Market Overview

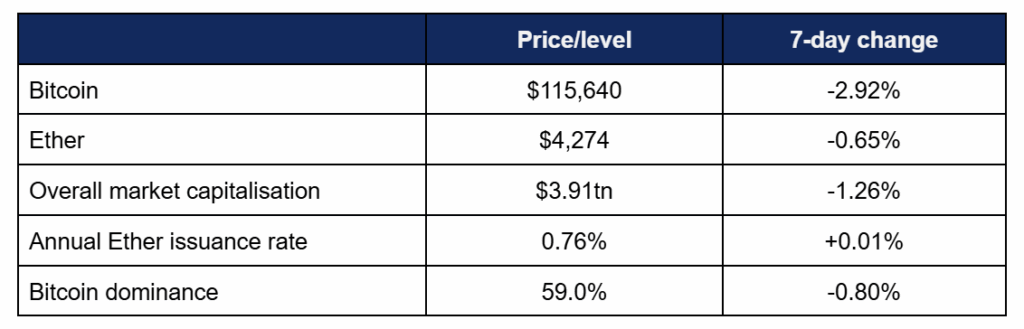

- Bitcoin hit a new all-time high this week, breaking above $124,000 for the first time as the entire digital asset sector also achieved new record market capitalisation

- Bitcoin achieved its new record high of $124,200 on Wednesday, before a complicating US macro picture (and widespread profit-taking) led to a sharp decline across the weekend, culminating in a weekly low of $114,730 on Monday

- Ether came within touching distance of its 2021 all-time high, reaching $4,785 on Wednesday, before declining to a weekly low of $4,231 on Monday

- Ether’s institutional momentum continued, as it strongly outperformed Bitcoin in ETF inflows

- Overall industry market capitalisation reached a new record high of $4.19tn on Wednesday, before dropping back down to current levels

- According to industry monitoring site DeFi Llama, total value locked in DeFi remained virtually unchanged at $149.4bn, after peaking at $159.6bn earlier in the week

Digital assets exhibited record performance in early trading, but reversed momentum following continued concern and uncertainty over US economic data and policy. Digital asset IPOs were Bullish by name and by nature as the newest entrant into the space gained over 80% following an oversubscribed raise. Spot Ether ETFs dominated institutional trading, Japan and South Korea increased their localised stablecoin development efforts, the FCA increased regulated crypto access in the UK, and much more.

What happened: Newest crypto IPO grows over 80% on debut

How is this significant?

- Despite “upsizing” its IPO plans last week, digital asset conglomerate Bullish (which owns an eponymous institutional exchange, and industry publication Coindesk) still managed to significantly exceed its funding goal this week, before its shares debuted to strong trading performance

- After increasing its original $629m raise to $990m at a $4.8bn valuation, Bullish ultimately raised $1.1bn at a $5.4bn valuation before its public float

- When shares opened to the public, performance matched the company’s name—very bullish, as shares closed 84% up on the first trading day, having traded more than 200% above the opening bell at their peak

- Reuters described Bullish’s debut as a “blowout” following this impressive growth

- The performance made its founders billionaires after the company’s valuation soared to $9.9bn following the first trading day

- Bullish’s institutional focus may have been a key factor behind its strong debut; Nickel Digital co-chief investment officer Michael Hall commented that “A pure institutional strategy positions Bullish for more stable, recurring revenue than exchanges reliant on retail volumes, which tend to be cyclical and sentiment-driven”

- Bullish CEO Tom Farley’s history as NYSE head also lends the firm credence, as Hall explained “For a sector still overcoming reputational headwinds, that kind of leadership experience can be a differentiator in securing institutional mandates”

- President Chris Tyrer told Reuters “We’ve gone public today, and there’s a slew of others that are going to follow us, and I think that is net beneficial, because it gives people more options in terms of how they access this asset class”

- Bullish joined Circle in recent wildly successful public launches, leading analysts at Barron’s to urge investors to “wait for the dip” rather than buy at buoyant prices

- In other digital asset IPO news, lender Figure Technologies revealed increased quarterly profits ahead of its planned public launch, whilst Gemini exchange (co-founded by twin billionaires Cameron and Tyler Winklevoss) also recently filed to follow in Coinbase’s footsteps as a publicly-listed exchange

- Gemini recruited a who’s who of finance titans for its IPO process, enlisting Goldman Sachs, Citigroup, Morgan Stanley, and Cantor as lead bookrunners

- IPOX CEO Josef Schuster told Reuters “Crypto is becoming one of the big pillars of the IPO market, with more deals expected not only via IPO- but also through deSPAC transactions”

What happened: ETF News

How is this significant?

- Digital asset investment products experienced another week of growth, marking positive performance for 18 of the last 19 trading weeks

- In fact, ETFs and other funds had their fourth-best week of all time in terms of inflows, and their best week ever in overall volumes

- According to Coinshares data published on Monday, crypto asset funds logged $3.75bn inflows in the trading week ending Friday the 15th, dominated by spot Ether funds

- Overall AUM reached a new record high of $244bn, boosted by strong volumes and price performance of the underlying assets

- CoinShares Head of Research James Butterfill pointed out how strongly Ether products have recently outperformed Bitcoin equivalents, as “The inflows far outstrip Bitcoin, with year to date inflows representing 29% of total AUM compared to Bitcoin’s 11.6%”

- Spot Bitcoin ETFs experienced four trading days of growth, before a slight pullback into outflows following inflation data from the US

- BlackRock’s IBIT absolutely dominated the trading this week with four days of nine-figure inflows, most notably on Thursday when IBIT added $524m on a day of $231m total inflows—more than counteracting nine-figure outflows from both Fidelity’s FBTC and ARK Invest’s ARKB

- No other Bitcoin funds achieved nine-figure daily inflows; the next-best performers were FBTC and ARKB on Wednesday at $27m and $37m each

- Spot Ether ETFs meanwhile had a banner week, including a rare day of ten-figure inflows, as funds added $1.02bn on Monday

- As with Bitcoin, Tuesday through Thursday also experienced inflows (ranging from $524m to $729m) before comparatively modest ($60m) macro-driven outflows on Friday

- These inflows were all at levels far higher than Ether ETFs’ post-launch daily average of around $47m

- BlackRock’s ETHA and Fidelity’s FETH led the way with multiple nine-figure inflow days (ETHA in particular added over half a billion dollars on three trading days), alongside an honourable mention for Grayscale’s 0.15% fee mini-ETF, which featured days of $61m and $67m inflows

- Bloomberg’s chief ETF analyst Eric Balchunas pointed out the scale of crypto ETF performances, writing “Spot Bitcoin and Ether ETFs did about $40bn in volume this week, biggest week ever for them, thanks to Ether ETFs stepping up big. Massive number, equivalent to a Top 5 ETF or Top 10 stock’s volume”

- He reserved extra praise for Ether products, adding “Ether ETFs packed one year’s worth of flows into about six weeks. A sleep for 11mo and then BOOM. I give [Ether treasury firm] Bitminer a lot of credit, along with stablecoin legislation, it gave Ether a good spokesman and its killer app. You gotta have an easy to understand narrative and Ether ETFs got one (finally)”

- Indeed, ETHA became the fastest non-Bitcoin ETF ever to achieve $10bn AUM

What happened: East Asian economic powerhouses join stablecoin race

How is this significant?

- After Financial Times reports last week that China is considering Hong Kong as a testbed for Renminbi-denominated stablecoins, East Asia’s other two largest economies appeared to escalate stablecoin plans this week

- Japan’s Nikkei news agency reported that the nation’s Financial Services Authority approved its first local stablecoin issuers

- JPYC received the licence in question “potentially enabling it to launch a regulated Yen stablecoin by October”

- According to statistics from banking infrastructure provider Swift, the Japanese Yen currently ranks fourth in cross-border payment statistics, so a regulated Yen stablecoin could add a large new geographic footprint to crypto assets

- JPYC plans to issue 1 trillion Yen worth of stablecoins over the next three years, and according to industry publication TheBlock “the JPYC stablecoin will be backed by highly liquid assets such as deposits and government bonds. Its potential use cases include international remittances, corporate payments and DeFi”

- Across the sea in South Korea, financial paper MoneyToday wrote that the Financial Services Commission (FSC) will submit its own stablecoin legislation bill in October, following in the footsteps of the USA’s recently-passed GENIUS stablecoin act

- Creating Won-pegged stablecoins was a campaign promise in the country’s recent election, and Yonhap news agency revealed that the country’s four largest banks intend to meet with representatives from stablecoin issuer circle when they visit Korea next month

- The Bank of Korea has encouraged any future stablecoin issuance be limited to banking institutions

- In other regional news, local newspaper The Korea Times reported that South Korean retail investors now favour digital asset stocks over more traditional tech stocks

- A new report by the Korean Centre for International Finance found “Investments in virtual assets, particularly in shares related to stablecoins, have expanded following the passage of the US GENIUS Act”

- Meanwhile in South East Asia, Thailand introduced an 18 month pilot program called “TouristDigiPay” , viewed as a means of boosting tourism by enabling foreign visitors an easy means of converting crypto assets into Thai Baht through regulated platforms

What happened: Circle to launch stablecoin-centric blockchain

How is this significant?

- Recently-floated American stablecoin giant Circle intends to improve the stablecoin transaction and transfer experience—by means of a blockchain dedicated specifically to the asset

- Last Tuesday, Circle issued a press release officially announcing its plans for Arc; “An Open Layer-1 Blockchain Purpose-Built for Stablecoin Finance”

- According to the release, Arc will use the USDC token as the native gas (transaction fee) for the network, hence enabling predictable dollar-denominated prices for all transfers across the blockchain

- Arc is compatible with Ethereum (the main current rail for stablecoin payments), and aims to address usecases including “tokenised equities, commodities, and real estate” alongside stablecoin swaps

- These plans advanced on Monday, as Circle’s acquisition of Malachite was confirmed; a technology firm specialising in blockchain consensus mechanisms, designed to “help bring greater performance, reliability, and security to stablecoin-based payments”

- The company aims to open a testnet for finetuning Arc this autumn, to ensure Day One access for institutions such as crypto custody specialists Fireblocks

- In its first public quarterly earnings report, Circle reported $658m in Q2 revenues, up 53% year-on-year

What happened: UK’s Financial Conduct Authority expands retail access to crypto assets

How is this significant?

- A Financial Times report this week revealed that UK retail investors would soon see greater access to digital asset exposure, via crypto ETNs

- Exchange Traded Notes were previously limited to professional investors since their launch last year, but from October onwards retail investors can access them on any FCA-approved UK-based investment exchange

- Digital asset ETNs will now be regarded as so-called “restricted mass market investments” alongside long-term asset funds (LTAFs)

- Morningstar research manager Monika Calay told the FT “While there are more than 20 LTAFs in the UK, not all are retail eligible. I think retail investors are currently more interested in crypto access than in LTAFs”

- She added “Bitcoin has become mainstream because it’s easy to understand. At its core, it’s just digital money, and people instinctively grasp that. Crypto is also highly accessible. Anyone with a smartphone can buy bitcoin in minutes in the UK, using apps like Revolut”

- Parmenion investment manager Colin Morris said “Retail ownership of unregulated crypto assets would suggest the regulator has been behind [on] the public’s appetite for these exposures…

- Fidelity International’s head of investment Georg Bauer commented that the UK could catch up to international markets now; “We are pleased that the regulator has recognised the growing retail demand for digital assets, which we also see in other markets we operate in such as Switzerland, Germany and Hong Kong”

What happened: US Treasuries execute repo trade on weekend thanks to blockchain

How is this significant?

- Although US markets have traditionally been bound by strict schedules of Monday-to-Friday business hours, blockchain and tokenisation may be changing that

- Last Saturday, a US Treasury repo trade (aka a repurchase agreement), occurred on the public Canton blockchain

- DRW founder and CEO Don Wilson told Bloomberg “This is the first time a US Treasury has been natively issued on-chain without the use of a broker-dealer intermediary. You’re getting the value of 24/7 movement, without introducing additional counter-party risk”

- Treasuries held at a DTCC subsidiary were tokenised and used as collateral to borrow USDC in an instantaneous transaction; bypassing lengthy delays and waits in legacy systems

- Tradeweb market structure head Elizabeth Kirby commented “You don’t have a time-gap or lapse in which a fail could happen because the settlement happens on-chain, in real-time”

What happened: Stablecoin news

How is this significant?

- According to Bloomberg reports this week, global remittance giant Western Union is considering the creation of its own stablecoin

- CEO Devin McGranahan said “We are exploring the opportunity for us to issue a stablecoin, particularly in non-US markets”, describing it as “almost like a savings account in US Dollars”

- Competitors Moneygram and Remitly have recently embraced stablecoins, meaning Western Union risks being left behind if it ignores the asset class; but if it does indeed issue its own stablecoin, it could secure an advantage over the two which utilise third-party coins

- Granahan believes the remittance veteran can act as an on/off-ramp for digital wallet developers, saying “Until the world works on stablecoin or crypto assets, most people still buy their groceries or pay for their rent in local currency so we’re enabling our network to be agnostic”

- Browser-based wallet developers Metamask are reportedly developing their own stablecoin, according to industry publication Coindesk, citing a governance proposal that appeared to be published prematurely

- The Metamask wallet extension currently boasts over 30 million monthly active users, making it one of the most popular interfaces for people to engage with DeFi

- Visa’s head of crypto Cuy Sheffield wants the payment processing giant to engage heavily with stablecoins, seen as a potential $2tn market

- Sheffield told Bloomberg “This is just another mechanism for value exchange. I see it massively expanding our addressable market”

- Competing payment processor Stripe recruited Matt Huang from crypto VC Paradigm as the CEO of its new stablecoin blockchain project, Tempo

- Huang will however retain his position at Paradigm

- Alongside Circle’s aforementioned Arc efforts, this represents another in several stablecoin-specific blockchain development efforts, including Plasma, which raised over $370m to build its blockchain vision

What happened: Crypto Treasury news

How is this significant?

- Crypto treasury efforts continued across the board, as companies either increased their existing exposure to digital assets, or embraced them for the first time

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) purchased 430 Bitcoin for around $51.4 million at an average $119,666 per Bitcoin

- However, the company is also coming under increasing scrutiny for its practice of funding Bitcoin purchases via frequent perpetual preferred stock sales to create a “Bitcoin Credit Model”

- CEO Phong Le claimed it creates a more resilient capital structure; “Over time, we may not have convertible notes… we will be relying on perpetual preferred notes that don’t ever come due”

- Bitmine consolidated its position as the leading Ether treasury company, and grew to the second-largest crypto treasury company overall, claiming $6.61bn crypto holdings as of August 17th

- Bitmine chairman Tom Lee stated in a press release “In just a week, BitMine increased its Ether holdings by $1.7bn to $6.6bn (adding over 373,000 tokens from 1.15 million to 1.52 million tokens), as institutional investors have expressed interest and support for our pursuit of the ‘alchemy of 5%’ of Ethereum”

- Shares in fellow Ether treasury firm 180 Life Sciences Corp (trading as ETHZilla) increased over 200% last week, as the company disclosed holdings of 82,186 Ether

- Some questioned a recent $1.5bn WLFI treasury deal by ALT5 Sigma Corp

- WLFI is the proprietary token of World Liberty Financial, a DeFi project inextricably linked to the Trump family—and its choice as a treasury cornerstone has raised some eyebrows as the token is not officially tradeable yet

- Lex Sokolin of Generative Ventures commented “It’s difficult to understand why WLFI is using a public equity vehicle to invest in the token at this stage, other than to create buying pressure”