Market Overview:

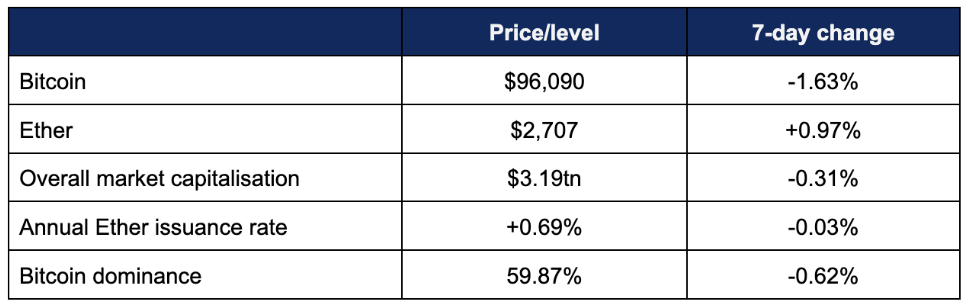

Digital assets experienced mixed performance amidst continued macroeconomic uncertainty, as Ether exhibited growth whilst Bitcoin continued its recent slide.

- Bitcoin once again traded in a relatively narrow range compared with usual activity, with the majority of trading between $95,800 and $97,600

- Bitcoin hit a weekend high of $98,570, up from a Wednesday low of $94,740

- Ether also hit its low on Wednesday, rising from $2,571 to a Monday peak of $2,819

- Industry sentiment on the Fear & Greed index remained fearful, virtually unchanged at 38/100

- Overall industry market capitalisation remained steady, at $3.19tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased slightly thanks to Ether’s appreciation, growing to $109.4bn

Digital assets remained almost unchanged in market capitalisation over the last week. The industry continued to move towards greater public recognition in the form of planned IPOs, Ether ETFs outperformed Bitcoin ETFs, Standard Chartered moved to issue stablecoins for the Hong Kong market, some of the world’s largest banks are considering crypto custody, and much more.

What happened: More digital asset firms move towards IPOs

How is this significant?

- Following numerous reports last week about digital asset exchanges and firms with planned public floats, several more joined the fray this week

- Crypto exchange com recently undertook a significant executive hiring spree, adding TradFi experience with a view towards going public

- Bloomberg reported that former Goldman Sachs executive Justin Evans joined as new CFO, whilst Point72 portfolio manager Mike Wilcox was recruited for the COO role

- Evans commented “Having worked with crypto companies during my time at Goldman, I’ve seen firsthand how dynamic this industry can be. Joining at this stage of the company’s journey presents growth opportunities… taking the steps necessary to be a public company, if and when the public markets are available”

- He added “The outlook in the US is much more favorable now than it was during my time when I was at Goldman Sachs, specifically related to the US policy environment toward the industry”

- Crypto custody company BitGo is also considering the IPO route, with Bloomberg sources suggesting an opening bell in H2 2025

- BitGo backers include Goldman Sachs and DRW Ventures, and the company was most recently valued around $1.75bn following a $100m raise in 2023

- Other major industry firms mulling potential IPOs include Kraken, Ripple, Circle, and Gemini

- As a corollary of potential future public launches, Bloomberg also reported greater banking involvement with the industry, citing Morgan Stanley and Bank of America as institutions reaching out to crypto firms

What happened: ETF News

How is this significant?

- Digital asset ETFs experienced their biggest outflows in five months as part of wider market pullbacks, marking only the second weekly decline in the last 19 trading weeks

- According to CoinShares data published on Monday, digital asset investment products collectively shed $415m, the largest losses since sentiment was buoyed by the US election

- CoinShares chief researched James Butterfill cited interest rate expectations as a key driver for the outflows, following a hawkish Fed “coupled with US inflation data exceeding expectations”

- In total, Bitcoin funds experienced $430m of outflows in the week ending Friday the 14th, although altcoin funds for XRP and Solana made modest gains around the $9m mark

- Spot Bitcoin ETFs featured nine-figure outflows in early trading before recovering slightly with eight-figure inflows on Friday

- BlackRock’s IBIT exhibited the strongest performance despite the wider downswing, posting inflows on four out of five trading days last week

- Admittedly, the inflows (and outflows) were much more modest than IBIT’s daily averages, as Monday to Friday flows were all in the eight-figure range; $55m, $24m, -$22m, $26m, $22m

- The biggest loser was the industry’s second-largest fund, Fidelity’s FBTC; it had the largest daily losses of the week at -$136m and -$102m on Monday and Wednesday, although it led the Friday recovery with $94m inflows

- Despite a rare week of outflows, the overall performance of Bitcoin ETFs remains strong, and Bloomberg ETF analyst James Seyffart pointed out that after the latest round of 13-F filings, Emirati sovereign wealth fund Mubadala Holdings has emerged as the seventh-largest holder of Bitcoin ETFs, valued at $461m

- Spot Ether ETFs outperformed their Bitcoin brethren (relatively speaking), posting inflows on three of the last four trading days

- Admittedly, these inflows were at much lower levels than Bitcoin ETFs, but so were the daily outflows

- Outflows on Wednesday totalled around $41m, whilst no daily inflows exceeded $13m

- New filings from NYSE petitioned for rule changes to allow staking on Ether ETFs; potentially creating passive income streams for holders

- Neither Ether nor Bitcoin experienced any trading on Monday, as US markets were closed for the Presidents Day public holiday

What happened: Franklin Templeton expands tokenised fund onto Solana blockchain

How is this significant?

- American asset management giant Franklin Templeton extended the reach of its FOBXX US government on-chain money market fund (token name BENJI) to the Solana blockchain this week

- This now makes BENJI—which was the first tokenised fund of its kind—available on the two largest smart contract blockchains in crypto, following an Ethereum version launched in November

- Franklin announced the move on Wednesday, praising Solana as a censorship-resistant layer-1 blockchain

- At the time of writing, BENJI remains the third-largest tokenised money market fund, with a total market capitalisation of around $584m, following BlackRock’s BUIDL and Hashnote’s US Yield Coin

- In other tokenisation news, Liechtenstein-based tokenisation platform Midas launched liquid yield tokens based on actively-managed DeFi funds from a variety of issuers

What happened: GameStop considering Bitcoin investment

How is this significant?

- CNBC reported this week that video game retailer GameStop could begin investing in “alternative asset classes including crypto”, according to three separate sources

- Speculation about possible digital asset (and specifically Bitcoin) allocation mounted after company CEO Ryan Cohen posted a picture of himself with Strategy (formerly MicroStrategy) founder Michael Saylor, known for his stance as a corporate Bitcoin reserve advocate

- According to a new investment policy ratified by the company board in 2023, “Cohen, plus two independent board members and other necessary staff” are able to manage the company’s portfolio of investments

- The market greeted this news with enthusiasm, as GameStop shares jumped by 20% in after-hours trading following the reports

- GameStop could potentially yield considerable buying power for digital assets; at the end of Q3, it held $4.6bn cash on its balance sheet, more than thrice its $1.5bn liabilities

- However, this performance has been driven primarily by cost-cutting rather than increased revenues, hence a greater focus on managing investments

What happened: Standard Chartered to launch Hong Kong Dollar stablecoin

How is this significant?

- International banking giant Standard Chartered sought to leverage Hong Kong’s increased acceptance of digital assets this week, by issuing a stablecoin pegged to the city’s dollar

- In a Monday press release, Standard Chartered group chief executive Bill Winters stated “Digital assets are here to stay… We are introducing solutions and instruments that service this market and meet the growing client demand. As public chain instruments with proven use cases, stablecoins play a critical role in the overall digital asset ecosystem”

- Hong Kong CEO Mary Huen added “Standard Chartered looks forward to becoming one of the first issuers launching an HKD-backed stablecoin together with our strategic partners, bringing an innovative medium of exchange to Hong Kong and charting a new chapter”

- The stablecoin is developed in partnership with Web3 and tech firms Animoca Brands and HKT

- Animoca will provide digital asset expertise, whilst Standard Chartered contribute banking infrastructure and HKT develop mobile wallet solutions for the stablecoin

- Hong Kong’s South China Morning Post newspaper reported that the move built on a proposed stablecoin bill published in December (currently under discussion), as “Policymakers in Hong Kong have been pressing ahead with initiatives to help promote the city as a leading crypto asset hub”

- In other Hong Kong news, VC firm Gaorong Ventures invested $30m in the operators of HashKey Group, the country’s largest licenced crypto exchange, leading a spokesperson to indicate a valuation of $1.5bn

- A crucial factor to note is Gaorong’s location—the VC is based in Beijing, the administrative heart of mainland China, where trading of digital assets remains officially banned (although ownership was recently confirmed as legal by Shanghai courts)

- Under the “one country, two systems” policy, several reports have previously suggested that mainland businesses are circumventing China’s official ban by gaining exposure to Hong Kong crypto funds and firms

- In other stablecoin news, leading issuer Tether confirmed a minority share in Italian football club Juventus as a continued investment diversification of the firm’s excess reserves

What happened: Metaplanet continues Bitcoin acquisition

How is this significant?

- Following recent reports of strong business performance by Japanese hotelier Metaplanet since adopting a “Bitcoin First, Bitcoin Only” financial strategy, the company continued its recent trend of Bitcoin acquisition this week

- In total, the firm confirmed four billion Yen ($26.4m) of buys, securing an additional 269.43 Bitcoin and bringing its total holdings above 2,000

- These buys were financed by a recent $745m raise intended primarily to secure future Bitcoin purchases

- According to company documents, Metaplanet has now spent a total 24.9bn Yen at an average price of 12.2m Yen per Bitcoin

- Metaplanet’s inspiration, enterprise software firm Strategy (formerly MicroStrategy) also featured in the news, as the latest 13-F filings revealed that a California pension fund holds $83m worth of Strategy shares, acquired as a proxy for Bitcoin exposure

What happened: Political News

How is this significant?

- Political reporting calmed down this week, although Latin America provided an example of why politicians and memecoins usually don’t (and shouldn’t) mix

- In the US, SEC commissioner Hester Peirce admitted that she had been “extremely frustrated” by the agency’s heavy-handed treatment of crypto during the previous administration, “putting roadblock after roadblock” in front of industry participants

- Speaking in her role as the SEC’s new crypto task force head, she told Bloomberg that (unlike the beliefs of previous chair Gary Gensler) the majority of digital assets are not under SEC purview

- The SEC also applied for a 60 day pause to current legal action against Binance, citing ongoing development of a regulatory framework in Congress

- Its filing stated “The work of this [SEC digital asset] task force may impact and facilitate the potential resolution of this case… the defendants agreed that a stay is appropriate and in the interest of judicial economy”

- On Friday, Argentinian president Javier Milei briefly promoted a Solana memecoin called LIBRA, purported to help small Argentine businesses—however he quickly deleted support for the token amidst concerns over its legitimacy, leading its value to plummet

- This led to accusations of a “rugpull” (crypto slang for a deliberate scam, as in pulling the rug out from under someone), and even potential fraud charges or impeachment proceedings for Milei himself

- In an interview, one of LIBRA’s creators admitted the development team had “sniped” (automatically purchased via smart contract) a large amount of the token’s supply at launch, raising frustrations over insider advantages for developers and promoters, though he claimed they did so in order to deter others from sniping

- Milei denied any wrongdoing on Monday, claiming he did not intend to promote the token, and that the vast majority of speculators who lost money were American or Chinese, rather than Argentinian

- This represents the third time a president was involved in promoting a memecoin (following Donald Trump and the Central African Republic’s Faustin-Archange Touadéra), but the LIBRA episode was identified as especially damaging by industry analysts, for fear of liquidity being diverted from legitimate projects and “overshadowed by these short-term, scam-driven games”

- Meanwhile, the Trump-backed World Liberty Financial (WLF) DeFi project unveiled its “Macro Strategy”; a “strategic token reserve designed to bolster leading projects like Bitcoin, Ethereum, and other crypto assets that are at the forefront of reshaping global finance”

- Details on exact reserve choices were scarce, but WLF confirmed it’s seeking partnerships with TradFi firms, including tokenised assets

What happened: Fintechs increase digital asset exposure

How is this significant?

- Several major fintech brands featured in reporting alongside digital assets this week, as finance firms increasingly embrace the new asset class

- Swedish payments firm Klarna announced intentions to “embrace crypto”, according to CEO Sebastian Siemiatkowski, who wrote that “We have 85 million users worldwide. $100bn of volume. Over half a million merchants”

- He was an outspoken critic of the industry in 2022, but this week told Bloomberg Technology “I met with a few very interesting crypto companies, Bitcoin and stablecoins… it’s time to bring crypto to Klarna. Sometimes you’re happy you’re wrong”

- Payments processor Stripe completed the $1,1bn acquisition of stablecoin platform Bridge

- Stock trading app Robinhood benefitted hugely from its integration of digital asset trading, as it doubled revenues in Q4, bolstered by a 700% increase in its crypto revenue

- CEO Vlad Tenev hailed “a more innovation-friendly environment” as a key tailwind for the industry

- He also promoted blockchain technology and stablecoins as an upgrade on existing financial infrastructure, enabling 24/7 trading

- Publicly-traded crypto exchange Coinbase also touted a successful fourth quarter, as $2.27bn revenues exceeded estimates by $400m, heralding “the dawn of a new era for crypto” in a shareholder letter

What happened: State Street and Citi moving into crypto custody

How is this significant?

- This week, tech industry publication The Information revealed that banking titans Citi and State Street are exploring custody services for institutional investors and large funds, taking advantage of the more supportive political and regulatory climate since Republicans took power

- In particular, the revoking the notorious SAB121 accounting guidelines helped level the playing field for digital assets

- SAB121 required crypto to be held on a bank’s own balance sheet (unlike other client assets), thus making it prohibitively expensive and disadvantaged compared to other asset classes

- Some industry participants would claim digital assets weren’t just disadvantaged, but actively discriminated against in a so-called “Operation Chokepoint 2.0” debanking effort—the FDIC recently came under congressional scrutiny after being compelled by courts to release letters to banks detailing the agency’s guidance on digital assets

- Acting FDIC chair Travis Hill stated that “certain types of experimentation with new technologies should not require time-consuming engagements with examiners or extensive approval processes”

- Federal Reserve chair Jerome Powell acknowledged in recent congressional testimony that some debanking happened; “We’re all struck at the number of complaints and the breadth of them… at least some of it is real. We need to understand it, and stop it from happening”

- Powell added the industry *had* previously been held to a different standard; “The threshold has been a little higher for banks engaging in crypto activities, and that’s because they’re so new and we don’t want to make the mistake”

- However, he also stated that banks can now serve crypto clients; “we’re not against innovation, and don’t want to take actions that would cause banks to terminate customers who are perfectly legal just because of excess risk aversion maybe related to regulation and supervision”

- Citi and State Street both represent a massive vote of confidence for the industry (and signal of client interest); Citi is the third-largest US bank by assets and recently completed a private fund tokenisation pilot, whilst State Street is the largest custodian bank in the world, holding $44tn in assets

- The Information also stated that existing custodian BNY wants to expand its custody services beyond Bitcoin and Ether, offering a wider range of assets as altcoins like Litecoin, XRP, and Solana attract attention for potential spot ETFs.

- Elsewhere in banking, new filings revealed that Goldman Sachs now holds over $1.5bn in Bitcoin ETFs (issued by BlackRock and Fidelity), and increased Ether ETF holdings by 2,000% (from $22m to $476m) in Q4

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.