a global pool of talent to deliver a diversified portfolio of hard-to-access

quant managers into a single investible fund with stringent risk oversight.

space. Portfolio construction is based on a research-intensive approach of

investing in liquid tokens of Layer 1, Layer 2 protocols and DeFi applications.

Central to our investment philosophy is a risk framework that is both robust and adaptive. Battle-tested through more than seven years of dynamic market cycles, it is engineered to support an expansive global network of diverse strategies.

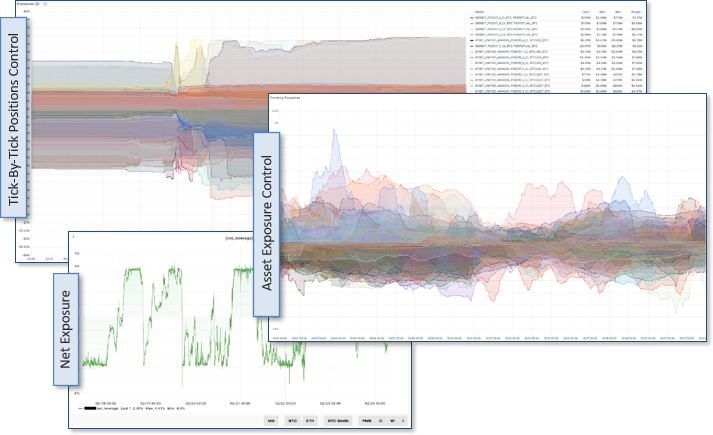

This entire process is anchored by RiskZeus, our proprietary risk management system, which provides real‑time analytics to enable 24/7/365 comprehensive portfolio control. This sophisticated infrastructure is fundamental to protecting capital and delivering risk-adjusted returns.

Security of clients’ assets is paramount at Nickel. The investment manager deploys an independent institutional-grade custody solution, whereby the manager has no transfer right over the funds. This control is retained jointly by the Fund Administrator and Custodian at all times.

In order to create a highly secure custody solution, we have partnered with leading custodians in the industry, including US-based Fidelity and UK-based Copper. This sophisticated solution includes an air-gapped, multi-signature cross-organisation custody model with automated and secure exchange-to-custody transfers.

Our performance is built on a foundation of risk management. For over seven years, our framework has been continuously refined, providing the stability needed to operate a diverse, global network of strategies. At its core is our proprietary Risk Management Solution, RiskZeus, our proprietary risk management system, that provides integrated risk oversight and facilitates lightning-fast alpha execution. This unique combination of proven experience and advanced technology sets our approach apart.

View our latest Quarterly Investor Call.