Market Overview:

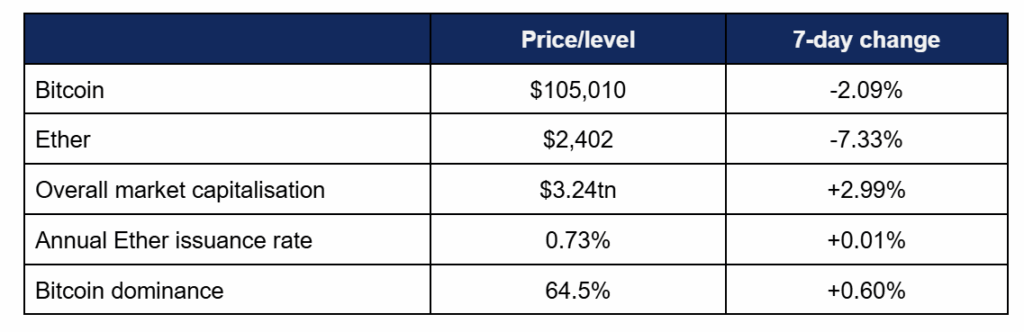

- Bitcoin pulled back further as US actions in the Middle Eastern conflict caused market concern—and due to crypto’s 24/7/365 trading window, the asset class was directly exposed despite the majority of the news cycle occurring across the weekend

- Bitcoin declined steadily throughout the week, declining from an early Tuesday high of $107,320 before a steep weekend drop to a Monday crash below $100,000 for a $98,600 weekly low

- This was swiftly followed by a rally amidst reports of ceasefire and de-escalation

- Ether moved in time with Bitcoin but pulled back further, falling from $2,570 on Tuesday to $2,131 late on Sunday

- Following the first US strikes on Iran, the market experienced over $1bn of liquidations

- Overall industry market capitalisation fell by $100m to $3.24tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell by around $4.5bn, to $110bn

Digital assets were rocked by increasing tensions and conflict between the US and Iran over the weekend, suffering heavy losses whilst TradFi markets remained closed. They did subsequently rally somewhat following a provisional ceasefire, but it remains to be seen what effects subsequent geopolitical developments will have. Outside the Middle East, adoption and development remained strong, featuring the likes of JP Morgan, Visa, BBVA, Texas, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products made it ten consecutive weeks of overall inflows, despite looming geopolitical uncertainty

- According to Coinshares data published on Monday, crypto funds achieved $1.24bn inflows during the truncated trading week ending Friday the 20th

- Of this, over $1.1bn came from Bitcoin products, with Ether ETFs making up the majority of the remainder

- Spot Bitcoin ETFs experienced three strong trading days of nine-figure inflows before Thursday’s Juneteenth public (and market) holiday in the US, closing off the week with nominal inflows on Friday

- The best trading day came on Monday, as ETFs accrued $412m more capital, followed by $217m and $388m the next days

- BlackRock’s IBIT predictably led the field once again—most notably on Tuesday, when it logged a massive $619m inflows to counteract nine-figure outflows from Fidelity’s FBTC and ARK Invest’s ARKB

- Even Friday’s modest $6.4m total inflows were entirely thanks to IBIT, as it added nearly $47m in the face of $40.5m outflows from FBTC

- FBTC did mitigate some of its weekly outflows with a strong Wednesday performance, adding $109m for the week’s only non-IBIT nine-figure result

- Bloomberg chief ETF analyst Eric Balchunas commented on the remarkable performance of ETFs (and Bitcoin) by writing “let me remind you that BlackRock filed for its Bitcoin ETF exactly two years ago. The return since then is 234%! If this doesn’t make you happy (and thankful) you should seek therapy”

- He added “Bitcoin is up 60% in the past 12 months (6 times more than US stocks) and yet many are complaining ”

- Balchunas noted that IBIT is now 4th on year-to-date inflows, and 5th over the last three years… despite only debuting 1.5 years ago

- Spot Ether ETFs displayed predominantly positive performance, with three inflow days to one day of outflows; but as levels far below the previous week’s nine-figure run

- BlackRock’s ETHA was once again the near-exclusive source of inflows for Ether products, and the only ETF to post any outflows on the market’s one day of losses

- Ether inflows throughout the week ranged from $11m to $21m, a steep dropoff from recent highs of $240m

- Elsewhere in ETFs, Bloomberg ETF analysts increased their perceived odds of approval for various altcoin ETFs (Cardano, Doge, and XRP) this year to 90%

- James Seyffart stated “Eric Balchunas and I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher. Engagement from the SEC is a very positive sign in our opinion”

What happened: JP Morgan announces deposit token on public blockchain

How is this significant?

- After last week’s speculation regarding its new blockchain-related “JPMD” trademark, JP Morgan provided some clarity this week around the token’s true function

- Theories that the bank is developing its own stablecoin weren’t quite right, but also weren’t far off

- On Tuesday, representatives of the bank told CNBC that JPMD will be a “deposit token”, where each token “serves as a digital representation of a commercial bank deposit”

- Bloomberg reported that the first transaction will take place via a direct JPMD transfer from JPM to Coinbase, and noted how institutions “including Banco Santander, Deutsche Bank and PayPal Inc. are experimenting with ways they can use digital assets to make payments faster and cheaper”

- One of the key differences from “traditional” stablecoins is clearly the clientele; JPMD is limited to institutional customers, and operates as a permissioned token despite being issued on the public BASE blockchain (an Ethereum Layer-2 developed by Coinbase)

- Like stablecoins, it will enable 24/7 transactions costing less than a cent; a distinct advantage over current banking technology

- JPM’s blockchain head Naveel Mallela explained that the deposit token (unlike stablecoins) enables fractional reserve access

- Mallela said “From an institutional standpoint, deposit tokens are a superior alternative to stablecoins. Because they are based on fractional banking, we think it is more scalable”

- By making it a deposit token rather than a stablecoin, JPM “gives institutional clients a way to move money around faster and easier while still having a close connection with traditional banking systems”

- He added “It’s the first time that a commercial bank is putting commercial money, a deposit-based product, on a public chain…Given the fact that deposit tokens would eventually be interest bearing as well, this would provide better fungibility with existing deposit products that institutions currently use”

- Onchain digital asset settlement and cross-border B2B transactions were cited as specific advantages over legacy banking infrastructure

- Whilst launching on a purely institutional and dollar-denominated basis, Bloomberg cited plans for “other users and currency denominations, pending approval from regulators”

- Mallela revealed “preliminary interest from large institutional players who want more native onchain cash solutions from pre-eminent and reputed financial institutions”

- This move was a long time coming; JPM published a white paper on deposit tokens back in 2022, and has seen success with the stablecoin-equivalent JPM Coin on its proprietary permissioned Kinexys blockchain; over $2bn daily volume reflecting a tenfold increase over the last year

What happened: Stablecoin news

How is this significant?

- The US Senate passed the GENIUS stablecoin bill this week, as president Donald Trump urged legislators in the House of Representatives to do the same

- The bill was approved with broad bipartisan support, by 68 votes to 30

- As the House is already discussing its own stablecoin bill (acronym: STABLE), it must decide now whether to take the Senate bill, or propose a compromise

- President Trump however favours GENIUS, addressing House representatives; “The Senate just passed an incredible Bill that is going to make America the UNDISPUTED Leader in Digital Assets—Nobody will do it better, it is pure GENIUS!. Digital Assets are the future, and our Nation is going to own it. We are talking about MASSIVE Investment, and Big Innovation. The House will hopefully move LIGHTNING FAST, and pass a ‘clean’ GENIUS Act”

- Senate approval proved beneficial to USDC issuers Circle, as its recently-floated CRCL by Seaport Global following the vote, leading to a 20% spike in value

- Analyst Jeff Cantwell wrote “We view Circle as a top-tier crypto ‘disruptor’ with a sizeable future opportunity”, potentially doubling revenue within the next year

- In other USDC news, Coinbase Derivatives partnered with clearing house Nodal Clear in order to allow USDC as collateral in US futures trading

- According to a press release, the partners are working directly with regulators on this first regulated case of stablecoins as collateral

- Oppenheimer & Co. analyst Owen Lau commented “It shows that stablecoin can get into and potentially disrupt capital markets on top of consumer payments”

- In other Coinbase news, the exchange launched a portal designed to foster adoption of stablecoins as a preferred means of online payment

- The company created a product suite “designed to help merchants and online platforms integrate stablecoin payments without requiring expertise in blockchain or crypto assets” and announced that “We built the new system to mimic credit-card rails so it slots into existing flows with zero disruption”

- Shopify will serve as the first client of the service, simplifying its merchants’ acceptance of stablecoin payments

- Benchmark Co. analyst Mark Palmer commented “This sort of initiative where the company is creating a new revenue stream, diversifying beyond transaction volume as the primary means of driving revenue, is very important from a long-term standpoint”

- The exchange also secured a MiCA licence in Luxembourg to ensure regulatory-compliant expansion throughout the EU

- VC giant Katie Haun, a long-time crypto and stablecoin advocate, told Techcrunch that the category has amazing appeal in countries with hyperinflation or limited banking infrastructure; “People in Turkey don’t think of Tether as a crypto. They think of Tether as money”

- The US state of Wyoming targeted August 20th for the first mainnet issuance of its local WYST stablecoin

- 11 different blockchains are currently being considered as the platform for WYST, and current timelines indicate Wyoming will “migrate WYST smart contracts” to the designated “in-scope candidate” blockchains, before testing in production by “funding a small WYST purchase with agency funds and ensure end-to-end processes are in place”

What happened: Visa teams with crypto firm for MENA expansion

How is this significant?

- Global payment giant Visa partnered with Africa’s largest crypto firm, Yellow Card, in order to expand its stablecoin presence throughout the MENA region

- Cross-border payments are a particular focus of the partnership, alongside “opportunities to streamline treasury operations, enhance liquidity management, and enable faster and more cost-effective transfers”

- A press release announced that Visa has already settled $225m of stablecoin payments globally via its 2023 USDC collaboration

- Visa SVP Godfrey Sullivan stated that the partnership is driven by current need as much as future expansion; “In 2025, we believe that every institution that moves money will need a stablecoin strategy”

- Edline Murungi, senior legal counsel for Yellow Card, said that Kenya’s Virtual Asset Service Providers Bill is an example of progressive regulation attempts across Africa; “Those use cases are going to really change the industry. And if other countries follow suit, then Kenya is going to be a hub for a lot of digital-asset activities”

- Yellow Card co-founder Chris Maurice commented “we’re building a bridge between traditional finance and the future of money movement… continuing to innovate new solutions that can transform how money moves for even more secure, efficient, and transparent payment solutions”

- He added “When you look at stablecoins, there’s a lot of excitement in the market and all the major payment companies are exploring ways to get into the space”

What happened: Texas officially approves and enacts Strategic Bitcoin Reserve

How is this significant?

- Texas governor Greg Abbott made Texas the third state in the union (and by far the largest) to adopt a Strategic Bitcoin Reserve strategy, by signing the state legislature’s recently-passed SB21 bill into law

- He also approved a companion bill which shields the reserve from periodic “fund sweeps” into the state’s general revenue

- The fund will be managed by the Texas Comptroller of Public Accounts, Glenn Hegar, according to industry publication TheBlock

- Texas Blockchain Council president Lee Bratcher expects modest beginning for the new reserve, stating “My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas. It’s still early and the comptroller is going to utilise proven investing standards to determine how much to buy, when to purchase, and that’s really outside of the hands of anybody except the professionals at the comptroller’s office”

- Coindesk reported that the state has appropriated $10m to kickstart the reserve; “just 0.0004% of the state’s budget”

What happened: Banking giant BBVA advises up to 7% crypto allocation

How is this significant?

- Reuters reported this week that Spanish banking giant BBVA is advising its wealthier clients on portfolio allocations towards digital assets—specifically Bitcoin and Ether

- BBVA’s private bank recommends its clients put 3% to 7% of their capital towards crypto, dependant on risk appetite

- Speaking at the DigiAssets conference in London, BBVA Switzerland’s digital asset chief Philippe Meyer said “With private customers, since September last year, we started advising on Bitcoin. The riskier profile, we allow up to 7% of (portfolios in) crypto”

- He also said he believed that the bank is one of the first global players to actively advise digital assets in portfolios, previously executing on client requests since 2021

- Meyer said “If you look at a balanced portfolio, if you introduce 3% you already boost the performance. At 3% you are not taking a huge risk”

What happened: Federal Reserve removes “reputational risk” from crypto banking assessment

How is this significant?

- The United States Federal Reserve officially removed the “reputational risk” clause from its examination program for banks, having previously prevented (or at least heavily discouraged) financial institutions from serving the digital asset industry

- In a Monday press release, the Fed said it would instead use “more specific financial risk discussions”

- The board of governors commented on Monday that “This change does not alter the Board’s expectation that banks maintain strong risk management to ensure safety and soundness and compliance with law and regulation”

- Fed alumnus Graham Steele told Bloomberg “My sense is that reputation risk is a factor—but just one factor—in examination and supervision, and is very rarely the sole basis upon which an agency would expect a bank to correct its behavior”

What happened: $4bn Hong Kong family office enters digital asset space

How is this significant?

- Early on Tuesday, reports surfaced that VMS Group, a Hong Kong multifamily office representing around $4bn AUM, is moving into digital asset investment

- VMS managing partner Elton Cheung said it was part of a strategy to diversify into more liquid investments

- Cheung said Hong Kong’s positioning as a regional crypto hub catalysed this strategy as “We thought this was the right time because of growing demand and we see clearer legislative and government support from various jurisdictions, as well as large institutional support and endorsement”

- VMS crypto lead Zhi Li told Bloomberg that generational shifts also played a role; “There is very strong institutional and family interest in getting regulated digital asset exposure. We have seen the younger generation of families wanting to do something different”

What happened: Crypto Treasury news

How is this significant?

- Bitcoin treasury giant Strategy (formerly MicroStrategy) increased its Bitcoin exposure once again this week—but at much lower levels than in recent history

- It purchased $26m of Bitcoin during a week marked by heightened geopolitical uncertainty, marking its second-smallest investment since November

- Meanwhile, leading Asian treasury firm Metaplanet made a major 1,111 Bitcoin purchase at an average price of $106,408 per Bitcoin

- This pushed its total holdings to 11,111 Bitcoin, after recently revising its total acquisition goal upwards to 30,000 Bitcoin by year-end

- Cardone Capital, of real estate guru Grant Cardone, added 1,000 Bitcoin to its balance sheet, according to Cardone’s twitter

- He said he expects to add another 3,000 Bitcoin before 2026, and claimed Cardone Capital is now the “first ever real estate/BTC company integrated with full BTC strategy combining the two best in class assets”

- Parisian IoT firm Sequans revealed a $385m Bitcoin acquisition plan, raising the funds through “private placement deals, including debt and equity offerings”

- CEO Georges Karam claimed “Our Bitcoin treasury strategy reflects our strong conviction in Bitcoin as a premier asset and a compelling long-term investment…”We believe Bitcoin’s unique characteristics will enhance our financial resilience and deliver significant value to our shareholders”

- Longtime Bitcoin educator Anthony Pompliano is taking his financial services firm public via a SPAC merger, with plans for a $1bn Bitcoin balance sheet

- His ProCap BTC and Columbus Circle Capital Corp have already secured $235m commitments for zero-coupon bonds, and $517m in a private placement

- Regarding the upcoming public listing, Pompliano said “We feel very fortunate to have the support of both the Bitcoin community and the traditional Wall Street players”

- Nakamoto Capital (created by Bitcoin Magazine founder David Bailey) reached $763m in its warchest for Bitcoin buys, funded by private placements and $200m of convertible notes

- Bailey stated “We continue to execute our strategy to raise as much capital as possible to acquire as much Bitcoin as possible”

- Finally, former Coral Capital hedge fund colleagues are launching “a new crypto treasury venture”; but one predicated on the BNB altcoin

- The coin is the proprietary token of Binance, with BNB tokens providing utility in terms of enhanced access to the exchange

- The new Build & Buy corporation (a riff on “BNB”) aims to raise $100m for BNB purchases

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.