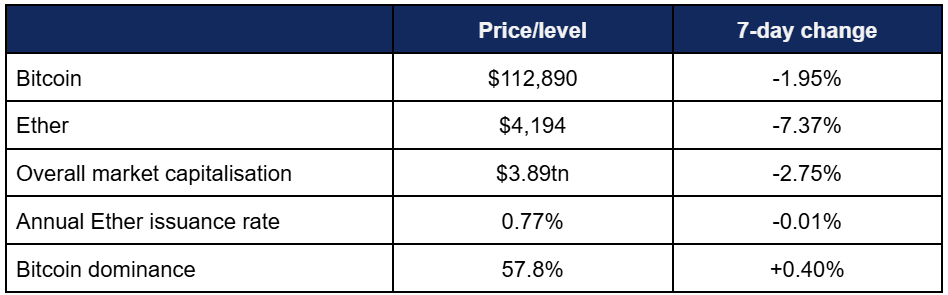

Market Overview

- Bitcoin performed steadily throughout the week, trading predominantly in the channel between $116,000 and $118,000, before cascading liquidations of longs across the market on Monday led to a significant late drop

- Bitcoin hit its weekly low of $111,810 in the early hours of today, after peaking at $117,890 on Friday following initial positive reaction to rate cuts

- Ether fell back hard from last week’s near-record performance, dropping to lows of $4,130 in early Tuesday trading, down from a Thursday high of $4,633

- Monday was particularly challenging for the market, as cascading liquidations wiped out over $1.5bn in bullish wagers, with Ether and altcoins particularly affected

- However, there was positive performance from at least one major asset; Binance’s proprietary BNB token secured a new record high of $1,080 over the weekend, surpassing Solana as the fifth-largest digital asset by market capitalisation

- Another top 20 token, AVAX, was up over 16% at the time of writing, thanks to its increased profile as a potential crypto treasury asset

- Overall market capitalisation erased last week’s gains and fell back to $3.89tn, after peaking at $4.13tn during intraweek trading

- According to industry monitoring site DeFi Llama, total value locked in DeFi declined around $6bn, to $154bn

Digital assets exhibited mixed performance, as strong early trading was erased by liquidations after initial positive reactions to Federal Reserve rate cuts. Adoption and regulation continued trending upward, as the SEC streamlined ETF listing processes, stablecoin developments continued globally, the US and UK agreed to collaborate on regulatory efforts, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products experienced another week of inflows, as traders initially responded positively to rate cuts from the Fed

- According to Coinshares data published on Monday, digital asset funds added about $1.8bn in fresh capital during the week ending Friday the 19th

- Coinshares head of research James Butterfill wrote that “Although investors initially reacted cautiously to the so-called ‘hawkish cut,’ inflows resumed later in the week, with $746 million entering on Thursday and Friday as markets began to digest the implications for digital assets”

- Spot Bitcoin ETFs once again put in a strong showing, with four of the five trading days recording nine-figure daily inflows; albeit in a narrower range than last week, between $163m and $292m

- BlackRock’s IBIT dominated the weekly flows as the only fund to return nine-figure daily inflows (four times), securing a best of $263m on Monday

- Fidelity’s FBTC only just missed out on the nine-figure club however, posting $97m inflows on Thursday

- The largest weekly outflows also came courtesy of FBTC, which lost $116m on Wednesday, leading to the day’s net $51m outflows

- Spot Ether ETFs had the largest weekly inflows on Monday ($360m), although they underperformed their Bitcoin brethren by posting two daily outflows (Tuesday and Wednesday)

- BlackRock’s ETHA and Fidelity’s FETH both returned nine-figure inflows this week, with top performances of $363m and $159m respectively

- In other ETF news, issuer Grayscale filed an updated S1 form with the SEC, regarding the request to convert its Doge memecoin fund into an ETF

- The same coin was the subject of a new actively-managed fund (under the ticker DOJE) from issuers REX Shares and Osprey Funds

- The two firms also issued a new XRP fund with the same legal structure as DOJE, commenting “As first-to-market funds, XRPR and DOJE give investors unique exposure to two of the leading names in the crypto and digital asset space —all in a regulated ETF”

- DOJE and XRPR both launched to strong trading on Friday, as per Bloomberg chief ETF analyst Eric Balchunas; “Really solid. $DOJE did $12m and $XRPR did $15m. All of them crush the average ETF launch although far cry from Bitcoin. Still, gotta be happy with that if you are those issuers”

- 21Shares also moved to list an ETF for the original memecoin, under the ticker TDOG

- ETF issuer Defiance increased the sophistication of crypto ETFs, filing for new Bitcoin and Ether products built around the basis trade, designed to exploit price disparities between spot and futures trades

What happened: Tokenisation news

How is this significant?

- After last week’s reveal that BlackRock plans to tokenise its ETFs, the industry sector appeared to take a breather this week, with no major developments

- Perhaps the largest story in the tokenisation field was one potentially far less positive than previous stories

- Reuters reported that (mainland) China’s leading regulator—the China Securities Regulatory Commission—is telling Hong Kong brokerages to pause their recent spate of real-world asset (RWA) tokenisation efforts

- According to Reuters, the new guidance remains informal and aimed at risk control concerns

- The move comes within three months of Hong Kong regulators publishing a piece on increasing tokenisation efforts within the city

- Recently, Chinese firms have been using Hong Kong subsidiaries to secure exposure to the digital asset industry despite a long-running ban on continued trading in the mainland

- Bloomberg revealed that Hong Kong entities of Shenzhen Futian and Shandong Hi-Speed both recently issued digital bonds on blockchain to raise funds for growth

- Dubai may attempt to capitalise on Hong Kong’s enforced inertia to establish itself as a regional leader in the space; the Emirate just approved its first tokenised money market fund

- Meanwhile, HSBC bank issued a statement on Monday, expanding its tokenised deposit program to include cross-border transactions, as in its first successful trial transfer, between Singapore and Hong Kong for treasury management of Ant International

- HSBC’s head of global payment solutions, Manish Kohli commented “Tokenised deposits represent a major step forward in the future of transaction banking and open new opportunities…. By combining real-time liquidity with programmability and secure settlement through blockchain, we can help clients better manage their liquidity, streamline operations and future-proof treasury functions”

- Unlike legacy infrastructure, tokenised assets allow customers to move currencies in real-time, with a 24/7/365 settlement period

- Ant International general manager Kelvin Li added “We believe tokenisation is key to enabling more efficient, cost-effective and trusted global transactions, and we will continue working with HSBC to make cross-border payments seamless for businesses of all size”

- Also in Singapore, DBS bank teamed with Franklin Templeton and Ripple to “offer accredited and institutional investors trading and lending services using tokenised money market funds and Ripple’s US dollar stablecoin”

- DBS will list Franklin’s localised sgBENJI token (tracking the Singapore dollar market rather than USD) on its digital asset exchange, as well as Ripple’s RLUSD stablecoin

- Lim Wee Kian, DBS Digital Exchange CEO, commented “This partnership demonstrates how tokenised securities can play that role while injecting greater efficiency and liquidity in global financial markets”

What happened: SEC significantly streamlines crypto ETF process

How is this significant?

- The new SEC leadership continued its supportive stance towards the digital asset sector this week, as it approved generic listing standards for crypto ETFs, exponentially streamlining the process for new funds in a post-Bitcoin and post-Ether ETF era.

- It cuts a previous 240 day process down to around 75 days, thanks to a new standardised rulebook.

- Bloomberg chief ETF analyst Eric Balchunas believes this could have a major effect in accelerating launches and accessibility, “unleashing a tsunami of products”

- He added “The last time they implemented a generic listings standards for ETFs, launches tripled. Good chance we see north of 100 crypto ETFs launched in the next 12 months”

- SEC chair Paul Atkins commented “This approval helps to maximise investor choice and foster innovation by streamlining the listing process and reducing barriers to access digital asset products within America’s trusted capital markets”

- It didn’t take long for the new rule to have an effect; on Wednesday, the SEC approved trading for Grayscale’s Digital Large Cap Fund (GDLC), offering exposure not just to Bitcoin and Ether, but also XRP, Cardano, and Solana

- Although it offers ETF exposure to the named altcoins for the first time, those wishing for more altcoin exposure may have to wait for bespoke products; 70% of funds are allocated to Bitcoin, and 17% to Ether

- GDLC debuted to strong volume with $22m inflows despite minimal pre-launch publicity; a figure which Balchunas notes “crushes the average ETF launch”

What happened: Crypto custodian BitGo becomes latest industry firm to file for IPO

How is this significant?

- Following last week’s public floats of both digital asset exchange Gemini and blockchain lender Figure, crypto custodian BitGo became the latest to join the industry IPO trend

- BitGo, founded in 2013, initially filed a confidential draft version of its IPO proposal in July, and this week revealed updated financial figures to support a public float

- Particularly notable is its near-quadrupling of H1 revenue to $4.2bn compared to the year prior

- The public S1 registration statement also disclosed $90.3bn worth of digital assets held on the platform in H1, over 4,600 institutional and HNW clients, and more than 1.1 million end-users in over 100 countries across the world

- However, despite the major surge in revenues, the firm’s profitability has actually declined due to rising operating costs; from $30.9m to $12.6m

- According to the statement, Bitcoin currently constitutes around 48.5% of the asset value held on the platform, and funds are earmarked for “technology development, acquisitions, and stock-based compensation while boosting visibility and financial flexibility”

- Goldman Sachs and Citi are acting as underwriters for the firm, with a planned listing on the NYSE under the ticker BTGO, under a dual-stock system that allows CEO Mike Belshe to maintain control of the company

What happened: Stablecoin news

How is this significant?

- Payment processor Stripe won perhaps the first “stablecoin bidding war” this week, as it won the right to issue USDH, the native stablecoin of the fast-growing Hyperliquid platform

- Stripe beat out more established names in the digital asset industry, such as Paxos and Ethena, through a partnership between its stablecoin platform Bridge and Native Markets

- The bidding process attempted to win over validators—the individuals who operate the software and nodes that keep a blockchain running smoothly—via various revenue-sharing agreements

- Fellow payment processor PayPal meanwhile moved to extend the reach of its proprietary PYUSD stablecoin

- In a company blog post, PayPal announced its expansion to a new stablecoin-centric blockchain called (aptly enough) Stablechain, in a bid to “make global payments faster and cheaper”

- Pan-Asian messaging giant LINE teamed up with the KAIA blockchain to create “Project Unify”, a “stablecoin superapp” for the Asian market

- Unify will feature consumer payments, remittances, and on- and off-ramps within a single interface

- According to their announcement, the comprehensive service will exist both as an integration within the popular LINE messaging app, and as a standalone platform

- KAIA itself was formed by the merger of blockchains from Korea and Japan’s messaging app leaders, Kakao and LINE respectively

- Adjacent to the stablecoin space, EU leaders pushed ahead with their plans for a Digital Euro CBDC, but a Reuters report noted the process will still take years, with concern over issues such as planned maximum ownership caps

What happened: US and UK to collaborate on crypto regulation efforts

How is this significant?

- As part of US president Trump’s UK state visit last week, both countries agreed to collaborate on creating a “crypto-focused task force to guide future regulations”

- Prime minister Keir Starmer has thus far been far less vocal about the asset class than his predecessor Rishi Sunak, who’d pledged to turn the UK into a “global cryptoasset technology hub”

- A Monday government statement announced the new “Transatlantic Task Force for Markets of the Future”, exploring both long-term cooperation and “options for short-to-medium term collaboration on digital assets whilst legislation and regulatory regimes are still developing”

- Prior to the visit last week, chancellor Rachel Reeves met with industry representatives and trade groups conveying the importance of blockchain in future financial infrastructure

- Some within the UK have lamented that regulatory inertia could cost the country crypto capital; regional Kraken exchange chief Bivu Das told Bloomberg “Other jurisdictions are racing ahead with clear frameworks for crypto, while the UK is hesitating. If we want the next generation of innovators and high-paying jobs to be built in the UK, rather than in Singapore, Dubai or the EU, we need to move”

- Simon Jennings of the UK Cryptoasset Business Council added “Future-proofing the UK’s financial services—responsible for over 10% of GDP and funding the public services we all rely on—should be at the very top of the national agenda”

- Regarding regulatory matter in the US, Senate Democrats pushed for a greater voice in shaping the current crypto market structures CLARITY bill

- In a statement, twelve pro-crypto Democratic senators wrote “We hope our Republican colleagues will agree to a bipartisan authorship process, as is the norm for legislation of this scale. Given our shared interest in moving forward quickly on this issue, we hope they will agree to reasonable requests to allow for true collaboration”

- They propose a seven-pillar framework for regulation, the party’s most comprehensive outline thus far, stating “Digital asset technology has the potential to unlock new businesses and spur American innovation”

- Crypto Council executive director Patrick Witt commented at Korea’s Blockchain Week 2025 that the White House expects the CLARITY bill to pass by the end of the year

- Witt said “We’re unblocking what we can, we’re serving as a referee when there’s kind of an impasse, weighing in where necessary. We’re respecting the process. We’re optimistic that we are going to get it done before the end of the year”

What happened: Standard Chartered raising $250m for crypto investments

How is this significant?

- SC Ventures, the VC arm of global banking institution Standard Chartered, appears to be betting big on blockchain, raising $250m for a new fund dedicated to digital assets

- Speaking at the Money 20/20 fintech event in Riyadh, SC Ventures’ Gautam Jain stated that the company plans to launch the fund next year with investors from the Middle East

- The new fund will focus on “early-stage companies developing digital custody infrastructure, compliance tools and hybrid platforms that connect fiat and crypto ecosystems”

- In other VC news, credit card startup Cardless raised $60m in fresh funding, with a portion earmarked for collaboration with crypto exchange Coinbase

- Cardless is able to use real-time blockchain data to tailor offers for cardholders

- According to Bloomberg “the Coinbase program, offers cardholders Bitcoin-related perks. They can get as much as 4% Bitcoin back on every purchase and receive immediate push notifications about those rewards. Customers with more assets on Coinbase receive higher rewards rates, a system designed to spur both card use and crypto deposits”

What happened: Santander launches digital asset trading for retail clients

How is this significant?

- Openbank, Santander’s online bank, announced this week that its retail customers are now able to trade digital assets through their banking platform

- As of Tuesday, Openbank customers in Germany have been able to buy and sell Bitcoin, Ether, Cardano, Litecoin, and Polygon

- This contrasts to other digital asset trading services launched recently by banks, which generally concentrate purely on Bitcoin, or the “Big Two” of Bitcoin and Ether

- According to Openbank’s statement, customers are afforded “the backing of Santander and the guarantees and investor protection provided by the European Markets in Crypto-Assets Regulation (MiCA)”

- Santander head of crypto Coty de Monteverde commented that the move was driven by market forces; “By incorporating the main crypto assets into our investment platform, we are responding to the demand of our customers”

- Whilst the service is launching with the above tokens in Germany, Santander noted plans to imminently expand access to Spain, and increase the number of tokens listed

What happened: Crypto Treasury news

How is this significant?

- In another big week for digital asset treasuries, a leading player made their largest purchase ever, whilst a significant corporate acquisition also took place

- Top Ether treasury firm BitMine now holds 2% of Ether’s current circulating supply, following a weekly purchase round of approximately $1.1bn

- BitMine also announced a $365m registered direct offering (priced at a 14% premium) alongside a possible $913m in warrants, for a potential $1.28bn in future funding

- Chairman Tom Lee wrote “This is materially accretive to existing shareholders as the primary use of proceeds is to add to our ETH holdings. In our view, this 14% premium reflects not only strong institutional investor interest in the BitMine story, but also confidence in our execution as a company”

- Leading Japanese Bitcoin treasury firm Metaplanet made its largest purchase to date, spending $632.5m at an average cost of $116,724 per Bitcoin, placing it as the fifth-largest corporate holder of Bitcoin

- Bitcoin treasury firm Strive agreed to buy fellow treasury firm Semler Scientific in an all-stock deal, marking the first major consolidation in the treasury field

- Strive founder Vivek Ramaswamy also revealed a $675m Bitcoin purchase for Strive’s own balance sheet last week

- Nasdaq-listed Brera Holdings is rebranding to Solmate as the company pursues a Solana treasury strategy, to the tune of $300m in allocated funds

- SkyBridge Capital’s Anthony Scaramucci is backing a new firm pursuing an Avalanche (AVAX) token treasury, with a planned raise of $550m

- AgriForce Growing Systems is rebranding to AVAX One with Scaramucci on its board of directors, sending its share prices up 149%

- Finally, B Hodl listed on the Aquis Stock Exchange in London, after completing a £15.3m raise to embark on a strategy of generating revenue via its Bitcoin holdings

- According to industry publication TheBlock “B HODL’s directors aim to build the company into a global player in Bitcoin services, with a focus on Lightning liquidity and infrastructure to support mainstream adoption”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.