Market Overview:

Digital assets performed positively as global markets reacted to a pause in new tariff policy, demonstrating less volatility than more traditional asset classes.

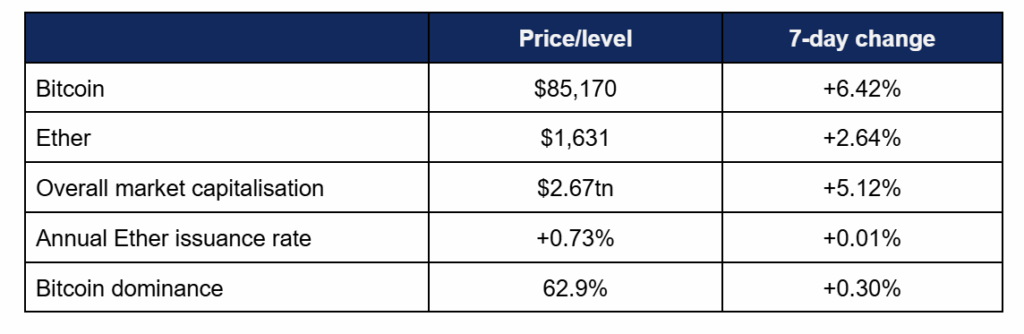

- Bitcoin posted growth this week, rising steadily throughout the week after early losses in wider macroeconomic anticipation of the (since-delayed) new US tariff regime

- Bitcoin hit a weekly low of $74,630 on Tuesday, eventually rising to a peak of $85,780 on Monday

- Atypically, crypto—a nascent asset class often criticised for perceived volatility—proved a more stable proposition than the stock market in the wake of global tariff concerns, actually gaining in value over the last month whilst most other markets suffered

- Grayscale’s Zach Pandl pointed out that historically, one may expect thrice the volatility from Bitcoin as from Nasdaq; but Bitcoin at its worst dropped around half of Nasdaq’s 15%; “the most bullish 8% drawdown I’ve ever seen”

- TradFi markets swung wildly, featuring the worst three-day run since 1987’s Black Monday, before news of the tariff pause led to Nasdaq’s best day since 2001

- Ether also regained some recent lost ground, returning above the $1,500 mark after hitting lows beneath $1,400

- Ether rose from a Wednesday low of $1,397 to a Monday high of $1,684

- Industry sentiment on the Fear & Greed index also stabilised somewhat, moving from “extreme fear” into “fear” at 31/100

- Overall industry market capitalisation added over $100bn, to $2.67tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased slightly to $90.9bn

Digital assets showcased a significant improvement over last week’s performance, as macroeconomic anxiety subsided somewhat following the pause on US tariffs. Regulatory developments continued, including confirmation of a pro-crypto SEC chief, whilst several states advanced strategic crypto reserve plans. Ripple confirmed one of the largest industry acquisitions ever, BlackRock recruited a new crypto asset custodian, digital asset hedge funds were singled out for strong returns, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced a second consecutive week of outflows, as tariff shock sent investors worldwide into risk-off mode before a late rally when the 90 day pause was announced

- According to CoinShares data published on Monday, digital asset investment products experienced $795m outflows in the week ending 11th April, as a response to president Trump’s “economically calamitous tariffs”

- Once again, the majority of this value decline came from Bitcoin products, which lost $751m

- However, at the time of writing, year-to-date inflows for Bitcoin ETFs remain positive in spite of this considerable weekly decline, adding $545m in 2025

- Spot Bitcoin ETFs suffered considerably in light of tariff panic, logging four consecutive trading days of nine-figure outflows, ranging from $107m to $326m on Tuesday (the day before tariffs were initially scheduled to take effect)

- The biggest loser of the week was BlackRock’s IBIT, which shed $252m on Tuesday, amidst widespread investor de-risking across most markets

- Despite the run of nine-figure losses across the spot complex, this was the only instance of a singular fund posting such daily losses, as the rest of the week saw outflows much more evenly distributed across the ETFs

- The next-largest outflows came from IBIT on Wednesday ($90m), and Fidelity’s FBTC on Thursday ($75m)

- As markets began to digest news around the broader tariff pause, the ETF complex stabilised, with outflows of just $1m on Friday (including $11m inflows for ARK Invest’s ARKB, the largest inflows of the week)

- At the time of writing, early (but incomplete) Monday data suggests a return to inflows in line with Bitcoin’s recovery

- Spot Ether ETFs logged four consecutive days of losses, albeit at much more modest levels than their Bitcoin brethren

- The highest daily outflows topped out at $39m across all nine funds

- On Monday, the SEC delayed its decision on allowing staking for Ether ETfs by 90 days

- Meanwhile, Bloomberg chief ETF analyst Eric Balchunas reported that Canadian regulators approved spot Solana ETFs for trading in the country from this week onwards

What happened: Regulatory news

How is this significant?

- The United States SEC dropped several more cases against crypto asset firms this week, continuing the post-inauguration trend as crypto-owning Paul Atkins was officially confirmed as the commission’s new chair

- Atkins previously criticised the perceived “regulatory overreach” of predecessor Gary Gensler’s regime, and is widely expected to take a more positive stance towards the industry (although longtime readers of the newsletter will recall that Gensler’s appointment was initially greeted with enthusiasm by the industry based on his time teaching “blockchain and money” at MIT

- Decentralised mobile network developers Nova Labs announced that the SEC was dropping its case against them regarding the network’s HELIUM token

- The SEC and Binance filed a joint court appeal to pause their legal dispute by 60 days, citing “productive discussions” on a potential resolution

- Donald Trump blocked some late Biden-era legislation (not yet in force) by signing a bill blocking IRS access to certain transaction records on crypto exchanges for tax purposes

- Republican congressman Mike Carey commented “By repealing this misguided rule, President Trump and Congress have given the IRS an opportunity to return its focus to the duties and obligations it already owes to American taxpayers instead of creating a new series of bureaucratic hurdles”

- Additionally, the Department of Justice scaled back the scope of its digital asset enforcement operations, dismantling the National Cryptoasset Enforcement Team (NCET) narrowing the focus to “terrorism, drug cartels, victimising investors and other limited categories”, and eschewing exchanges and mixers

- In a Monday memo, Deputy Attorney General Todd Blanche explained “The Department of Justice is not a digital assets regulator. However, the prior administration used the DoJ to pursue a reckless strategy of regulation by prosecution, which was ill-conceived and poorly executed”

- However, some Senate Democrats—most notably congressional crypto opponent Elizabeth Warren—criticised the DoJ crypto unit’s downsizing, arguing it gives “a free pass” to criminals

- The Wall Street Journal reported that Binance (the world’s largest crypto exchange) met with Treasury Department officials, in order to loosen government oversight and work on a potential collaboration with the Trump family’s World Liberty Financial (WLF) DeFi project

- Bloomberg profiled the Trump clan’s crypto complex, which now ranges from NFTs and DeFi to Bitcoin mining and potential stablecoin launches

- Although as president, Donald Trump is not currently officially involved in the above, his sons Donald Junior, Eric, and Barron are all executives in (WLF) and its holding company

What happened: BlackRock adds new digital asset custodian

How is this significant?

- The world’s largest asset manager increased its presence and practice within the digital asset industry this week, as BlackRock recruited a new custodian for its ETF-related Bitcoin and Ether holdings

- BlackRock revealed federally-chartered digital asset bank Anchorage as its second crypto custodian, supplementing Coinbase

- In a press release, head of digital assets Robert Mitchnick commented “As demand for digital asset products increases, and as our footprint in the ecosystem grows, we continue to expand our network of service providers with a focus on the highest quality institutional providers. After a thorough evaluation, Anchorage Digital clearly meets these standards”

- Anchorage CEO Nathan McAuley added “We’re serving a lot of the large companies that are buying Bitcoin. A lot of large institutions are buying significant amounts of Bitcoin”

- However, Barrons reported a few days later that Anchorage is being investigated by the Department of Homeland Security, reaching out to former employees about the “company’s practices and policies” regarding potential AML issues

What happened: Bitcoin mining profitability drops in March

How is this significant?

- Several factors including declining prices and transaction volumes (and thus transaction fees) led to a 7.4% decline in profitability for Bitcoin miners last month, according to a new research report by Jefferies

- Bitcoin’s price fell 11.4% in March, whilst transaction fees dropped 9.1%

- Last year’s Bitcoin halving event greatly reduced the profitability of Bitcoin miners, as the block reward was reduced to 3.125 Bitcoin per block

- President Trump’s pledge to increase the amount of Bitcoin “Made in America” is bearing fruit; US-listed Bitcoin miners increased their share of overall Bitcoin generation by mining 3,534 coins in March, up from 3,002 the month before

- Jefferies also noted that profitability may improve in April, as Bitcoin is currently outperforming the stock market month-to-date

What happened: Bitcoin treasury news

How is this significant?

- Several of the most prominent companies to pursue a Bitcoin treasury strategy took advantage of recent market turmoil in order to increase their holdings

- Leading Bitcoin balance sheet advocate Strategy (formerly MicroStrategy) purchased $285.8m of Bitcoin, fuelled by price swings in its common shares

- Strategy said it sold shares through its at-the-market program, financing the addition of 3,459 Bitcoin at an average price around $82,620 according to its latest SEC filings

- Total holdings now stand at over 531,000 Bitcoin, acquired at an average unit cost of $67,556 and equal to approximately 2.5% of the 21 million supply cap

- Company founder Michael Saylor announced the purchase with a cheeky nod towards the wider macroeconomic chaos, tweeting that “there are no tariffs” on Bitcoin buys

- Metaplanet, a Japanese hotel firm turned “Asia’s (Micro)Strategy” spent $26.3m to buy 319 Bitcoin at an average price of $82,549

- This brought the overall average unit cost of its 4,525 Bitcoin holdings down to $85,366

- The company is currently targeting a total 10,000 Bitcoin this year, rising to 21,000 in 2026

- Whilst Strategy has been acquiring Bitcoin since 2020, Metaplanet only began pursuing the treasury option in April 2024

- Meanwhile, American retailer GameStop recently adopted a plan for a corporate Bitcoin reserve, and raised $1.5bn via convertible note issuance to fund future Bitcoin purchases

What happened: Hedge Fund Research finds crypto funds led global performance

How is this significant?

- According to a new global report by Hedge Fund Research, digital asset hedge funds led the world in returns during Q4 2024

- The researchers found that crypto-centric hedge funds were “the leading area of overall [hedge fund] industry performance”, and noted that a specific Bitcoin-focused fund featured within the top 5 globally

- 210k capital (the fund of Swiss-based UTXO Management) profited from the growth of the wider Bitcoin complex, investing in companies such as (Micro)Strategy and Metaplanet as proxies for the asset

- Around 80% of the fund is invested in “Bitcoin equities”, including mining companies

- This netted them 164% returns net of fees, well above the (formidable) category average of 59.8% for crypto funds

- Co-founder Tyler Evans told industry publication Blockspace “Over the last 12 months, we went very hard into the Bitcoin treasury-play thesis as as we really saw it play out with what [Michael] Saylor is doing, and the opportunity to really globalise it”

- Evans added “We saw the demand for institutional capital to get exposure to Bitcoin and the role that these Treasury companies can serve is securitising Bitcoins for fixed income investors, the insurance funds, or the mutual funds… We think that there’s an opportunity for a Bitcoin treasury company in every tier-one financial market globally”

What happened: JP Morgan adds GBP support for blockchain payment system

How is this significant?

- Banking giant JP Morgan expanded its corporate digital asset faculties this week, adding sterling-denominated support on its Kinexys (formerly JPM Coin) Digital Payments network for commercial bank transactions

- On Monday, its London branch launched blockchain based deposit accounts supporting GBP payments, adding to current USD- and EUR-denominated services

- Currently, Dollar-based payments constitute about 80% of Kinexys’ $2bn daily transaction volumes, which increased tenfold last year

- As the first-ever bank-created digital asset, Kinexys was designed to directly address several shortfalls in existing banking infrastructure, including simplified movements between multiple JP Morgan accounts

- In a statement to industry publication TheBlock, representatives said “The new GBP-denominated blockchain accounts enable clients to conduct seamless cross-border transactions, including 24/7 foreign exchange. Clients can access funds on demand with weekend processing and extended same-day FX settlements, offering enhanced flexibility, speed and efficiency”

- According to Kinexys co-head Naveen Mallela, initial customers will include commodities trader Trafigura, and SwapAgent Ltd

What happened: States advance Bitcoin reserve plans

How is this significant?

- Several US states made progress in plans for local strategic Bitcoin reserves or integrations

- North Carolina lawmakers submitted a new bill named the Digital Asset Freedom Act, allowing eligible digital assets (a ten-year history, market capitalisation above $750bn with $10bn daily trading volume) to be used in “tax payments and other economic transactions”

- Co-sponsor Neal Jackson wrote “Digital assets are [if the bill passes] recognised as a valid medium of exchange in North Carolina. A transaction shall not be denied legal effect or enforceability solely because it uses a digital asset”

- This is the third bill submitted in the state regarding the asset class, alongside moves towards enabling pension funds and state treasurers to invest in crypto

- New Hampshire and Florida legislators advanced bills to create Bitcoin reserves, but according to monitoring site BitcoinLaws, Arizona currently leads the race; one full House vote and gubernatorial signature away from becoming law

- In late-breaking news, Trump’s digital asset advisor Bo Hines proposed a potential acquisition mechanism for a national Bitcoin reserve

- Speaking at the White House, he said “We’ve been very clear, we want to acquire as much as we can get… in a budget-neutral way… we’re looking at many creative ways… [including fees from] tariffs”

What happened: VC news

How is this significant?

- XRP issuer Ripple Labs completed one of the largest industry acquisitions in history, as M&A activity ramped up alongside VC deals

- Ripple paid $1.25bn for prime broker Hidden Road, marking the most expensive deal in the company’s history, and only second in the industry behind Kraken’s March acquisition of NinjaTrader for $1.5bn

- Under the terms of the deal, Hidden Road will use Ripple’s new RLUSD stablecoin as collateral across its prime brokerage products

- Ripple CEO Brad Garlinghouse told Bloomberg “This is by far our largest deal. If we want the crypto industry to continue to become more institutional friendly, having robust infrastructure that enables those players to enter this space and do it easily is a very big deal”

- Meanwhile, crypto M&A reached record levels, concluding a record quarter with 61 deals worth $2.2bn

- Spartan Group partner Casper Johansen commented “We’re busier than we’ve ever been on M&A,” said the former Goldman Sachs banker. “Like not even close. We’re three times as busy”

- In the VC realm, blockchain-based loyalty app Blackbird raised $50m in funding from strategic investors including Amex, Coinbase

- Bitcoin-denominated life insurance firm Meanwhile raised $40m in Series A funding, earmarked for global expansion

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.