July 26th, 2024

Market Overview:

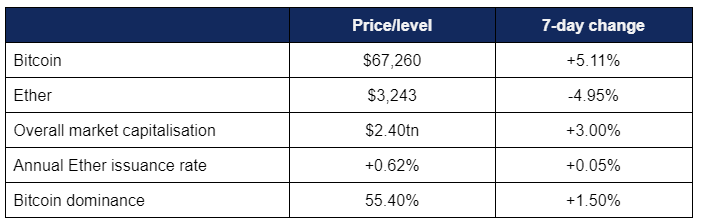

Digital assets performed well in early-week trading, before pulling slightly back amidst wider global investor caution.

- Bitcoin rose above $67,000 for the first time in a month, fuelled by optimism around potentially more positive regulatory environments following Joe Biden’s withdrawal from the US presidential race

- The leading digital asset was however affected in midweek by wider market moves away from perceived risk-on assets, after the worst S&P 500 drop since 2022

- Bitcoin increased from a Friday low of $63,440 to a Monday high of $68,360, before a steep drop back down to $64,000 levels amidst the aforementioned risk-off movement

- However, Bitcoin did bounce back early on Friday, rising above $67,000 once more

- Ether experienced “sell the news” price movements following the launch of spot ETFs, partly fuelled by large outflows from Grayscale’s converted Ethereum Trust

- Ether traded steadily throughout the week, reaching $3,558 on Monday ahead of ETF launches, before a steep drop to a weekly low of $3,103 on Thursday driven by wider macro movements

- Overall digital asset market capitalisation grew to $2.4tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi declined slightly to $95.8bn

Digital assets continued recent growth, as Bitcoin hit its highest levels since early June. Spot Ether ETFs launched to a largely positive performance and analyst reception, despite declining in price amidst macro headwinds. Elsewhere, there were nine-figure sums in both Bitcoin acquisition and VC raises, Citi upgraded its industry outlook amidst greater political optimism, and Ferrari expanded a crypto payment program into Europe, citing US success.

What happened: Spot Ether ETFs begin trading

How is this significant?

- Following recent SEC approval, spot Ether ETFs began trading on Tuesday, within days of final S-1 form filings from a range of issuers

- In total, nine filings from eight issuers were approved and launched:

- BlackRock (ETHA: 0.25% fee, halved for first $2.5bn assets)

- Fidelity (FETH: 0.25% fee, waived for 2024 calendar year)

- Invesco (QETH: 0.25% fee)

- Franklin Templeton (EZET: 0.19% fee, waived for six months or first $10bn assets)

- Bitwise (ETHW: 0.2% fee, waived for six months or first $500m assets)

- 21Shares (CETH: 0.21% fee, waived for six months or first $500m assets)

- VanEck (ETHV: 0.2% fee, waived for one year or first $1.5bn assets)

- Grayscale (ETHE [converted Trust]: 2.5% and ETH mini-ETF [10% of converted existing Trust]: 0.15%, fee waived for six months or first $2bn of assets)

- The first few days of trading experienced significant volume; over $1bn traded on Day 1, with around $107m in inflows

- BlackRock led the way, with ETHA posting $266.5m inflows, followed by industry natives Bitwise ($204m ETHW inflows), and Fidelity’s FETH ($71.3m)

- Fidelity led the second day of inflows, accruing $74.5m, followed by $29.6m for Bitwise and $17.4m for BlackRock

- Bloomberg’s senior ETF analyst Eric Balchunas noted that Wednesday “did about as much or even a little more volume than yesterday… That's a good sign as a lot of times there's a sizable dropoff after hyped-up Day One”

- He was very impressed with the debut, noting “The New Eight [i.e. ETFs excluding ETHE] taking in $590m on first day is huge, more than I guessed (the New Nine in Bitcoin race did $720m, so Ether was 83% of that). It needed it too because $ETHE unlock was also bigger than I thought.”

- However—as with Bitcoin ETF launches in January—Grayscale’s ETF was converted from an existing trust that held around $9.2bn of ETH and traded at discount to NAV for a long time, charging ten times the fees of any ETF competitors at 2.5%

- Thus, Grayscale’s ETHE has mirrored the performance of its GBTC ETF; bleeding vast amounts of AUM, as customers either cash out entirely on long-held Ether purchased at a discount, or seek to reallocate into funds with smaller fees

- On its first day, ETHE experienced $484m outflows, followed by $326m on Wednesday and $346m on Thursday; leading to net outflows across all issuers, despite the other ETFs still trading strongly

- Analysts noted that ETHE actually experienced much larger (comparative) outflows than its Bitcoin contemporary GBTC at launch, since it both carries a higher fee (2.5% vs 1.5%) and GBTC still carried some NAV discount when it launched

- Additionally, it should be noted that Wednesday saw the worst day for stock markets since 2022, leading to wider risk-off behaviour

- Analyst reception to early trading was broadly positive; Bloomberg Intelligence ETF analyst Rebecca Sin recognised “a very solid first day of trading”, noting “the Ether market is much smaller than the Bitcoin market, so education is critical as we are only at the beginning of a long journey”

- Her colleague James Seyffart agreed and cautioned against too much comparison with Bitcoin ETFs, stating “If we compare it to a standard ETF launch, it was a smashing success… The problem is [if] we are comparing it to the biggest ETF launch of all time in the Bitcoin ETFs”

- When removing comparisons with Bitcoin ETFs, the Ether launches were in a class of their own, as evidenced by Balchunas; “I was curious how the ETH ETFs would rank in Day One volume vs all 600 or so new launches in the past 12 months but *excluding* the Bitcoin ETFs and $ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot…. $CETH, which was lowest among group, would still rank in Top 10% vs a normal new launch”

- Bitwise CIO Matt Hougan declared “It’s been an incredible reaction, to be honest… It’s exceeded my expectations”

- He added “We've now fully entered the ETF era of crypto. Investors can now access more than 70% of the liquid crypto asset market through low-cost ETPs”

- Federico Brokate, 21Shares’ US head shared some perspective on the broader significance of the funds; “I think it's important to underscore the Ether ETF launch as an inflection point. It represents further comfortability with the asset class from the SEC and serves as further proof of crypto's broader momentum and adoption”

- Christopher Jensen, head of digital assets research at Franklin Templeton believes that the success of Bitcoin products could benefit Ether contemporaries; “People have already done some of their homework and many have already dipped their toes in, so this would be a way to diversify into this new asset class”

What happened: Bitcoin ETF News

How is this significant?

- Although the launch of spot Ether ETFs dominated reporting this week, Bitcoin ETFs still maintained strong trading, with Friday and Monday consecutively registering the largest intakes since early June

- Friday featured $427.2m inflows, led by Fidelity ($141m) and BlackRock ($116.2m)

- BlackRock’s IBIT registered a mammoth $526.7m inflows on Monday, its largest rise since March 13th

- As a result, IBIT also overtook the Nasdaq-tracking QQQ ETF in year-to-date flows, at $18.97bn (despite not trading for half of January)

- This helped Monday to $485.9m inflows, offsetting outflows from some smaller funds ahead of the Ether ETF launches the nest day

- CoinShares data revealed that the trading week ending 19th July saw $1.35bn in digital asset investment product inflows, bringing total inflows over the last three weeks to $3.2bn

- Of the $1.35bn, $1.27bn were directly from Bitcoin ETFs

- As a result of strong digital asset ETF performance, Bloomberg reported that within 48 hours of Ether ETFs launching, “asset managers are rushing to crank out fresh products for the fledgling digital-asset class”

- This includes a range of long/short Bitcoin and Ether products from ProShares, as well as a combination Bitcoin/Ether fund from Hashdex

- In another sign of “establishment” approval for Bitcoin ETFs, Jersey City mayor Steven Fulop announced that his city will allocate part of its pension fund towards the products

- On X (formerly Twitter), he wrote “the question on whether Crypto/Bitcoin is here to stay is largely over + crypto/Bitcoin won. The #JerseyCity pension fund is in process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs similar to the Wisconsin Pension Fund has done (2%). It Will be completed by end of the summer and I’m sure eventually it will be more common”

- In Hong Kong CSOP Asset Management Ltd. CEO Ding Chen revealed the firm would launch an inverse Bitcoin ETF, effectively allowing investors to profit from bearish price movements

What happened: Mining firm makes nine-figure Bitcoin purchase

How is this significant?

- Nasdaq-listed mining firm Marathon Digital made a sizeable addition to its Bitcoin balance sheet this week; announcing a $100m Bitcoin purchase in a press release

- CEO Fred Thiel stated that the company intends to hold (or “hodl”, in industry slang) the coins as a reserve asset, rather than selling them off; “Adopting a full HODL strategy reflects our confidence in the long-term value of Bitcoin. We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset”

- This “full HODL” strategy involves retaining all mined Bitcoin it generates, as well as occasional strategy open-market purchases

- CFO Salman Khan added “Given Bitcoin’s current tailwinds, including increased institutional support and an improving macro environment, we are… focusing on growing the amount we hold on our balance sheet. Bitcoin’s recent price decline, coupled with the strength of our balance sheet, afforded us an opportunity to add to our holdings”

- The company now holds over 20,000 Bitcoins, following the nine-figure acquisition

- As of June 30th, the company had $268m in cash on its balance sheet, so it may have mobilised nearly a third that amount to increase its Bitcoin coffers

What happened: Citi upgrades industry outlook

How is this significant?

- Analysts from Citibank revealed a positive prediction on the future of the digital asset market, upgrading their assessment of Coinbase shares whilst outlining several justifications for broader optimism across the industry

- In a Tuesday note, analyst Peter Christiansen raised COIN shares from “neutral” to “buy”, citing a less hostile regulatory environment in the US

- Christiansen wrote “Shifts in the US. Election landscape and the Supreme Court’s overturning of the long-standing Chevron precedent has changed our view on Coinbase’s regulatory risks… We surmise the upside opportunity from a more conducive regulatory environment to be too large to ignore”

- Indeed, this week Coinbase appointed Paul Clement to its board, a lawyer instrumental to overturning the aforementioned Chevron deference, which made courts defer to federal agencies and “gave government regulators more freedom to interpret unclear laws”

- This led to many industry accusations of the SEC simultaneously over-reaching and under-informing

- Citi also responded positively to Joe Biden’s withdrawal from the presidential race, saying “potential for pro-crypto legislation would fare better under a different administration”, particularly a Trump-led Republican White House

- However, Biden’s (presumptive) Democrat replacement Kamala Harris also appears to be more conciliatory to crypto, with billionaire Mark Cuban stating “I'm getting multiple questions from her camp about crypto. So I take that as a good sign….The feedback I’m getting, but certainly not confirmed by the VP, is that she will be far more open to business, AI, crypto and government as a service”

What happened: Mt. Gox Bitcoin distributed to customers via crypto exchanges

How is this significant?

- Over a decade after a hack drove the Mt. Gox exchange into bankruptcy, creditors began receiving back a share of their deposits via several contemporary exchanges used to streamline the distribution process

- At the time, Bitcoin was valued around $600; now creditors stand to reap more than a hundred-fold increase in price (though not a full return on Bitcoin amount) after their lengthy “forced hodl”

- Kraken exchange revealed that it had distributed Bitcoin (and Bitcoin Cash, generated via a 2017 hard fork of the main Bitcoin blockchain) to all entitled parties, whilst Bitstamp—the world’s longest-running crypto exchange—revealed it began the restitution process on Thursday

- An estimated $8bn of Bitcoin will be distributed to creditors this year, but given the fact that anyone affected is an ultra-early adopter from well before current institutional adoption, some analysts don’t expect large-scale liquidations

- Raghuram Vadapally, a senior fixed income analyst at Carson Capital told Bloomberg “There’ll be some selling, but not a crazy sale like the German government [editor’s note: actually Saxony state government]. They’re not going to dump because they’ve all made huge profits”

What happened: Galaxy Digital raises $113m for crypto venture fund

How is this significant?

- Tech billionaire Mike Novogratz’s Galaxy Digital has raised around $113m for a new crypto venture fund, and will keep allocations open up to next year with a view towards a total $150m, according to a Thursday statement from the firm

- Fundraising for Galaxy Ventures Fund I LP began in Q2 this year, aiming to ultimately invest in a portfolio of around 30 different projects with allocations generally ranging between $3m to $5m

- General Partner Mike Giampapa commented on a very long-term investment horizon for the firm; “Our macro view is blockchains will be utilised to settle the majority of transactions. It’s a one-, two-decade transition that we are betting on”

- Steve Kurz, Galaxy’s global head of Asset Management stated “This fund will strengthen our commitment to fostering innovation in the digital asset space, enabling us to back visionary startups and gain unparalleled insights into the emerging technologies that will shape both our company and the future of finance”

- The announcement of this fund is part of a wider revival in digital asset VC activity, following a prolonged period of steep decline after the 2021 bull market

What happened: Ferrari extends digital asset payments for luxury cars

How is this significant?

- Luxury automobile manufacturer Ferrari revealed on Wednesday that it’s expanding a US-based scheme allowing car purchases via crypto into Europe from August onwards

- In a press release, the firm touted adoption of the payment option in America, stating “entry into the European market follows the successful launch of this alternative payment system in the United States less than a year ago, to support dealers in better addressing the evolving needs of its clients”

- Payments are processed in partnership with industry firm BitPay, settled instantly into cash from Bitcoin, Ether, or the USDC stablecoin

What happened: Deutsche Telekom deepens blockchain node involvement

How is this significant?

- Telecommunications giant Deutsche Telekom increased its involvement in the cryptosphere this week, announcing on Thursday that it will “expand Web3 services” to the tokenisation-centric XDC blockchain

- XDC, with a focus on real-world assets (RWA) and decentralised physical infrastructure (DePin) is an Ethereum-compatible institutional chain, catering to a variety of finance applications within the burgeoning tokenisation space

- Deutsche Telekom MMS web3 head Dirk Röder commented to industry publication Coindesk that “This addition utilises our enterprise-grade infrastructure to enable secure blockchain-based applications, with a focus on the finance sector”

- The MMS unit, dedicated to cloud and infrastructure services, will operate a standby masternode on the XDC network, helping to maintain consistent and speedy execution of transactions if participation levels drop below a predetermined threshold of 108 separate nodes

- Much of Telekom’s activity in the digital asset space thus far has been on an infrastructural level—actively participating as a node operator in securing and running blockchains, rather than just allocating capital towards token purchases

- Such efforts include staking-as-a-service provisions for clients, and the recent revelation that the firm would enter the Bitcoin mining space, with a particular focus on developing energy-efficient mining solutions