August 9th, 2024

Market Overview:

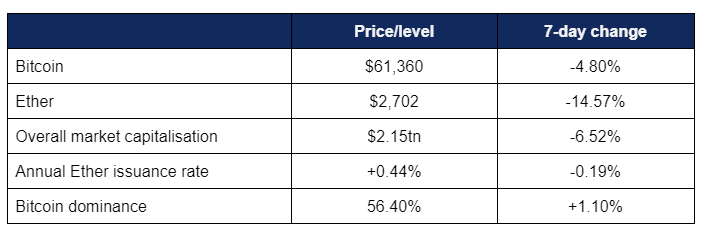

Digital assets were affected by the global investor panic across all markets and suffered one of their worst weeks since the FTX collapse, before rallying to erase some of the losses.

- Bitcoin briefly dropped below $50,000 on Monday amidst wider investor risk-off behaviour, as markets were severely affected by a variety of factors including US job data, increased geopolitical tensions, and the Japanese Yen “carry trade”

- Trading across major markets was in turmoil this week; the Nikkei experienced its worst single day since 1987 (more than 21 years before Bitcoin was even released), and at one stage after trading opened on Monday, the US stock market lost more value than the entire market capitalisation of digital assets

- However, after a few days to calm down and digest, digital assets rebounded; Bitcoin’s current price reflects an increase of over 20% from its weekly lows

- Bitcoin traded across one of the largest ranges in recent memory this week; from a Friday high of $65,380 to a steep weekend decline and Monday low of $49,810, before recovering above $60,000 on Thursday with a post-crash high of $62,500

- Ether was hit even harder by the market uncertainty, dropping from a Friday high of $3,165 to Monday doldrums of $2,190, before rallying and recovering some losses

- In particular, the behaviour of wallets linked to major market maker Jump Trading are believed to have spooked investors, after the firm offloaded large amounts of Ether

- Overall digital asset market capitalisation dropped to $2.15tn, having fallen as low as $1.81tn on Monday

- According to industry monitoring site DeFi Llama, total value locked in DeFi was hit hard by the bearish momentum, dropping around $10bn to $85.2bn

Digital assets experienced their worst week since the FTX collapse, amidst a wider global market meltdown. However, they managed to stabilise and rally in midweek trading, recovering the majority of their losses. ETFs saw massive volume thanks to the volatility, political overtures continued in the US, Morgan Stanley greenlit their financial advisors to recommend Bitcoin exposure, and a federal judge’s ruling fell far (far) short of the SEC’s requested fine against XRP issuers Ripple Labs.

What happened: ETF News

How is this significant?

- Digital asset ETFs saw increased trading volumes as a corollary of the volatility in the crypto market this week

- According to data from Coinglass, Bitcoin ETF volumes hit $5.7bn on Tuesday—the highest amount since March

- CNBC deemed the steep weekend drop across the industry “the first big market test” for the new ETF category

- Bloomberg chief ETF analyst Eric Balchunas believes that, despite net outflows on Monday and Tuesday (amidst investor panic across multiple markets beyond crypto), the ETFs passed this test

- He tweeted “Bitcoin ETFs back to inflows on Wednesday, after two days of very mild outflows representing just 0.5% of total AUM, meaning 99.5% of the money hung tough in face of a -14% Monday and -21% week. $IBIT saw no money leave at all, yet traded $5bn, a total freak…. even I'm surprised here. I was expecting 2-3% of the AUM to leave and declare that as 'strong'”

- Indeed, BlackRock’s IBIT experienced over $50m of inflows on Wednesday, alongside nearly $110m of Tuesday inflows for its spot Ether fund, ETHA

- The newer spot Ether ETFs traded with net inflows between Monday and Thursday, despite Ether being hit harder than Bitcoin by the market drop—indicating significant appetite from investors looking to “buy the dip” and gain Ether exposure

- Arbelos Markets director Sean McNulty told Bloomberg “We are seeing buying on the dip. But generally sentiment is still cautious on concerns that this is the start of a larger deleveraging process”

- Spot Ether ETFs accrued nearly $150m of inflows on Monday and Tuesday, before $23.7m of outflows on Wednesday—once again led by Grayscale’s converted trust, ETHE

- Although the 2.5% fee ETHE maintained its post-launch run of outflows, it appears that momentum may be heading towards an equilibrium; outflows have declined every day since the 31st of July ($133m) up to and including August 8th ($19.8m)

- In a new research note, Bernstein analysts lauded “highly liquid” Bitcoin ETFs with around $2bn average daily volume, and wrote “We expect more wirehouse approvals into Q3 and Q4, thus providing further on-ramps for asset allocation to Bitcoin”

- One of Europe’s largest hedge funds, Capula Management revealed in new SEC filings that it holds around $500m in Bitcoin ETFs, spread across multiple issuers

- Virtual bank Mox, a subsidiary of Standard Chartered, opened crypto trading to Hong Kong customers through access to spot Bitcoin and Ether ETFs

- Hideki Ito, head of Japan’s financial regulator, stressed “cautious consideration” regarding whether the country would follow the US and Hong Kong in approving spot crypto ETFs

- In other ETF developments, BlackRock and Nasdaq filed with the SEC to list and trade options on ETHA

- Given previous decision timeframes from the SEC, Bloomberg ETF analysts James Seyffart believes Ether options could be approved in April 2025

- He also forecasts a Q4 2024 approval for options on Bitcoin ETFs, pointing out that CBOE withdrew and then immediately refiled its application—indicating specific engagement and instruction from the SEC

- Seyffart added that CBOE’s original filing was 15 pages long, followed by an updated 44 page refiling that addressed potential market manipulation concerns

What happened: Political news

How is this significant?

- Digital assets continued to make headlines in the political sphere this week, building on Donald Trump’s speech at the Bitcoin 2024 conference at the end of July

- Although the bulk of last week’s coverage concentrated on the industry’s favour within Republican circles (whether through genuine enthusiasm or just anti-Biden positioning), this week saw several developments aligned with the Democratic Party’s side of the race

- Kamala Harris is currently viewed as more favourably (or less-negatively) disposed towards the asset class and industry

- Business website The Information mirrored last week’s FT reports that the Harris campaign is seeking a “reset” with the industry

- According to The Information, “Crypto executives and... industry groups including the Blockchain Association are among those requesting meetings with Harris and her campaign team, according to [Blockchain Association CEO] Kristin Smith

- Smith said “She's a blank slate. That is a huge opportunity for her to have a more pro-innovation posture than the Biden administration”

- Bloomberg and Politico also reported on potential meetings between the industry and Harris’ campaign, before late-breaking news of a White House conference call with industry leadership

- The call was a positive development, but ultimately inconclusive as “Advisors to the Biden administration stopped short of making any promises to crypto industry executives who voiced policy concerns”

- Participants included executives from digital asset issuers Ripple and Circle, exchanges Kraken and Uniswap, and major VCs Ron Conway, Chris Dixon, and Mark Cuban

- FOX Business reported that billionaires such as Mark Cuban and Skybridge’s Anthony Scaramucci are setting up a “Crypto for Harris” advocacy group in conjunction with several party members supportive of the asset class

- According to FOX, “the Democratic arm of the crypto industry is determined not to let former President Trump run away with the crypto vote this fall”

- Congressman Wiley Nickel stated “We’re not giving this issue to Trump. We want to encourage innovation and protect consumers, but allowing crypto to become a political football is only going to set the US further behind”

- FOX also noted the recent addition of several digital asset industry alum to Harris’ campaign team as crypto advisors; David Plouffe and Gene Sperling (formerly of Binance and Ripple respectively)

- Crypto VC Dragonfly general partner Rob Hadick told Bloomberg “Most of us in the industry are both hopeful and, frankly, eager to have a potential Harris nominee embrace the industry… But we need to see a true commitment toward engaging with our best actors to encourage a thoughtful regulatory environment”

- Coinbase chief legal counsel Paul Grewal acknowledged a warming political environment for the industry, stating “Even as we continue to face real challenges in the United States with the SEC in particular, we’re seeing a resetting of that conversation at the political level”

- Increased political acceptance within the US may pose a challenge to other countries such as Hong Kong, Singapore, and the UAE, which have positioned themselves as crypto hubs, according to Bloomberg

- Pantera Capital portfolio manager Cosmo Jiang noted “Due to the hostile regulatory environment in the US, the availability of opportunities shifted overseas over the last couple of years. As the US continues to make progress and that shifts back, so will our capital allocation”

- Grewal characterises this increased competition as “a race to the top”, stating “I think that as global regulators in hubs all over the world pay attention to that changing dynamic in Washington, they’re going to respond in kind and up their own regulatory game”

- Grewal also attempted to downplay any suggestions Coinbase is taking a partisan position in politics, tweeting that “Coinbase has donated to Dem and GOP super PACs equally with $500,000 to House and Senate funds for each party, respectively, for 2024”

- Bloomberg reported support across both sides of the aisle; a pro-crypto PAC called Protect Progress has invested $13.5m into Democratic candidates this election cycle, roughly on a par with the Democratic support from Fairshake, the largest crypto Super-PAC

- The $14.3m spent influencing Democratic candidates by Fairshake actually dwarfs the $552,000 it has spent on influencing Republicans; albeit with the caveat that a Republican pro-crypto PAC, Defend American Jobs, spent $17.4m influencing Republicans

What happened: Morgan Stanley allows wealth advisors to recommend Bitcoin ETFs

How is this significant?

- CNBC broke news on Friday Morgan Stanley would be the first major Wall Street bank to allow its financial advisors to recommend investing in the ETFs

- As Bloomberg senior ETF analyst Eric Balchunas pointed out; "Major deal. Morgan Stanley's advisors manage $5.7tn in client assets, the biggest of the wirehouses"

- There are some caveats; thus far only BlackRock’s IBIT and Fidelity's FBTC have been approved for recommendation, and only clients with a minimum $1.5m net worth and "aggressive" risk tolerance may be considered by advisors

- According to CNBC's sources, the bank "made the move in response to demand from clients and in an attempt to follow an evolving marketplace for digital assets"

- This demand may have been driven by the success of spot Bitcoin ETFs, which have "all but shattered expectations from flows to assets"

- Morgan Stanley’s 15,000 financial advisors "can solicit eligible clients to purchase shares of two Bitcoin ETFs starting August 7"

- Analyst response was positive, and led to speculation that other banks may follow when they conclude their due diligence processes; ETF Store founder Nate Geraci tweeted; "Spot Bitcoin ETFs have shattered industry launch records with one hand tied behind back...These products are only starting to be made available at the largest financial advisory shops".

- Bloomberg's James Seyffart quipped "I made a joke on stage at last week's Bitcoin 2024 conference that if I had a dollar every time I saw an article or tweet about Morgan Stanley being close to fully approving the Bitcoin ETFs—I'd be a rich man. Guess that fictional gravy train has come to an end!"

- At the same conference panel, BlackRock's digital asset head Robert Mitchnick proved prescient and predicted advisor approvals forthcoming; "It's still quite early in their journey. There's a long research, diligence, exploration process... the big wirehouses and private bank platforms... [are] expediting those processes"

What happened: Bitcoin miner earns additional $2bn by outsourcing processing power

How is this significant?

- Core Scientific, one of the largest publicly-listed Bitcoin miners, saw its shares defy general market momentum this week, thanks to support from the AI industry

- The company extended a previous deal with AI scaling firm CoreWeave to provide high-performance computing power via its Bitcoin mining hardware

- Initially, the mining firm agreed a deal to host 200MW of computing infrastructure for CoreWeave, before extending it by 70MW, and now by another 112MW

- This also brings the total value of their deal with CoreWeave to around $6.7bn, with CoreWeave bearing all the costs for re-tuning hardware

- Core Scientific CEO Adam Sullivan stated “We have now contracted with CoreWeave for a total of 382 megawatts of HPC infrastructure, reflecting the strong demand for high-power data centre infrastructure and the unique ability of our team to deliver it”

- He added “The latest contract also validates that our strategy for developing application-specific data centres aligns with the increasing energy density requirements for high-performance computing that legacy data centres do not typically satisfy”

What happened: SEC fails in $2bn claim against Ripple Labs

How is this significant?

- In the final order of the SEC’s long-running lawsuit against XRP token issuers Ripple Labs, judge Analisa Torres imposed a fine on Ripple after finding it guilty last year of securities violations for previous direct sales to sophisticated institutional investors

- However, industry reaction indicated that Ripple may be far happier with the judge’s decision than the SEC; the agency requested that Ripple Labs pay a $2bn fine, but Judge Torres ruled to impose a $125m fine; just 6% of what the SEC wanted (and possibly less than the firm spent on legal fees throughout the four-year lawsuit)

- Ripple CEO Brad Garlinghouse sounded a positive note after the judgement, calling it a “victory for Ripple, the industry and the rule of law”, claiming the courts recognised “that they [the SEC] had overplayed their hand”

- Chief legal officer Stuart Alderoty added “A final judgement. The Court rejects the SEC’s suggestion that Ripple acted recklessly and she reminds the SEC that this case did not involve any allegations of fraud or intentional wrongdoing, and no one suffered any financial harm. She rejects the SEC’s absurd demand for $2bn in fines and penalties”

- This was the only one of the SEC’s initial claims that reached this stage, after Judge Torres previously ruled that programmatic sales were not securities—a landmark victory for the industry—and claims against specific executives were withdrawn

- Alderorty also stated that “Hopefully this signals the end of this administration’s war on crypto. We need a better way forward for this industry and this country”

- Whether or not the SEC maintains the pace of its “regulation by enforcement” approach remains to be seen; but for now the gulf between its request and its award suggests that the agency’s understanding of the law and the asset class remains less clear than chair Gary Gensler consistently claims

What happened: Robinhood’s crypto revenues increase over 160% in Q2

How is this significant?

- Trading app Robinhood experienced major year-on-year growth in its Q2 crypto performance, boosted by $21.5bn in trading volume

- This volume was up 137% y.o.y., and brought the firm’s transaction-based digital asset revenues to $81m

- Equities performance in the same quarter only yielded half as much revenue for the firm

- Revenues themselves were up 161% y.o.y

- However, as Q2 was subdued in comparison to Q1 marked by ETF launches and a new Bitcoin record high, trading volumes were significantly down from $36bn the previous quarter

- Robinhood acquired digital asset exchange Bitstamp in June, although the earnings call didn’t reveal whether that platform’s earnings were already factored in

What happened: Bitcoin miner reserves drop to 3-year low

How is this significant?

- According to a new report from industry analytics firm Kaiko, the amount of Bitcoin held by miners has plunged to its lowest levels in three years

- As of August 3rd, miners held around 1,510,300 Bitcoins from their mining activities, equivalent to nearly $93bn worth at the time of writing

- The data reveals that miners haven’t only been selling their coins since the quadrennial “halving” event in April reduced block rewards by 50%; sell-offs began late last year as Bitcoin began to rally strongly

- However, selling has certainly continued since the adjustment to Bitcoin’s issuance, as lower rewards mean smaller stockpiles to pay operating costs with

- A lower reward rate hasn’t deterred miners though; last week Bitcoin mining difficulty hit a new all-time high, indicating consistently high levels of activity and competition to generate new blocks and validate transactions on the network

- Furthermore, publicly-traded Bitcoin miners have actually increased their holdings by around 54,000 coins since January last year—Marathon Digital purchased $100m worth last month as a reserve asset