open the door to the collection of personal financial data, or use of a CBDC as “as a tool to control the American economy”

- Interestingly, he also stated that "this bill ensures the future of crypto is in the hands of the American people, not the administrative state", echoing some perceptions of the current administration's enthusiasm towards CBDCs as a "trojan horse" to displace decentralised crypto assets whose value is determined by social consensus, rather than highly centralised decision-making

- Meanwhile, interbank messaging system SWIFT said that three central banks are now testing its digital currency interoperability project, alongside 30 independent financial institutions

- One of the participating central banks is the Hong Kong Monetary Authority, furthering the city’s proactive approach towards digital currencies and assets

- Tom Zschach, Chief Innovation Officer at Swift, said “Our focus is on interoperability–ensuring that new digital currencies can seamlessly coexist with each other and with today’s fiat-based currencies and payment systems”

- This desire to “prevent digital islands” where value cannot be easily transmitted across institutions or economies is particularly crucial in the face of data from the Atlantic Council, which reveals that 130 countries—representing 98% of global GDP—are currently exploring CBDCs

What happened: PayPal adds support for Web3 payments via crypto

How is this significant?

- PayPal, an early institutional supporter of crypto, deepened its integration of the asset class this week with the introduction of On and Off Ramps for Web3 business customers

- This acts as an enhancement of PayPal’s previous integrations on its app, when it first allowed users to buy and sell digital assets back in 2020

- With On and Off Ramps, Web3 businesses and services like wallets, marketplaces, and dApps (decentralised apps) can directly integrate PayPal’s payment services into their business, allowing purchase of and payment via crypto in a framework that includes PayPal’s fraud management, chargeback and dispute security controls and tools

- In a press release, PayPal commented that “By adding Off Ramps, crypto wallet users in the US can convert their crypto into USD directly from their wallet to their PayPal balance so they can shop, send money, save or transfer to their debit or debit card”

- Another major online brand, Telegram, also announced an increase in its blockchain integration this week

- Speaking at the Token2049 conference, Telegram announced the forthcoming integration of a self-custodial wallet app on its messaging platform, which boasts 800 million users

- Crucially, the wallet was developed by a third party (TOP Labs) and will be unavailable within the US, following a previous SEC lawsuit against Telegram when it conducted an ICO (Initial Coin Offering) for its own TON token in 2020

- The wallet will be available without registration from November onwards, part of Telegram’s ambition to emulate WeChat’s “super-app” status in offering a broader range of services than just instant messaging

What happened: Contagion latest

How is this significant?

- Genesis wound down all its trading services this week, “voluntarily and for business reasons”, following the bankruptcy of its Genesis Global lending division

- Meanwhile, parent company Digital Currency Group urged creditors to accept a repayment plan that it claims could return 100% of value to Gemini Earn customers, and 70%-90% of value to other unsecured creditors

- Binance.US experienced major cutbacks as US regulatory hostility continues to bite the business; they eliminated 100 jobs this week, approximately one-third of their total workforce

- A spokesperson stated “The actions we are taking today provide Binance.US with more than seven years of financial runway and enable us to continue to serve our customers … The SEC’s aggressive attempts to cripple our industry and the resulting impacts on our business have real-world consequences for American jobs and innovation, and this is an unfortunate example of that”

- The redundancies included CEO Brian Schroder, the latest in a string of executive-level departures from both Binance Global and its American subsidiary

- Singapore regulators MAS slapped the leadership of failed hedge fund Three Arrows Capital (3AC) with a nine-year ban from any regulated activities, citing “flagrant disregard of MAS’ regulatory requirements and dereliction of their directors’ duties”

- FTX secured court approval to begin selling off $3.4bn of digital asset holdings to help pay off creditors, capped at $100m of sales per week

- Attorney Andrew Dietderich stated “We are not in a rush, but we expect to do it based on market opportunities as the case proceeds”

- A presentation in a Delaware court revealed that around 75 parties have been approached for a potential relaunch of the FTX exchange, with a deadline for bids set at September 24th

- According to the filing, the FTX estate could execute the relaunch with winning bidders in a variety of ways, including “an acquisition, merger, recapitalization or other transaction to relaunch the FTX.com and/or FTX US exchanges”

- The filing furthermore stated that the FTX estate has currently recovered around $7bn in assets, including the aforementioned $3.4bn in liquid crypto, and Bahamas properties with a book value of $222m

- In terms of former FTX leadership, ex-CEO Sam Bankman-Fried’s legal team filed a number of questions deemed relevant for jury selection, including jurors’ history of crypto trading and opinions on the Effective Altruism movement

- Meanwhile, former FTX co-CEO Ryan Salame pled guilty to one campaign finance violation and one charge of illegally transmitting money, but his plea agreement doesn’t compel him to testify against Bankman-Fried in the upcoming trial

What happened: Coinbase launches Web3 wallet to boost institutional DeFi participation

How is this significant?

- Digital asset exchange Coinbase increased its institutional focus this week, introducing a new blockchain wallet to allow institutional customers easier access and interaction with DeFi platforms and services

- Kevin Johnson, vice president of institutional sales, commented “More and more, we're seeing corporations who want to participate on-chain in some way, whether that's by doing an NFT drop, or, in some cases, even voting in DAOs… But they need a safe way to do that”

- According to a recent survey of institutional investors by Nickel Digital, there is indeed a growing appetite for DeFi exposure amongst professional investors; CEO Anatoly Crachilov acknowledged barriers such as the user experience, but stated “DeFi solutions demonstrated the resilience of decentralised applications during last year’s ‘mass extinction’ of centralised entities. The market now increasingly recognises DeFi’s value proposition and the growth opportunities over the coming years”

- Johnson says that institutional concerns over asset security were paramount in their design process, saying all their Coinbase Prime security will be mirrored within the wallet; “we've seen that demand from clients and we knew that this was critical in order to bring them on-chain, and now they have that product”

- This new solution also includes institutional functionality like multi-user setup with different types of permissions and configurations

What happened: HSBC reportedly working with crypto custody firm Fireblocks

How is this significant?

- According to sources speaking with industry publication Coindesk, global banking giant HSBC is working with digital asset infrastructure and custody firm Fireblocks, although both remained silent when approached for comment

- Fireblocks has a history of working with major financial institutions; it’s previously secured investment from, and subsequently built custody solutions for BNY Mellon

- HSBC allows its Hong Kong customers to trade in Bitcoin and Ether ETFs, but has yet to integrate any physical custody solutions

- In other institutional custody news, Nomura-backed Komainu added institutional credit network Hidden Road to its list of customers, making them the first prime broker to join the Komainu Connect collateral management platform

- Komainu CEO Nicolas Bertrand commented “Hidden Road is a key addition to our expanding collateral management network, representing another piece of the puzzle in bringing this much needed and institutional grade offering to the digital asset marketplace”