March 25th, 2025

Market Overview:

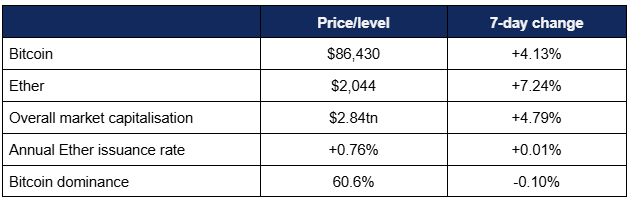

Digital assets continued last week’s recovery, buoyed by ETFs performing positively for the first time in over a month.

- Bitcoin built on last week’s growth, hitting highs of nearly $89,000 before a minor pullback following reports of possible Mt Gox creditor repayments late on Monday

- The leading digital asset spent the majority of the week trading between $83,700 and $88,030, with a steady upward trajectory from a Tuesday low of $81,200 to $88,620 on Monday afternoon

- Like many other major markets, digital assets responded favourably to statements suggesting softening tariff policy by Donald Trump, encouraging traders to re-enter the market

- Ether crossed the $2,000 threshold once again, two weeks after falling below those levels for the first time since 2023

- Ether increased from a Tuesday low of $1,874 to a weekly high of $2,100 in early Monday trading

- Overall industry market capitalisation increased to $2.84tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew almost $10bn, crossing the $100bn landmark once again for $100.7bn

Digital assets showcased a second week of growth, indicating a possible return of market optimism as rhetoric around tariff wars softened slightly, and Trump maintained his support for digital assets. There was also political support forthcoming in other countries, ranging from Australia to the UAE. Standard Chartered demonstrated Bitcoin’s role as a superior diversifier in tech portfolios, Fidelity joined the tokenisation ranks, several industry firms made major acquisitions or moved towards significant funding, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs moved back into inflows this week, bucking a negative five-week trend

- According to CoinShares data published on Monday, digital asset investment products achieved $644m in inflows

- These flows were dominated by Bitcoin funds, which added $724m to more-than-offset continued outflows across altcoin products

- CoinShares analysts led by head of research James Butterfill were optimistic about immediate prospects, writing “Total assets under management have risen by 6.3% from their low point on March 10th. Notably, every day last week recorded inflows, following a 17-day consecutive run of outflows—signalling a decisive shift in sentiment toward the asset class”

- At the time of writing, spot Bitcoin ETFs registered six consecutive days of inflows, three of which added nine figures

- Following an uncharacteristic extended run of losses, BlackRock’s market-leading IBIT once again dominated inflows, adding $218m and $172m on Tuesday and Thursday respectively

- Other funds’ inflows were very modest in comparison, but Fidelity’s FBTC ($127m) and ARK Invest’s ARKB ($89m) performed strongly early in the week

- Spot Ether ETFs however displayed a different performance, continuing the recent trend of outflows for 12 consecutive days of outflows at the time of writing

- Only two funds registered any inflows at all in the last week; 21Shares’ CETH (below $1m), and Grayscale’s ETHE ($10m)

- A press release late on Monday revealed Trump Media partnered with crypto.com to launch digital asset basket and “Made in America” ETFs

- Crypto.com co-founder and CEO Kris Marszalek said “Once launched, these ETFs will be available on the Crypto.com App for our more than 140 million users around the world”

- Although details remain scarce, Bloomberg chief ETF analyst Eric Balchunas reported that the funds are expected to launch later this year

- Asset management giant Fidelity filed for a Solana ETF, making it by far the largest potential issuer for such a product, following similar filings from Grayscale, VanEck, and newcomer Canary Capital

- According to research from TMX VettaFi, digital asset ETFs are gaining popularity amongst financial advisors, as 57% plan to increase allocations, whilst 42% of respondents expected to maintain current investment levels

What happened: Political news

How is this significant?

- Several significant political and legislative developments—both in the US and internationally—contributed to a broadly positive atmosphere amongst digital assets this week

- President Trump appeared via videolink at the Blockworks Crypto Conference in New York, reaffirming his administration’s support for blockchain and digital assets

- He remarked that “I’ve also called on Congress to pass landmark legislation creating simple, common sense rules for stablecoins and market structure… You will unleash an explosion of economic growth, and with the dollar backed stablecoins, you’ll help expand the dominance of the US dollar”

- Regarding the aforementioned stablecoins, Bloomberg reported via Capitol sources that the Financial Services Committee will consider (and is expected to advance) the current GENIUS Act stablecoin bill on April 2nd

- However some politicians (including long-time crypto opponent Elizabeth Warren) have voiced concerns over a perceived lack of consumer protections (from an entity such as the FDIC) within the bill

- Federal Reserve board member Lisa D Cook also warned “If a run on a large stablecoin were to occur, liquidation of the assets backing the stablecoin could be disruptive, especially if those assets were linked to other funding markets”

- US stablecoin legislation is perceived as less stringent than the conditions within Europe’s MiCA regulations, which caused delistings of major stablecoins such as Tether’s USDT within the EU

- ECB chief economist Philip Lane advocated for a Digital Euro CBDC as a bulwark against stablecoin-spurred US Dollar hegemony within the EU

- Speaking at a conference in Cork he claimed a Digital Euro “limit[s] the likelihood of foreign-currency stablecoins gaining a foothold as a medium of exchange in the Euro area… The Digital Euro is not just about making sure our monetary system adapts to the digital age. It is about ensuring that Europe controls its monetary and financial destiny”

- Elsewhere in Europe (and outside the Eurozone), Swiss National Bank chief Martin Schlegel denied the chance of a Swiss Strategic Bitcoin Reserve, stating “We do not have plans to buy crypto assets”

- Explaining why, he added “it’s the preservation of value… as you know, crypto assets have large fluctuations in value, so this is not a given”

- On the other side of the world, Australia’s government published a paper providing plans on a “fit for purpose” digital asset regime, following a previous public consultation

- The paper states “Digital assets are a rapidly evolving part of the economy, offering opportunities for new products and productivity gains… The potential benefits of these assets are far reaching, from streamlining payments systems to transforming how we invest and do business”

- Back in the US, Ripple Labs CEO Brad Garlinghouse confirmed that the SEC dropped its landmark case against Ripple over its XRP digital asset, declaring an end to a case started in 2020 which cost the company $150m in legal fees alone

- Earlier this month, Ripple also seeded $50m to create the National Crypto Association (NCA), intended to act as an independent (albeit chaired by Ripple chief legal officer Stuart Alderoty) and non-political entity to “demystify crypto”

- Crypto’s clout in Washington is perceived to have grown substantially since the election, with some Democrat stalwarts such as Kirsten Gillibrand creating bipartisan support

- Interim CFTC and SEC leadership stated that under the incoming heads, approaches would likely differ from the previous administration—particularly in regards to fines and regulation via enforcement

- At the SEC’s first Crypto Task Force Roundtable, a16z general counsel Miles Jennings opined; “I don't think that anyone could credibly argue that the last administration's approach to the industry accomplished any of the SEC's objectives… the [Biden administration] approach is clearly a failure and we have to do better”

- On Thursday, the agency also released a statement confirming “proof-of-work mining does not involve the offer and sale of securities”

What happened: Standard Chartered replaces Tesla with Bitcoin in “Magnificent 7” Index

How is this significant?

- Analysts from global bank Standard Chartered this week opined that Bitcoin can be considered analogous to leading tech stocks, providing alpha when replacing Tesla in a portfolio of seven major firms

- The hypothetical “Mag 7B” portfolio (an alternative to the established “Magnificent 7” of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) “has both higher returns and lower volatility than Mag 7", according to analyst Geoff Kendrick

- Standard Chartered undertook the modelling on the belief that Bitcoin’s short-term movements historically align with the Nasdaq more often than gold

- Kendrick wrote “This suggests that investors can view Bitcoin as both a hedge against TradFi and as part of their tech allocation”

- Mag 7B outperformed Mag 7 by around 5% in comparisons undertaken from December 2017—a date specifically chosen for Bitcoin’s historic all-time high around $20,000, “to avoid biasing our analysis by giving Bitcoin an unfair advantage in terms of returns”

- Kendrick explained “as Bitcoin’s role in global investor portfolios becomes established, we think that having more than one use will bring fresh capital inflows to the asset. This is particularly true as Bitcoin investment becomes more institutionalised”

- Additionally (as per industry publication TheBlock), “Mag 7B also showed lower volatility than Mag 7 in every single year of the analysis… on average, it was nearly 2% less volatile. When combined with stronger returns, this gave Mag 7B a higher information ratio: 1.13 versus 1.04”

What happened: Digital asset firms poised for massive acquisitions and funding

How is this significant?

- Several major crypto (or crypto-adjacent) companies featured in reports of acquisitions and large-scale funding this week, as life and optimism returned to the sector

- Bloomberg revealed that crypto exchange Coinbase is in advanced talks to acquire derivatives platform Deribit in what “would mark one of the most-significant acquisitions in the industry’s history”

- Dubai-based Deribit was valued at $4bn to $5bn in January, which would indeed make such a deal one of the largest in the industry

- Rival US exchange Kraken meanwhile purchased futures platform NinjaTrader for $1.5bn, enabling it to offer crypto derivatives and futures in its home market for the first time

- Co-CEO Arjun Sethi commented “This transaction is the first step in our vision of an institutional-grade trading platform where any asset can be traded, anytime”

- Additionally, sources claim Kraken may raise up to $1bn in debt ahead of its planned IPO

- However, this figure could also be “as low as” $200m, with funds entirely bookmarked for growth as operational needs are already covered

- The company posted $1.5bn revenues in 2024, up 128% from the year prior

- On Thursday, the TON Foundation (governing the TON blockchain, previously developed by Telegram) disclosed a $400m raise via token sales to numerous investors, including Sequoia Capital and Kingsway

- A TON spokesperson said “Essentially, these VCs are placing their bets on the future success and utility of the TON blockchain, its growing ecosystem, and its potential to provide real-world utility for crypto holdings, especially within Telegram”

- Market maker DWF Labs announced its own $250m fund designed for mid- to large-cap digital asset projects

- According to an email, allocations will range between $10m to $50m

- Digital asset VC Haun Ventures is currently raising $1bn for two new crypto investment funds

- The raise is split evenly across both funds, with one dedicated to early-stage projects, and the latter to late-stage projects

What happened: Cantor amongst lenders servicing crypto companies

How is this significant?

- Following last week’s news of Cantor Fitzgerald launching a new Bitcoin financing business, several analysts identified a recent rise in crypto lending after financing dried up following the 2022 crypto winter

- Alongside Cantor, wealth manager Xapo Bank recently began offering Bitcoin-backed loans worth up to $1m, and sources reported that earlier this month Blockstream “secured a multibillion-dollar investment to launch three funds, including two that will enable crypto lending”

- Bitstamp USA CEO Bobby Zagotta, commented “With the new administration, I think that regulators will have a more reasonable regime and approach and perhaps the banks will get more involved”

- Dragonfly VC general partner Rob Hadick also thought the shift in political winds will yield results; “We have seen excitement from more traditional lenders as they have gotten more comfort from the current administration, legislation and the regulators are going to allow them to do that”

- Following the collapse of crypto-native lenders such as Genesis Global and Celsius, there is a greater acceptance of TradFi firms providing finance to the industry

- NYU business school professor Austin Campbell commented “I remain sceptical crypto natives can spontaneously invent hundreds of years of credit lessons and instead think it requires expertise from outside the industry coming in”

What happened: Dubai Land Department launches real estate tokenisation pilot

How is this significant?

- On Wednesday, the Dubai Land Department (DLD) announced a pilot program (in partnership with the Emirate’s VARA regulatory body) to tokenise real estate across the city

- According to a press release, this marks “the first real estate registration entity in the Middle East to implement tokenisation on property title deeds”

- DLD officials forecast tokenisation to account for $16bn of value by 2033, equivalent to around 7% of all real estate transactions

- Director general (His Excellency Eng.) Marwan Ahmed Bin Ghalita stated “real estate tokenisation emerges as a revolutionary tool driving fundamental change in the real estate sector. By converting real estate assets into digital tokens recorded on blockchain technology, tokenisation simplifies and enhances buying, selling, and investment processes”

- He added “It aligns with our strategy to unlock new opportunities… and enable a wider pool of investors to participate in large-scale real estate projects in Dubai”

- DLD highlighted specific advantages of tokenisation, particularly “enabling fractional property ownership. This innovative approach marks a significant shift by allowing investors to acquire a portion of a property without fully purchasing it, leveraging advanced technology”

What happened: Fidelity launching on-chain money market fund

How is this significant?

- According to a recent regulatory filing, finance giant Fidelity is joining its contemporaries BlackRock and Franklin Templeton in tokenising money market funds

- The $5.9tn AUM asset manager will issue shares of its Fidelity Treasury Digital Fund (FYHXX) on the Ethereum blockchain

- However, the filing also acknowledged that (like BlackRock’s BUIDL and Franklin’s BENJI), the fund could expand to other blockchains in the future

- BUIDL recently crossed $1bn in total assets within less than a year of launch, before soaring yet further to around $1.5bn at the time of writing—showcasing the growing appeal of on-chain funds

- BENJI meanwhile has accrued around $690m AUM since launch, with category tracker rwa.xyz logging the current value of all tokenised treasuries at $4.77bn

- Cynthia Lo Bessette, head of Fidelity digital asset management, stated “we see promise in tokenization and its ability to be transformative to the financial services industry by driving transactional efficiencies with access, and allocation, of capital across markets”

- Pending regulatory approval, the tokenised fund is expected to launch on May 30th

What happened: USDT issuer Tether ranks amongst top foreign buyers of US Treasuries

How is this significant?

- According to a recent tweet by CEO Paolo Ardoino, USDT stablecoin issuer Tether was the 7th-largest foreign purchaser of US Treasuries last year

- As per data from the US Treasury Department and Tether’s own reserve reports, the company purchased a net $33.1bn in US Treasuries last year

- This puts it ahead of several significant global economies including Germany, Mexico, and Canada, ranking just behind the UK

- Additionally, Ardoino pointed out that some larger purchasers such as the Cayman Islands and Luxembourg “includes all the hedge funds buying into T-bills”, rather than reflecting singular national policy

- This news supports recent sentiments by new Treasury Secretary Scott Bessent, who believes stablecoins strengthen—rather than weaken—the US Dollar

- Speaking at this month’s White House Crypto Summit, he stated “we are going to keep the US [Dollar] the dominant reserve currency in the world, and we will use stablecoins to do that”

- Although its leading stablecoin is the US Dollar-pegged USDT, Tether recently moved its headquarters to El Salvador, perceiving it as one of the most pro-crypto jurisdictions possible

- Treasuries are popular amongst stablecoin issuers as backing assets for the tokens they generate; unlike direct cash holdings, favourable interest rates on Treasuries allow the issuers to generate large profits whilst issuing assets designed not to increase (or decrease) in nominal value

What happened: Strategy adds to Bitcoin holdings with nine-figure purchase

How is this significant?

- Institutional Bitcoin advocate Strategy (formerly MicroStrategy) this week expanded its considerable corporate coffers yet further, disclosing a major new Bitcoin buy following a fresh fundraise

- According to Monday SEC filings, the enterprise software firm (and Bitcoin exposure proxy) spent $584.1m last week purchasing 6,911 Bitcoin at an average price of approximately $84,529

- This brings the firm’s total holdings to around 2.4% of Bitcoin’s (eventual) 21 million coin maximum supply

- Early last week, Strategy offered a $500m preferred perpetual stock sale to finance the latest round of Bitcoin buys, leading to an oversubscribed round of $700m sold

- Since October, the firm has announced new acquisitions on a near-weekly basis, as founder Michael Saylor remains one of the most visible (and outspoken) Bitcoin bulls in the corporate realm, praising Bitcoin’s properties as an inflation hedge and so-called “magnet for capital”

- News of the latest purchase pushed Strategy’s stock price up around 9%, continuing growth of around 2,500% since the company shifted to a Bitcoin-centric investment model in 2020