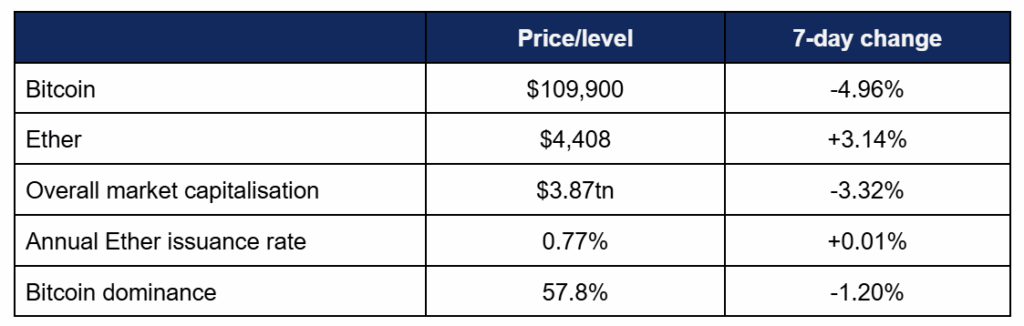

Market Overview

- Bitcoin retreated from last week’s new record highs, as traders took profit and then hedged their bets during a broader market decline

- Bitcoin peaked at $117,130 on Saturday, before falling below $110,000 on Monday to a weekly low of $109,220

- Ether meanwhile did hit a new all-time high for the first time since 2021, coming within sight of the landmark $5,000 figure

- This performance was driven by a variety of factors, including increased institutional attention and reallocation from existing Bitcoin whales (large-scale holders)

- Ether grew from a Tuesday low of $4,081 to its new record of $4,954 on Sunday, breaking through $4,900 for the first time ever

- Overall industry market capitalisation sits at $3.78tn, down from a weekly peak of $4.04tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased slightly as investors took advantage of new Ether records, reaching $151.4bn

Digital assets showcased volatility, as Ether finally eclipsed its 2021 record highs, before a sharp decline across multiple markets spurred by macroeconomic concerns. Tokenisation, stablecoin, and treasury efforts continued regardless of market conditions, featuring major names like State Street, JP Morgan, and SBI, alongside reported Eastern outreach efforts from Donald Trump’s family.

What happened: ETF News

How is this significant?

- Digital asset investment products experienced significant outflows as traders took profits and hedged their bets amidst continued macroeconomic uncertainty and wider market nerves

- According to Coinshares data published on Monday, crypto asset funds registered $1.43bn outflows in the trading week ending Friday the 22nd; their largest losses since March

- Around $1bn of this figure could be attributed to Bitcoin products, with the rest coming from recently-buoyant Ether ETFs

- CoinShares Head of Research James Butterfill believes that the trading activity was largely policy-driven, writing “Trading volumes in ETPs reached US$38bn last week, about 50% above this year’s average, as investor sentiment became increasingly polarised over US monetary policy. Early in the week, pessimism around the Federal Reserve’s stance drove outflows of US$2bn”

- However, he added that “sentiment shifted later in the week following Jerome Powell’s address at the Jackson Hole Symposium, which was widely interpreted as more dovish than expected, sparking inflows of US$594m”

- Spot Bitcoin ETFs suffered net outflows on every trading day last week, ranging from $23m to $523m

- As by far the largest fund, BlackRock’s IBIT had by far the most to lose—and accordingly, it suffered three nine-figure outflows last week, shedding between $128m and $220m

- The largest single outflow however came from Fidelity’s FBTC, which lost $247m on Tuesday, with Grayscale’s GBTC standing as the other unwelcome member of the nine-figure outflows club, after it closed $116m down on Tuesday

- There were some mild green shoots of recovery on Friday after Jerome Powell spoke, as ARK Invest’s ARKB posted the week’s largest inflows at $66m (followed by FBTC at $51m)

- According to Bloomberg ETF analyst James Seyffart, investment advisors are now by far the largest holders of Bitcoin ETFs, and “Pretty much every category we track on Bloomberg increased their Bitcoin ETF exposure over Q2”

- Spot Ether ETFs also suffered in early trading, kicking off the week with three consecutive days of nine-figure outflows (ranging from $197m to $430m), before moving back into inflows as Ether made its march to new record highs

- Inflow levels were healthy on Thursday and Friday, adding $288m and $338m, led by BlackRock’s ETHA and Fidelity’s FETH, as the former accrued $234m on Thursday, followed by $118m for the latter on Friday

- Elsewhere in ETFs, there were filings for: an “American-made crypto” ETF, numerous updated XRP spot ETF filings (suggesting imminent approval), liquid staking ETFs, and conversion of an Avalanche (AVAX) trust into an ETF by Grayscale

What happened: Tokenisation news

How is this significant?

- Numerous established financial institutions featured in new tokenisation efforts this week, as TradFi continues to embrace this area of DeFi

- Japanese finance giant SBI Holdings partnered with crypto infrastructure company Startale Group to create an onchain trading platform for tokenised RWA (real world assets) and stocks

- According to a press release, the platform aims to leverage the 24/7/365 nature of digital asset markets, and “will be highly interoperable, always open, accessible to anyone, and designed to meet the needs of users worldwide in the global market”

- SBI Holdings CEO Yoshitaka Kitao commented “We predict that this [tokenisation] movement will eventually lead to the digitalisation of capital markets themselves, including exchanges”

- Banking veteran State Street joined JP Morgan’s blockchain platform as a custodian for tokenised assets

- This makes them the first third-party custodian on the platform, integrating TradFi standards and mitigating counterparty risk

- According to a press release, the first transaction involved an inaugural $100m commercial paper transaction by Singapore’s Overseas-Chinese Banking Corporation (OCBC)

- JP Morgan credit lead Emma Lovett stated “Digital asset adoption and investment continues to increase across financial markets globally… our Digital Debt Service application is a significant advancement in the evolution of digital issuances, providing clients the opportunity to use blockchain in unlocking ecosystem-wide efficiencies across capital markets and the lifecycle of bond”

- Anthony Scaramucci’s SkyBridge Capital also announced plans to tokenise $300m worth of its hedge funds on the Avalanche (AVAX) blockchain, in partnership with tokenisation specialists Tokeny and Apex Group

- Scaramucci said “We look forward to bringing our hedge funds into the digital, on-chain era, improving transparency, liquidity, and accessibility for our investors, and demonstrating how traditional finance and blockchain can work together to create smarter, more efficient investment solutions”

What happened: New details emerge on Bullish IPO

How is this significant?

- Following the recent successful IPO of digital asset firm Bullish, more details emerged this week about unique elements of its pre-IPO raise process

- In a press release, Bullish revealed that it received $1.15bn capital in stablecoins, a first for US public markets

- The majority of this was raised in Circle’s USDC token, with Coinbase acting as custodian

- As operator of an eponymous institutional crypto exchange and digital asset media platform Coindesk, Bullish was well positioned to benefit from increased enthusiasm after Circle’s successful IPO, and has in turn catalysed further public launch filings within the industry

- These include recent filings from blockchain-based lender Figure Technology, and American crypto exchange Gemini

- Bullish chief financial officer David Bonanno commented “We view stablecoins as one of the most transformative and widespread use cases for digital assets. Internally, we leverage them for rapid and secure global fund transfers”

What happened: KPMG predicts continued crypto investor interest

How is this significant?

- KPMG analysts foresee continued investor demand for digital assets the rest of the year (and going forward into 2026), according to its latest global Pulse of Fintech report

- The report, based on H1 2025 data, noted that “At a sector level, digital assets and currencies attracted the most fintech investment globally this half year—$8.4bn, compared to $10.7bn during all of 2024”

- Analysts noted the success of Circle’s IPO, and opined that it could open the floodgates to more industry IPOs; as appears to be the case based on the preceding story

- Stablecoins were highlighted as another area of positive momentum, as the analysts believed America’s GENIUS legislation could catalyse similar legislative efforts elsewhere

- Edith Hitt of KPMG Canada explained the positive outlook; “If we look at the first half of 2025, it’s clear that digital assets have re-emerged as a magnet for investor interest, despite the broader contraction in venture investment values… Investor interest in digital will remain strong in the second half of the year and into 2026, driven by the US administration’s bullish view and lighter regulatory touch on cryptoassets”

- Additionally, the report noted that in Europe new regulations have also attracted established names; “there has been a surge in MiCA license activity from both traditional finance institutions and crypto-native firms; BBVA, Commerzbank, and Société Generale’s Forge are there next to established crypto actors like Coinbase, Circle, and Kraken activating their new MiCA licenses”

What happened: Trump’s son to make international trip promoting digital assets

How is this significant?

- According to Bloomberg sources, president Trump’s son Eric will imminently visit Japan as part of a “crypto push”

- The planned visit in September reportedly includes a meeting with leading Japanese Bitcoin treasury firm Metaplanet

- This follows reports in the Financial Times last week that mining firm American Bitcoin (backed by both Eric Trump and his brother Donald Jr) is seeking acquisitions in Asia (with a particular focus on Japan and Hong Kong) to expand its Bitcoin treasury footprint

- Japanese politicians are expected to speak at this week’s WebX2025 summit in Tokyo, outlining the country’s crypto plans in greater detail

- In other Trump-adjacent news, Bloomberg reported that several blue-chip hedge funds (including Point72 and ExodusPoint) have secured stakes in Alt5 Pharma, the first company to pursue World Liberty Financial’s WLFI token as a treasury asset

- In other Asia Pacific news, Japanese news agency Nikkei reported that the country is considering a flat 20% tax on crypto trades, giving it a unique classification compared to the “miscellaneous income” bucket it currently sits in, where progressive tax rates can hit 55%

- Australian authorities have reportedly requested an audit of Binance’s local arm there, citing “serious concerns” regarding the relative scale of its disclosures

What happened: Stablecoin news

How is this significant?

- The Financial Times reported that EU lawmakers are accelerating plans for a Digital Euro, spurred into action by the speedy passage of the GENIUS stablecoin act in the US

- According to EU sources, the FT says recent US clarity is “generating conversations [among lawmakers] that were not in place before the Genius Act… They’re saying, ‘Let’s speed up, let’s push’.”

- Additionally, deployment on public blockchains is allegedly “definitely something that [EU officials are] taking more seriously now”; an approach which would mark a stark departure from the ECB’s previous push for a traditional (private) CBDC

- On a more localised level, Wyoming became the first in the US to launch a state-issued stablecoin

- The Frontier Stable Token (FRNT) is 2% overcollateralised, and backed by dollars and short-term treasuries

- Governor Mark Gordon stated “Today, Wyoming reaffirms its commitment to financial innovation and consumer protection. The mainnet launch of the Frontier Stable Token will empower our citizens and businesses with a modern, efficient, and secure means of transacting in the digital age”

- Browser-based wallet provider Metamask (one of the most popular means of interacting with DeFi applications with 100 million users) is launching its own stablecoin—mUSD—developed in conjunction with Bridge, the stablecoin platform acquired by payment processor Stripe in February

- Product lead Gal Eldar commented “With MetaMask USD, users can bring their money onchain, put it to work, spend it almost anywhere, and use it like money should be used… reducing both friction and costs for people onboarding directly into a self-custodial wallet”

- Leading stablecoin issuer Tether hired former White House crypto advisor Bo Hines to oversee its US strategy

- According to a press release, Hines will help the El Salvador-headquartered firm establish “a strong US-based presence that spans across multiple sectors, starting with digital assets and expanding to new opportunities, including a deep focus on potential further investments in domestic infrastructure”

What happened: Crypto Treasury news

How is this significant?

- Digital asset treasuries continued expanding in both breadth and scope despite challenging market conditions this week

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) made a substantial addition to its coffers, buying 3,081 Bitcoin for $357m over the last week

- Galaxy, Jump, and Multicoin Capital may invest up to $1bn in creating a Solana treasury firm, hoping to leverage the second-largest smart contract blockchain

- Ether treasury firm ETHzilla approved a $250m stock buyback plan for outstanding shares of common stock

- TON Strategy Co. (formerly Verb Technology) announced a $558m private placement to build a Toncoin treasury as part of Telegram’s “Digital New Continent” initiative, targeting ~5% of TON’s circulating supply and leveraging staking to grow reserves

- According to chairman McAndrew Rudisill “As we continue to scale our Ether reserves and pursue differentiated yield opportunities, we believe an aggressive stock repurchase program at the current stock price underscores our commitment to maximising value for shareholders”

- The firm purchased just over 7,500 Ether last week, at an average price of just under $4,000

- Top Ether treasury firm BitMine grew its Ether holdings to around $8bn, consolidating its place as the second-largest crypto treasury firm by purchasing another 190,500 Ether

- Investment firm B Strategy announced a $1bn acquisition strategy for crypto exchange Binance’s proprietary BNB token, funded by YZi Labs; the family office of Binance founder Changpeng “CZ” Zhao

- Nasdaq-listed Sharps Technology announced a $400m raise to establish the world’s largest corporate Solana treasury

- A new bill in the Philippines proposed creation of a national Bitcoin reserve, seeking a 10,000 Bitcoin pool, to be bought over five years with a minimum 20 year hold