September 27th, 2024

Market Overview:

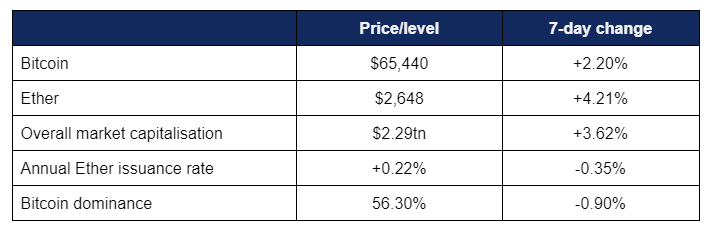

Digital assets performed strongly this week, hitting their highest levels in almost two months amidst positive rate cut reactions and ETF volumes.

- Bitcoin rose above $65,000, hitting its highest levels in nearly two months, buoyed by positive macroeconomic news

- The leading digital asset spent most of the week trading in the $63,000 to $64,000 range, with a Sunday low of $62,520 before breaking to a weekly high of $65,690 in late Thursday trading; its highest price since late July

- Ether performed with a steady upward trajectory, rising from a weekly low of $2,496 on Friday to a Monday high of $2,685

- This snapped a long run of Ether underperforming Bitcoin, and renewed activity on the chain led to a significant increase in supply reduction via transaction fees burned

- Overall digital asset market capitalisation increased to $2.29tn, with 97 of the top 100 projects by market capitalisation exhibiting growth at the time of writing

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew by nearly $5bn, to $88.4bn

Digital assets built on last week’s considerable growth, showcasing strong performances backed by bullish ETF inflows and buoyed by macroeconomic data. BNY Mellon moved to secure a spot as a leading crypto custodian, Kamala Harris finally provided some unambiguous support for the digital asset sector within her policies, stablecoin development continued, and there was more involvement from key crypto-friendly institutions including BlackRock, Visa, and PayPal, amongst others.

What happened: ETF News

How is this significant?

- Digital asset ETFs performed strongly this week, including some of the strongest inflows for spot Ether products since they launched

- According to CoinShares data, digital asset investment products saw $321m of inflows, of which $284m came from spot Bitcoin products

- Spot Bitcoin ETFs continued their inflow streak as of Thursday (experiencing net gains in 12 days of the last 14 trading days)

- BlackRock’s IBIT saw major inflows for the first time in several weeks, gaining $99m on Tuesday and $184m on Wednesday

- Most other funds saw net zero flows throughout the week, except for Fidelity, Bitwise, and Grayscale’s 0.15% fee mini-ETF

- Grayscale’s converted GBTC trust (hampered by a 1.5% fee far in excess of competitors) saw its best run of non-outflows (not to be confused with inflows), with five net zero flow days in the last eight trading days

- Spot Ether ETFs reflected the positive momentum of their underlying asset this week, including $59.3m inflows for BlackRock’s ETHA on Tuesday, and $26.6m for Grayscale’s 0.15% fee mini-ETF

- Grayscale’s converted ETHE trust (trading with a 2.5% fee) experienced one day of major outflows—worth nearly $81m—on Monday, but also experienced several days of net zero flows in stark contrast to consistent post-launch outflows

- In ETF-adjacent news, the SEC approved options trading for BlackRock’s IBIT, allowing them to trade on the Nasdaq (pending approval from Options Clearing Corp. and CFTC)

- Bloomberg’s lead ETF analyst Eric Balchunas commented that this opens Bitcoin up to an even wider audience; “Getting the SEC to come around is a big step toward listing options, which can be a huge help for attracting more and larger investors as well as bringing in more liquidity around the ETFs”

- According to VanEck’s head of digital asset research Matthew Sigel (citing a report from K33 Research), “Bitcoin’s derivatives market is 1/279th the size of its equity and commodity counterparts”

- However, the SEC delayed decisions on options applications for spot Ether ETFs from BlackRock and Bitwise, citing the need for more time to consider

What happened: Political news

How is this significant?

- Digital asset reporting once again featured in the US presidential election as Democratic candidate Kamala Harris finally outlined her policy platform on crypto

- Addressing donors in New York, Harris declared that “We will partner together to invest in America’s competitiveness, to invest in America’s future. We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors”

- This marked the first specific policy position of the Harris campaign regarding the asset class, after long-running reports that her advisors were reaching out to industry figures in an attempt to “reset” relations following the damaged of perceived Biden-administration hostility

- Her competitor Donald Trump has been more vocal in his support of the industry since campaigning began, vowing to make the US “the crypto capital of the world”

- In a speech at the Economic Club in Pittsburgh, Harris said “I will re-recommit the nation to leadership in the industries that will define the next century…AI and quantum computing, blockchain and other emerging technologies”

- She also published an 80 page economic plan titled “A New Way Forward for the Middle Class” in which these sentiments were reinforced

- Analysts from VanEck posit that either candidate could be beneficial to the digital asset industry; “We think that while Kamala Harris and Donald Trump are bullish for Bitcoin, each presents more nuanced implications for the broader digital asset markets. Both administrations will likely maintain fiscal spending if not further accelerate, which could lead to further quantitative easing—especially if exacerbated by anti-business policies”

- In their worst-case scenario of Harris keeping Gary Gensler as chair of the SEC and aligning with Elizabeth Warren on economic policies, VanEck said that the broader digital asset industry would likely suffer from restrictive regulation; but Bitcoin could benefit

- “On Bitcoin alone, however, we would argue that a Kamala Harris presidency might be even better for Bitcoin than a second term for Trump because it would, in our view, accelerate many of the structural issues that drive Bitcoin adoption in the first place”

- They added that “Regardless of the election outcome the trend of growing fiscal deficits and rising national debt will likely continue. This suggests a weakening of the US dollar, a macroeconomic environment in which Bitcoin has historically thrived”

- In the regulatory realm of government, SEC chair Gary Gensler was grilled before Congress this week, facing criticism (mainly from Republicans) regarding a variety of issues ranging from his agency’s misconduct to prosecution of NFT projects

- In a CNBC interview, Gensler declined to comment on the forthcoming election, but stated “This field will not long persist without investor protection or consumer protection”

- Meanwhile, Coinbase continued its legal efforts to compel the SEC into actually making and explaining rules to govern digital assets

- Coinbase lawyer Eugene Scalia told a three-judge panel that it was “extraordinarily oppressive governmental behaviour” for the SEC to threaten enforcement actions without providing a method for firms to register

- Elsewhere, Dubai’s regulatory authority instituted stricter rules for digital asset marketing, requiring firms to include risk disclaimers in communications

What happened: Stablecoin news

How is this significant?

- The stablecoin space continued its recent spate of activity this week, as several significant firms advanced their efforts and developments with the digital asset subcategory

- Robinhood and Revolut, two of the world’s leading fintech firms, are both developing their own stablecoins, with a particular eye towards the EU and upcoming enforcement of MiCA regulations

- Tether, the largest stablecoin issuer in the market today, does not currently have an e-money licence within the EU, although CEO Paolo Ardoino said the company is developing a “technology-based solution” to operate in the region

- Thomas Eichenberger, chief product officer at Swiss bank Sygnum said “Many businesses have looked at the likes of Circle and Tether and the [profit] figures they’ve posted. It sounded like a beautiful business model, and there are many out there that might want to replicate that”

- Christian Catalini of the MIT Cryptoeconomics Lab backs up the appeal of stablecoin issuance, stating “Mainstream retail brands, neobanks and exchanges will think about issuing. The credit-card companies, too. There’s dawning realisation that Tether and Circle have massive power in this market”

- Societe Generale is moving its Euro-pegged stablecoin from the Ethereum blockchain to competing smart contract platform Solana, eager to leverage the benefits of its lower transaction costs

- SG Forge CEO Jean-Marc Stenger added that Solana's speed "will unlock new possibilities for both retail users and institutional players" in DeFi

- Meanwhile, Ethereum-based synthetic dollar protocol Ethena is issuing a new stablecoin—using digital assets (of a sort) as the backing assets for the dollar peg

- In collaboration with tokenisation platform Securitize, Ethena will back its new UStb stablecoin with tokens from BUIDL, BlackRock’s on-chain money market fund

What happened: BNY Mellon approved to act as digital asset custodian

How is this significant?

- BNY Mellon, the world’s largest custodian bank, could soon become one of the world’s largest crypto custodians, having received approval from the SEC to safeguard digital assets for crypto clients

- In particular, the approval relates to crypto ETFs for Bitcoin and Ether, but could expand to other digital assets in future if BNY decides

- Crucially, the SEC waived its own SAB 121 accounting requirements for BNY, which generally require banks to hold custodied crypto—unlike other assets—on their own balance sheets as liabilities

- However, initial reports stated that the exemption is “specific to the financial institution’s ETP use case”, and thus “banks argue it locks them out of custodying digital assets, a potentially lucrative business”

- Later in the week, Gary Gensler himself appeared to contradict this, telling Bloomberg News “Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was. It didn’t matter what the crypto was”

- One of the key criticisms to emerge from the crypto contagion of 2022 was the amount of “one-stop-shop” behaviour practiced by certain digital asset firms; the introduction of one of the world’s largest, longest-established, and most-reputable asset custodians could go a long way towards boosting institutional confidence

- According to some recent estimates, crypto custody is a $300m business with 30% annual growth, currently dominated by industry-native firms

- Duke University finance professor Campbell Harvey told Bloomberg “New entrants are betting that this market becomes substantially larger”

- Lawyer David Portilla added “Although the SEC has begun to provide relief under SAB 121 for banks, it has not done so in a transparent manner that applies across the board. The technological, legal and regulatory risks cited by SAB 121 are substantially mitigated by the existing and extensive legal and supervisory framework that applies to banking organisations, yet the SEC’s policy does not reflect that”

What happened: BlackRock digital asset chief outlines firm’s Bitcoin perspective

How is this significant?

- Following on from the firm’s recent report identifying Bitcoin as a “unique diversifier” in portfolios, BlackRock’s head of digital assets Robert Mitchnick further elucidated on the institution’s Bitcoin outlook this week

- Although the report stated that it doesn’t fit neatly into established categories and conventions of “risk-on” or “risk-off” assets, Mitchnick believes that Bitcoin leans more towards the risk-off side due to its unique properties

- On a long-term basis, he argues that Bitcoin shows near-zero correlation with stock markets, albeit with some short-term overlap on equity markets

- “When we think about Bitcoin, we think about it primarily as an emerging global monetary alternative. A scarce, global, decentralised, non-sovereign asset. And it’s an asset that has no country-specific risk, that has no counterparty risk”

- He also spoke on the evolving custody landscape, with “operational finetuning” eight months on from launches

- Mitchnick identifies approval of IBIT options as “a great milestone” to allow investors to “hedge risk in a more flexible way”

- He also expressed optimism over bipartisan recognition of the need for proper digital asset regulatory frameworks, a sign of greater maturity within the industry

- In news of other TradFi analysis, Standard Chartered researchers identified the US yield curve and derivatives interest as bullish indicators for Bitcoin, potentially building on a rally fuelled by recent rate cuts

What happened: MicroStrategy raises over $1bn, purchases additional Bitcoin

How is this significant?

- MicroStrategy—the enterprise software firm that has become a proxy for digital asset exposure as the largest corporate holder of Bitcoin—added to its substantial Bitcoin coffers this week with another large purchase

- Hot on the heels of the firm’s recent $1.1bn Bitcoin acquisition, the company raised $1.01bn in a convertible senior notes issuance; exceeding its original $700m target

- Of this amount, $458m was used to buy more Bitcoin, whilst $500m redeemed previously-issued senior notes

- As of its latest SEC filing on the 19th of September, MicroStrategy held 252,220 Bitcoin

What happened: PayPal expands crypto capabilities to US merchant and business accounts

How is this significant?

- PayPal this week deepened its long-running involvement with the digital asset industry, by opening up crypto offerings to merchant accounts, including those in the US (except for New York)

- Jose Fernandez da Ponte, SVP of blockchain and crypto at PayPal noted that “Business owners have increasingly expressed a desire for the same crypto asset capabilities available to consumers”

- The company was one of the first major institutions to recognise and embrace digital assets back in 2020, when it first allowed users to buy, hold, and sell digital assets within its app

- Now, merchants will be able to do the same from their accounts, potentially opening up new capital flows to supported tokens

- In a Wednesday press release, the firm added that merchants won’t have their funds stuck within their own platform; they “can externally transfer crypto on chain to third-party eligible wallets. PayPal business account holders can now send and receive supported crypto tokens to and from external blockchain addresses”

What happened: Visa launches tokenisation platform to help banks put assets on blockchain

How is this significant?

- Payments processing giant Visa has launched a new platform called VTAP, aimed at bolstering tokenisation efforts within the banking industry

- The Ethereum-based platform will allow banks to issue fiat-backed tokens reflecting assets like bonds or commodities

- Using blockchain-based tokens, banks will be able to “purchase tokenised RWAs [real world assets] such as commodities or bonds with near-real-time settlement”

- VTAP provides a regulated environment for banks to explore tokenisation technology, with Spanish banking giant BBVA confirmed as one of the first adopters with a live pilot expected in 2025

- The tokenisation platform is versatile enough to cover multiple usecases, including “real-time money transfers between bank clients, interbank transfers using wholesale central bank digital currencies (CBDCs), and cross-border transactions for multinational companies”

- According to a statement seen by industry publication Coindesk, “Visa Tokenised Asset Platform (VTAP) will enable the development of fiat-backed tokens powered by smart contracts to help digitise and automate existing processes that will then power the exchange of real-world assets”

- Catherine Gu, Visa’s head of CBDC and tokenized assets told industry publication Blockworks “We think this creates a significant opportunity for banks to issue their own fiat-backed tokens on blockchains, do it in a regulated way, and enable their customers to access and participate in these on-chain capital markets”, adding that “For multinational corporates moving money 24/7, current rails are limited”

- In other RWA news, ETF issuers WisdomTree recently launched a new platform—WisdomTree Connect—allowing users to hold tokenised funds in their own digital wallets

- According to a press release, the tokens will initially be minted on Ethereum (with possible expansion to other blockchains later), and purchasable via US dollars or the USDC stablecoin

- Will Peck, head of digital assets at WisdomTree commented “With increasing interest in tokenised RWA, WisdomTree Connect opens up additional B2B and business-to-business-to-consumer (B2B2C) opportunities for WisdomTree to provide access to digital funds to on-chain firms without leaving the ecosystem”

- Further along the horizon for RWAs, a subcommittee of the CFTC’s global advisory committee “intends to make recommendations to the full committee on how registered firms can use distributed ledger technology for holding and transferring non-cash collateral”

- Subcommittee co-chair Caroline Butler told Bloomberg “This will be huge and really important. Collateral has become one of the primary use cases and drivers for tokenisation”

- McKinsey estimates a total tokenised asset market (excluding stablecoins) of $2tn by the year 2030