In the digital asset ecosystem, security is not a static state but a process of continuous evolution. Our framework is designed to provide institutional-grade protection today while actively integrating the next generation of security protocols. We combine best-in-class technology with rigorous, independently-verified controls to safeguard capital against both current and emerging threats. This multi-layered approach, blending established solutions with forward-looking architecture, is fundamental to protecting client assets.

This is a model that separates trading from custody. Instead of depositing assets onto an exchange to trade, assets remain in our secure, independent custody accounts. An OES provider, such as Copper, acts as a secure messaging layer that communicates with exchanges and settles trades after the fact, drastically reducing the risk of loss from an exchange failure.

This is an advanced legal and operational framework involving three parties: an exchange, a regulated custodian bank (such as Sygnum Bank) and the institutional client — where the client’s assets are held at the custodian (typically in t-bills), pledged to the exchange for trading, but remain segregated and bankruptcy-remote. This significantly reduces counterparty and custodial risk, whilst improving capital efficiency and aligning the fund with institutional operational standards.

Fundamental Custody Risk: The risk of private key compromise, theft, or loss at a foundational level.

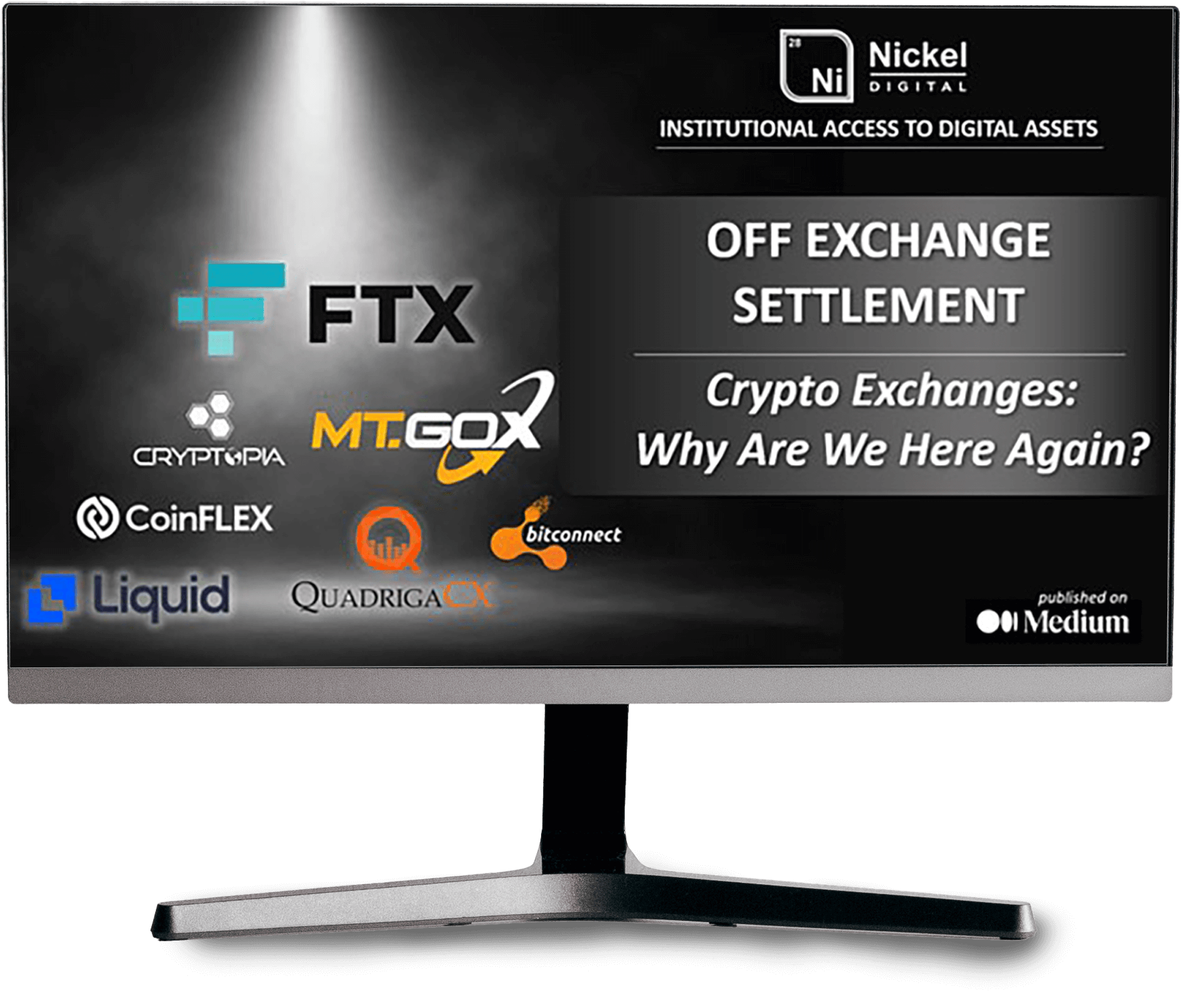

Exchange Counterparty Risk: The risk of capital loss due to the insolvency, hack, or failure of a third-party trading venue.

Operational & Transfer Risk: The risk of unauthorised fund movements, collusion, or human error during asset transfers.

Segregated, Multi-Party Custody: We partner with leading regulated custodians like Fidelity Digital Assets and Copper, using Multi-Party Computation (MPC) and air-gapped cold storage to eliminate single points of failure.

Off-Exchange Settlement (OES): We leverage prime brokerage infrastructure from providers like Copper to execute trades across multiple venues while assets remain secured in dedicated custody accounts, drastically reducing direct exchange exposure.

Independent Oversight & Dual Control: The Investment Manager has no unilateral right to transfer funds. All movements require joint authorisation from the independent Fund Administrator and the Custodian, creating institutional-grade checks and balances.

On-Chain Segregation & Policy Enforcement: We are moving towards next-generation custody models where security policies, such as withdrawal addresses and velocity limits, are enforced directly on-chain, making them immutable and transparent.

Tri-Party Agreements: We are actively developing frameworks for tri-party agreements. This structure allows assets to be held with regulated banks (typically in t-bills) in a bankruptcy remote structure. Providing maximum security and mitigating counterparty risk in bilateral transactions.

Automated & Programmable Governance: The industry is moving towards fully programmable governance where multi-signature approvals and transfer rules are embedded into smart contracts, automating compliance and further minimising the potential for human error.

The digital asset security landscape is constantly advancing. Our team is at the forefront of this evolution, contributing to and publishing research on emerging protocols and best practices. We believe in transparency and education as key components of security.