25th August, 2023

Market Overview:

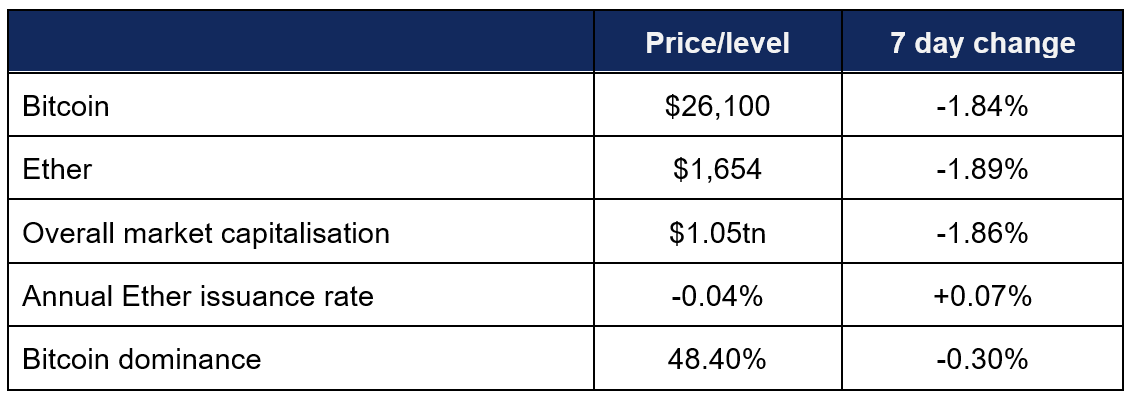

Digital assets traded within a relatively stable range following last week’s losses, albeit with some large short-term rebounds.

- Bitcoin traded predominantly between $25,800 and $26,250, following a Tuesday low of $25,630 with a weekly high of $26,790 on Wednesday

- Ether mirrored Bitcoin, with a weekly high of $1,695 on Wednesday after a Tuesday low of $1,603, experiencing range-bound trading between $1,1650 and $1,680 for the majority of the week

- Overall digital asset market capitalisation dropped slightly to $1.05tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week dropped by $0.5bn to $38bn

Digital assets appeared to recover and reset following last week’s dramatic decrease. Institutional exchanges and market makers made the news this week with partnerships and acquisitions, another new VC emerged, pro-crypto politicians entered the global public consciousness, Coinbase secured a stake in Circle, regulatory-compliant tokenisation entered the fray, and Mastercard made some CBDC moves following Visa’s Ethereum development efforts last week.

What happened: Citadel-backed EDX digital asset exchange secures crypto custodian

How is this significant?

- EDX markets—the institutionally-focused crypto exchange backed by TradFi giants Citadel, Charles Schwab, and Fidelity—confirmed their choice of digital asset custodian this week, selecting Goldman Sachs- and KKR-backed Anchorage Digital for the role

- The move signals an intent to shift towards more institutional standards and practices than most “legacy” crypto exchanges, after last year’s FTX collapse signalled the dangers of one-stop-shop exchanges maintaining custody of funds

- Diogo Mónica, founder and president of Anchorage Digital commented that “We’re getting closer to the tested solutions you see in the traditional financial world. It’s a market structure change for crypto investors, combining the best of both worlds”

- EDX chief executive Jamil Nazarali agreed, stating “As the crypto asset class is maturing, we are separating the role of the custodian and exchange. Customers don’t need to tie up assets, parked at an entity where they aren’t sure what’s going on”

- Anchorage is in the unique industry position of holding a bank charter from the OCC, and was valued at $3bn during its last funding round in 2021, making this a cooperation between two of the crypto firms with the most significant backing from the world of traditional finance

What happened: Coinbase secures direct ownership stake in stablecoin issuers Circle

How is this significant?

- Leading US-based exchange Coinbase and USDC stablecoin issuers Circle formalised their relationship this week as the former took a stake in the latter

- The two firms were previously linked as co-founders of the Circle Consortium, which governed the USDC stablecoin—but citing “growing regulatory clarity for stablecoins in the US”, the two decided to restructure their partnership, with Circle being dissolved and Coinbase taking an undisclosed stake in Circle

- In a blog post, Circle confirmed that the restructured relation will include new revenue streams for Coinbase, saying the firms “will continue to be shared based on the amount of USDC held on each of our platforms, and additionally we will now equally share in interest income generated from the broader distribution and usage of USDC”

- A bill to regulate stablecoins is currently advancing through various committees and layers of US Congress, and appears to have influenced their reference to “growing regulatory clarity in the US”

- Due to the liquid reserves (such as cash and treasuries) of fully-backed stablecoins like USDC, combined with rising interest rates, interest income can prove a viable revenue stream for stablecoin issuers

- Coinbase gained $151m from USDC revenue in Q2, and leading stablecoin Tether boasted $850m in profits and boosted excess reserves to $3.3bn in the same timeframe

- In other Coinbase news, its international crypto derivatives exchange surged to over $280m of daily trading volume, with $5.5bn in trading within seven weeks of launch

- In a shareholder letter, they said 50 institutions have already been recruited onto Coinbase International, noting that “While we are in the early days of investing to build liquidity and grow institutional participation, we are also working to bring new features and additional products to market over the second half of the year, such as additional asset trading books and spot trading”

What happened: Tokenised stock platform launches for US customers

How is this significant?

- Earlier this year at Davos, tokenisation was one of the key areas of interest for WEF participants with an eye towards the digital asset space

- This week, progress was made towards wide-scale tokenisation of a widely-traded traditional investment class; securities

- Startup Dinari has acquired a broker-dealer licence and registered as a transfer agent with the SEC, to allow the company to distribute dividends and maintain records of securities ownership

- Dinari allows users to buy tokenised stocks (backed one-to-one by real-world shares purchased by Dinari) directly with crypto

- Tokenisation of such assets opens up a variety of interesting possibilities; including use as collateral or direct trades for other tokenised stocks

- The company has raised seed funding from a variety of firms and well-known investors, including Susquehanna International Group company, venture-capital firm 500 Global, and Balaji Srinivasan

- The tokenised shares will offer buyers dividends, but not direct shareholder voting rights, and a “complex regulatory landscapes across jurisdictions” means that initially the digitised assets can only be sold directly to Dinari itself

- In another nod towards the mechanisms of the US stock market, the tokenised shares will only be tradeable between the bells on Wall Street, rather than across the 24/7/365 experience of native digital assets

- Co-founder Chad Rampenthal explained that these severe restrictions were part of their efforts to be regulatory compliant, and hoped that their facilities will expand over time; “The end game of Dinari is to use our broker-dealer licences to be able to have an operating exchange where these securities can be traded. In order to run, you have to walk, and in order to walk, you have to crawl. This is kind of our way of getting started”

What happened: BitStamp removes staking services for US customers citing SEC environment

How is this significant?

- BitStamp, one of the oldest digital asset exchanges in the world, is adjusting their offering for US customers based on “current regulatory dynamics”

- CEO Bobby Zagotta said the exchange (founded in the primordial days of crypto in 2011) will discontinue their staking services in one month’s time, due to SEC pressure

- In the news a couple weeks ago for a funding raise geared towards international expansion, this latest development may signal a shift of focus away from the USA

- The SEC cited Coinbase’s provision of staking services as a rules violation in their June lawsuit, indicating that the regulators are sceptical of staking-as-a-service, after targeting rival exchange Kraken for their staking services

- Staking (at least in the case of Ethereum, the largest Proof-of-Stake protocol) involves users pledging (i.e. “staking”) their tokens within a smart contract to help secure the blockchain by validating transactions and blocks

- Unlike straight dividends from stock or share ownership, stakers have to directly undertake efforts of launching nodes, and rewards aren’t uniformly distributed or guaranteed across specific timeframes; decentralisation means the process is randomised

What happened: Vessel Capital launches $55m digital asset VC fund

How is this significant?

- In an environment of reduced venture capital allocations across the board (outside of AI, the current darling of investors) new VC dollars have the potential to make more impact than in the more exuberant times of 2021’s bull market

- This week Vessel Capital emerged from stealth with $55m AUM to invest in Web3 projects (primarily focused on infrastructure and applications)

- The fund will be deployed over a five year period, but is viewed as “evergreen”, allowing the potential for more capital to be added over that timeframe

- Co-founder Mirza Uddin told TechCrunch “On a high level, we really wanted to build a new type of venture fund. A lot of giant funds are getting raises, but the VCs themselves don’t have a lot of skin in the game when it comes to using their own capital”

What happened: Thailand appoints crypto-friendly prime minister

How is this significant?

- This week, Thailand appointed property tycoon Srettha Thavisin as prime minister, concluding a drawn-out election process which saw his Pheu Thai party assemble an 11-party coalition

- Of particular interest to those in the digital asset space however is that Thavisin represents another entry into the small (but growing) pantheon of pro-crypto heads of state

- Prior to entering politics, the 61-year old took a 15% stake in a local digital asset service provider, and his real estate conglomerate Sansiri also launched its own token in a 2021 ICO (Initial Coin Offering)

- Indeed, a key facet of Thavisin’s election promise was digital asset distribution, via a 10,000 Baht ($300) “airdrop” to every citizen of Thailand above the age of 16, distributed via blockchain

- This distribution “will use a form of national token, not an existing digital asset or cryptocurrency”, and will be convertible to cash within national banks by participating vendors

- Interestingly, although Pheu Thai finished second in the popular vote, the leader of the top party, Pita Limjaroenrat of Move Forward, is also a supporter of digital assets, disclosing holdings of Bitcoin, Ether, Cardano, and BNB in his personal portfolio

- In other political news, pro-Bitcoin libertarian Javier Milei emerged as the winner of Argentina’s presidential primary, viewed as a key indicator for the actual election

- Milei has stated that Bitcoin “represents the return of money to its original creator, the private sector”, and argued against the country’s central bank, which he claims “is a scam, a mechanism by which politicians cheat the good people with inflationary tax”

- As a candidate in Argentina, his words may have more resonance for most than in other nations; the central bank recently raised its interest rate from 97% to 118%, and as a result of ongoing currency devaluation, Bitcoin recently hit another record high denominated in Argentine Pesos, rising above 22,000,000 pesos

What happened: Contagion latest

How is this significant?

- In a new motion, current FTX management filed to maximise returns from current crypto assets in the company’s portfolio by appointing Galaxy Digital to oversee the sale, staking, and hedging of FTX’s digital assets

- According to FTX, “Proactive risk management will best protect the value of crypto holdings and therefore help to achieve an equitable distribution of funds in a potential reorganisation of the company”

- Bankrupt lender Blockfi meanwhile is trying to prevent its fellow contagion hit firms FTX and Three Arrows Capital from clawing back funds, claiming such actions could reduce compensation for its own customers by $1bn

- A former manager at NFT trading platform OpenSea was sentenced to three months in prison after being found guilty in the first-ever NFT insider trading case

- Nate Chastain used his knowledge of projects to be highlighted on the site’s homepage to purchase their NFTs before boosting their profile, netting him as much as 500% returns

- Two founders of Tornado Cash, a crypto mixer, were charged with money laundering by US authorities

- A lawyer representing one stated “We are incredibly disappointed that the prosecutors chose to charge Mr. Storm because he helped develop software, and they did so based on a novel legal theory with dangerous implications for all software developers”

What happened: Mastercard launches CBDC program with digital asset partner firms

How is this significant?

- Payments giant Mastercard further deepened its ongoing involvement with the digital asset space this week by launching a CBDC forum and inviting numerous firms from the crypto sphere to participate

- In a press release announcing the program, Mastercard revealed that 93% of central banks are currently engaged in some form of CBDC development, with the BIS expecting over 20 major CBDCs to be issued by the end of the decade

- Inaugural partners amongst the “group of leading blockchain technology and payment service providers” include digital asset stalwarts Ripple Labs, Ethereum development firm Consensys, and custodial technology developers Fireblocks

- Mastercard’s head of digital assets and blockchain, Raj Dhamodharan, said “We believe in payment choice and that interoperability across the different ways of making payments is an essential component of a flourishing economy. As we look ahead toward a digitally driven future, it will be essential that the value held as a CBDC is as easy to use as other forms of money”

- He added “By assembling the strengths, deep expertise and different capabilities of these partners, we can drive innovation in the central banking community and along the CBDC value chain as the space continues to evolve”

- Potential CBDC issues, challenges, and requirements being investigated by the forum include offline payments, privacy, and user education

- This follows on from Mastercard’s own recent research regarding tokenised bank deposits in the UK

What happened: Liquidity provider B2C2 acquires rival to create European expansion pathway

How is this significant?

- B2C2, a major London-based institutional liquidity provider, announced the acquisition of French market makers Woorton this week; granting B2C2 access to licences enabling European operations

- Paris-based Woorton held PSAN (prestataires de services sur actifs numériques) licences, allowing B2C2 to provide institutional services in the EU following the takeover

- In a press release, B2C2’s head of EMEA Thomas Restout stated “Like us, the [Woorton] team has a TradFi background, but with the same crypto and digital assets laser focus. Together we are a combination of highly complementary businesses that deliver multi asset breadth and depth to clients in the EU market”

- With the UK operating in a post-Brexit context, and the EU entering MiCA (Markets in Crypto Assets) regulations in the near future, securing a European licence is vital for any British businesses wishing to do digital asset business on the continent as regulatory regimes gradually begin to crystalise around the nascent asset class

- To add more international flavour to the deal, B2C2 was actually acquired by Japan’s SBI Holdings back in 2020, making them the first major financial firm to own a crypto trading group