July 7, 2023

Market Overview:

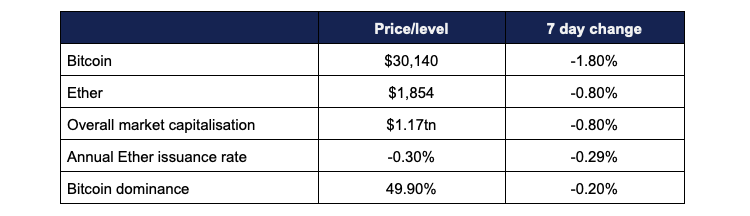

Digital assets cooled off and pulled back slightly after Bitcoin posted a new 14 month high.

- Bitcoin reached a new yearly high on Thursday, peaking at around $31,500; its highest value since May 2022

- Bitcoin dropped to a weekly low of $29,850 in the immediate aftermath of the SEC’s objections against several spot Bitcoin ETF filings on Friday, but recovered to its high less than a week later, spending the majority of the week ranging between $30,400 and $31,000

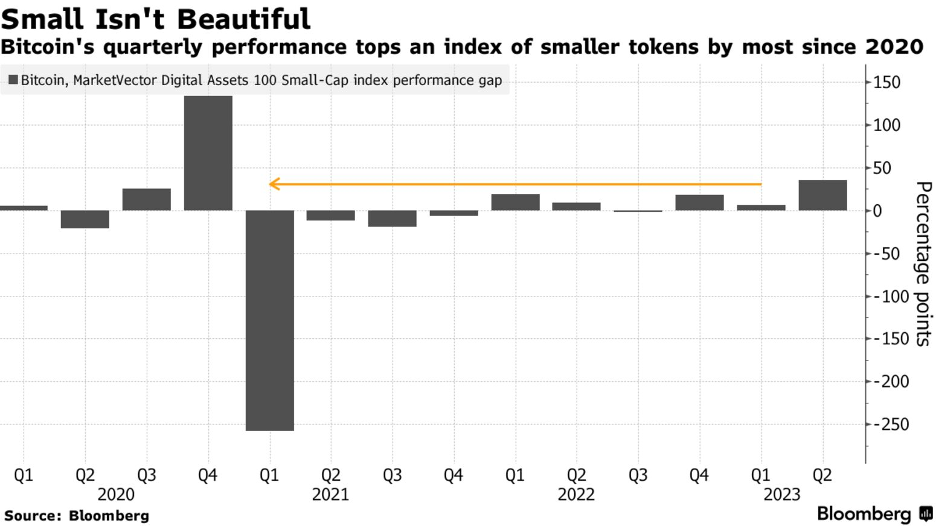

- At the end of June, Bitcoin capped off another quarter of growth; and its greatest outperformance of altcoins since Q4 2020

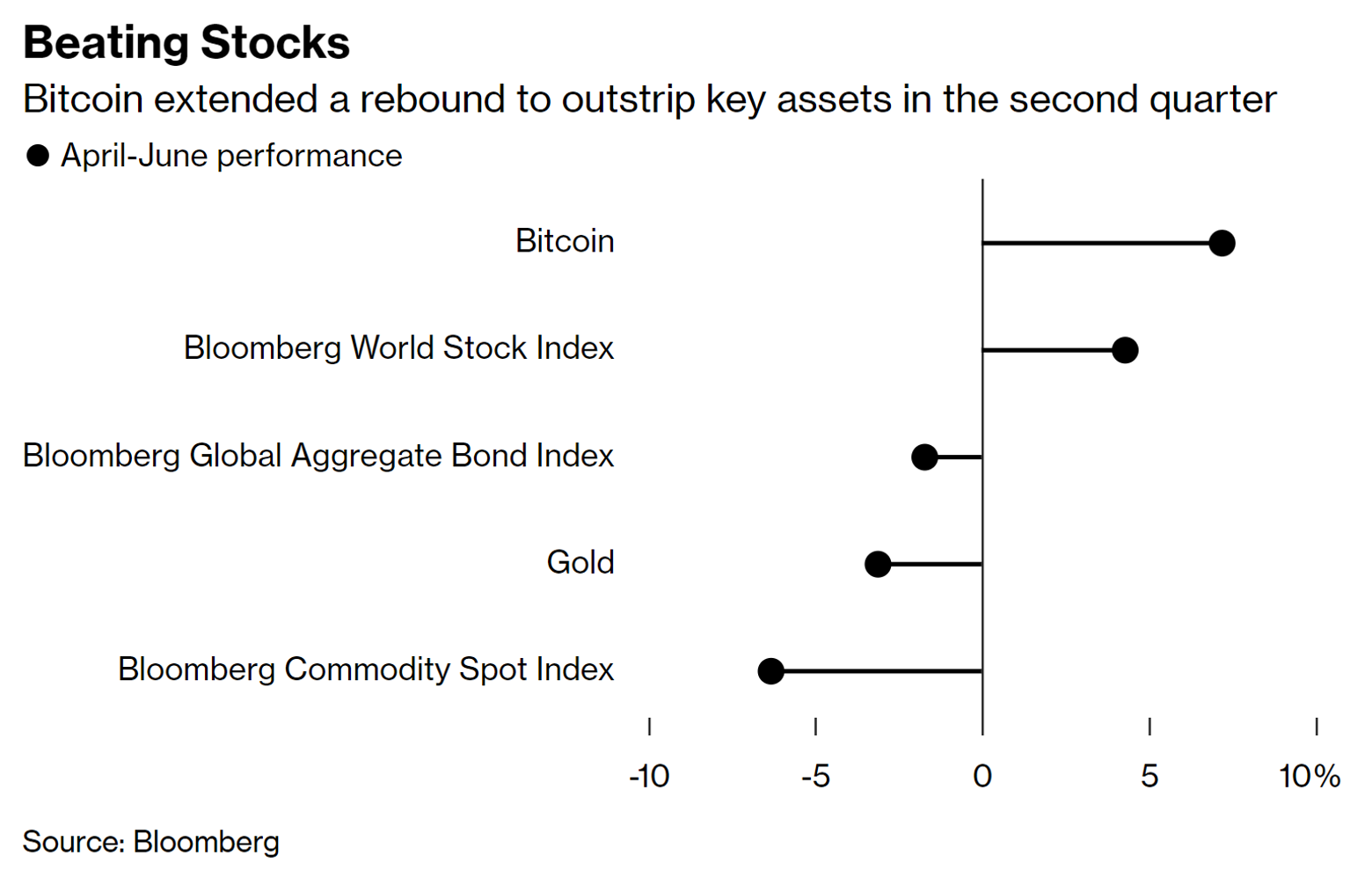

- Bitcoin also outperformed other major asset classes, including traditional inflation hedge gold

- Ether peaked at $1,975 on Monday, steadily declining to a weekly low of $1,845 early on Friday

- Overall digital asset market capitalisation reached a 7-day apex of $1.22tn when Bitcoin hit its high, before pulling back to current levels of $1.17tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi this week across all blockchains, and platforms remained steady, around $44bn

Digital assets declined slightly this week, but only after Bitcoin posted another new 2023 high. Spot Bitcoin ETFs once again dominated reporting, as the SEC raised some objections which the torrent of TradFi titans immediately addressed. BlackRock CEO Larry Fink spoke glowingly of Bitcoin and crypto, declaring his belief that the “fantastic technology” could help to “revolutionise finance”. Singapore, China, South Korea, and Japan all featured in Asian developments, whilst lack of regulatory clarity continued to frustrate in the US.

What happened: BlackRock CEO declares intention to “democratise crypto”

How is this significant?

- BlackRock’s recent filing for a spot Bitcoin ETF was one of the key catalysts to recent growth in the industry; this week company CEO Larry Fink spoke out on his perceptions of—and ambitions for—the asset class

- In an interview with FOX Business on Wednesday, Fink set out a bullish case for Bitcoin and digital assets, underscoring their recent ETF filing

- He said that BlackRock are “believers in the digitisation of products”

- Fink went further, saying that digital assets (including the tokenisation of existing products and assets) could “revolutionise finance”

- He admitted a personal shift in opinion on the asset class, after initial scepticism based on perceived illicit usage during Bitcoin’s early days, but said that his views shifted as crypto became more accessible, and he now sees its role as “digitising gold”

- This indeed marks a strong reversal to previous criticisms; he called Bitcoin “an index of money laundering” in October 2017—since then the asset has increased in value by over 420%

- Fink told FOX “instead of investing in gold as a hedge against inflation, a hedge against onerous problems of any one country or the devaluation of your currency…let’s be clear: Bitcoin is an international asset”

- Since Bitcoin isn’t tied to any particular fiat currency, Fink believes that “it can represent an asset that people can play as an alternative”

- He also declared that “the underlying technology is fantastic… the blockchain will help you accelerate the processes of transactions, the blockchain will help you identify; if you have a pure blockchain, you have knowledge of who the buyers and sellers are, you don’t need custodians anymore”

- Fink also identified their spot ETF filing as an attempt to further grow the accessibility of the asset class

- “It costs a lot of money right now to transact Bitcoin. We hope our regulators look at these filings as a way to democratise crypto, making it much cheaper for investors. We look at this as an opportunity. We work really closely with our regulators”

- However, Fink refused to be drawn into specific timeframes regarding the ETF process, only stating “We hope that, like in the past, we could be working with our regulators and get the filing approved one day, and I have no idea what that one day will be, but we’ll see how that all plays out”

- Bloomberg echoed many of Fink’s sentiments, noting the increased presence of TradFi institutions like BlackRock, JPM, Citadel, Fidelity, and Charles Schwab in digital assets

- They cited predictions by Citi of $5tn in tokenised funds by 2030, with the same amount in tokenised money

- Tyrone Lobban of JP Morgan’s Onyx digital assets division praised improved efficiencies: “Once you see it, you can’t unsee it… you can see that it’s faster, it’s cheaper, you reduce the back and forth”

What happened: TradFi titans refile Bitcoin ETF applications after SEC objections

How is this significant?

- The digital asset market has been buoyed recently by the spate of spot Bitcoin ETF filings following in the wake of BlackRock’s mid-June application; but momentum was briefly rocked this week when the SEC voiced objections

- The Wall Street Journal broke news on Friday that the SEC was dissatisfied with the level of detail concerning “surveillance–sharing agreements” that BlackRock proposed (and others mimicked) in order to address previous SEC concerns over possible market manipulation

- Sources told the Journal that in their original state, the filings weren’t “sufficiently clear and comprehensive”

- Some crypto industry observers noted it was slightly uncanny that the SEC would strike down filings so expeditiously during a perceived crypto winter, when they always delayed decisions until final possible deadlines during previous ETF filings made during more bullish market conditions

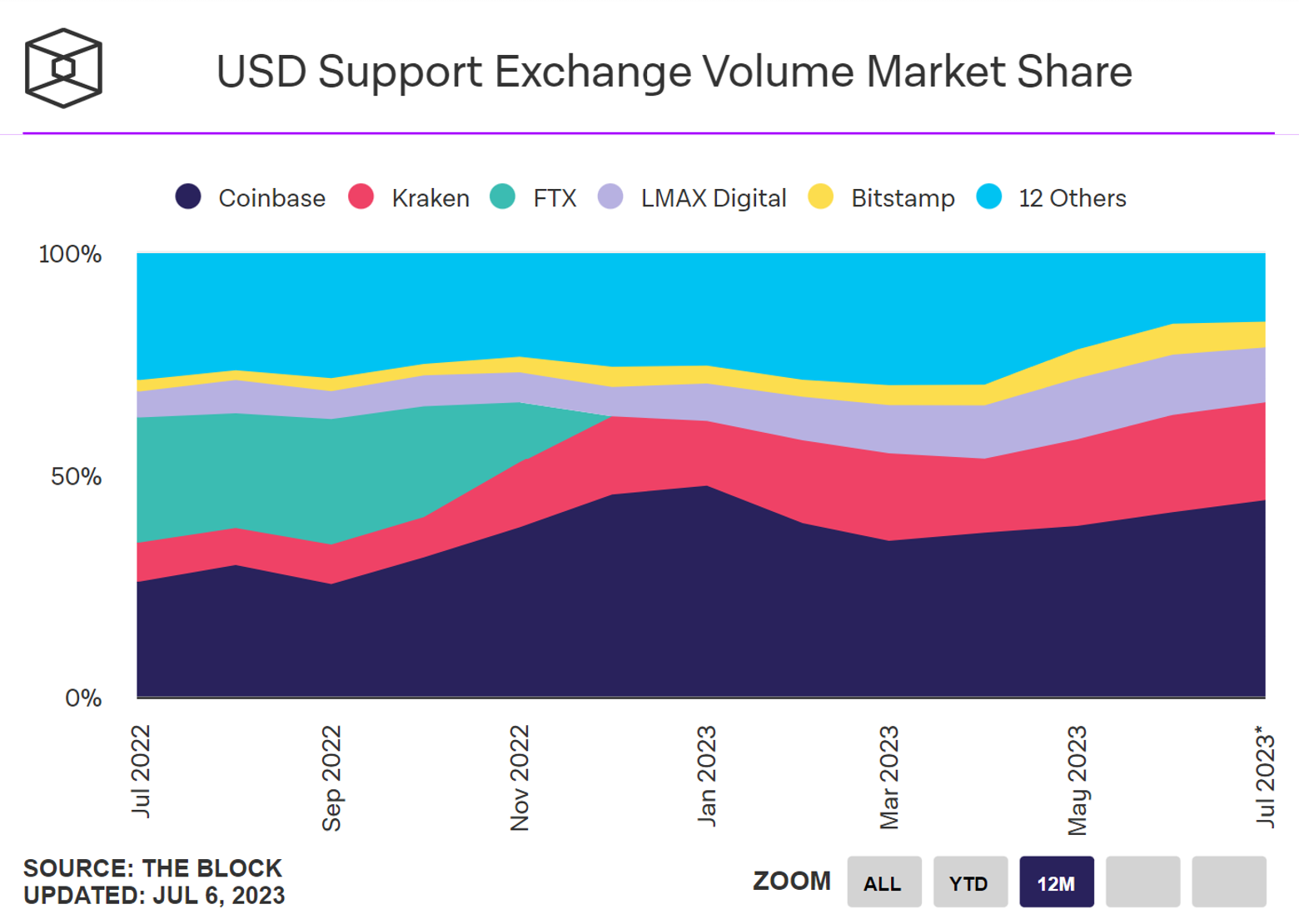

- Fidelity were the first to re-file on the same day as the Journal’s report, adding details confirming that Coinbase would provide market surveillance for them

- Invesco, VanEck, 21Shares, and WisdomTree refiled later on Friday, all similarly citing Coinbase as a partner for their ETFs’ market surveillance efforts

- BlackRock and Valkyrie followed in refiling after the weekend, also disclosing Coinbase as a partner in market surveillance alongside Nasdaq

- Ophelia Snyder, co-founder of ETF issuers 21Shares, explained why Coinbase was the universal choice; “Coinbase represents such a large proportion of the US market for these products and is so well-established in this market that it’s actually the major difference”

- BlackRock’s excellent record in ETF applications informs cautious optimism; as Bloomberg Intelligence analysts James Seyffart and Eric Balchunas opined in a research note “BlackRock doesn’t appear to file for an ETF unless it views approval as likely”

- ETFs are currently a $7tn industry—more than 5 times the entire market capitalisation of digital assets

- ProShares’ futures-based Bitcoin ETF has performed strongly since BlackRock’s ETF filing on June 15th; growing from $822m AUM to $1.04bn AUM

- Grayscale’s GBTC fund also continues to benefit from the awareness brought by ETF filings; its shares are up over 50% since BlackRock’s filing, and its discount to NAV has dropped below 30% for the first time in a year

What happened: Circle aims to issue stablecoins in Japan

How is this significant?

- Circle, issuers of the USDC stablecoin, my make moves into Japan, following recent regulatory changes in the major Asian economy

- In an interview with industry publication Coindesk, Circle CEO Jeremy Allaire stated that recent changes to laws that had prohibited foreign stablecoins rank amongst “the most important thing the government and the Financial Services Agency have done”

- In particular, he identified Japan as a potential international hub if stablecoin payments become more widely accepted for cross-border trade, due to the nation’s status as a major exporter of goods

- Last month, MUFG (the largest bank in Japan) declared their intention to move into stablecoin issuance across a variety of currencies, taking advantage of the new regulations limiting issuance to licenced banks, registered money transfer agents, and trust companies

What happened: Singapore’s DBS integrates Chinese CBDC into business client services

How is this significant?

- Singapore’s largest bank, DBS, announced on Wednesday that it had launched a new merchant solution, allowing businesses to execute automated settlement of China’s e-CNY CBDC into their bank deposit accounts

- According to their own press release, this makes them “one of the first foreign banks in China to launch an e-CNY merchant collection solution and complete an e-CNY transaction for a client”

- DBS China CEO Ginger Cheng said the bank had fielded strong interest from clients and had successfully completed transactions in Shenzhen; “By seamlessly integrating a CBDC collection and settlement method into our clients’ existing payment systems, this will help position their business for a digital future where consumers in China use e-CNY for their daily activities”

- Lim Soon Chong of DBS’ global transactions division said the integration “marks yet another milestone in our vision of enabling instant and frictionless 24/7payments for our customers”

- According to Chinese government newspaper Economic Daily, there are currently 13.6bn e-CNY in circulationacross 26 cities, making the nation one of the leaders in CBDC deployment

- In other Singapore-based news, the country’s central bank (MAS) released a statement informing exchanges that they will have to keep customer assets in a trust by the end of the year, to ensure higher standards of safekeeping

- MAS stated “This will mitigate the risk of loss or misuse of customers’ assets, and facilitate the recovery of customers’ assets in the event of a DPT (Digital Payment Token or Cryptocurrency) service provider’s insolvency”

What happened: South Korea passes crypto bill

How is this significant?

- On Friday, South Korea’s parliament passed the Virtual Asset User Protection (VAUP) bill, boosting investor protection and defining digital assets within a new legal framework

- South Korea has traditionally been a significant digital asset trading territory; during the late 2017 bull run, requirements that investors use Korean-domiciled exchanges led to a 10% price premium compared to global rates

- However, regulatory scrutiny has increased there since last year’s crypto contagion event was catalysed by the collapse of a Korean-developed algorithmic stablecoin and alleged fraud by its developer Do Kwon

- VAUP integrated 19 crypto-related bills, puts the industry under the supervision of the Financial Services Commission, and defines “penalties for transgressions such as the use of non-public information, market manipulation and unfair trading practices”

- Investor protection is the main focus of the new bill, with proposals to expand towards wider oversight in future

- Reception was mixed within Korea; Lee Suh Ryoung of the Korean Blockchain Enterprise Promotion Association stated “We welcome the authorities’ attempt to build order. But the law in general remains stuck in the perspective of traditional finance in terms of regulating crypto”

What happened: New York Fed praises digital dollars

How is this significant?

- After a trial spanning several months, the New York Federal Reserve’s Innovation Centre shared its findings on the use of digital dollars settled “through central bank reserves on a [permissioned] distributed ledger”

- Per von Zelowitz, director of the New York Innovation Centre, stated that “From a central banking perspective, the proof of concept was conducive to exploring tokenised regulated deposits and understanding the potential functional benefits of central bank and commercial bank digital money operating together on a shared ledger”

- In particular, the New York Fed concluded that “digital dollars could be an effective way to improve domestic and cross-border payments”

- Participants in the trial included major banks like Citi and Wells Fargo; Tony McLaughlin of Citigroup’s business development division was encouraged by the trial, saying “We have been greatly encouraged by the business, legal and technical findings. In particular, the prospect of a global, instant US dollar payment system that could benefit cross-border settlements merits further serious study”

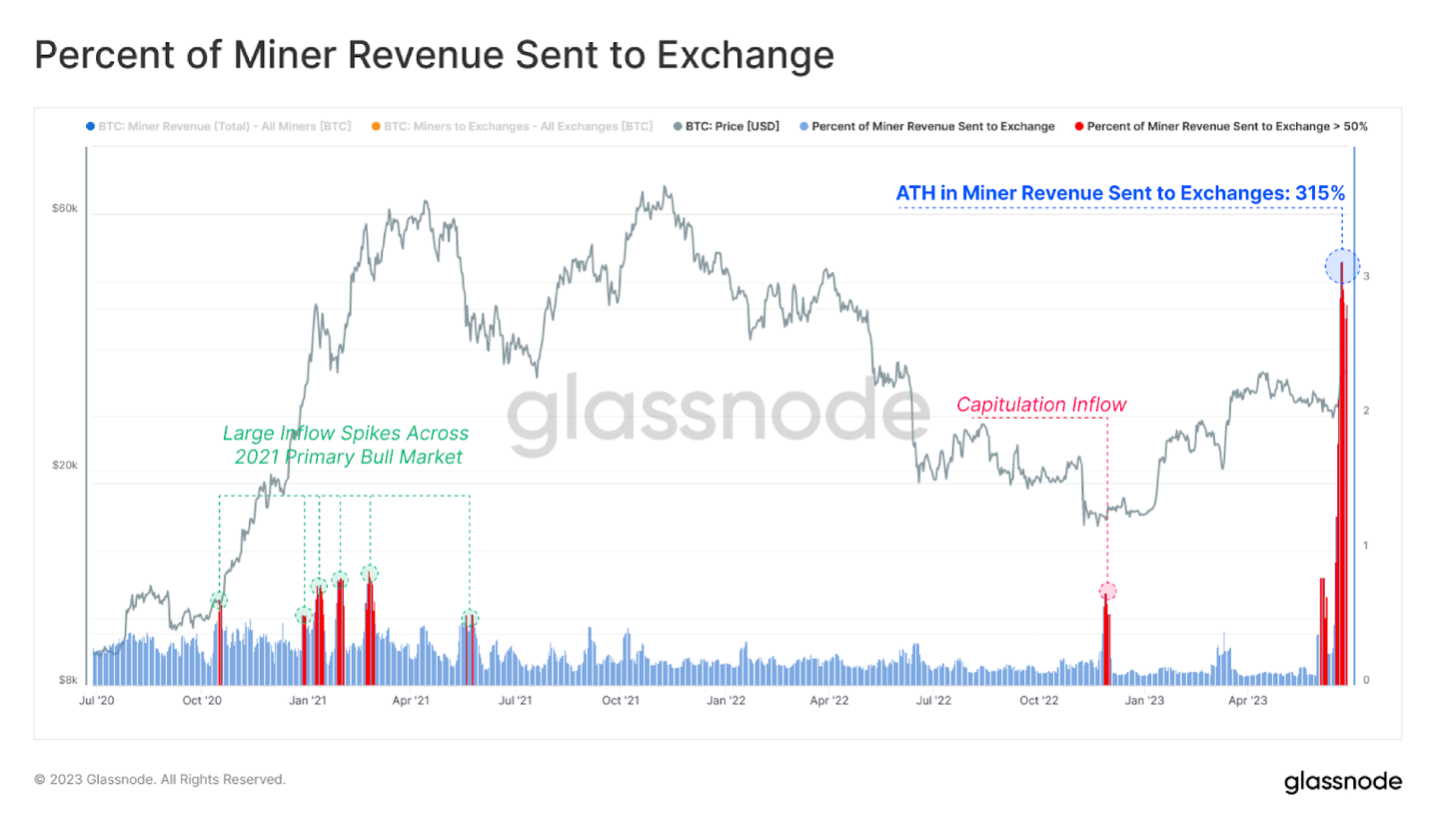

What happened: Bitcoin miners increase selling activity after strong 2023 performance

How is this significant?

- Miners have been selling their freshly-mined Bitcoins at an increased rate, as higher mining difficulty and challenging weather conditions have reduced margins

- According to data from industry analytics firm Glassnode, the percentage of miner revenues sent to exchanges reached all-time highs within the last few weeks, matching with a steady run in all-time highs for mining difficulty

- This indicates greater competition for mining new Bitcoin blocks; and thus likely higher energy expenditure to solve the computational puzzles involved

- Colin Harper, head of research at mining firm Luxor Technologies believes that caution and opportunism play a part in this trend; “I think many of these miners learned their lessons in the past two years. Back then, they liquidated coins in the bear market when Bitcoin’s price was low and they really needed the cash. Some miners are probably just using the recent move in Bitcoin to liquidate mined coins while the price is higher”

- This has been compounded by several other factors; major mining facilities in Texas have shut down as a major heatwave spiked power demands in the state, and next year’s Bitcoin halving event will reduce block rewards (as the name suggests) by 50%, leading some to liquidate and secure cash now in anticipation of lower future rewards

- Publicly-listed mining firm Hut8 recently entered into a $50m credit facility with Coinbase, citing a desire to ensure that they “can maintain [a] dynamic Bitcoin treasury management strategy going into the halving”

What happened: Contagion latest

How is this significant?

- Bloomberg reported via sources that the CFTC had concluded an investigation into bankrupted lender Celsius, finding that the firm and former CEO Alex Mashinsky “broke US rules before the firm’s implosion”

- If a majority of CFTC commissioners agree with these findings, it could lead to a legal filing within the month

- According to Bloomberg, the CFTC “determined that Celsius [which offered several high-interest products] misled investors and should have registered with the regulator, and that former CEO Alex Mashinsky also broke regulations”

- The New York Times published a report this week outlining the scale of spending on celebrity endorsements by FTX, including a $100m sponsorship deal with popstar Taylor Swift—which former CEO Sam Bankman-Fried withdrew from

- Gemini exchange co-founder Cameron Winklevoss continued a public spat with industry conglomerate Digital Currency Group (DCG) and its CEO Barry Silbert, after prolonged efforts to secure restitution after DCG’s Genesis Lending suffered liquidity issues earlier this year that killed off Gemini’s Earn program

- Winklevoss tweeted out a “best and final offer” to DCG featuring a term sheet which included “$1.465 billion of payments and loans denominated in dollars, bitcoin and Ether”

- Failing to accept this deal would, according to Winklevoss, lead to direct legal action against both DCG and Silbert personally

What happened: US institutional exchange Bakkt seeks regulatory clarity overseas

How is this significant?

- Bakkt, an institutional exchanged based in the United States, is now looking beyond their home borders in search of markets with more straightforward operating conditions

- In an interview at a fintech conference, Bakkt CEO Gavin Michael revealed “We’ve said quite clearly that whilst we’re committed to the U.S. market, we’re looking for markets where there’s traction and using those markets as a way to fuel growth”

- Regulatory frameworks were cited as a key factor in their expansion plans; “We’re particularly focused on Hong Kong, the UK and parts of the EU because we see partners wanting to move into those spaces and we want to be able to support them”

- Bakkt previously delisted multiple coins and tokens in the crosshairs of the SEC, which Michael acknowledged has complicated their US business; “when you pull back further from the U.S. and you look at what’s happening in other markets, we see them moving slightly ahead of where we are”

- He added “When we think about trading, trading is really heavily influenced by regulatory clarity. We’ve seen that in the overseas markets where regulatory clarity has led to a change in consumer sentiment”

What happened: SEC Commissioner argues that US regulatory ambiguity “hurts” Americans

How is this significant?

- Hester Peirce, a noted pro-crypto voice amongst the SEC Commissioners gave an interview this week which once again appeared to contradict SEC chair Gary Gensler’s repeated assertions that regulations for the industry are clear and coherent

- Peirce told industry publication Coinage that all the previous spot Bitcoin ETF rejections are an example of inconsistency within the agency; deeming approval standards for ETFs “a moving target… not consistent with how we've treated other products”

- She noted “In other countries there are spot products that have been approved for a long time and there's a lot of demand for spot products and I think if you look at the rationale for approving a futures product, it would seem that you could apply that same rationale and apply it a spot product”

- Peirce lamented the lack of clarity, saying “I think one of the reasons that I've been critical and that some others have been critical is that in the absence of a regulatory framework that makes sense. I don't think that it serves the American public to keep this sort of regulatory ambiguity so that you can come in after the fact with enforcement”