1st September, 2023

Market Overview:

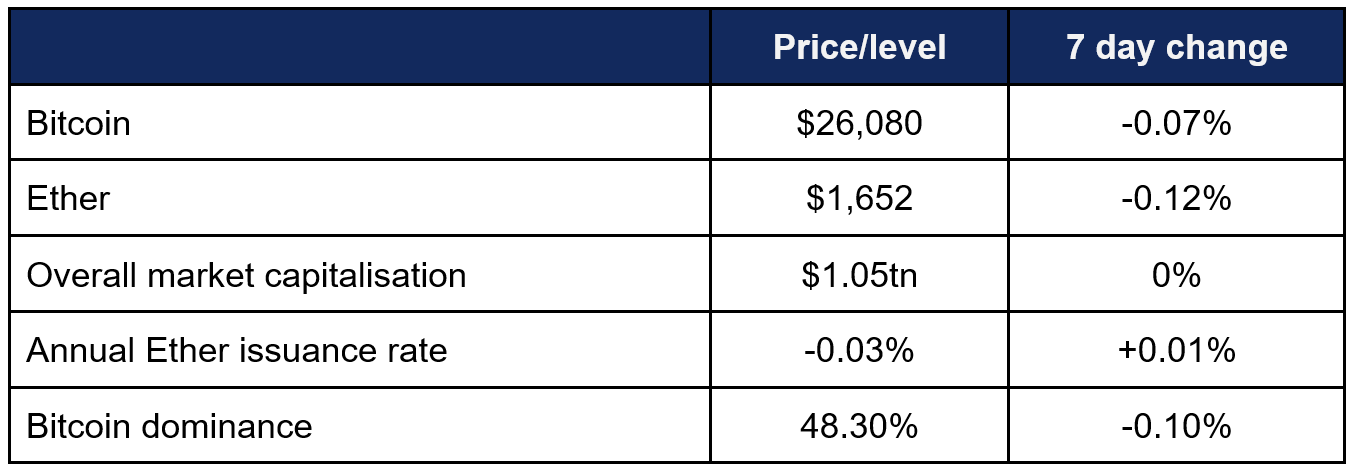

Digital assets experienced major midweek gains following a landmark legal victory, before paring them towards the weekend following SEC delays on ETF decisions.

- Bitcoin experienced one of its most volatile weeks of the year, as prices surged following a key legal victory against the SEC concerning spot Bitcoin ETFs, before reversing course when the Commission delayed decisions on all current applications

- Bitcoin hit a weekly high of $28,010 within hours of the court ruling, but was unable to sustain a run above the $28,000 level; although it did trade comfortably above $27,000 for two days after the Grayscale news

- Multiple SEC delays on ETF decisions subsequently brought momentum and prices back down to earth, leading to a weekly low of $25,790 late on Thursday night

- Ether went from a Monday low of $1,632 to a Wednesday high of $1,742, before erasing most gains following Bitcoin’s drop

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week remained steady around $37.8bn

Digital asset reporting this week was dominated by Grayscale’s court win against the SEC—the second major legal setback for the regulator in as many months, and one that could open the doors for future spot Bitcoin ETF approvals within the USA. There was also continued enthusiasm for the asset class internationally; including Singaporean family offices in Bahrain, Swiss banks in Hong Kong, and renewable Bitcoin mining in Iceland, plus developments from X (formerly known as Twitter), Binance, and new research findings.

What happened: Grayscale wins legal victory over SEC in ETF conversion bid

How is this significant?

- On Tuesday, the verdict in the long-running Grayscale vs SEC case arrived, regarding the SEC's refusal to convert Grayscale's GBTC fund into a spot Bitcoin ETF—and, as in the recent Ripple trial, the ruling came out in favour of the crypto company

- Filed last June, Grayscale appealed the SEC's decision, which cited the same "market manipulation" and "significant market" concerns as every other spot Bitcoin ETF rejection thus far

- The three judges in the DC Circuit Court of Appeals ruled unanimously that the SEC failed to uphold consistent legal standards, or reasonably explain its decision-making, in an decisive rebuke that went “beyond expectations”

- In her opinion accompanying the verdict, judge Neomi Rao wrote "It is a fundamental principle of administrative law that agencies must treat like cases alike... The Commission failed to reasonably explain why it approved the listing of two Bitcoin futures ETPs but not Grayscale’s similar proposed Bitcoin ETP. Without such an explanation, inconsistent treatment of similar products is arbitrary and capricious”

- The only consistency from the SEC appears to be its bias against Grayscale and spot ETFs. Judge Rao stated "Grayscale presented uncontested evidence that there is a 99.9% correlation between Bitcoin’s spot market and CME futures contract prices", yet the SEC denied the usage of similar market manipulation protections

- The SEC was also deemed unreasonable in the way it applied both prongs of the "significant market test" to Grayscale, alongside apparent concerns over price lead/lag; offering "no compelling reason" for differing treatment across futures and spot products

- GBTC currently holds around $14bn AUM, and conversion to an ETF would unlock significant additional value for customers; not least because GBTC currently charges a significant 2% fee (compared to average ETF fees around 0.5%) and doesn't offer continuous redemption

- It's important to note that this ruling doesn't compel the SEC to grant Grayscale’s conversion request; it just requires them to accept their appeal for review. Furthermore, Grayscale may have to refile their application

- The company’s legal head though believes that regardless of whether they must refile, “it’s a question of when, not if”

- Several digital asset industry observers however commented that what the verdict does do is undermine the legitimacy of the SEC's legal opinions and repeated reasoning of "market manipulation concerns" for spot ETF denials

- Bloomberg called the ruling “a stinging rebuke of Chair Gary Gensler’s bid to clamp down on the industry” and commented that “recent legal setbacks have Wall Street’s top cop on the defensive”, whilst Coinroutes CEO David Weisberger expressed the sentiment of many industry analysts; "It virtually guarantees they will approve BlackRock and Fidelity"

- Republican congressman Warren Davidson reiterated his efforts to remove Gensler from office following this second consecutive legal rebuke, as the Wall Street Journal wrote “SEC Strikes Out Again on Crypto”

- In a statement after the verdict, the SEC raised the possibility of an appeal, saying “We are reviewing the court’s decision to determine next steps”

- Some observers urged caution against expecting too many imminent ETF approvals, claiming “the most likely scenario seems to be that the SEC will fast-track applications from large traditional asset managers rather than concentrating on Grayscale’s application”

- Immediate market reaction was very positive; GBTC rallied as much as 21%, and Bitcoin gained nearly $2,000 to trade near $28,000 for a limited time

- However, enthusiasm soon waned, following concerns over ambiguity (such as the uncertainty around whether Grayscale needs to refile) and the SEC’s trend of delaying decisions until the final applicable deadline

- Ahead of a Thursday (non-final) decision deadline, Bitwise CIO Matt Houghan urged the SEC to approve all pending spot ETFs, claiming “the best outcome is likely to line up multiple ETFs and allow them to launch at once”

- His entreaties fell on deaf ears, as the SEC indeed delayed decisions on all applications, leaving mid-October as the next deadline for observers to watch

- This decision appeared to erase all of the week’s gains, as investors had their hopes dashed for a speedy approval after the SEC’s previous rejection playbook was ruled “arbitrary and capricious”

- Indeed, Bloomberg’s senior ETF analyst Eric Balchunas shared that he and Seyffart predict “odds to 75% of spot bitcoin ETFs launching this year (95% by end of '24). While we factored Grayscale win into our previous 65% odds, the unanimity & decisiveness of ruling was beyond expectations and leaves SEC with very little wiggle room”

What happened: JP Morgan alum joins Singaporean crypto family office project in Bahrain

How is this significant?

- Three-decade JP Morgan veteran Ali Moosa was recruited by Singaporean family office Whampoa Group this week, to serve as executive vice chairman at their new Singapore Gulf Bank project in Dubai

- Moosa previously served as head and vice chairman of the central and eastern Europe, Middle East and Africa businesses, giving him regional expertise pertinent to the new business based in Bahrain

- Whampoa Group received Bahraini approval to set up the digital bank in May, with plans for a December launch to “bridge conventional and digital financial services and facilitate financial integration between Asia and the Middle East and North Africa”

- In particular, these “digital financial services” will include payments and settlements for companies in the digital asset industry, as Bahrain looks to catch up with regional rivals UAE, who have become a global hotspot for crypto asset firms and investment

- Whampoa CEO Shawn Chan disclosed more forthcoming senior appointments, as the family offices builds out its digital asset investment strategy with the bank

What happened: Swiss bank SEBA gets regulatory approval for Hong Kong crypto operations

How is this significant?

- SEBA, a Swiss bank specialising in digital assets and backed by Julius Baer, achieved in-principle approval from Hong Kong regulators this week for crypto-related services

- Following full approval, SEBA Hong Kong will be able to deal in securities (including OTC derivatives), alongside providing “advice on securities and crypto and conduct asset management for discretionary accounts in both traditional and virtual assets”

- The bank’s APAC chief Amy Yu believes that “Derivatives is going to be a very interesting angle in Asia”, with “a lot of demand” for such products

- She also hopes to leverage the bank’s experience working with digital asset partners in its native Switzerland, as Hong Kong regulators have urged banks to support legitimate industry firms locally; “We are comfortable interacting with these kinds of clients”

What happened: Binance considers full withdrawal from Russian market

How is this significant?

- The Wall Street Journal reported this week that Binance is withdrawing support for several Russian banks as part of international sanctions compliance

- The five sanctioned banks are now excluded from the exchange’s peer-to-peer services, preventing the transfer of Rubles to and from the exchange

- A Binance spokesperson told industry publication Coindesk that they were acting in response to earlier WSJ reports; “When gaps are pointed out to us, we seek to address and remediate them as soon as possible. In line with our ongoing commitments, payment methods on the Binance P2P platform that do not fit with our compliance policies are not available on our platform”

- The news came soon after Visa and Mastercard both ended partnerships with Binance

- The exchange is now mulling the mechanics of any further exposure to the market, including the possibility of a complete withdrawal; the spokesperson commented that “all options are on the table, including a full exit”

What happened: Renewable Bitcoin mining surges in Iceland

How is this significant?

- Iceland is the latest notable beneficiary of China’s 2022 Bitcoin mining ban, becoming “a refuge” for miners thanks to its surplus—and renewable—energy production

- Another geographic “benefit” for the island is its cool year-round temperatures; this helps to cool data centres where Bitcoin mining hardware is housed, ensuring fewer mechanical breakdowns than in overheated conditions

- Daniel Jonsson of local data centre GreenBlocks claims that mining is a win-win for the island, especially when its natural power supply exceeds the demand capacity of its small population; “Up until the mining industry showed up here in Iceland, the vast majority of this non-guaranteed power was not a sell-able product, so we are essentially buying power that nobody else can buy”

- According to a research report by Luxor Technologies, Iceland is the most Bitcoin-mining-dense country on the planet”

- In other mining power news, the Cambridge Bitcoin Electricity Consumption Index revised its methodology to recognise the participation of newer mining hardware, indicating a previous gross overestimation of Bitcoin mining’s power consumption

What happened: Bitcoin held on exchanges decreases by over 4% in August

How is this significant?

- The amount of Bitcoin held on centralised exchanges declined significantly over the month of August, according to CryptoQuant data

- In total, Bitcoin held on exchanges dropped 4.1%, bringing reserve levels to their lowest point since January 2018

- Decreased supply on exchanges is often interpreted within the industry as an intent for long-term asset holding; favouring self-custody over the convenience of quickly selling

- CryptoQuant analyst Adam Murad told industry publication TheBlock “The considerable transfer of Bitcoin from exchange platforms to secure cold wallets underscores the assurance exhibited by long-term investors”

- He also observed that during the price surge following Grayscale’s legal victory, more than 20,000 Bitcoins were moved off of exchanges; a move which he believes “signified a belief in the enduring value of Bitcoin”

What happened: Contagion latest

How is this significant?

- Prosecutors moved to block former FTX CEO Sam Bankman-Fried from paying expert witnesses up to $1,200 an hour in his forthcoming trial, believing the fee could be tantamount to bribery

- Bankman-Fried also petitioned judge Kaplan for several days of release per week to work on his legal defence, but no decision has yet been made on that request

- A Tuesday court filing revealed an in-principle agreement between the Digital Currency Group (DCG) and Genesis creditors, affected by the bankruptcy of DCG’s Genesis Global Lending subsidiary

- According to the filing, the plan “if consummated, could result in estimated recoveries of about 70% to 90% for unsecured creditors in U.S. dollar equivalent and a 65% to 90% recovery on an in-kind basis depending on the denomination of the digital asset”

- A possible knock-on effect of Grayscale’s court victory this week is that it could render moot a legal challenge from Bankman-Fried’s trading firm Alameda Research

- The lawsuit from Alameda attempted to reduce GBTC’s fees and allow continuous redemptions; both actors which could be realised if Grayscale is eventually granted approval to convert GBTC into an ETF

What happened: X (formerly Twitter) secures licences necessary for crypto payment integration

How is this significant?

- Social media platform X (aka the company formerly known as Twitter) secured several payment licences this week—including a Rhode Island currency transmitter licence “allowing it to facilitate the storage, transfer, and conversion of Bitcoin and other digital currencies on behalf of their users”

- The Rhode Island licence allows X to integrate and operate crypto payments and trading for customers within the USA, although it remains to be seen how quickly such services might actually go live within the app

- This move also aligns with previous statements by Musk about turning X into an “everything app” along the lines of China’s WeChat, which includes facilities for payments and money transfers

- It follows on from April’s eToro partnership which allows users to purchase stocks or digital assets directly through an integration—but this licence could effectively cut out the middleman, allowing Twitter to develop and deploy their own crypto wallets and trading platforms