February 11th, 2025

Market Overview:

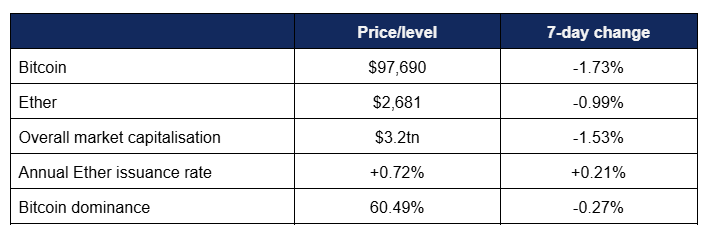

Digital assets experienced slight losses over the week, as positive policy pronouncements were counteracted by continued macroeconomic uncertainty over potential international trade wars.

- Bitcoin predominantly traded within a relatively narrow range, as traders remained reticent to commit too heavily towards perceived risk-on assets

- Bitcoin dropped from a Tuesday high of $101,220 to a Monday low of $94,890, spending most of the week below the $100,000 mark, trading between $95,900 and $98,000

- Ether peaked at $2,855 on Thursday, dropping to a low of $2,555 on Sunday

- Overall industry market capitalisation fell by $50bn, dropping to $3.2tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi remained steady at $108.2bn

Digital assets faced another challenging week, as continued international trade tensions affected perceived risk-on assets. Nevertheless, adoption and policy progress continued globally; the industry appears primed for a series of IPOs, the new White House “Crypto Czar” held his first press conference and outlined priorities, Bitcoin volatility declined to an all-time low whilst still leading all asset classes in five-year returns, companies in the US and Japan continued to demonstrate the benefits of a Bitcoin balance sheet, and much more.

What happened: Digital asset exchanges consider IPO plans

How is this significant?

- Two major American crypto exchanges both spoke about the possibility of going public this week, in a sign of further shifts in the political perception of the asset class

- Gemini, the exchange co-founded by the Winklevoss twins, is considering a 2025 IPO according to Bloomberg sources

- Representatives for Gemini didn’t provide any comment to Bloomberg, but the sources claimed “deliberations are ongoing” and no final decisions have been made on the matter

- Co-founders Cameron and Tyler Winklevoss were major contributors to campaign funding (donating the maximum Bitcoin amount permissible to the Trump campaign) and industry super-PACs like Fairshake during the recent US general elections, and now appear poised to benefit from a more positive political environment

- Bullish, an exchange backed by PayPal co-founder Peter Thiel, is also considering the IPO route

- According to sources, the company has recruited Jefferies and JP Morgan to prepare for the potential listing

- In 2023, Bullish acquired major industry media platform Coindesk from the Digital Currency Group for approximately $75m, meaning Coindesk could potentially benefit from a public launch too

- When USDC stablecoin issuer Circle relocated its headquarters to New York late last year, reports mounted that it was priming itself to go public, with a confidential prospectus filed

- However, an IPO remains uncertain; CEO Jeremy Allaire noted the firm’s strong financial position with no need for external funding

- Other potential players for going public include crypto exchange Kraken, XRP issuers Ripple, blockchain forensics firm Chainalysis, Anchorage Digital, and infrastructure firm Fireblocks

What happened: ETF News

How is this significant?

- Digital asset ETFs outperformed the broader market this week, posting overall inflows and record volumes despite declining spot prices

- According to CoinShares data published on Monday, digital asset investment products benefitted from “significant buying on weakness” as they collected $1.3bn inflows in the week ending Friday the 7th of February

- This marked the fifth consecutive week of inflows, and the 17th of the last 18 weeks

- Ether took the largest inflows in a nigh-unprecedented move, adding $793m during on-weakness buying as investors capitalised on a flash crash in price the previous Sunday

- Bitcoin’s weekly inflows were $407m

- Spot Bitcoin ETFs exhibited both inflows and outflows in the nine-figure range, but managed to add significantly more than they lost overall

- Last Tuesday was the strongest trading day of the week, as funds accrued nearly $341m, dominated by $249m inflows for BlackRock’s market-leading IBIT fund

- The day’s runner-up was ARK Invest’s ARKB, which posted a gain in excess of $56m

- Wednesday’s inflows were more muted at $66m, followed by significant outflows on Thursday as funds lost over $140m

- This figure was down to declines in just two of the eleven funds, as Fidelity’s FBTC (-$103m) and Grayscale’s converted GBTC fund (-$42m) both experienced sell-offs

- These losses were (more than) recovered the very next day, as funds gained over $171m on Friday; and this recovery was spread across multiple funds, as five of the eleven posted eight-figure inflows, and none registered a daily decline

- BlackRock is reportedly planning to launch its Bitcoin ETFs in Europe, domiciled in Switzerland

- Meanwhile, Trump Media filed for a slew of ETFs, including a “Bitcoin Plus” fund; tracking the price of Bitcoin and custodied by Charles Schwab

- Bloomberg’s chief ETF analyst Eric Balchunas commented that “Trump is going to launch a Bitcoin Plus ETF. Safe to say first-ever POTUS ETF issuer. What a country…”, before adding the disclaimer that the actual issuer is (Trump-owned) Truth.Fi, rather than the president personally

- Spot Ether ETFs experienced one of their best weeks ever despite (or rather due to) a flash crash in the price of the underlying asset

- In particular, Tuesday saw record volumes as tariff tensions caused leveraged positions to unwind during market sell-offs, leading to short-term bargains for hawk-eyed investors

- The $308m inflows were near historic levels for the funds, marking the highest daily gains in two months

- BlackRock’s ETHA dominated the day, adding over $276m, whilst Fidelity’s FETH accrued $27.5m

- Inflows throughout the rest of the week were more subdued, but no days witnessed any net outflows

- In other ETF news, the SEC began seeking comments on filings for Litecoin and Solana-based products, indicating a greater engagement with altcoins than under the previous administration

- Solana was previously accused of being a security during Gary Gensler’s SEC leadership, marking a dramatic turnaround in agency attitudes

- Bitwise president Teddy Fusaro noted “The mere acceptance of the filings into the review process—which is what happened this week—indicates that their view is already changing. Just a few months ago, they wouldn’t review them at all, and now they have officially taken them into the review process”

- Bloomberg ETF analyst James Seyffart revised the firm’s odds of various altcoin ETF approvals, led by Litecoin (90%), Dogecoin (75%), and Solana (70%)

- His colleague Balchunas noted that they perceived the odds of any approvals for those assets at below 5% before the election

What happened: New “Crypto Czar” holds first White House press conference

How is this significant?

- New US "Crypto Czar" David Sacks spoke at length about the industry last week during his first press conference since appointment, identifying the direction of future digital asset policy developments

- Sacks indicated that the new government will create the regulatory clarity that the previous administration failed to bring, featuring new market structure legislation based on the previous FIT21 Bill, with a few tweaks

- Sacks told CNBC's Opening Bell "They [the administration] are very committed to moving legislation through the House and the Senate this year in order to provide that clear regulatory framework that the digital assets ecosystem needs... I think this is something we could do in the next six months"

- He also opined that stablecoins and stablecoin issuance benefit the dollar—and could reduce interest rates:

- Sacks supports the GENIUS Stablecoin Bill introduced by senator Bill Hagerty last week, stating "Stablecoins have the potential to ensure American dollar dominance internationally to increase the usage of the US dollar digitally as the world’s reserve currency, and in the process create potentially trillions of dollars of demand for US Treasuries, which could lower long-term interest rates"

- The Crypto Czar also touted bicameral efforts to keep the industry onshore, via a new joint working group between the House and Senate dedicated to crypto legislation will help ensure the US doesn't fall behind in financial innovation and lose talent or business offshore

- He also confirmed that the crypto industry will have input; "we’ll have an announcement at some point that will be the authorisation to do some sort of outreach with the industry"

- Reserve asset plans are on the table, but the final form is currently uncertain; "That is one of the first things we’re going to look at as part of the internal working group in the administration... We’re still waiting for some cabinet members who are on the working group to get confirmed...[we'll investigate] whether it’s feasible to create either a Bitcoin reserve or some sort of digital asset stockpile"

What happened: Bitcoin volatility falls to all-time low

How is this significant?

- ARK Invest’s annual “Big Ideas” report highlighted the firm’s attitudes and insights towards various investment classes, including Bitcoin

- Dubbing it “A Maturing Global Monetary System With Sound Network Fundamentals And Growing Institutional Adoption”, ARK analysts Yassine Elmandjra, David Puell, and Lorenzo Valente called the spot Bitcoin ETF complex “The Most Successful ETF Launch In History”

- They also found that Bitcoin’s inflation rate has dropped below the long-term supply growth of gold, and that its volatility dropped to all-time lows in 2024, despite Bitcoin boasting (by far) the best five-year CAGR of any major asset

- Additionally, the analysts noted strong growth in Bitcoin held on the balance sheets of public companies; a number which more than doubled in 2024

- The report also found that “Bitcoin’s velocity dropped to a 14-year low in 2024, as supply held for three years or more reached an all-time high”

- Given 2024 performance metrics, the analysts believe that Bitcoin remains on pace to meet the firm’s 2030 price targets—ranging from a bear case of $300,000 to a bull case of $1.5m

What happened: Stablecoin news

How is this significant?

- Several significant developments unfolded this week in the stablecoin space, as the new United States “Crypto Czar” highlighted it as the immediate priority of the country’s new digital asset working group

- A new stablecoin bill by senator Bill Hagerty (with bipartisan co-sponsors) has the official support of the administration, suggesting that it could pass into legislation after previous proposals failed during the previous government

- The GENIUS Act (“Guiding and Establishing National Innovation for US Stablecoins”) aims to codify rules around stablecoin issuance and usage, including “payments and requirements to back stablecoin payments with US currency, Federal Reserve notes, Treasury bills and other assets”

- Additionally, stablecoin issuers would have to submit monthly audited reports verifying the backing assets for their tokens

- This could potentially complicate operations for stablecoin issuers Tether, which currently operates on a system of quarterly attestations rather than monthly audits; but the firm’s recent HQ move to El Salvador may have lessened such requirements

- House Republican Bryan Steill commented that “By implementing a clear regulatory structure for payment stablecoins, we can support continued innovation, bolster the U.S. dollar’s position as the world’s reserve currency, and protect consumers and investors”

- In other stablecoin news, USDC issuer Circle reached a new all-time high in market capitalisation, recovering the losses it suffered following the collapse of FTX in November 2022

- Circle CEO Jeremy Allaire praised the aforementioned GENIUS Act as “a tremendous opportunity to strengthen the US dollar and drive enormous innovation in the global economic system”, indicating industry support for the bill alongside political backing

What happened: Japanese hotel firm reaps benefit of Bitcoin strategy pivot

How is this significant?

- Japanese hotelier Metaplanet recently posted one of the best yearly stock performances in the world—thanks primarily to its “Bitcoin First, Bitcoin Only” financial strategy

- Over the last year, Metaplanet’s share price increased by 4,800%; the largest of any Japanese equity

- Dubbed “Asia’s MicroStrategy” by some for its strategy of relentless Bitcoin acquisition, the firm recently raised $745m to fund future Bitcoin buys; the largest such move on the continent

- The company’s shift towards Bitcoin was precipitated by numerous hotel closures across Japan during the pandemic era; but the public seems to prefer the new direction, as the number of shareholders increased by 500% last year

- Metaplanet also reported its first operating profit in six years, after only pivoting towards a Bitcoin strategy in 2024

- CEO Simon Gerovich cited numerous factors as cause for the stock’s popularity; including Bitcoin enthusiasm under the Trump administration, ongoing Yen depreciation, and avoidance of potential 55% capital gains taxes on Bitcoin bought directly (rather than via a share proxy like Metaplanet)

- Other Japanese firms have followed Metaplanet’s lead; Software developer Remixpoint Inc. has experienced 300% share price growth since announcing a Bitcoin buying plan in September

- According to a Metaplanet presentation, the firm plans to increase its current Bitcoin holdings (around 1,800 Bitcoins) to 10,000 this year, and 21,000 next year

What happened: Political News

How is this significant?

- Alongside David Sacks’ first press conference as Crypto Czar, several events regarding digital assets in the political sphere were worth noting this week

- Debate around perceived industry debanking efforts under the previous administration (known as Operation Chokepoint 2.0) were a key area of focus in and around Washington

- Whilst some commentators believe that reports were exaggerated, industry participants—such as Ethereum and Consensys co-founder Joseph Lubin—attest that they were unfairly targeted

- Lubin told Coindesk “The bank indicated to us they were getting a lot of pressure to shut down our account: a $7 billion company, always an excellent customer for them… They basically said, 'We like you guys. We don't want to do this. We're going to try to delay the process as long as possible, and we'll let you know if we have to do something’.”

- Coinbase tweeted a video accusing the FDIC of lying to the public, saying that banking services remain essential as a means for bringing more people on-chain

- The FDIC was compelled by the courts to release letters sent to institutions regarding reasons they denied requests for crypto businesses, with numerous different causes cited

- Incoming FDIC leadership may concede that previous standards required for banking crypto firms could have been too onerous; acting FDIC chair Travis Hill stated “certain types of experimentation with new technologies should not require time-consuming engagements with examiners or extensive approval processes”

- Some reports indicated that potential Federal Reserve supervision vice chairs are taking a more conciliatory approach to digital assets; although the nominees in question previously voted against crypto policies, so it could be a case of political pandering rather than genuine sentiment

- Canada appears to have adopted an opposite policy; the (Alberta) government-owned bank ATB Financial has emerged as a key banking partner for the local digital asset industry

- Nikkei reported Japan’s FSA is currently considering classifying crypto in a manner akin to securities, as a means of enhancing business disclosures and investor protections

- Digital asset firms in the US are increasingly engaging lobbyists to help represent them in the hallways of political power, including engagement with the newly-formed Presidential Council of Advisers for Digital Assets

- Meanwhile, FOX Business reported Eleanor Terrett disclosed that the CFTC will “hold a CEO Forum to discuss the launch of the agency’s digital asset markets pilot program for tokenised non-cash collateral such as stablecoins”

- Participants in the forum include a who’s-who of American industry firms; Circle, Coinbase, Ripple, and Crypto.com

- North Carolina became the latest state to propose a Strategic Digital Asset Reserve, allowing Bitcoin allocations for pension funds, and up to “10% of the state’s funds into exchange-traded products tied to digital assets with a market capitalisation exceeding $750bn”

- Trump-founded DeFi project World Liberty Financial also confirmed plans for a strategic token reserve, and purchased $55m of Ether during a flash-crash following announcements of new tariff policies

- Eric Trump tweeted his own perception regarding Ether’s status as a “buy”, leading to some unease amongst observers about the family’s potential growing influence in the DeFi space

What happened: MicroStrategy rebrands, continues major Bitcoin purchases

How is this significant?

- Enterprise software firm (and corporate Bitcoin poster child) MicroStrategy is likely one of the most familiar names to subscribers of this newsletter due to its record Bitcoin holdings and multifarious financing methods to fund Bitcoin buys—but we may have to get used to a less familiar name, following a recent company rebrand

- No longer “micro”, the company is now simply “Strategy”; founder and chairman Michael Saylor announced in a press release that “Strategy is one of the most powerful and positive words in the human language. It also represents a simplification of our company name to its most important, strategic core”

- Whilst the name may have changed, the play remains the same; according to an SEC 8-k filing on Monday, the firm purchased $742m on its latest addition to the holdings

- In total, the company bought 7,633 Bitcoin at an average price of $97,255, bringing total holdings to 478,740 Bitcoin, worth over $46 billion

- Furthermore, accounting changes could herald significant benefits for the firm, built on a Bitcoin balance sheet

- Bernstein analysts believe the new FASB accounting standards allowing crypto assets to be noted at carrying value could provide a one-time cumulative adjustment of $12.75bn

- Under previous accounting rules, losses in crypto value (even when unrealised) had to be noted on balance sheets, but increases could only be noted if the asset was sold

- The analysts wrote “Beginning in Q1CY25 financials, the carrying value of Bitcoin will align with its market value, allowing MSTR [now Strategy] to report any appreciation in Bitcoin’s price as a gain in its net income”

What happened: JP Morgan analysts highlight rising Bitcoin correlation with tech stocks

How is this significant?

- In a new research note released on Wednesday, JP Morgan analysts led by MD Nikolaos Panigirtzoglou reported that Bitcoin’s performance correlates most closely with “small-cap tech stocks, as measured by the Russell 2000 tech sector”

- The analysts wrote that “The fact that crypto is more correlated with smaller rather than the largest tech stocks makes sense due to the crypto reliance on VC and due to blockchain/crypto technological innovation typically being the focus of smaller rather than the largest tech companies”

- JPM noted that “the crypto-equity correlation has remained structurally positive since the pandemic due to two factors: the role of retail investors, who have access to leverage in both markets and the tech-driven nature of both sectors”

- However, the correlation isn’t constant, fluctuating over time and aligning most closely when the tech sector experiences major shifts