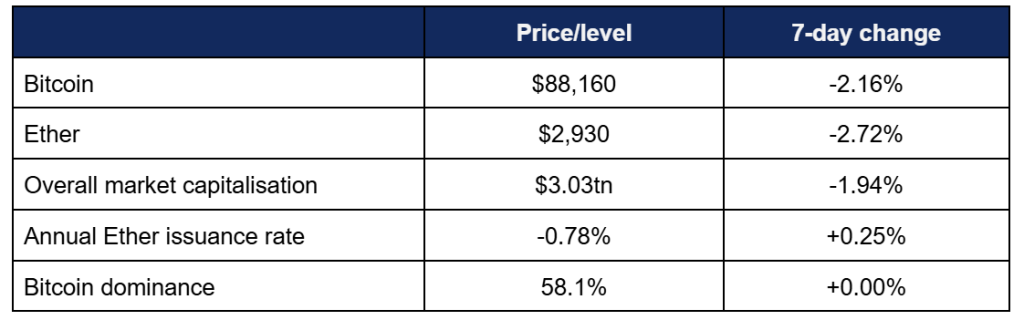

Market Overview

- Bitcoin faced another challenging week in the markets, before mounting a modest recovery amidst reports that the Federal Reserve might pivot towards an interest rate cut next month

- At the time of writing, Bitcoin remains “on track for its worst month since June 2022”, when the market was undone by bad actors, including Terra Luna and Three Arrows Capital

- Bloomberg notes that recent growth contributed to the recent losses; “crypto has become much bigger than the retail traders and techno futurists who are committed to HODLing [holding] through thick and thin… it is now woven into the fabric of Wall Street and broader public markets, bringing a whole new set of finicky players to the table”

- Bitcoin dropped from a weekly high of $93,600 on Tuesday (18/11) to a weekly low around $80,500 on Friday (21/11), before moving into a gradual upward trend to current levels

- Ether showcased the same patterns, dropping from $3,164 on Tuesday to $2,632 on Friday, with on-chain activity resulting in a major spike of Ether burned from transaction fees

- Investor sentiment on the Fear & Greed index remained in “extreme fear” at 15/100; Coinmarketcap noted that it has never before remained in this zone for so long (10 days at the time of writing), with an intraweek capitulation-level low of 10/100

- Overall market capitalisation fell as low as $2.82tn during the week, before recovering above $3tn again

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped about $3.5bn to a total of $117.5bn

Digital assets faced more challenges, but rallied from intraweek lows to minimise losses to modest levels. ETFs experienced some of their largest outflows ever before returning to inflows on Friday, US exchange Kraken filed for an IPO at a potential $20bn valuation, Bitcoin mining showcased growth in China (despite an official ban) and adoption news continued across the world, from the USA to UAE to East Asia.

What happened: ETF News

How is this significant?

- Digital asset investment products registered a fourth consecutive week of outflows, marking the third-largest such run since 2018

- According to Coinshares data published on Monday (24/11), net outflows across all funds reached $1.9bn in the trading week ending Friday the 21st

- Coinshares’ Head of Research James Butterfill wrote that despite this run of poor performances, year-to-date inflows remain high at $44.4bn, and he suggests that Friday trading activity may have displayed “tentative signs of a turnaround in sentiment” after seven consecutive outflow days

- Spot Bitcoin ETFs did register nine-figure inflows ($238mn) on Friday, stemming the tide slightly after three days of nine-figure outflows earlier in the week

- Last Thursday (20/11) proved one of the worst days in Bitcoin ETF history, marked by $903mn outflows

- BlackRock’s market-leading IBIT once again led in losses, including daily outflows of $523mn and $356mn, with total weekly outflows around $1.09bn

- The $523mn outflows on Tuesday (18/11) marked a (negative) record for BlackRock since the runaway success of IBIT’s launch in January 2024

- In total, IBIT posted four days of nine-figure outflows, interspersed with $61mn inflows on Wednesday (accounting for the majority of the day’s overall $75mn inflows)

- Bloomberg Chief ETF analyst Eric Balchunas repeated last week’s calls for perspective, noting that IBIT short interest has plummeted, and that fearmongering over its “record outflows” is only possible because “it never had outflows before!”

- He added that “I cannot predict the future. What I do know is this asset [Bitcoin] has a 100% track record of coming back from sometimes nasty downturns to hit all-time highs”

- Despite the overall market negativity, Grayscale’s 0.15% fee mini-ETF actually posted significant weekly inflows, including $140mn and $85mn; making it the only fund other than Fidelity’s FBTC ($108mn on Friday) to add nine figures

- Spot Ether ETFs fared slightly worse than their Bitcoin counterparts, only returning inflows on Friday, at much more modest overall levels ($56mn)

- BlackRock’s ETHA accounted for the majority of weekly outflows, with three days of nine-figure losses between $123mn and $193mn

- As for Bitcoin ETFs, the best daily returns were posted by Fidelity ($95mn on Friday) and Grayscale’s 0.15% fee mini-ETF ($62mn on Tuesday)

- In other ETF news, Grayscale launched both an XRP ETF and a Dogecoin ETF on the NYSE Arca exchange on Monday (24/11)

- Franklin Templeton likewise launched an XRP ETF on NYSE Arca the same day, as its Digital Asset Chief Roger Bayston commented “Blockchain innovation is driving fast-growing businesses, and digital asset tokens like XRP serve as powerful incentive mechanisms that help bootstrap decentralised networks and align stakeholder interests”

- These firms follow Canary Capital and REX Shares in issuing XRP funds, providing more exposure for the number four crypto asset by market capitalisation

- Meanwhile, CME Group touted recent record volumes for its regulated futures and options, as traders looked to leverage ongoing market volatility

- In a press release, Global Head of Crypto Products Giovanni Vicioso stated “Amid ongoing market uncertainty, demand for deeply liquid, regulated crypto risk management tools is accelerating… with both large institutions and retail traders driving record activity across our product suite”

What happened: Kraken confidentially files for IPO

How is this significant?

Kraken, one of the top US digital asset exchanges, confirmed its confidential IPO filing this week, advancing a process which it has been considering since at least March this year

- Assuming its plans come to fruition, Kraken will become the second-largest publicly listed American crypto exchange, after Coinbase, but above Gemini and Bullish

- The lead-up to its filing involved some major fundraising; Fortune reported that the exchange secured $800mn in a round led by Citadel Securities and Jane Street, valuing Kraken at $20bn

- Third Bridge analyst Jacob Zuller told Reuters “Kraken’s confidential IPO signals one thing, crypto is here to stay and crypto exchanges are not a winner takes all market. The pathway for crypto exchanges in the US is to innovate and expand with more tradable assets and penetrating payments”

- Analysts told industry publication Coindesk that a mix of capital access and regulatory progress helped Kraken secure this strong funding support despite the current market downturn

- Securities attorney Megan Penick commented “As digital asset treasury companies are increasingly seeking to access the US capital markets… crypto exchanges, such as Kraken, are also seeking to access greater liquidity through initial public offerings”

- Since Kraken could complete its IPO process within six months, it could potentially align nicely with the current market structure bill being debated in the US Senate

- Penick told Coindesk “Regulators are moving to bring greater clarity to crypto regulation, with a bipartisan proposal aiming to bring BTC, ETH and crypto exchanges clearly within the CFTC’s regulatory purview”, potentially boosting interest in the asset class amongst institutional investors

What happened: Bitcoin mining news

How is this significant?

- Numerous reports from the world of Bitcoin mining emerged this week, illustrating the complex interplay between the asset’s price and the cost of mining blocks via its proof-of-work consensus mechanism

- Bitcoin’s hashprice dropped to historic lows, as the decline in the coin’s price hasn’t been matched linearly by a decline in hash power (generally adjusted on a fortnightly basis), reducing profit per mined coin and leading to a more challenging economic proposition for miners

- Some miners have recently voted with their feet, pivoting their hardware towards the AI industry

- Hash power (or hash rate) is generally viewed analogous to overall demand amongst miners, as more participation in the network equals greater competition to mine new blocks, and higher hash power as a corollary

- Another consequence of increased hash rate is increased decentralisation, and thus security across the blockchain

- Some however are leaping back into Bitcoin mining; Reuters reported on Monday that Bitcoin mining is growing in China, despite an official ban since 2021

- China now accounts for a 14% share of global hash rate, up from 0% in the aftermath of the government prohibition

- According to the report, private miners are taking advantage of cheap and abundant electricity at the local level; one miner said “A lot of energy cannot be transmitted out of Xinjiang, so you consume it in the form of crypto mining. New mining projects are under construction. What I can say is that people mine where electricity is cheap”

- The second-largest mining hardware manufacturer, Canaan, generated nearly a third of its revenue from Chinese sales last year, confirming in a statement that “in China, the R&D, manufacturing, and sale of mining machines are permitted”, despite the official ban on mining activity

- Patrick Gruhn, CEO of crypto infrastructure firm Perpetuals stated “The resurgence of mining activity in China is one of the most important signals the market has seen in years… even hints of China’s policy easing could act as a tailwind for Bitcoin’s narrative as a global, state-resilient asset”

- Meanwhile, the world’s largest manufacturer, Chinese firm Bitmain, is reportedly the subject of a federal investigation regarding possible national security risks, though the manufacturer dismissed claims of remote hardware control from China as “unequivocally false” and “nothing out of the ordinary was found”

What happened: SocGen debuts tokenised bond in the US

How is this significant?

- SG-FORGE – Société Générale’s digital asset subsidiary – issued its first blockchain-based bond in the US this week, the latest in a long line of recent financial tokenisation efforts

- The bond in question was issued on the privacy-centric Canton blockchain, which mimics the legal structure of traditional finance

- In a press release, the bank confirmed the bonds were issued through the debut tokenisation capability of Broadridge Financial Solutions, and were purchased by proprietary trading firm DRW

- Meanwhile, banking and custody giant BNY acts as the paying agent for the bonds

- SG-Forge CEO Jean-Marc Stenger stated “The successful completion of this transaction highlights our industry-leading position in securities tokenisation. It demonstrates Societe Generale’s capability to securely bring new instruments on-chain, in a sophisticated legal and regulatory environment”

- Despite the effort being its first tokenised bond in the US, Société Générale indeed has a long history in the field within Europe; dating back to 2019

- Chris Zuehlke of DRW declared “The issuance of these landmark digital bonds is an important step toward building the future of finance. As long-time advocates of innovation financial markets, we believe tokenisation has the potential to unlock efficiency, transparency, and broader access across the ecosystem”

What happened: Korean exchange Upbit merges with media giant to go public

How is this significant?

- Reports in the South Korean press this week suggested that leading local exchange Upbit is looking towards a US IPO following this year’s merger between its parent company Dunamu and Korean internet giant Naver

- According to the Seoul Economic Daily, Upbit is pursuing a Nasdaq listing, although exact details on potential date and valuation remain undisclosed

- The paper noted that “Upbit boasts spot trading volumes comparable to global distributor Coinbase, but is undermined by domestic regulatory risks and international recognition, according to both inside and outside Dunamu”

- If Upbit is able to list in the USA (on the assumption of market structure regulatory clarity forthcoming before Korea), then it would mark one of the most significant Asian crypto firms listed there

- Sources indicate that Upbit may launch as a crypto/TradFi hybrid in a new company aligned with the Naver Financial subsidiary

- This follows on from reports last week that key Upbit competitor Bybit is looking to consolidate its position within the Korean market by acquiring and absorbing one of the country’s oldest crypto exchanges

What happened: Stablecoin transaction volumes reach new records

How is this significant?

- A new report by digital asset firm Grayscale revealed the continued growth of the stablecoin sector, as stablecoin transaction volumes continued their recent record-setting trend

- In October, stablecoins transacted about $1.4tn worth of value, and total market capitalisation reached $300bn for the first time

- Grayscale foresees continued acceleration amidst the stablecoin sector, citing developments such as remittance firm Western Union’s creation of its own stablecoin on the Solana blockchain, Mastercard’s $2bn acquisition of Zerohash, and Circle’s forthcoming Arc blockchain

- Elsewhere in the report, Grayscale also noted increased momentum in market legislation efforts, the introduction of staking rewards to select crypto ETFs and renewed demand for privacy-centric coins despite the bearish market conditions

What happened: Abu Dhabi sovereign wealth fund increases Bitcoin exposure

How is this significant?

- According to its latest SEC filings, investment vehicle Al Warda more than tripled its Bitcoin exposure in Q3

- Al Warda – overseen by the the Mubadala sovereign wealth fund subsidiary Abu Dhabi Investment Council (ADIC) – invested in BlackRock’s IBIT spot Bitcoin ETF, increasing the size of its investment 230%, to almost 8 million shares, valued at $517.6mn

- An ADIC spokesperson told Bloomberg “We view Bitcoin as a store of value similar to gold, and as the world continues to move toward a more digital future, we see Bitcoin playing an increasingly important role alongside gold… we expect to hold them as part of our near and long term strategy”

- Other recent significant IBIT disclosures also include Harvard University’s Endowment fund, which revealed $443mn worth of IBIT holdings earlier this month

What happened: Japanese asset managers planning crypto investment trusts

How is this significant?

- Japan’s Nikkei press agency reported that the nation’s finest financial firms are considering creating crypto asset investment products as the country’s Financial Services Authority weighs up reclassifying the asset class as financial instruments rather than payment tools

- Treating digital assets as a regulated financial product would bring capital gains tax down to a flat 20%, in line with stocks, bonds, and other established financial instruments – presenting a more attractive investment option to institutions

- Industry publication TheBlock notes that “If adopted, the reforms would also pave the way for amendments to the Investment Trust Act. This would allow asset managers to offer crypto investment trusts to retail and, eventually, institutional investors”

- Firms currently considering new investment products include SBI, Daiwa Asset Management and Mitsubishi UFJ Asset Management

- The Nikkei also reported FSA plans for new exchange reserve requirements

- According to the news, Japanese exchanges will increase their obligations from holding customers funds in cold [i.e. offline] storage to holding additional liability events to compensate customers in the event of exploits or hacks

What happened: Crypto Treasury news

How is this significant?

- According to analysts from TD Cowan, leading Bitcoin treasury firm Strategy (formerly MicroStrategy) has seen its Bitcoin premium “heading toward ‘crypto winter’ lows” during the recent bearish market downturn

- Barron’s took note that the firm didn’t announce any new Bitcoin buys on Monday (as is practically tradition), and firms such as BlackRock, Vanguard and Fidelity cut $5.4bn of Strategy exposure as the the enterprise software company’s position as an indirect Bitcoin vehicle is now undermined by the availability of ETFs and other regulated Bitcoin avenues

- In a note last Wednesday, JP Morgan analysts posited that Strategy’s recent share price slide could be attributed to possible future exclusion from equity indexes if its Bitcoin holdings go into the red

- They wrote that “outflows could amount to $2.8bn if MicroStrategy gets excluded from MSCI indices and $8.8bn from all other equity indices if other index providers choose to follow MSCI”

- Leading Ether treasury firm BitMine purchased $200mn worth of Ether over the past week, increasing its holdings to 3% of the total token supply

- In its weekly statement, the company claimed “the continued decline in crypto prices in the past week reflects the impaired liquidity since October 10th, as well as price technicals, which remain weak. A few weeks ago, we noted the likely downside for Ether prices would be around $2,500… This implies asymmetric risk/reward as the downside is 5-7%, while the upside is the supercycle ahead for Ethereum”

- In a Bloomberg interview, BitMine chair Tom Lee said he “remained bullish”, personally predicting a return to six-figure Bitcoin by January 2026

- Finally, Latin American digital asset exchange Ripio revealed the second-largest crypto treasury on the continent, boasting $100mn worth of Bitcoin and Ether acquired since 2017

- This puts it behind Brazilian exchange OranjeBTC, which has known treasury reserves of 3,713 Bitcoin worth more than $335mn

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.